|

市场调查报告书

商品编码

1642071

TaaS(追踪即服务):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Tracking-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

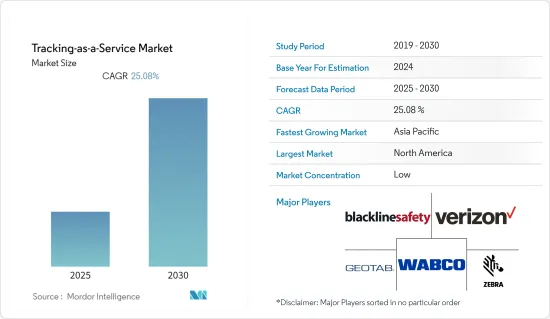

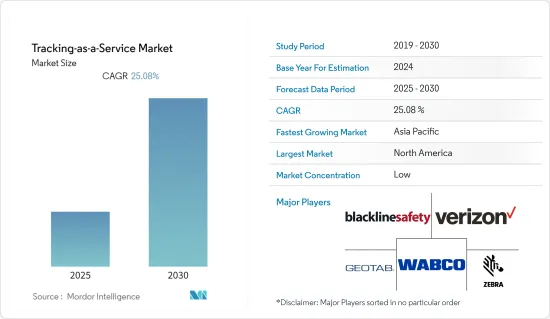

预测期内,追踪即服务 (TaaS) 市场预计将实现 25.08% 的复合年增长率。

主要亮点

- 追踪即服务 (TaaS) 可协助您监控日常业务流程。透过正确的追踪解决方案,企业可以获得有关业务和资产的正确信息,了解资产运转率和生产力,并从单一来源存取所有资讯。这样的解决方案可以准确记录所有资产,并清楚地显示它们在每个流程中的使用方式。如今,几乎任何依靠资产来完成工作的企业都可以从正确实施的追踪解决方案中受益。

- 零售业正日益自动化,推动了对云端基础的解决方案(如追踪即服务 (TaaS))的需求。此外,个人和专业目的的电子监控使用越来越多,预计也将推动追踪即服务 (TaaS) 市场的成长。

- 行动技术的使用日益增多、车队管理人员对提高效率的需求日益增长、眼动追踪系统的出现以及用于监控目的的电子监控系统等因素正在推动市场的发展。

- 此外,物联网(IoT)的普及也是刺激市场成长的关键因素。智慧互联设备可以帮助即时追踪货物运输。此外,世界各国政府都要求所有新车都安装 GPS 追踪装置,以确保驾驶者的安全。透过云端提供的车辆追踪解决方案可以以较低的成本提高车队管理人员的效率。

- 在许多行业中,对电子监控的隐私担忧阻碍了公司采用这种解决方案。入侵者甚至可能破坏追踪软体并破坏安全性。

- COVID-19 也对市场成长产生了重大影响。由于缺乏投资,运输和物流行业的供应商受到的打击最为严重。

TaaS(追踪即服务)市场的趋势

运输和物流的 TaaS 采用率最高

- 交通运输是现代社会的重要组成部分。运输和物流领域使用的追踪解决方案可改善车辆维护。更好的维护有助于延长车辆的使用寿命。它还有助于防止因车辆故障而发生的延误。

- 过去几年,Uber、Lyft 和 Roam 等提供共乘和汽车服务的私人公司经历了滚雪球式增长。用于追踪的位置资讯对于这些公司来说是至关重要的资产。

- 虽然大多数参与者都具备内部分析能力,但预计在预测期内,资料量和复杂性的增加将推动这些公司与追踪服务提供者之间的合作。

- 推动该领域市场发展的另一个趋势是卡车运输和物流公司越来越多地采用物联网。卡车运输和物流公司也使用物联网来追踪包裹,以确保货物准时送达客户,并使用追踪资料来节省燃料并实施车辆的预测性维护计划。

- Trafiksol 正在使用 TaaS 应用程式开发公共交通追踪解决方案 (PTTS),该解决方案将告知乘客公共交通车辆的到达和离开时间,并显示他们相对于各个站点和车站的当前位置。客户可以透过行动应用程式追踪他们的车辆并在地图上了解其确切位置。乘客将获得一张通用支付卡,可用于支付 PTTS公共交通费用。

预计北美将占据最大市场占有率

- 北美预计将成为追踪即服务 (TaaS) 的最大市场。大多数追踪即服务供应商都位于北美,包括 AT&T 公司、摩托罗拉解决方案公司和霍尼韦尔国际公司。

- 该地区的成长归功于自动化技术的不断进步,特别是在物流和运输领域。这是因为仓库和配送机器人的采用正在增加。

- 该地区的犯罪监控市场也在不断成长。在美国大部分地区,性犯罪者必须使用罪犯追踪设备。由于监管机构鼓励在私人乘用车上安装 GPS 追踪装置,北美市场也将持续成长。

- FieldLogix 等公司协助北美各地的客运组织使用 GPS 车辆追踪技术来改善路线规划和客户服务。运输机构使用 FieldLogix 货运追踪系统来满足合约履行要求。

- 例如,为了补充其市场领先的车队管理解决方案,视讯远端资讯处理解决方案的全球领导者Lytx Inc.于 2022 年 7 月推出了 Lytx 资产追踪服务。该服务在美国和加拿大均可使用。 ICCT 还透露了其车队追踪服务的新维护改进,计划于今年稍后发布。

- 根据 ICCT 的采访,加拿大 40% 至 50% 的卡车车队目前使用远端资讯处理系统。美国和加拿大对电子记录设备 (ELD) 的强制要求为远端资讯处理系统的采用创造了成熟的市场。

追踪即服务 (TaaS) 产业概述

TaaS(追踪即服务)市场的特点是存在众多供应商。这些供应商专注于开发具有附加功能的云端处理解决方案,并以具有竞争力的价格提供它们。预计云端处理服务需求的不断增长将加剧市场的竞争环境。为了扩大在这个全球市场的影响力,供应商正在投资开发特定的客製化云端基础解决方案。

2022 年 3 月,领先的居家照护供应商软体平台 Housecall Pro 与 Mojio 合作开发了 Force by Mojio,这是第一个专为中小型企业设计的车队管理解决方案。 Mojio 是领先的互联行动平台和 SaaS 解决方案供应商。此次合作将把 Mojio 的 Force 即时远端检测资料与 Housecall Pro 的一体化平台结合起来,让居家照护专业人员更容易追踪公司车辆、增强业务并实现客户体验现代化。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

- 市场驱动因素

- 行动科技使用量快速成长

- 车队营运商需要提高效率

- 提高物联网采用率

- 市场限制

- 关于电子监控系统的隐私问题

- 给予客户有限的控制权

第五章 市场区隔

- 按配置

- 云

- 本地

- 按最终用户产业

- 零售

- 製造业

- 电子商务

- 运输和物流

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Motorola Solutions

- Wabco Holdings Inc.

- AT&T Inc.

- Zebra Technologies Corp.

- Verizon Communications

- Geotab Inc.

- Blackline Safety Corp.

- Spider Tracks Limited

- Honeywell International Inc.

- Trimble Inc.

第七章投资分析

第八章 市场机会与未来趋势

The Tracking-as-a-Service Market is expected to register a CAGR of 25.08% during the forecast period.

Key Highlights

- Tracking-as-a-service helps industries to monitor their day-to-day business processes. With a proper tracking solution in place, businesses can get proper information about their operations and assets, know about asset availability and productivity, and access them from a single source. Such solutions maintain an accurate record of all the assets, providing a clear picture of how assets are utilized in each process. Currently, almost every business that relies on assets to get things done can benefit from a properly implemented tracking solution.

- Automation in the retail industry has resulted in the increased demand for a cloud-based solution like tracking-as-a-service. Moreover, the growing use of electronic monitoring for personal and professional work is anticipated to boost the market growth of tracking-as-a-service.

- Factors such as increasing usage of mobile technology, the increasing need to improve fleet operator efficiency, the emergence of eye tracking systems, and the use of electronic monitoring systems for monitoring purposes are factors driving the market.

- Another key factor stimulating the market's growth is the increasing Internet of things (IoT) adoption. Smart-connected devices help to track the shipments of goods in real-time. Also, governments worldwide are mandating GPS tracking in all new vehicles in a bid to maintain driver safety. Vehicle tracking solutions offered through the cloud improve fleet operator efficiencies at lower costs.

- Many industries have privacy concerns regarding electronic monitoring, restraining enterprises from adopting the solution. There is even a chance of a security breach by intruders interrupting the tracking software.

- COVID-19 also challenged market growth to a great extent. Vendors serving the transportation and logistics industry were hit the most due to a lack of investment.

Tracking-as-a-Service Market Trends

Transportation and Logistics have Shown Highest Adoption of TaaS

- Transportation is a crucial element in modern society. Tracking solutions adopted by the transportation and logistics sector improve vehicle maintenance. Improved maintenance helps to extend the life of vehicles. It may also help in preventing delays that may be caused when the vehicles break down.

- Private companies offering ride-sharing and car services, such as Uber, Lyft, and Roam, have witnessed snowballing growth over the past few years. Location data for tracking is a crucial asset to these companies.

- While a majority of the companies involved have in-house analytical capabilities, the growing volumes and complexities involved in the data are expected to drive collaborations between these companies and tracking as a service provider over the forecast period.

- Another trend driving the market in this sector is the increasing adoption of IoT by trucking and logistics companies, which are also using IoT to track packages and make sure deliveries reach customers on time, as well as saving fuel and implementing predictive maintenance plans for their vehicles, by using tracking data.

- A Public Transport Tracking Solution (PTTS) is being developed by Trafiksol using TaaS applications that assist with letting people know about the arrivals and departures of public transport under PTTS and will also indicate the current position with respect to individual stops/ stations. A User will be able to track their respective vehicle through a mobile app to know the vehicle's exact position on the map. A common payment card will be provided to users through which they can pay on any public transport under PTTS.

North America To Hold The Largest Market Share

- North America is expected to be the largest market for the Tracking-as-a-Service market. Most Tracking-as-a-Service vendors, such as AT&T Inc., Motorola Solutions Inc., and Honeywell International Inc., are based in the North American region.

- The growth can be attributed to increasing advances in automation technology, especially in the logistics and transportation sector in the region. The adoption of warehouse or delivery robots is growing at an increasing pace, and hence, the adoption of these services is increasing.

- The region is also witnessing an expansion in the criminal offender monitoring market. Most areas in the US have compelled the use of offender tracking equipment for sexual offenders. The market will also continue to grow in the region as the regulatory bodies in North America are encouraging the installation of GPS tracking devices in private passenger vehicles.

- Companies like FieldLogix are helping its passenger transportation organizations throughout North America improve their route planning and customer service with GPS fleet tracking technology. Transportation organizations use FieldLogix's transportation tracking system to meet the performance requirements of their contracts.

- For instance, in July 2022, to complement its market-leading fleet management solutions, Lytx Inc., a global leader in video telematics solutions, introduced the Lytx Asset Tracking Service. Fleet managers searching for a streamlined method of tracking down and controlling their powered equipment can use the Asset Tracking Service, which is now offered in the United States and Canada. The business also disclosed a number of brand-new maintenance improvements for its Fleet Tracking Service, set for release later this year.

- According to interviews by the ICCT, 40-50% of trucking fleets in Canada are currently using telematics systems. The electronic logging device (ELD) mandates in the United States and Canada has created a ripe market for the adoption of telematics systems.

Tracking-as-a-Service Industry Overview

The presence of many vendors characterizes the tracking-as-a-service market. These vendors focus on developing cloud computing solutions with added features and supplying them at competitive prices. The increasing demand for cloud computing services is expected to strengthen the market's competitive environment. To increase their footprint in this global market, the vendors are investing in developing specific and customized cloud-based solutions.

In March 2022, the leading software platform for home service providers, Housecall Pro and Mojio, partnered to create Force by Mojio, the first fleet management solution designed particularly for small businesses. Mojio is a leading connected mobility platform and provider of SaaS solutions. The alliance makes it simpler for home service professionals to track their company vehicles, enhance operations, and modernize the client experience by combining Force by Mojio's real-time telemetry data with Housecall Pro's all-in-one platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

- 4.4 Market Drivers

- 4.4.1 Upsurge in Use of Mobile Technology

- 4.4.2 Need To Improve Fleet Operator Efficiency

- 4.4.3 Increasing Adoption of IoT

- 4.5 Market Restraints

- 4.5.1 Privacy Concerns Regarding Electronic Monitoring System

- 4.5.2 Limited Control Given to Customers

5 MARKET SEGMENTATION

- 5.1 Deployment

- 5.1.1 On Cloud

- 5.1.2 On-premise

- 5.2 End-user Industry

- 5.2.1 Retail

- 5.2.2 Manufacturing

- 5.2.3 E-commerce

- 5.2.4 Transportation and Logistics

- 5.2.5 Healthcare

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Motorola Solutions

- 6.1.2 Wabco Holdings Inc.

- 6.1.3 AT&T Inc.

- 6.1.4 Zebra Technologies Corp.

- 6.1.5 Verizon Communications

- 6.1.6 Geotab Inc.

- 6.1.7 Blackline Safety Corp.

- 6.1.8 Spider Tracks Limited

- 6.1.9 Honeywell International Inc.

- 6.1.10 Trimble Inc.