|

市场调查报告书

商品编码

1642977

无线扬声器:市场占有率分析、产业趋势与成长预测(2025-2030 年)Wireless Speaker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

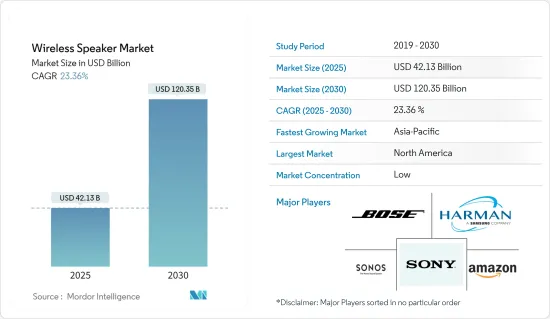

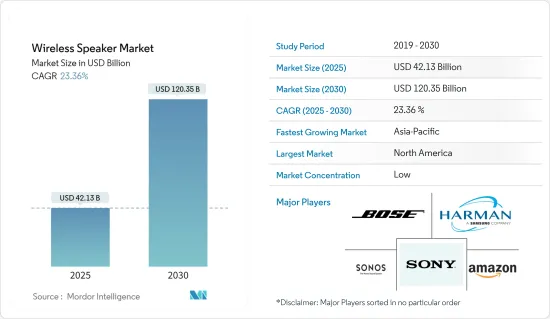

无线扬声器市场规模预计在 2025 年为 421.3 亿美元,预计到 2030 年将达到 1,203.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 23.36%。

智慧家庭领域的投资增加、对可携式扬声器的偏好日益增长以及无线扬声器领域的产品创新不断增加是推动无线扬声器普及的一些关键因素。由于调查市场的产品创新率较高,目前大多数无线扬声器的价格都较实惠。无线扬声器的使用十分方便,这进一步创造了研究市场的机会。

关键亮点

- 主要受语音助理趋势推动的全球智慧音箱日益流行,也进一步推进了无线音箱的发展空间。近年来,千禧世代用户对扬声器市场投入的增加以及对便利、便携设备的偏好,迫使全球扬声器製造商从有线扬声器转向无线技术。最初,大多数市场供应商的目标客户都是喜欢随身携带扬声器播放音乐的千禧世代用户。谷歌和亚马逊等公司最近越来越多地瞄准这一客户群。市场上的供应商还提供防泼水、防水等附加功能来吸引更多客户。

- 目前,蓝牙音箱在许多地区占据较大的市场占有率,但趋势正主要转向Wi-Fi音箱。许多客户表示,延迟、可靠性、直接网路连线和多种模式等特点是 Wi-Fi 扬声器相对于蓝牙的优势。 Sonos 等公司销售的 Wi-Fi 扬声器支援高达 16 位元深度、1,536kbps 的位元率和 48kHz 的取样率的音频,高于 CD 品质等级。由 60 多家电子公司组成的无线扬声器音讯协会 (WiSA) 等倡议正在推动无线扬声器和高解析度音讯的标准化,进一步刺激市场的产品创新。

- 此外,蓝牙连接领域正在进行各种创新,以进一步提高品质和隐私。例如,2022年3月,Sonos升级了其蓝牙音箱。新款 Sonos Roam SL 移除了原始 Sonos Roam 扬声器的麦克风,这意味着用户无法用语音控制它,也无法用它来管理其他智慧家庭设备。

- Sonos 等市场供应商最近推出了 Sonos Radio,这是一个免费的、广告支援的串流广播体验。这也推动了对无线扬声器的需求。 Google Home Max、Amazon Echo Dot 第三代、JBL Link 10 都是搭载AI技术的无线智慧音箱。去年,终端用户在支援虚拟助理的无线扬声器上的支出预计将超过 35 亿美元。

- 此外,Dixon Technologies 最近与以开发 boAt 穿戴式电子产品而闻名的 Imagine Marketing 签署了一项协议,以生产双无线扬声器。 Dixon 将在其位于北方邦诺伊达的製造工厂生产该产品。这些新兴市场的发展预计将为市场成长提供进一步的动力。

- COVID-19 对市场产生了重大影响。中国、印度、韩国、台湾和日本等拥有大量无线扬声器原料製造商的亚洲国家遭遇了封锁,生产计画被打乱。由于全球大部分经济处于封锁状态,交货仅限于必需品,随着企业重新评估其收益目标,销售额下降。然而,在许多国家,封锁措施放鬆后,智慧家庭细分产品的需求增加。

无线扬声器市场趋势

蓝牙无线扬声器可望占据市场份额

- 过去几年,无线扬声器的需求和普及推动了对蓝牙扬声器的需求。这一趋势可以归因于这些经济实惠设备的普及以及消费者对智慧行动装置的偏好。真正无线连接(TWS)日益流行的趋势,允许用户将两个蓝牙扬声器连接在一起以使输出功率加倍,正在推动蓝牙扬声器的普及,主要是在千禧世代。多房间无线扬声器无需依赖电话或电脑即可直接连接到互联网,但防止电话、电子邮件和其他通知中断播放对蓝牙扬声器来说是一个挑战。

- 此外,内建 Chromecast 的扬声器也对蓝牙扬声器的需求构成威胁,因为它们允许用户立即将音乐、广播和播客从行动装置传输到扬声器。与蓝牙不同,内建 Chromecast 扬声器可透过 Wi-Fi 运作,因此您可以同时将多个装置连接到扬声器,并在家中的任何地方控制正在播放的内容。持续的产品创新和进步支撑了蓝牙音箱市场的发展。这些侵犯包括开发防水扬声器、更长电池寿命的多设备连接等等。

- 此外,锂离子电池的进步极大地帮助了可携式扬声器市场,因为它可以提供更长的播放时间而无需频繁充电。行动电源和快速充电技术解决了充电问题并减轻了扬声器的重量,从而促进了需求。

- 不断的产品创新和进步推动着蓝牙音箱市场的发展。例如,2022年2月,华为发布了一款新的可携式蓝牙音箱。华为Sound Joy 是该公司首款可携式蓝牙扬声器。这款扬声器防尘防水达到 IP67 标准,可在最深 1 公尺的水中浸泡 30 分钟。有两种颜色可供选择:绿色和黑色。

- 此外,2022 年 2 月,Mivi 更新了其 Octave 无线扬声器系列,并推出了 Octave 3 蓝牙扬声器。它有四种鲜艳的颜色:灰色、红色、蓝色和绿色。 Mivi 的 Octave 是一系列无线扬声器。因此,新款 MiviOctave 3 采用圆柱形外型和设计,是耳机的延伸,可输出 16W 的声音,并提供 360° 全方位声音体验。

- 蓝牙也是全球无线扬声器和娱乐设备最广泛使用的无线技术标准之一。据蓝牙技术联盟称,去年全球蓝牙音讯设备的出货量预计将达到 13 亿台。预计五年后年出货量将达18亿台。无线耳机、无线扬声器和车载系统是蓝牙音讯设备的典型应用。

预计北美将占很大份额

- 预计北美将占据无线扬声器市场的大部分份额。技术的突破推动了无线扬声器的进步,可以大大提高各种应用的准确性。

- 美国是可携式扬声器的早期采用者,部分原因是智慧型手机和其他行动装置的广泛采用以及线上音乐和视讯串流的早期普及。根据美国唱片协会统计,美国付费订阅串流音乐销量从去年的7,300万张成长了13%,达到8,200万张。

- 根据美国人口普查局的数据,2022年1月美国智慧型手机销售额将增加17亿美元,使2022财年的总销售额达到747亿美元。此类智慧型手机的发展可能会进一步加速市场的发展。

- 为了满足此类无线扬声器的需求,蓝牙技术的广泛采用进一步加强了市场需求。在日本最常用的扬声器是索尼、飞利浦、松下和Bose。此外,美国也为总部位于北美的 Bose 等公司创造了可观的收益。对于索尼公司和三星集团等总部位于亚太地区的公司来说,美国提供了有利可图的扩张机会。这是由于技术发展迅速以及智慧家庭的区域普及率高。

- 此外,Bose 公司最近在美国推出了 Bose Smart Soundbar 900。 Bose Smart Soundbar 900 支援多房间 Wi-Fi 音乐串流与 AirPlay 2。新款 Bose Smart Soundbar 900 取代了 Bose Smart Soundbar 700,也与 Amazon Alexa 和 Google Assistant 相容。

无线扬声器产业概况

由于消费者需求的变化迫使企业进行创新以吸引更多消费者,无线扬声器市场呈现细分化。这个市场竞争逐年激烈,各公司推出越来越多的产品来吸引消费者。市场参与企业包括索尼公司、哈曼国际工业公司、Bose 公司、Sonos 公司和亚马逊公司。

- 2022 年 7 月 - 索尼电子推出三款新机型,扩大了其可携式扬声器产品线:功能强大、高品质的 SRS-XG300 以及 SRS-XE300 和 SRS-XE200,它们由于采用线形扩散器而提供了更大的聆听区域。这三种型号都是可携式的,因此您可以在任何地方享受它们。

- 2022 年 7 月-三星电子澳洲公司推出了「派对音讯」类别。该产品系列包括三款 Sound Tower 产品:MX-ST90B、MX-ST50B 和 MX-ST40B。音响塔是休閒聚会、卡拉 OK 之夜和花园派对的完美娱乐中心,可提供可携式、均匀扩散的双向声音,并配有 LED 灯。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

第五章 市场动态

- 市场驱动因素

- 无线可携式扬声器的使用增加

- 智慧家庭领域的需求不断增长

- 市场限制

- 讯号干扰导致音质劣化

6. 技术概况、政府监管和认证

第 7 章 市场区隔 市场区隔

- 按连线类型

- Bluetooth

- Wi-Fi(含组合扬声器,不含智慧扬声器)

- 智慧音箱

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第八章 竞争格局

- 公司简介

- Bose Corporation

- Samsung Electronics Co. Ltd(Harman International Industries Inc.)

- Sonos Inc.

- Sony Corporation

- Amazon.com Inc.

- Beats Electronics LLC(Apple Inc.)

- Koninkluke Philips NV

- Logitech International

- Panasonic Corporation

- Pioneer Electronics Inc.

- Bang & Olufsen

- LG Electronics Inc.

- Google LLC

- Baidu Inc

- Xiaomi Corporation

第九章投资分析

第十章:市场的未来

The Wireless Speaker Market size is estimated at USD 42.13 billion in 2025, and is expected to reach USD 120.35 billion by 2030, at a CAGR of 23.36% during the forecast period (2025-2030).

The growing investment in the smart home segment, increasing preference for portable speakers, and increasing product innovations in the wireless speaker segment are some of the major factors driving the adoption of wireless speakers. Due to the high rate of product innovation in the studied market, most wireless speakers now come at affordable prices. They are convenient to use, which is further creating opportunities in the studied market.

Key Highlights

- The growing trend of smart speakers globally, mainly due to the trending feature of voice assistants, is further developing space for wireless speakers. In recent years, the growing investment by millennial users in the speakers market and their preference for convenient and easy-to-carry devices have forced global speaker manufacturers to shift to wireless technology from wired speakers. Initially, most market vendors target millennial users who like to carry their speakers around while playing music. Companies like Google and Amazon have been increasingly targeting this customer base recently. Market vendors also provide additional features such as splash resistant or water-resistant to attract more customers.

- Although, presently, Bluetooth speakers account for a significant market share in many regions; however, the trend is mainly shifting toward Wi-Fi speakers. Features like latency, reliability, direct connection to the internet, and multiple modes are some of the advantages of Wi-Fi speakers over Bluetooth reported by many customers. Companies like Sonos are selling Wi-Fi speakers that support audio up to 16-bit depth, 1,536kbps bitrate, and 48 kHz sample rates above the CD-quality level. An initiative like the Wireless Speaker and Audio Association (WiSA), consisting of more than 60 electronics companies, promotes standards and high-resolution audio across wireless speakers, further supporting product innovation in the market.

- Furthermore, various technological innovations are witnessed in the Bluetooth connectivity space to enhance quality and privacy further. For instance, in March 2022, Sonos upgraded its bluetooth speaker. The new Sonos Roam SL removes the microphones from the original Sonos Roam speaker, which means the user won't control it with voice or use it to manage other smart home devices.

- Market vendors like Sonos recently launched Sonos Radio, a free, ad-supported streaming radio experience that brings 60,000 global stations to the sound system. This is also driving the demand for wireless speakers. Google Home Max, Amazon Echo Dot 3rd Gen and JBL Link 10 are some wireless smart speakers with AI technology. It was expected that end-user spending on virtual personal assistant-enabled wireless speakers would be estimated to cross USD 3.5 billion last year.

- Furthermore, recently, Dixon Technologies signed an agreement with Imagine Marketing, the famous boAt wearable electronics developer, to manufacture twin wireless speakers. Dixon will manufacture the products at its manufacturing facility in Noida, Uttar Pradesh. Establishing such developments will further drive market growth.

- COVID-19 impacted the market significantly. Asian countries such as China, India, South Korea, Taiwan, and Japan, which have a significant presence of manufacturers of the raw materials used in wireless speaker manufacturing, experienced lockdowns and disrupted production schedules. The sales were down as the lockdown in most global economies resulted in deliveries limited to essentials and companies revising their revenue targets. However, in many countries, the smart home segment products witnessed increased demand after the ease of the lockdown.

Wireless Speaker Market Trends

Bluetooth Wireless Speakers are Expected to Hold the Major Share

- The need and popularity of wireless speakers bolstered the demand for Bluetooth speakers over the past few years. This trend can be attributed to the greater availability of these affordable devices and the consumer preference for smart portable devices. The growing trend of True Wireless Connectivity (TWS), where one can connect two Bluetooth speakers and double the output, is mainly driving the adoption of Bluetooth speakers among millennials. Although multiroom wireless speakers connect directly to the internet instead of relying on a phone or computer, preventing calls, texts, and other notifications from interrupting playback has posed a challenge to Bluetooth speakers.

- Moreover, Chromecast built-in speakers have also threatened the demand for Bluetooth speakers, as they can instantly stream music, radio, or podcasts from a mobile device to speakers. Unlike Bluetooth, Chromecast's built-in speakers work over Wi-Fi to connect multiple devices to speakers simultaneously and control what's playing from anywhere in the house. Nevertheless, constant product innovations and advancements have sustained the market for Bluetooth speakers. These encroachments include developing water-resistant speakers to connect more than one device with considerable battery life.

- Furthermore, the evolution of lithium-ion batteries helped the portable speaker market immensely by offering more extended playtime without frequent charging. Power banks and quick charging technology assisted in fueling the demand by addressing charging concerns and reducing the weight of speakers.

- Constant product innovations and advancements have sustained the market for Bluetooth speakers. For instance, in February 2022, Huawei announced its new portable Bluetooth speaker. The Huawei Sound Joy is the company's first portable Bluetooth speaker. The speaker is IP67-rated, dustproof, and water-resistant for 30 minutes at a depth of one meter. The speakers are offered in two colors, green and black.

- Furthermore, in February 2022, Mivi announced updating the Octave wireless speaker series with the Octave 3 Bluetooth speaker. Grey, Red, Blue, and Green are the four vibrant color possibilities. Mivi'sOctave is a series of wireless speakers. As a result, the new MiviOctave 3 is an extension capable of producing 16W of sound and experiencing 360° Omnidirectional sound due to its cylindrical shape and design.

- In addition, Bluetooth is one of the most widely used wireless technology standards for wireless speakers and entertainment devices globally. According to Bluetooth SIG, annual Bluetooth audio device shipments worldwide were expected to reach 1.3 billion units last year. Annual shipments are expected to reach 1.8 billion units in five years. Wireless headsets, wireless speakers, and in-car systems are typical applications for Bluetooth-enabled audio devices.

North America is Expected to Hold Major Share

- North America is expected to hold a prominent share of the wireless speaker market. Technological breakthroughs have assisted the advancement of wireless speakers that can significantly improve accuracy in various applications.

- The United States had marked the beginning of the early use of portable speakers, owing to increased penetration of smartphones and other mobile devices and the availability of online music and video streaming at the earliest. According to the Recording Industry Association of America, the paid subscription streaming music revenue in the United States increased from 82 million recently, up 13% compared with 73 million in the previous year.

- In January 2022, according to the U.S. Census Bureau, a 1.7 billion U.S. dollar increase in the sales value of smartphones sold in the United States for a sum of 74.7 billion U.S. dollars in sales in FY 2022. Such developments in smartphones may further drive market growth.

- In support of this demand for wireless speakers, the extensive use of Bluetooth technology further strengthens the market demand. Sony, Philips, Panasonic, and Bose are the most used speakers in the country. Furthermore, for companies like Bose based out of North America, the United States generates significant revenues. For companies like Sony Corporation and Samsung Group that are out of the Asian-Pacific region, the United States offers a lucrative opportunity for expansion. This is due to rapid technological developments and higher regional smart home penetration.

- Furthermore, Bose Corporation recently launched Bose Smart Soundbar 900 in the United States. The Bose Smart Soundbar 900 supports multi-room Wi-Fi music streaming and AirPlay 2. The new Bose Smart Soundbar 900, marketed as a replacement for the Bose Smart Soundbar 700, also supports Amazon's Alexa and Google Assistant.

Wireless Speaker Industry Overview

The wireless speaker market is fragmented, as changing consumer demands push companies to innovate to attract more consumers. The competition in this market has intensified over the years, with companies launching many products to attract consumers. Some of the market players are Sony Corporation, Harman International Industries, Bose Corporation, Sonos Inc., and Amazon.com Inc.

- July 2022 - Sony Electronics Inc. expanded its portable speaker lineup with three unique models: the SRS-XG300, which features powerful and high-quality sound, and the SRS-XE300 and SRS-XE200, which feature a larger listening area from the Line-Shape Diffuser. All three models are portable, permitting users to enjoy them wherever they go.

- July 2022 - Samsung Electronics Australia has launched the "party audio" category by introducing its Sound Tower series of multi-purpose speakers. The Sound Tower MX-ST90B, MX-ST50B, and MX-ST40B are among the three products in the lineup. The Sound Tower is an ideal entertainment hub for casual gatherings, karaoke nights, and garden parties, with a bi-directional sound that disperses evenly and is complemented by LED lights while remaining portable.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Usage of Wireless Portable Speakers

- 5.1.2 Growing Demand in Smart Home Segment

- 5.2 Market Restraints

- 5.2.1 Signal Interference that Causes Degradation in the Sound Quality

6 TECHNOLOGY SNAPSHOT AND GOVERNMENT REGULATIONS AND CERTIFICATIONS

7 MARKET SEGMENTATION

- 7.1 By Connectivity Type

- 7.1.1 Bluetooth

- 7.1.2 Wi-Fi (Incl. Combo Speakers and Excl. Smart Speakers)

- 7.1.3 Smart Speakers

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia-Pacific

- 7.2.4 Latin America

- 7.2.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Bose Corporation

- 8.1.2 Samsung Electronics Co. Ltd (Harman International Industries Inc.)

- 8.1.3 Sonos Inc.

- 8.1.4 Sony Corporation

- 8.1.5 Amazon.com Inc.

- 8.1.6 Beats Electronics LLC (Apple Inc.)

- 8.1.7 Koninkluke Philips NV

- 8.1.8 Logitech International

- 8.1.9 Panasonic Corporation

- 8.1.10 Pioneer Electronics Inc.

- 8.1.11 Bang & Olufsen

- 8.1.12 LG Electronics Inc.

- 8.1.13 Google LLC

- 8.1.14 Baidu Inc

- 8.1.15 Xiaomi Corporation