|

市场调查报告书

商品编码

1643070

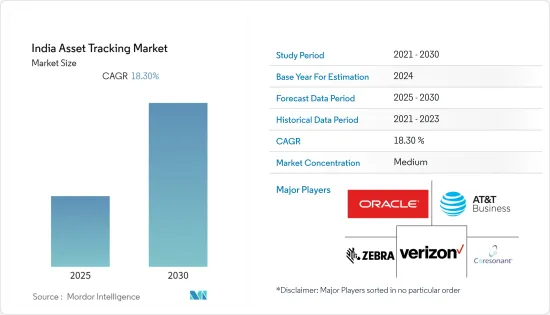

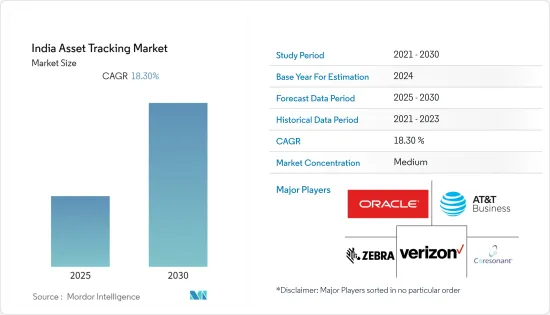

印度资产追踪:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)India Asset Tracking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预测期内印度资产追踪市场预计复合年增长率为 18.3%

关键亮点

- 物联网技术的最新进展使得多个最终用户能够使用经济高效的资产追踪硬体。与标准的传统资产追踪系统相比,现代物联网设备消耗的电力和基础设施最少,正在推动该地区资产追踪系统的销售。

- 由于该地区越来越多地采用各种技术进步以及新兴经济体的重大贡献,预计该国在预测期内将实现显着增长。该地区几乎所有终端用户产业对物联网和人工智慧的快速应用预计将成为关键驱动因素。

- 此外,印度预计还将因中小企业的投资而实现成长。中小型企业正在投资在其业务流程中增加各种先进的技术解决方案。根据印度中小微型企业部的资料,印度是全球中小企业数量最多的国家,达5,000万家。

- 此外,世界各国都在推动本地资料存储,这也涵盖资产追踪市场。例如,印度目前正在製定本地化资料储存的规则。由于这些努力,提供云端基础的服务的供应商将面临限制,并且采用率预计会增加。

- 由于新冠疫情爆发,预计全球景气衰退压力将对全球出口水准产生直接影响。由于中小微型企业占印度出口的40%以上,其影响可能十分严重且持久。由于客户延迟付款,中小微型企业预计将面临一些流动性问题,这可能很快就会导致企业资产追踪采用率下降。

印度资产追踪市场趋势

国内资产追踪硬体供应商和第三方服务供应商的影响力日益增强

- 物流公司越来越多地将物流业务外包给第三方物流服务供应商(3PL)。物流和供应链管理是全球商业的关键组成部分。

- 第三方物流市场的各个细分领域包括运输、仓储、货运代理、附加价值服务等物流功能。第三方物流利用规模经济来更快地交付产品,减少频繁交付,并更有效地追踪仓库库存。

- 本公司主要使用第三方物流物流(3PL) 来提供仓储、运输和出货等核心履约服务。第三方物流提供更现代化的便利设施,通常称为“附加价值服务”,以满足快节奏、按需的业务需求。例如,电子商务公司需要根据消费者的需求、偏好和偏好,更细緻地交付产品和履行订单,才能脱颖而出。专业运输、客製化标籤和最终组装都是附加价值服务的例子。

- 此外,条码和二维码是印度资产追踪系统中越来越多使用的硬体类型。它们提高了用户的业务效率,促进了更好的客户服务,并提供了业务管理流程的可视性。由于条码和二维码的开发成本较低,因此它们多用于不可退货且生命週期较短的产品。例如,食品包装的运输单元可能会被这样标记。

运输和物流领域预计将占很大份额

在印度,运输和物流业对行动资产追踪解决方案的需求庞大。在当前的市场情况下,运输物流参与企业正在使用最先进的自订追踪解决方案。由于该领域的巨大需求,市场上几乎每个资产追踪供应商都有量身定制的解决方案来服务运输和物流行业。

- 此外,根据 IBEF 的数据,印度电子商务市场规模预计将从 2017 年的 385 亿美元成长到 2026 年的 2,000 亿美元。上述新兴市场的发展很可能在不久的将来推动市场成长。此外,由于印度正在进行的数位转型,印度网路用户总数预计将从2019财年的6.3673亿增加到2021财年的8.29亿。运输和物流可能是印度电子商务成长的主要因素,预计这将推动资产追踪市场的发展。

- 此外,预计印度公共交通领域对资产追踪系统的需求将很高。政府委託的公车和卡车车队需要进行即时监控,以确保公共运输的正常运转,并利用资产追踪解决方案提供的预测性维护功能最大限度地降低维护和营运成本。

- 由于新冠疫情和全球供需中断,印度汽车产业大幅下滑,但其乘用车产量却强劲成长。去年,该国生产了360万辆乘用车,预计2020年将达到280万辆。预计汽车产量的成长将推动资产追踪市场的需求。

印度资产追踪产业概况

印度资产追踪市场细分程度适中,由 Oracle、Verizon 和 AT&T Inc. 等多家全球和区域参与企业组成,在竞争激烈的市场领域中占据突出地位。有许多参与企业成功进入了新进入者难以进入的市场。

2022年3月,全球区块链技术供应商SettleMint宣布将与北阿坎德邦一所医科大学启动基于区块链的资产追踪解决方案先导计画。该计划的启动标誌着该公司进军该国公共部门领域。此次合作预计将提高库存管理的效率和改进,有助于降低设备成本。

2022 年 2 月,为服务生命週期管理 (SLM) 提供先进 SaaS 解决方案的非上市公司 Syncron 宣布与印度第二大商用车製造商、全球第四大公车製造商 Ashok Leyland 建立合作伙伴关係。该合作伙伴关係将利用工业IoT为製造商的大型车队开发预测性维护解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 工业影响评估

- 与印度相关的关键使用案例和采用案例

第五章 市场动态

- 市场概况

- 市场驱动因素

- 国内资产追踪硬体供应商和第三方服务供应商的影响力日益增强

- 车辆优化工作持续与技术进步同步进行

- 市场问题

- 缺乏最终用户意识和实施成本仍然是主要问题

第六章 市场细分

- 类型

- 硬体

- 软体

- 服务

- 最终用户产业

- 运输和物流

- 製造业

- 建设业

- 资讯科技/通讯

- 石油和天然气

- 其他的

第七章 竞争格局

- 公司简介

- Coresonant Systems Private Limited

- AT&T Inc.

- Zebra Technologies India

- Quinta Systems Private Limited(Software)

- Oracle Corporation

- Hilti(Software)

- Chekra Business Solutions

- Trimble Inc.

- Identis

- Verizon Communications Inc.

- NFC Group

- SAP SE

- ORBCOMM India

- Omnitracs India

第八章投资分析

第九章 市场机会与未来趋势

The India Asset Tracking Market is expected to register a CAGR of 18.3% during the forecast period.

Key Highlights

- Recent advancements in IoT technology have enabled several end users to acquire economical and efficient asset-tracking hardware. Compared to standard, traditional asset tracking systems, modern IoT equipment that uses minimal electricity and infrastructure is driving the sales of asset tracking systems in the region.

- The country is expected to witness a significant growth rate over the forecast period, owing to the rising adoption of various technological advancements in the region and the significant contributions made by emerging economies. Rapid adoption of IoT and AI in almost every end-user industry in the region is expected to be a major driver.

- Moreover, India is expected to witness growth owing to the investments of small and medium-sized organizations. SMEs are investing to increase the adoption of various technologically advanced solutions for their business processes. According to data from the Ministry of Micro, Small, and Medium Enterprises, India has 50 million MSMEs, which makes it among the world's largest.

- Also, various nations worldwide are pushing toward local data storage, which also covers the asset tracking market. For example, India is looking to move toward localized data storage rules. As a result of such initiatives, vendors who provide cloud-based services face constraints and are expected to see increased adoption.

- Due to the outbreak of COVID-19, recessionary pressures worldwide were anticipated to directly impact the level of global exports. Given that MSMEs contributed to over 40% of India's exports, the impact could be severe and could last for a long time. MSMEs were expected to experience several liquidity problems due to delayed customer payments, which could result in a lower conversion rate for enterprises to adopt asset tracking shortly.

India Asset Tracking Market Trends

Growing Presence of Hardware and Third-Party Service Asset Tracking Vendors in the Country

- Logistics companies are increasingly outsourcing their logistics activities to third-party logistics service providers (3PL). Logistics and supply chain management are critical components of global business.

- The various segments of the third-party logistics market are the logistics functions, such as transportation, warehousing, freight forwarding, and value-added services. Third-party logistics apply economies of scale to deliver the products more quickly, reduce frequent deliveries, and track inventory in warehouses more effectively.

- Companies mostly use third-party logistics providers (3PLs) for core fulfillment services like warehousing, transportation, and shipping. Third-party logistics offer more modern amenities, often known as "value-added services," due to fast-paced and on-demand business needs. For instance, e-commerce companies need to stand out due to consumer demands, tastes, and preferences due to the finer details in product delivery and order fulfillment. Specialized distribution, customized labeling, and final assembly are all examples of value-added services.

- Moreover, barcodes and QR codes are a type of hardware that has witnessed increased usage among the asset tracking systems in India. They improve the users' operational efficiency and foster better customer service, thus providing visibility into business management processes. Since the cost of developing a barcode or a QR code is low, they find applications on products that are non-returnable and have a shorter life cycle. For example, a unit shipment of any food package would bear such a tag.

Transport and Logistics Segment is Expected to Hold a Major Share

Transportation and logistics are witnessing a significant demand for mobile asset tracking solutions in India. Transportation and logistics players use some of the most advanced custom-built tracking solutions in the current market scenario. Due to the significant demand from the sector, almost all the asset-tracking vendors in the market have custom-built solutions to serve the transportation and logistics sector.

- Moreover, according to the IBEF, the Indian e-commerce market is expected to grow to USD 200 billion by 2026 from USD 38.5 billion as of 2017. The above developments may boost the market's growth in the near future, and the ongoing digital transformation in the country is expected to increase India's total internet user base to 829 million by 2021 from 636.73 million in FY19. Transport and logistics may be a big part of why e-commerce in India is growing, which is expected to help the asset-tracking market.

- Furthermore, asset tracking systems are expected to gain significant demand from the public transportation sector in India. Fleets of buses and trucks commissioned by the government need to be monitored in real-time in order to ensure the good health of public transport and minimize maintenance and operation costs through the predictive maintenance features offered by asset tracking solutions.

- India is witnessing a significant increase in the production of passenger cars after the country saw a major decline in the automotive industry owing to the COVID-19 pandemic and global supply-demand disruption. Last year, the country produced 3.6 million passenger cars, with 2.8 million expected in 2020. This increase in automotive production is expected to drive demand for the asset-tracking market.

India Asset Tracking Industry Overview

The Indian asset tracker market is moderately fragmented and comprises several global and regional players, like Oracle, Verizon, and AT&T Inc., vying for attention in a highly competitive market space. Even though it's hard for new players to get into the market, a number of them have been able to do so.

In March 2022, SettleMint, a global blockchain technology provider, announced the launch of a pilot project for blockchain-based asset tracking solutions with the Uttarakhand medical colleges. With the launch of this project, the company has initiated inroads into the public sector in the country. The collaboration would lead to multiple efficiencies and improvements in inventory management and help reduce the cost of equipment.

In February 2022, Syncron, a privately held provider of sophisticated SaaS solutions for service lifecycle management (SLM), announced a partnership with Ashok Leyland. as India's second-largest commercial vehicle manufacturer and the world's fourth-largest bus maker. The partnership would provide for the development of an industrial IoT-enabled predictive maintenance solution for the manufacturer's large fleet of vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of Impact of COVID-19 on the Industry

- 4.4 Key Use-cases and Implementation Case Studies Related to India

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Growing Presence of Hardware and Third-Party Service Asset Tracking Vendors in the Country

- 5.2.2 Ongoing Efforts Toward Fleet Optimization, Coupled with Technological Advancements

- 5.3 Market Challenges

- 5.3.1 Relative Lack of Awareness among End Users and Installation Cost Remain a Key Concern

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 End-user Industry

- 6.2.1 Transportation and Logistics

- 6.2.2 Manufacturing

- 6.2.3 Construction

- 6.2.4 IT and Telecommunication

- 6.2.5 Oil and Gas

- 6.2.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Coresonant Systems Private Limited

- 7.1.2 AT&T Inc.

- 7.1.3 Zebra Technologies India

- 7.1.4 Quinta Systems Private Limited (Software)

- 7.1.5 Oracle Corporation

- 7.1.6 Hilti (Software)

- 7.1.7 Chekra Business Solutions

- 7.1.8 Trimble Inc.

- 7.1.9 Identis

- 7.1.10 Verizon Communications Inc.

- 7.1.11 NFC Group

- 7.1.12 SAP SE

- 7.1.13 ORBCOMM India

- 7.1.14 Omnitracs India