|

市场调查报告书

商品编码

1642171

ZigBee:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)ZigBee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

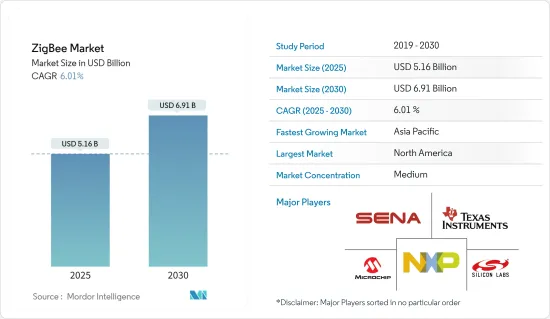

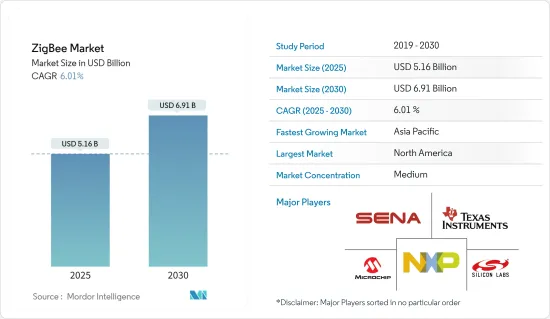

ZigBee 市场规模预计在 2025 年达到 51.6 亿美元,在 2030 年达到 69.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.01%。

主要亮点

- 全球智慧家庭设备采用率的激增将推动未来几年对支援 ZigBee 的设备的需求。随着智慧家庭市场迅速扩张,对与家庭网路无缝整合的智慧家电和电器产品的需求日益增长。 ZigBee通讯协定允许远端控制各种家用电器,从照明和暖通空调系统到安全设备,从而提高能源效率并减少电力浪费。

- 由于智慧型设备的趋势日益增长,家电行业的成长预计将推动新兴经济体采用基于 ZigBee 的通讯服务来监控和控制基于 IEEE 802.15.4 的设备。

- 随着技术的重大进步,市场预计将受到大规模部署 ZigBee 无线网路日益增长的需求的推动,这种网路采用低成本、低功耗的解决方案,可利用廉价电池运行多年,适用于各种监控和控制应用,如智慧型能源能源/智慧电网和楼宇自动化系统。

- 智慧感测器技术的普及、连接性的提高以及云端处理的快速发展正在推动工业IoT的采用和扩展。这一趋势也预计将增加 ZigBee 在微型工业环境中的采用,在这种环境中,製造设备必须在短距离内进行互动。 ZigBee 基于 802.15.4通讯协定,但安全性尚未得到 ZigBee 开发人员的有效处理。该漏洞引起了许多资讯安全专家的兴趣,他们正在研究 802.15.4通讯协定的安全功能以及 ZigBee 无线电在物联网设备中的实现。

- 根据爱立信的《2023年行动报告》,大规模物联网技术NB-IoT和Cat-M将继续在全球部署,这两种技术支援涉及大量低复杂度、低成本、长电池寿命和中低吞吐量设备的广域用例。在全球范围内,已有 128 家服务供应商部署或商业性推出 NB-IoT 网络,60 家服务供应商推出了 Cat-M,45 家服务供应商同时部署了这两种技术。预计到 2023年终,蜂巢式物联网连接总数将达到约 30 亿。网路中新增的功能将促进大规模物联网技术的发展,包括频分双工 (FDD)频宽的频谱共用,以使大规模物联网能够与 4G 和 5G 共存。

ZigBee 市场趋势

住宅自动化领域预计将占据市场主要份额

- 不断增长的都市区对可用资源带来越来越大的压力,因此有必要进行资源监测。物联网可以收集智慧型设备内建感测器的资料,作为支撑智慧城市发展的数位服务的基础。物联网催生了大量互联智慧设备,它们在现代家庭中变得不可或缺。世界银行预计到2025年智慧城市将贡献全球GDP的60%左右。

- 智慧建筑还可以连接到智慧电网,使智慧建筑组件与电网进行互动。这项技术可以实现更有效率的能源发行、主动维护和更快的停电解决。连网装置的使用增加推动了 ZigBee 的采用,从而使智慧集线器变得更加普及。 Amazon Echo、Google Home、Insteon Hub Pro、Samsung SmartThings 和 Wink Hub 是一些智慧家庭中心的范例。

- 此外,全球物联网平台供应商涂鸦也提供智慧家庭自动化中心。它配备了Pegasus技术,可以支援多种智慧家居设备,并配备Gigabit路由器和ZigBee网关。除了平台和技术供应商之外,消费性电子产品製造商也将 ZigBee 技术融入他们的产品中。例如,主要产品为照明系统的电子产品製造商 XAL 目前正与 DALI 一起提供 ZigBee 开放通讯标准。

- 此外,随着智慧家庭设备的重要性日益提高,以及消费者为了方便和节能而对自动化的需求日益增长,物联网 (IoT) 正迅速成为现实。联网生活的概念已经成为焦点,主要是因为它能够增强住宅居住者的安全性。值得注意的是,技术进步正在刺激这些智慧型设备的广泛应用,从而实现联网家庭框架内的广泛用途。

- 此外,根据美国人口普查局的数据,美国住宅数量与前一年同期比较增加,去年达到约 1.44 亿套。此外,美国将于 2023 年 8 月开始建造约 114,200住宅。预计住宅的增加将为市场创造成长机会。根据《2024 年数位游民状况》,截至 2024 年 3 月,伦敦是数位游牧者访问量最大的城市,约占全球数位游牧者旅行的 2.3%。数位游民的此类发展预计将推动所调查市场的发展。

预计北美将占据最大的市场份额

- 北美是主要市场之一,因为该地区大量终端用户行业相关人员对先进技术的需求日益增加。此外,该地区高速网路技术的进步也推动了市场的成长。零售业正在拥抱家庭自动化和智慧家庭自动化。它具有智慧家居系统,可以控制照明、娱乐系统、家用电器和家庭气候。例如,飞利浦照明控股有限公司 (Philips Lighting Holding BV) 提供智慧照明系统 Hue,可了解居住者何时在房间里,并根据需要调整灯光。

- 随着对整合 ZigBee通讯协定的网路硬体的需求日益增长,IT 和通讯行业有望主导市场。 Silicon Labs 的晶片用于三星智慧集线器和Google Wi-Fi 路由器等产品,支援 BLE 和 ZigBee Pro。此外,ZigBee 联盟的「全集线器计画」旨在提高整个生态系统的可靠性、互通性和安全性。藉此势头,D-Link 宣布推出采用 ZigBee 技术的最新解决方案。

- 预计 ZigBee 在住宅自动化领域将会有强劲的需求。越来越多的供应商将该技术融入自己的产品并与其他供应商合作。此外,根据美国人口普查局的数据,2023 年 8 月美国将开始建造约 114,200 套住宅。如此大规模的新居住者可能会为所研究的市场创造成长机会。

- 物联网在医疗保健领域的应用日益广泛,有助于优化业务。物联网提供了远端监控等重要的解决方案。该领域使用这些解决方案有助于提供更好的患者照护。该解决方案还透过提高患者参与度使医生能够提供最好的护理。世界各国政府都在增加医疗保健支出,以确保医疗福利能惠及最偏远的地区。这项技术将使医疗保健系统更有效率地运作。例如,根据经合组织的数据,美国政府将其GDP的16.9%用于医疗保健。

- 此外,ZigBee 的进步可能会推动该地区的采用。例如,在 ZigBee 3.0 中,ZigBee 集群库 (ZCL) 包含所有可用集群,为任何设备利用集群和相关功能提供了完整的工具箱。 ZigBee 3.0 软体堆迭包含一个“基础设备”,可为网路上的性能验证节点提供一致的行为。此外,ZigBee 3.0 支援各种无线网路日益增长的规模和复杂性,可解决超过 250 个节点的大型本地网路。此外,ZigBee 3.0 还提供增强的网路安全性。

ZigBee 行业概览

ZigBee 市场是半静态的,由几个主要参与者组成。从市场占有率来看,少数几家公司占据着产业主导地位。然而,随着通讯技术在连结媒介方面的进步,新公司正在加强其市场影响力,并扩大其在新兴经济体的企业足迹。

- 2024 年 4 月恩智浦半导体将在其最新的 MCX W 系列中推出两款尖端多协定无线多重通讯协定单元 (MCU)。这些 MCU 支援多种通讯协定,包括 Matter、Thread、ZigBee 和低功耗蓝牙 (BLE)。 MCX W72x 是一款具有蓝牙通道侦测功能的先锋无线 MCU。 NXP 专门针对工业IoT应用客製化这些产品。这些产品是恩智浦最近发布的 MCX A 系列和 MCX N 系列的补充。此外,这些产品利用了恩智浦的 FRDM 开发平台,该平台基于 MCX 产品组合的架构、核心、週边和用户友好的 MCUXpresso 开发人员体验构建。

- 2023 年 9 月,大金澳大利亚推出采用 ZigBee 3.0通讯协定的新型时尚控制器,有白色 (BRC1H63W) 和黑色 (BRC1H63K) 两种饰面可供选择。配备ZigBee 3.0通讯协定,可与各种大金无线感测器无缝连接。此升级型号拥有关闭定时器、每週计划定时器和改进的使用者介面等附加功能。此外,您可以使用专用的「Daikin App」从主萤幕轻鬆地与蓝牙装置配对。此外,对ZigBee 3.0的支援使其可以连接各种无线感测器。大金提供四种类型的感测器:二氧化碳感测器(CO2ZB1)、温度和湿度感测器(H24428)、人体存在感测器(H74426)和门窗感测器(DWZB1-CE)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 疫情对市场的影响评估

第五章 市场动态

- 市场驱动因素

- 工业自动化和智慧家庭连网型设备的采用日益增多

- 物联网生态系统中高性能设备的成本不断降低的趋势日益明显

- 市场挑战

- 製造 ZigBee 网路设备的复杂性

- 技术简介

- Zigbee 网状网络

- Zigbee 3.0

- ZigBee RF4CE

- ZigBee PRO

- ZigBee IP

第六章 市场细分

- 按最终用户产业

- 资讯科技/通讯

- 住宅自动化

- 工业自动化

- 卫生保健

- 零售

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 义大利

- 法国

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 北美洲

第 7 章 供应商市场占有率

第八章 竞争格局

- 公司简介

- Texas Instruments Incorporated

- NXP Semiconductors NV

- Microchip Technology Inc.

- Silicon Laboratories Inc

- Digi International Inc.

- Sena Technologies Inc.

- Nordic Semiconductor ASA

- Qualcomm Technologies Inc.

- Semiconductor Components Industries LLC(ON Semiconductor)

第九章投资分析

第十章:市场的未来

简介目录

Product Code: 67134

The ZigBee Market size is estimated at USD 5.16 billion in 2025, and is expected to reach USD 6.91 billion by 2030, at a CAGR of 6.01% during the forecast period (2025-2030).

Key Highlights

- The surge in smart home device adoption globally is set to propel the demand for ZigBee-enabled devices in the coming years. With the smart home market expanding at a rapid pace, the need for smart consumer electronics and appliances that seamlessly integrate with home networks is on the rise. Utilizing the ZigBee protocol allows users to remotely control a range of home appliances, from lighting and HVAC systems to safety equipment, bolstering energy efficiency and curbing power wastage.

- Due to the expanding trend toward smart device adoption, the growing consumer electronics sector is predicted to boost the implementation of ZigBee-based communication services used for monitoring and controlling devices based on IEEE 802.15.4 throughout emerging countries.

- With significant advancements, the market is expected to be driven by growing demand for the ZigBee wireless network deployment on a large scale using low-cost, low-power solutions that can run for years on inexpensive batteries for a variety of monitoring and control applications across smart energy/smart grid and building automation systems.

- The acceptance of smart sensor technologies increases in connection, and breakthroughs in cloud computing have all aided in the acceptance and expansion of Industrial IoT. This trend is also predicted to increase ZigBee adoption in tiny industrial settings where manufacturing gadgets must interact over short distances. ZigBee is based on the 802.15.4 protocol, although security is not effectively handled by ZigBee developers. This vulnerability has piqued the interest of many information security professionals, who are investigating the security capabilities of the 802.15.4 protocol and the implementation of ZigBee radios in IoT devices.

- According to Ericsson Mobility report 2023, the Massive IoT technologies NB-IoT and Cat-M supporting wide-area use cases involving large numbers of low-complexity, low-cost devices with long battery lives and low-to-medium throughput continue to be rolled out across the world. Globally, 128 service providers have deployed or commercially launched NB-IoT networks, 60 have launched Cat-M, and 45 have deployed both technologies. The total number of cellular IoT connections is forecasted to reach around 3 billion at the end of 2023. The growth of massive IoT technologies is enhanced by added capabilities in the networks, enabling massive IoT to co-exist with 4G and 5G in frequency division duplex (FDD) bands via spectrum sharing.

ZigBee Market Trends

The Residential Automation Segment is Expected to Hold a Significant Share of the Market

- As the burden on available resources increases owing to urban population growth, there is a need for resource monitoring. As the Internet of Things (IoT) can gather data from sensors embedded in smart devices, it serves as the foundation for digital services that can aid in developing smart cities. IoT has given rise to many linked smart gadgets that are quickly becoming indispensable in modern households. The World Bank expects smart cities to contribute around 60% of global GDP by 2025.

- Smart buildings can also be linked to a smart grid, allowing smart building components and the electric grid to interact. This technology allows for more effective energy distribution, proactive maintenance, and swifter power outage resolution. The increased use of connected devices has resulted in the adoption of ZigBee, which aids in the proliferation of smart hubs. Amazon Echo, Google Home, Insteon Hub Pro, Samsung SmartThings, and Wink Hub are examples of smart home hubs.

- In addition, Tuya, a global vendor of tailored IoT platforms, provides a smart home automation hub. The technology will be equipped with Pegasus technology, which enables multiple smart home devices and comes with a Gigabit router and ZigBee gateway. Apart from platform and technology vendors, appliance manufacturers are incorporating ZigBee technology in their offerings. For example, XAL, an electronics manufacturing company whose major offerings are lighting systems, is increasingly offering ZigBee open communication standards along with DALI in its offerings.

- Furthermore, the Internet of Things (IoT) is rapidly becoming a reality, fueled by the rising significance of smart home gadgets and a surging consumer appetite for automation, aiming at both convenience and energy efficiency. The concept of connected living is taking center stage, primarily due to its capacity to bolster home residents' security. Notably, technological strides are spurring the uptake of these smart devices, which have a diverse array of applications within the connected home framework.

- Further, according to the US Census Bureau, the number of housing units in the United States has been growing Y-o-Y, and there were approximately 144 million homes in the past year. Further, in August 2023, approximately 114,200 home constructions started in the United States. Such a rise in residential construction is expected to create an opportunity for the studied market to grow. According to the 2024 State of Digital Nomads, London was the most visited city by digital nomads as of March 2024, accounting for roughly 2.3% of trips by digital nomads across the world. Such developments toward digital nomads are expected to drive the market studied.

North America is Expected to Account for the Most Significant Share in the Market

- North America is one of the prominent markets, owing to the growing need for advanced technology by numerous end-user industry players in the region. Additionally, the evolution of high-speed networking technologies in the area is aiding the market's growth. The retail sector is embracing domotics and automation for smart homes. It has a home automation system that controls the lights, entertainment system, appliances, and house climate. For instance, Philips Lighting Holding BV offers Hue, a smart lighting system that can see when residents are in the room and adjust lighting as needed.

- The IT and telecommunications sector is poised to dominate the market, driven by a rising appetite for network hardware integrating the ZigBee protocol. Silicon Labs' chips in products like Samsung's Smart Hub and Google's Wi-Fi router support BLE and ZigBee Pro. Furthermore, the ZigBee Alliance's "All Hubs Initiative" aims to bolster reliability, interoperability, and security across ecosystems. Adding to this momentum, D-Link unveiled its newest solutions featuring ZigBee technology.

- ZigBee's residential automation segment is expected to hold significant demand. An increasing number of vendors are incorporating technology into their offerings and forming alliances with other vendors. Further, according to the US Census Bureau, in August 2023, approximately 114,200 home constructions started in the United States. Such huge construction of new residents in the country would create an opportunity for the market studied to grow.

- The increasing use of IoT in healthcare is helping optimize operations. It offers vital solutions, such as remote monitoring. The usage of these solutions in the sector assists in providing better patient care. The solutions also empower physicians to deliver superlative care by increasing patients' engagement. Governments across the world are increasingly spending on healthcare to make sure that the healthcare benefits reach even the remotest places. This technology enables the healthcare systems to work efficiently. For instance, according to the OECD, the US government spent 16.9% of its GDP on healthcare.

- Further, the advancements of ZigBee would propel the adoption in the region. For instance, in ZigBee 3.0, the ZigBee Cluster Library (ZCL) contains all available clusters and thus provides a complete toolbox from which all devices take their clusters and associated functionality. The ZigBee 3.0 software stack incorporates a 'base device' that provides consistent behavior for commissioning nodes into a network. Further, ZigBee 3.0 supports the increasing scale and complexity of different wireless networks and muddles through large local networks of over 250 nodes. Additionally, ZigBee 3.0 provides enhanced network security.

ZigBee Industry Overview

The ZigBee market is semi-consolidated and consists of a few major players. In terms of market share, several players dominate the industry. However, as communication technology advances throughout the connection medium, new firms are strengthening their market presence and expanding their corporate footprint across emerging nations.

- April 2024: NXP Semiconductors introduces two cutting-edge multiprotocol wireless microcontroller units (MCUs) under its latest MCX W series. These MCUs support a range of protocols, including Matter, Thread, ZigBee, and Bluetooth Low Energy (BLE). The MCX W72x is the pioneer wireless MCU featuring Bluetooth Channel Sounding. NXP is specifically tailoring these offerings for industrial IoT applications. These additions complement NXP's recent releases in the form of the MCX A and MCX N series. Moreover, they leverage NXP's FRDM development platform, which is built on the MCX portfolio's architecture, core, peripherals, and user-friendly MCUXpresso developer experience.

- September 2023: Daikin Australia introduced the new Stylish Controller, available in white (BRC1H63W) and black (BRC1H63K) finishes, equipped with ZigBee 3.0 protocol. This enhancement allows seamless connectivity with a variety of Daikin's wireless sensors. The upgraded model boasts additional features, including an off-timer, a weekly schedule timer, and an improved user interface. Users can easily pair the controller with Bluetooth devices directly from the home screen using the dedicated Daikin App. The controller's ZigBee 3.0 compatibility broadens its connectivity options, supporting a range of wireless sensors. Daikin offers four sensor types: a CO2 sensor (CO2ZB1), a temperature and humidity sensor (H24428), a motion sensor (H74426), and a door/window sensor (DWZB1-CE).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Connected Devices Across Industrial Automation and Smart Homes

- 5.1.2 Rising Trend of Low Cost with High Performance Equipment Across IoT Ecosystem

- 5.2 Market Challenges

- 5.2.1 Complexity in the Manufacturing of Networking Equipment With ZigBee Standards

- 5.3 Technology Snapshot

- 5.3.1 Zigbee Mesh Network

- 5.3.2 Zigbee 3.0

- 5.3.3 ZigBee RF4CE

- 5.3.4 ZigBee PRO

- 5.3.5 ZigBee IP

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 IT and Telecommunication

- 6.1.2 Residential Automation

- 6.1.3 Industrial Automation

- 6.1.4 Healthcare

- 6.1.5 Retail

- 6.1.6 Other End-user Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 Italy

- 6.2.2.4 France

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 South Korea

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Mexico

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Texas Instruments Incorporated

- 8.1.2 NXP Semiconductors NV

- 8.1.3 Microchip Technology Inc.

- 8.1.4 Silicon Laboratories Inc

- 8.1.5 Digi International Inc.

- 8.1.6 Sena Technologies Inc.

- 8.1.7 Nordic Semiconductor ASA

- 8.1.8 Qualcomm Technologies Inc.

- 8.1.9 Semiconductor Components Industries LLC (ON Semiconductor)

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219