|

市场调查报告书

商品编码

1642126

混合积层製造设备:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Hybrid Additive Manufacturing Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

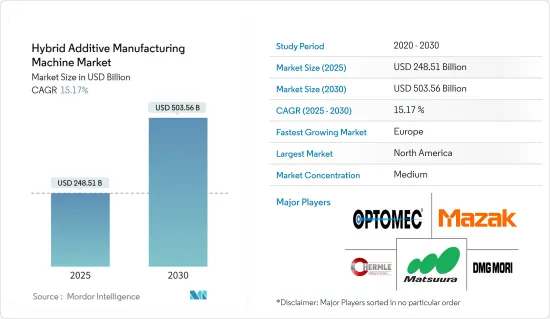

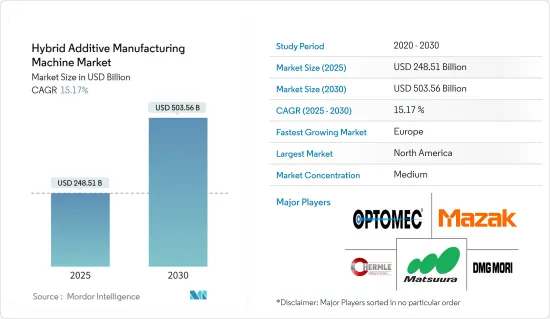

混合积积层製造设备市场规模预计在 2025 年为 2,485.1 亿美元,预计到 2030 年将达到 5,035.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 15.17%。

航太、国防和汽车工业日益增长的需求推动了市场的发展。

混合製造是将减材製造和加材製造流程结合在一台机器上的过程。推动这一市场发展的主要因素是一台机器可以完成两种工艺。在航太、国防和汽车工业尤其如此。能够在两个流程之间即时切换使得生产变得更容易。与 3D 列印一样,该技术相对较新,但混合积层製造的潜在优势让采用者对该技术的未来非常乐观。由于主要国际市场的长期封锁,COVID-19 疫情已导致混合积层製造领域的多种产品生产暂停。因此,过去几个月混合积层製造设备的市场成长明显放缓。新冠疫情影响了 2020 年第一季的设备和机械销售,全年市场成长举步维艰。

混合製造还可以在您需要时生产您需要的零件,从而无需持有昂贵且占用空间的库存。混合积层製造使製造商能够生产自订材料和快速原型,为新产品和提高效率提供机会。最近,美国于2023年1月在巴丹号航空母舰上部署了飞利浦增材混合金属3D列印解决方案。此外,各行各业使用这种设备有助于减少对环境的负面影响。混合製造过程释放的化学物质和有害污染物较少,显着减少碳足迹。

混合积层製造还透过使用能够向任何方向移动製造零件的多轴系统克服了积层製造系统的缺点。此外,减少 95% 的废弃物、提高效率、製程开发和材料表征能力以及节省材料和材料成本是进一步推动整个产业采用混合积积层製造设备的一些主要优势。然而,这些机器的高昂初始投资和安装成本阻碍了市场的成长。此外,投资能力较低的中小企业和製造业因前期投资成本过高而无法引进机械。

此外,机器的操作需要熟练且训练有素的劳动力。为了保持设备的性能并消除系统故障问题,公司必须花费巨额费用为工人提供专门的培训课程。尼康公司透露了最近对 Hybrid Manufacturing Technologies Worldwide Inc. 的投资。混合製造技术公司 (HMT) 是增材製造 (AM) 领域屡获殊荣的行业领导者,已成功开发出允许在任何平台上整合积层工具的整合技术。这项突破性的解决方案将多种互补技术整合到单一设定中,使用户能够最大限度地利用其生产流程。

混合积层製造设备的市场趋势

医疗领域预计将占很大份额

- 在混合积层製造设备市场中,医疗领域占了很大的份额。混合製造在医疗领域的优势在于可以选择客製化零件,而不是使用现成的钛零件。在医疗产业,混合製造用于生产手术器械、义肢和植入物以及鹰架等最终产品。

- 混合积层製造在医疗领域的应用正在增加,主要是因为进行的手术越来越多,越来越多的人开始了解和使用医疗技术的进步。例如,医疗领域手术机器人的广泛应用正在推动自动化,因此医疗领域需要混合製造。

- 此外,与医疗产业的传统製造相比,混合製造的主要优势是产品开发时间更快、患者治疗效果更佳、针对患者或外科医生进行特定的产品开发、製造成本更低以及精度更高。

- 此外,医疗领域的积层製造流程传统上被认为是仅用于生产原型和模型的技术。然而,随着先进技术和生物相容性材料的发展,市场越来越多地采用混合製造作为主要製程。

- 随着数位化的兴起,现在一切都可以透过线上完成,包括 3D 列印。 3D文件储存在线上平台上,客户和经销商可以随时随地轻鬆存取并按需订购。趋势表明,人们对医疗设备的3D列印前景乐观。这是因为它可以帮助医疗专业人员重复手术,减少手术时间并限制决策时间。然而,混合积层製造设备的高成本预计会阻碍市场的发展。

北美占主要份额

- 由于存在多家主要参与者,且所有工业领域的混合製造机器消耗量相对较高,预计北美地区将在混合积层製造市场占据主要份额(从收益来看)。

- 然而,医生和患者对新医疗技术的好处越来越了解,这有助于加速该地区采用这些技术。

- 北美也是最早采用先进医疗技术的地区之一。此外,医疗支出的增加、可支配收入的提高、製造成本的降低、产品开发的快速发展以及作为医疗旅游替代方案的外科手术数量的不断增加,正在推动市场参与者的兴趣。

- 此外,美国航太和汽车工业的持续扩张,也推动着产业快速发展。人们对具有高效生产能力的混合製造机器的认识不断提高,这推动了整个行业的需求。

混合积积层製造设备产业概况

混合积层製造设备市场的竞争格局适度集中,因为主要供应商提供混合製造中使用的机器和设备,占据了大部分市场占有率。提供混合製造机器的公司正在采用各种策略,例如新产品开发、技术创新、併购、合作伙伴关係和协作,以在竞争激烈的行业中生存并加强其在全球范围内提供混合积层製造。此外,混合製造机市场的主要企业正专注于创新和开发技术先进且具有成本效益的设备,这些设备价格实惠,因此适用于大多数行业以及大型行业。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 工业 4.0 集成

- 医疗保健和汽车等行业对客製化、患者专用零件的需求日益增长。

- 市场限制

- 混合积层製造设备的购买和安装成本通常很高,这可能会阻碍中小型製造商和企业采用该技术。

- 确保混合製造过程中始终一致的品质和精度极具挑战性,因为它们需要增材和减材阶段之间的紧密整合、精确的校准和维护。

- 市场机会

- 在航太和国防领域中广泛应用

- 石油和天然气等能源产业可以从混合 AM 机器中受益,该机器可以生产具有更高耐腐蚀性和结构完整性的复杂零件和零件。

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

第五章 市场区隔

- 按最终用户产业

- 航太和国防

- 能源和电力

- 电子产品

- 医疗

- 车

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争格局

- 公司简介

- Optomec, Inc.

- Mazak Corporation

- DMG MORI

- Matsuura Machinery Ltd.

- Hybrid Manufacturing technologies

- ELB-SCHLIFF Werkzeugmaschinen GmbH

- Mitsui Seiki, Inc.

- Okuma America Corporation

- Diversified Machine Systems

- Fabrisonic*

第七章投资分析

第 8 章:市场的未来

The Hybrid Additive Manufacturing Machine Market size is estimated at USD 248.51 billion in 2025, and is expected to reach USD 503.56 billion by 2030, at a CAGR of 15.17% during the forecast period (2025-2030).

The market is driven by the increasing demand from the aerospace, defense, and automotive industries.

Hybrid manufacturing is the process of putting both subtractive and additive processes into a single machine. The market is mostly driven by the fact that both processes can be done on one machine. This is especially true in the aerospace, defense, and automotive industries. It makes manufacturing effortless with the capability to switch between two processes instantly. Although the technology is relatively new, much like 3D printing, the potential benefits of hybrid additive manufacturing have made the adopters of the technology very optimistic about the technology's prospects. The COVID-19 epidemic halted the production of several items in the hybrid additive manufacturing machine sector, mostly because of the extended lockdown in important international markets. This severely slowed the market growth for hybrid additive manufacturing equipment during the past several months. COVID-19 impacted equipment and machinery sales in the first quarter of 2020, and market growth suffered throughout the year.

Hybrid manufacturing also makes parts as they are needed, so there is no need to keep expensive and space-consuming stock. With hybrid additive manufacturing, manufacturers can produce custom materials and rapid prototypes and provide an opportunity for new products and better efficiency. Recently, in January 2023, the US Navy installed a Phillips additive hybrid metal 3D printing solution on USS Bataan. Also, using this equipment in different industries helps to reduce the bad effects on the environment. The hybrid production processes release fewer chemical and hazardous pollutants and account for a major reduction in the carbon footprint.

Also, hybrid additive manufacturing makes up for some of the flaws of the additive manufacturing system by using multi-axis systems that let the parts being made move in any direction. Also, 95% waste reduction, better efficiency, capabilities for process development and material characterization, and material and material cost savings, etc., are some of the major benefits that are further augmenting the adoption of hybrid additive manufacturing machines across sectors. However, high initial investments and installation costs associated with these machines are hindering market growth. Further, SMEs and manufacturing companies with low investment capabilities are unable to deploy the machinery due to the high initial investment costs.

Additionally, the machines require skilled and well-trained labor to operate them. To maintain equipment performance and eliminate system breakage issues, companies need to incur huge costs to provide professional training sessions for workers. Nikon Corporation (Nikon) has disclosed a recent investment in Hybrid Manufacturing Technologies Global, Inc. An integration technique that enables users to integrate additive tools onto any platform was successfully developed by Hybrid Manufacturing Technologies Global, Inc. (HMT), an award-winning industry leader in additive manufacturing (AM). By combining several complementary technologies in a single setup, this ground-breaking solution enables users to fully use the production process.

Hybrid Additive Manufacturing Machine Market Trends

Medical Sector Expected to Hold a Significant Share

- In terms of rate of deployment, the medical sector holds a significant share of the market for hybrid additive manufacturing machines. The benefits of hybrid manufacturing in the medical sector are due to the option to customize parts rather than using pre-made titanium pieces. In the medical industry, hybrid manufacturing is used to make end products such as surgical equipment, prosthetics and implants, and scaffolds.

- The use of hybrid additive manufacturing in the medical field is growing, mostly because more surgeries are being done and more people are becoming aware of and using advances in medical technology. For example, the widespread use of surgical robots in the medical field is leading to automation, which is why the medical field needs hybrid manufacturing.

- Further, the major benefits of hybrid manufacturing over traditional manufacturing in the medical industry are short product development times, better patient recovery, the development of patient- or surgeon-specific products, low manufacturing costs, and better accuracy.

- Also, traditionally, the additive manufacturing process in the medical field was considered a technique used solely to produce prototypes or models. However, with the development of advanced technologies and biocompatible materials, the market has grown in its adoption of hybrid manufacturing as a major process.

- Also, with a splurge in digitization, everything, including 3D printing, is happening online. 3D files can be kept on an online platform that is easily accessible to clients or distributors everywhere at any time to order on demand. According to the trends, 3D printing for medical devices seems optimistic. Such practices are further expected to augment market demand in the industry because they help medical practitioners repeat the operation, reduce the time of the surgery, and limit the decision-making time. However, the high cost of hybrid additive manufacturing machines is expected to hamper the market.

North America to Hold a Major Share

- The North American region is expected to hold a major share in the hybrid additive manufacturing machines market in terms of revenue, owing to the presence of several major players and the relatively higher consumption of hybrid manufacturing machines across all industry verticals.

- However, doctors and patients are becoming more educated about the benefits of new medical technologies, which is helping to speed up the adoption of these technologies in the region.

- Also, North America has been an early adopter of advanced medical technologies. Moreover, the increasing healthcare expenditure, high disposable incomes, low cost of manufacturing, rapid product development, and a growing number of surgical procedures in lieu of medical tourism have amplified the interest of market players.

- Furthermore, the continuous expansion of the aerospace and automotive industries in the U.S. is driving industry development at a rapid pace. The rising awareness of hybrid manufacturing machines that offer efficient production capabilities is driving overall industry demand.

Hybrid Additive Manufacturing Machine Industry Overview

The competitive landscape of the hybrid additive manufacturing machine market is moderately concentrated due to the presence of major vendors providing the machines and equipment used for hybrid manufacturing, and these vendors hold the majority market share. The companies providing hybrid manufacturing machines adopt various strategies, such as new product development, innovations, mergers and acquisitions, partnerships and collaborations, to sustain in the highly competitive industry and to enhance their hybrid additive-manufacturing machines offerings worldwide. Moreover, major players in the hybrid manufacturing machine market are focusing on innovation and development of technologically advanced and cost-effective equipment so that they are affordable and hence applicable to a majority of industries and not just large industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Industry 4.0 Integration

- 4.3.2 In industries like healthcare and automotive, there is a growing demand for customized and patient-specific parts.

- 4.4 Market Restraints

- 4.4.1 Hybrid additive manufacturing machines are often expensive to acquire and install, which can deter smaller manufacturers and businesses from adopting this technology.

- 4.4.2 Ensuring consistent quality and precision in hybrid manufacturing processes can be challenging, as it requires tight integration between additive and subtractive stages, precise calibration, and maintenance

- 4.5 Market Opportunities

- 4.5.1 Increased Adoption in Aerospace and Defense

- 4.5.2 The energy sector, including oil and gas, can benefit from hybrid AM machines for producing complex components and parts with improved corrosion resistance and structural integrity

- 4.6 Industry Value Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By End-user Industry

- 5.1.1 Aerospace & Defense

- 5.1.2 Energy & Power

- 5.1.3 Electronics

- 5.1.4 Medical

- 5.1.5 Automotive

- 5.1.6 Other End-user Industries

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Optomec, Inc.

- 6.1.2 Mazak Corporation

- 6.1.3 DMG MORI

- 6.1.4 Matsuura Machinery Ltd.

- 6.1.5 Hybrid Manufacturing technologies

- 6.1.6 ELB-SCHLIFF Werkzeugmaschinen GmbH

- 6.1.7 Mitsui Seiki, Inc.

- 6.1.8 Okuma America Corporation

- 6.1.9 Diversified Machine Systems

- 6.1.10 Fabrisonic*