|

市场调查报告书

商品编码

1642106

边缘 AI 硬体:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Edge AI Hardware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

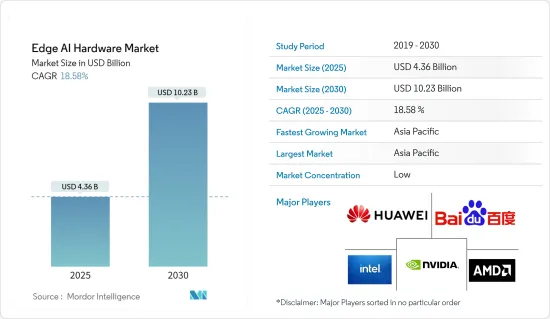

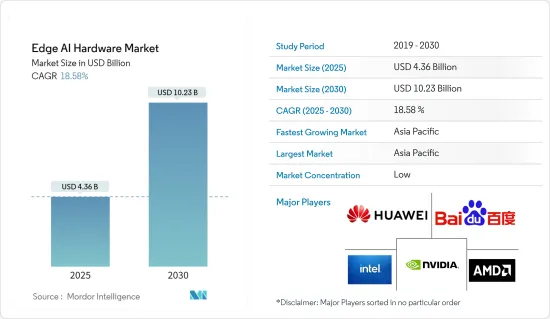

边缘AI硬体市场规模在2025年估计为43.6亿美元,预计到2030年将达到102.3亿美元,预测期内(2025-2030年)的复合年增长率为18.58%。

主要亮点

- 在对沉浸式虚拟实境(VR)环境的追求的推动下,对边缘 AI 硬体的需求激增。 VR 环境需要超低延迟才能提供真正身临其境的体验,即使是最轻微的处理延迟也会破坏使用者的存在感。边缘 AI 硬体促进了设备上的处理,大大减少了设备和云端之间的资料传输。这确保了即时效能,这对于游戏、模拟和培训程式等 VR 应用至关重要。

- 边缘 AI 硬体正在改变媒体和娱乐产业,这主要归功于其实时、高效能的处理能力。此特性对于创造身临其境的客製化体验至关重要。 Netflix、YouTube 和 Amazon Prime Video 等领先的串流媒体平台正在越来越多地利用边缘 AI 硬体来增强即时内容传送。透过更接近最终用户处理资料,Edge AI 有效降低了延迟,确保了流畅的影片串流和更好的观看体验。

- 除了串流媒体之外,Edge AI 硬体还可以帮助视讯编辑和广播。它具有分辨率升级、影格速率提高以及过滤器和效果的即时应用等功能。例如,AI演算法可以直接在边缘装置上将标准影片提升到4K或8K,因此无需依赖云端即可提高观看品质。此外,边缘设备上的人工智慧驱动的视讯压缩优化了频宽使用率。这是直播的关键因素,保持视讯品质的同时减少资料负载至关重要。

- 然而,边缘AI硬体市场面临挑战,主要是由于硬体和软体都前期投资。边缘AI硬体的基础由专用晶片、GPU(例如Nvidia的Jetson平台)、张量处理单元(TPU)和其他高效能处理器组成。这些组件对于即时资料处理和人工智慧推理至关重要,但其高成本成为其采用的障碍,尤其是对于预算紧张的中小型企业和行业而言。

- 疫情爆发后,通讯设备需求、数位化、智慧建筑兴起、汽车搭载ADAS、工业4.0等趋势,带动了智慧电子和通讯设备的成长,从而支持了后续市场的扩张。

边缘人工智慧 (AI) 硬体市场趋势

机器人设备领域预计将占据主要市场占有率

- 人工智慧 (AI) 和边缘运算正在迅速重塑机器人格局,开启更智慧、自主的机器时代。边缘运算可以有效地处理大量资料并解决机器人技术中的传统挑战,例如延迟和频宽问题。同时,人工智慧将使机器人能够从经验中学习并做出明智的决策,从而打造出智慧且适应性强的机器。在报导中,我们探讨这些技术对机器人和自动化未来的影响。

- 边缘人工智慧使机器人能够动态处理环境资料,从而做出即时决策并快速适应周围环境。这种 AI 边缘处理同时利用了机器学习和推理演算法。这种响应能力对于自动驾驶汽车和製造业等领域至关重要,因为及时对环境变化做出反应至关重要。

- 此外,边缘人工智慧提高了机器人决策的准确性。透过在边缘设备上实现人工智慧演算法,机器人可以提高其决策的准确性。对于医疗保健等高风险产业来说,这种准确度至关重要。

- 此外,边缘人工智慧将改善隐私和安全性并增强机器人技术。将资料储存在边缘装置上可降低敏感资讯在传输到集中资料中心或云端的过程中被拦截的风险。这种保护对于处理个人资料的行业(例如医疗保健和金融)至关重要。透过在边缘处理资料,敏感资讯的传输大大减少。然后,云端充当这些处理过的资料的储存库和连接设备的控制中心。这种转变导致对弥合软体和机器人之间差距的边缘人工智慧硬体的需求激增。

- 2024 年 4 月,高通发布了针对物联网和机器人技术的 Edge AI RB3 Gen 2 晶片,并附带「微功率」Wi-Fi SoC。这些开发套件旨在加速该公司AI加速晶片的部署,这些晶片面向嵌入式应用以及机器人和物联网,并具有高达88%的节能潜力。这些投资重点关注边缘人工智慧,正在推动机器人领域的市场成长。

亚太地区成长强劲

- 亚太地区在消费性电子产品市场占有主导地位。印度、中国和韩国等主要国家正在透过政府措施和主要产业参与者的存在来加强本地製造业。此举可能会刺激家电的需求。人工智慧演算法直接整合到智慧型手机、物联网设备和嵌入式系统等边缘设备将进一步推动市场扩张。此外,随着该地区投资的增加,市场对这些技术的需求将大幅增长。

- 根据中国资讯通讯研究院预测,2023年中国行动电话出货量预计将达2.89亿部,与前一年同期比较增加6.5%。 5G行动电话出货量2.4亿部,较去年成长11.9%,占国内行动电话出货量的82.8%。中国信通院资料也显示,国产品牌行动电话新机型上市406款,与前一年同期比较成长5.5%。 2023年12月行动电话出与前一年同期比较增1.5%至约2,828万部。这些重大发展将对市场成长产生正面影响。

- 此外,根据Invest India的数据,印度电子产品市场目前价值1,550亿美元,其中国内生产占65%。电子产品的加速普及是由技术变革所推动的,尤其是5G网路和物联网(IoT)的推出。 「数位印度」和「智慧城市」计划等措施正在推动电子市场对物联网的需求,开创电子产品的新时代。过去六年里,印度不仅一跃成为全球第二大行动电话製造国,国内电子设备产量也增加了一倍以上。

- 亚太地区历来是製造业强国,但物联网 (IoT) 的应用日益普及。 Telenor IoT报告显示,在韩国、日本、澳洲和中国等物联网已开发国家以及印度、巴基斯坦、孟加拉、印尼和泰国等新兴经济体的协同效应推动下,亚太地区的物联网设备数量预计将从最近的145亿成长到2030年的389亿。随着物联网预计将快速成长,对边缘人工智慧硬体的需求也预计将同时大幅增加。

- 此外,该地区多个行业对机器人技术的采用日益广泛,也有望推动市场机会。根据IFR的数据,到2023年,亚洲将成为工业机器人应用的主导力量,占所有新安装量的70%。其中,中国尤为突出,共有1,755,132台机器人投入运作,占全球整体的51%。

边缘人工智慧(AI)硬体产业概览

边缘AI硬体市场由主要供应商主导,他们在各个地理市场激烈竞争以站稳脚跟。出于此原因,供应商正在建立多种联盟和伙伴关係关係以获得市场占有率和技术力。市场的主要企业包括英特尔公司、华为科技公司、英伟达公司、超微半导体公司和百度公司。

厂商之间的竞争策略是透过创新在市场上站稳脚步,由于主要厂商的研发投入能力较强,市场竞争日益激烈。

获得分销管道、现有的业务关係、更好的供应链知识甚至自有平台,使现有的科技巨头比新参与企业拥有市场优势。总体而言,所研究市场中竞争公司之间的敌意程度适中,预计在预测期内将保持不变。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估影响市场的宏观经济因素

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 在虚拟实境环境中创造更逼真体验的兴起

- 电脑视觉在运动产业的应用日益广泛

- 媒体和娱乐应用中越来越多地采用边缘 AI 硬体将推动成长

- 市场限制

- 需要在边缘 AI 硬体和软体上进行大量的前期投资

第六章 市场细分

- 按处理器

- CPU

- GPU

- FPGA

- ASIC

- 按设备

- 智慧型手机

- 相机

- 机器人

- 穿戴式装置

- 智慧音箱

- 其他设备

- 按最终用户产业

- 政府

- 房地产

- 家电

- 车

- 运输

- 卫生保健

- 製造业

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Intel Corporation

- Huawei Technologies Co. Ltd

- Nvidia Corporation

- Advanced Micro Devices Inc.

- Baidu Inc.

- Google LLC(Alphabet Inc.)

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Apple Inc.

- Amazon.com Inc.

- Alibaba Cloud(Alibaba Group Holding Limited)

- Continental AG

- Denso Corporation

- Robert Bosch GmbH

- Kalray

- MediaTek Inc.

- Imagination Technologies

第八章投资分析

第九章:市场的未来

The Edge AI Hardware Market size is estimated at USD 4.36 billion in 2025, and is expected to reach USD 10.23 billion by 2030, at a CAGR of 18.58% during the forecast period (2025-2030).

Key Highlights

- Driven by the quest for heightened realism in virtual reality (VR) environments, the demand for Edge AI hardware is witnessing a significant surge. VR environments necessitate ultra-low latency for a truly immersive experience; even a minor processing delay can disrupt the user's sense of presence. Edge AI hardware facilitates on-device processing, significantly reducing the data transfer between the device and the cloud. This ensures the real-time performance crucial for VR applications, including gaming, simulations, and training programs.

- Edge AI hardware is transforming the media and entertainment industry, primarily due to its capability for real-time, high-performance processing. This attribute is essential for creating immersive and tailored experiences. Leading media streaming platforms, such as Netflix, YouTube, and Amazon Prime Video, are increasingly leveraging Edge AI hardware to enhance real-time content delivery. By processing data closer to the end-users, Edge AI effectively reduces latency, guaranteeing smooth video streaming and an enhanced viewing experience.

- Beyond the realm of streaming, Edge AI hardware is instrumental in video editing and broadcasting. It boasts capabilities like upscaling resolutions, enhancing frame rates, and applying filters or effects in real-time. For example, AI algorithms can elevate a standard video directly to 4K or even 8K on edge devices, boosting viewing quality without relying on the cloud. Furthermore, AI-driven video compression on edge devices optimizes bandwidth usage, a critical factor for live streaming where it's essential to maintain video quality while reducing data loads.

- However, the Edge AI hardware market grapples with challenges, primarily due to the hefty upfront investments in both hardware and software. The foundation of Edge AI hardware comprises specialized chips, GPUs (such as Nvidia's Jetson platform), Tensor Processing Units (TPUs), and other high-performance processors. While these components are vital for real-time data processing and AI inference, their high costs pose a barrier to adoption, particularly for smaller enterprises and industries with tighter budgets.

- Post the COVID-19 pandemic, trends like the demand for communication devices, digitalization, the rise of smart buildings, ADAS-equipped vehicles, and the principles of Industry 4.0 have spurred the growth of smart electronics and communication devices, subsequently driving the market expansion.

Edge Artificial Intelligence (AI) Hardware Market Trends

Robots Device Segment is Expected to Hold Significant Market Share

- Artificial intelligence (AI) and edge computing are rapidly reshaping the landscape of robotics, ushering in an era of smarter and more autonomous machines. Edge computing efficiently processes vast data volumes, tackling traditional challenges in robotics, such as latency and bandwidth issues. Concurrently, AI equips robots to learn from their experiences and make informed decisions, leading to machines that are both intelligent and adaptable. This article explores the profound influence of these technologies on the future of robotics and automation.

- Edge-AI enables robots to make real-time decisions by processing environmental data on-site, allowing for swift adaptation to their surroundings. This edge processing, powered by AI, utilizes both machine learning and inference algorithms. Such responsiveness is vital in sectors like autonomous vehicles and manufacturing, where timely reactions to environmental changes are crucial.

- Moreover, edge AI boosts the accuracy of robotic decisions. By deploying AI algorithms on edge devices, robots enhance their decision-making precision. This heightened accuracy is paramount in industries like healthcare, where the stakes are high.

- Additionally, Edge-AI fortifies robotics with enhanced privacy and security. By storing data on edge devices, the risk of sensitive information being intercepted en route to centralized data centers or the cloud diminishes. This protection is essential for sectors like healthcare and finance, which handle personal data. With data processed on the edge, the transfer of sensitive information is significantly reduced. The cloud then acts as both a repository for this processed data and a control center for connected devices. This shift has led to a surge in demand for edge AI hardware, bridging the gap between software and robotics.

- In April 2024, Qualcomm launched its Edge AI RB3 Gen 2 Chip tailored for IoT and robotics, accompanied by a "Micro-Power" Wi-Fi SoC. These development kits aim to expedite the company's AI-accelerating chip's deployment, targeting not just robotics and IoT but also embedded applications and boasting a potential power draw reduction of up to 88%. Such investments, heavily leaning on Edge AI, are driving the robotics segment's growth in the market.

Asia Pacific to Register Major Growth

- The Asia Pacific region stands out as a dominant player in the consumer electronics market. Major countries, including India, China, and Korea, are ramping up local production through government initiatives and the presence of key industry players. This push is set to amplify the demand for consumer electronics. The market's expansion is further fueled by the direct integration of AI algorithms into edge devices, encompassing smartphones, IoT devices, and embedded systems. Additionally, with rising investments in the region, the appetite for these market technologies is poised for substantial growth.

- According to the China Academy of Information and Communications Technology (CAICT), China's mobile phone shipments in 2023 reached 289 million units, marking a 6.5% increase from the previous year. Shipments of 5G phones hit 240 million units, an 11.9% annual rise, making up 82.8% of the country's total mobile phone shipments. CAICT data also highlighted the introduction of 406 new domestic-brand phone models, a 5.5% increase from the prior year. December 2023 saw mobile phone shipments touch approximately 28.28 million units, reflecting a 1.5% year-on-year growth. These significant developments are poised to positively influence the market's growth.

- Moreover, according to Invest India, the electronics market in India is currently valued at USD 155 billion, with domestic production constituting 65% of this value. The accelerated adoption of electronic products is being driven by technological transitions, notably the rollout of 5G networks and the Internet of Things (IoT). Initiatives like 'Digital India' and 'Smart City' projects have heightened the demand for IoT in the electronics devices market, signaling the dawn of a new era for electronic products. Over the past six years, India has not only emerged as the world's second-largest mobile manufacturer but has also seen its domestic production of electronics more than double.

- The Asia Pacific region, historically a manufacturing powerhouse, is increasingly embracing the Internet of Things (IoT). Telenor IoT reports that in APAC, the synergy between established IoT frontrunners like South Korea, Japan, Australia, and China and emerging players such as India, Pakistan, Bangladesh, Indonesia, and Thailand is propelling the number of IoT devices from a recent tally of 14.5 billion to a projected 38.9 billion by 2030. With this anticipated surge in IoT, there's a parallel expectation for a significant uptick in demand for Edge AI hardware.

- Furthermore, the growing adoption of robots across multiple industries in the region is also expected to drive market opportunities. According to IFR, in 2023, Asia emerged as the dominant force in industrial robot adoption, representing 70% of all new installations. Notably, China stands out, contributing a significant 51% to the global tally, boasting 1,755,132 operational robots across its factories.

Edge Artificial Intelligence (AI) Hardware Industry Overview

The Edge AI Hardware market is dominated by major vendors that cover a significant share of the market studied, and they are intensely competing to gain a foothold in different regional markets. Owing to this, vendors are involved in several partnerships and alliances to gain market presence and technological capabilities. Some of the major players in the market are Intel Corporation, Huawei Technologies Co. Ltd, Nvidia Corporation, Advanced Micro Devices Inc., and Baidu Inc., among others.

The competitive strategy among the vendors is to gain a foothold in the market studied with innovation, and the capability of investing in R&D by major vendors is on the higher side, thus, intensifying the competition in the market studied.

Access to the distribution channel, existing business relations, and better supply chain knowledge, along with the self-owned platform, give the established tech giants a market advantage over the new competitors. Overall, the degree of competitive rivalry in the market studied is moderately high and expected to remain the same over the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Macroeconomic Factors on the Market

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in the Creation of More Realistic Experiences for Virtual Reality Environments

- 5.1.2 Increased Usage of Computer Vision in the Sports Industry

- 5.1.3 Growing Adoption of Edge AI Hardware in Media and Entertainment Applications Is Boosting Growth

- 5.2 Market Restraints

- 5.2.1 Significant Upfront Investment Required for Edge AI Hardware and Software

6 MARKET SEGMENTATION

- 6.1 By Processor

- 6.1.1 CPU

- 6.1.2 GPU

- 6.1.3 FPGA

- 6.1.4 ASICs

- 6.2 By Device

- 6.2.1 Smartphones

- 6.2.2 Cameras

- 6.2.3 Robots

- 6.2.4 Wearables

- 6.2.5 Smart Speaker

- 6.2.6 Other Devices

- 6.3 By End-User Industry

- 6.3.1 Government

- 6.3.2 Real Estate

- 6.3.3 Consumer Electronics

- 6.3.4 Automotive

- 6.3.5 Transportation

- 6.3.6 Healthcare

- 6.3.7 Manufacturing

- 6.3.8 Others

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Huawei Technologies Co. Ltd

- 7.1.3 Nvidia Corporation

- 7.1.4 Advanced Micro Devices Inc.

- 7.1.5 Baidu Inc.

- 7.1.6 Google LLC (Alphabet Inc.)

- 7.1.7 Qualcomm Incorporated

- 7.1.8 Samsung Electronics Co., Ltd.

- 7.1.9 Apple Inc.

- 7.1.10 Amazon.com Inc.

- 7.1.11 Alibaba Cloud (Alibaba Group Holding Limited)

- 7.1.12 Continental AG

- 7.1.13 Denso Corporation

- 7.1.14 Robert Bosch GmbH

- 7.1.15 Kalray

- 7.1.16 MediaTek Inc.

- 7.1.17 Imagination Technologies