|

市场调查报告书

商品编码

1643110

压力控制设备:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Pressure Control Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

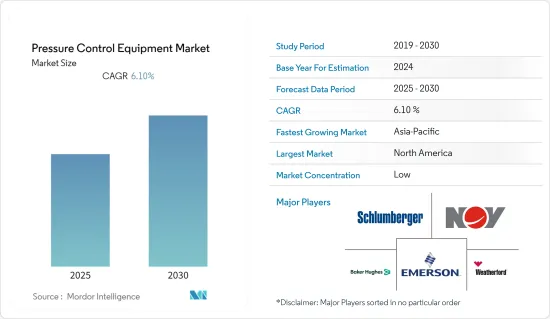

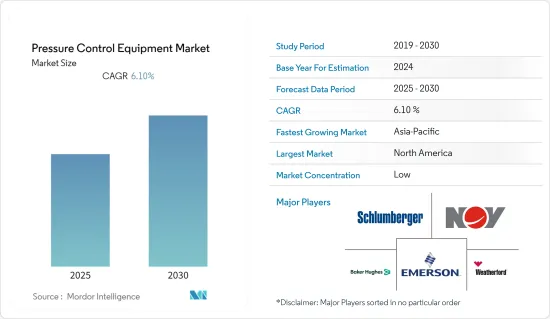

预计预测期内压力控制设备市场复合年增长率为 6.1%。

主要亮点

- 预计压力控制设备市场将受到旨在提高陆上和海上探勘和生产活动效率的先进技术、工具和设备日益增长的需求的推动。然而,近期原油价格因供需缺口、地缘政治等多种因素波动,抑制了压力控制设备需求的成长。

- 作为世界主要能源,碳氢化合物的需求不断增加,导致全球石油和工业发生重大变化。这种转变推动了钻井技术和设备的进步,包括测量、监控和控制流体压力的压力控制装置。

- 预计石油和天然气设备需求的不断增长以及钻井承包商对更高安全标准的不断增长的需求将推动压力控制设备市场的成长。此外,对高压、高温井的专用设备和材料的需求增加可能会推动对压力控制设备的需求。

- 此外,工业物联网 (IIoT)、先进资料分析平台和模拟软体的发展有望推动市场发展。对于设备可靠性测试,压力控制设备市场的製造商越来越多地转向数位化工具。

- COVID-19 疫情影响了市场成长,尤其是在 2020 年。然而,疫情过后,原油、天然气、钢铁等各类工业的需求将会增加。贝克休斯(通用电气旗下一家公司)等产业领导者正在与客户、供应商和厂商密切合作,以尽量减少对其营运的干扰。

- 然而,钻井活动和钻机数量的下降可能会阻碍压力控制设备市场的成长。此外,近期供需缺口、地缘政治等因素造成油价波动,抑制了压力控制设备市场的需求。

压力控制设备市场趋势

阀门行业预计将占据主要份额

- 引导、调节和控制气体、浆液、液体、蒸气和其他物质是阀门在製程工业的主要应用。工业阀门通常由碳钢、铸铁、不銹钢和其他高性能金属合金製成,用于在水、用水和污水、石油和电力、食品和饮料、化学品等领域提供有效的流量控制。

- 此外,石油和天然气产业在下游、中游和上游製程应用中使用工业阀门,使其成为世界上最大的工业阀门消费者。

- 在选择石油和天然气应用中使用的流体系统组件时,所使用的液压阀类型会对设备的稳定性能产生重大影响。无论是为了控制压缩机油压或控制轴承润滑而安装,导向活塞阀都能提供特定的流动和稳定性特性,实现可靠、无颤动的性能。如果使用者意识到导向柱塞阀、泵浦和其他油气处理设备的相对优势,它们的使用寿命将会更长。

- 2022 年 7 月,Connex Banninger 在中东推出了其压力独立控制阀。透过此次发布,Connex Banninger 透过增加一种新型阀门扩大了其广泛的产品范围。新产品旨在提高能源效率并提供更持久、更经济的解决方案。 PICV 提供「三合一」解决方案,包括体积流量控制、差压控制和双埠控制与驱动。

亚太地区推动市场成长

- 市场主要受开发中国家石油需求的推动,预计发展中国家的石油需求将很快超过已开发国家的石油需求。这主要归因于中国、印度和亚洲其他开发中国家的强劲需求,这些国家的经济成长持续强劲。预计随着煤层气和页岩气勘探活动的增加以及油气价格的上涨,钻井量将会增加,市场将会扩大。

- 印度对石化和精製业的投资正在不断增加,预计将开拓高压控制设备市场。过去一年来,印度炼油炼製产业呈指数级增长。印度精製能力为每年2.489亿吨,是继美国、中国和俄罗斯之后的世界第四大精製。

- 随着100万吨/年的乙烯贸易和中化泉州精製炼油厂开发计划的实施,中国的精製能力也不断提升。此外,根据英国石油公司的数据,到 2021 年,中国的精製能力将从每天约 1,670 万桶增长至每天近 1,700 万桶。 1970年至2021年间,该国的石油精製能力每天增加约1,640万桶,并在2021年达到高峰。这些因素可能有助于为压力控制设备的成长开闢新的可能性。

- 国际能源研究所能源与气候中心称,中国的天然气需求也将继续上升,预计每年增长 7% 至 9%,到 2025 年达到 5,000 亿立方公尺。由于页岩气生产的蓬勃发展,国内天然气产量也持续大幅增加。根据中国的五年计划,政府打算加强国内探勘和生产活动,以增加天然气在国家能源消费结构中的份额。这些政府措施是推动压力控制设备市场扩张的因素之一。

- 在预测期内,中国还将扩大其天然气管道网络,以寻求增加无污染燃料在其能源结构中的份额。根据国发改委预测,未来几年我国石油天然气管网总长度将达24万公里,其中天然气管道总合将达12.3万公里。因此,推动压力控制设备市场成长的一些主要因素是亚太地区不断增长的需求和新的管道基础设施。

压力控制设备产业概况

全球压力控制设备市场高度分散。主要企业包括斯伦贝谢有限公司 (原卡梅伦国际公司)、艾默生电气公司、福斯公司、IMI PLC 和克兰公司。

- 2022 年 10 月—艾默生宣布,中国一位客户最近购买了 300 万台 Fisher FIELDVUE 数位阀门控制器,用于膜厂水处理的压力控制阀。数位阀门控制器调节和监控控制阀的开启和关闭,同时提供大量有关阀门状态和健康状况的资讯。

- 2022 年 6 月 - Pressure Tech Ltd. 及其马来西亚授权经销商 ENE Petro Services Sdn Bhd 庆祝了其在东南亚的重要里程碑。 Pressure Tech 已订单PETRONAS/MMHE 的合同,将在 Kasawari天然气田安装压力调节器。包括用于井口控制系统的额定压力为 1,034 bar (15,000 PSI) 的 Inconel 625 背压稳压器。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- 油田装备技术进步

- 全球勘探与生产(E&P)投资增加

- 市场限制

- 钻井承包商的客製化请求

- 减少钻井活动和钻机数量

- COVID-19 产业影响评估

第五章 市场区隔

- 按组件

- 阀门

- 控制头

- 井口法兰

- 圣诞树(漂浮)

- 适配法兰

- 快速联盟

- 其他的

- 按应用

- 海上

- 陆上

- 按类型

- 高压(超过 10,000 PSI)

- 低压(低于 10,000 PSI)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

第六章 竞争格局

- 公司简介

- Allied Valves, Inc.

- Baker Hughes(A GE Company)

- Brace Tool Inc.

- Emerson Electric Co.

- FHE USA LLC

- GKD Industries Ltd

- Hunting PLC

- IKM Pressure Control AS

- Schlumberger Ltd

- Weatherford International PLC

- National Oilwell Varco Inc.

- Kirloskar Brothers Ltd

- Lee Specialties Inc.

- TIS Manufacturing Ltd

第七章投资分析

第八章 市场机会与未来趋势

简介目录

Product Code: 69760

The Pressure Control Equipment Market is expected to register a CAGR of 6.1% during the forecast period.

Key Highlights

- The market for pressure control equipment is expected to be driven by increased demand for advanced technology, tools, and equipment to improve the efficiency of exploration and production activities in onshore and offshore areas. However, the recent volatility in oil prices due to the supply-demand gap, geopolitics, and a variety of other factors has stifled growth in the demand for pressure control equipment.

- Increasing demand for hydrocarbons, a key source of global energy supply, has resulted in significant changes in oil and industry in various parts of the world. This transformation has resulted in advancements in well-drilling technologies and various equipment, including pressure control equipment that measures, monitors, and controls fluid pressure.

- The rising demand for oil and gas equipment, as well as the increasing need for higher safety standards by well-drilling contractors, are expected to drive the growth of the pressure control equipment market. Furthermore, rising demand for special instruments and materials in high-pressure and high-temperature wells may drive up demand for pressure control equipment.

- Also, the market expansion is anticipated to be aided by developments in the Industrial Internet of Things (IIoT), sophisticated data analytics platforms, and simulation software. For equipment reliability testing, manufacturers in the pressure control equipment market are increasingly turning to digital tools.

- The COVID-19 pandemic affected the market's growth, particularly in 2020, due to lockdowns across various countries. However, post-COVID-19, the demand for various industrial goods, including crude oil, natural gas, steel manufacturing, etc., will rise. Major companies in the industry, such as Baker Hughes (GE Company), are working closely with customers, suppliers, and vendors to minimize operational disruption.

- However, declining drilling activities and rig counts may hamper the growth of the pressure control equipment market. Also, the volatile oil prices over recent periods, owing to the supply-demand gap, geopolitics, and several other factors, have been restraining the demand for the pressure control equipment market.

Pressure Control Equipment Market Trends

Valves Segment Expected to Hold Significant Share

- The direction, regulation, and control of gases, slurries, liquids, vapors, and other substances are the main uses of valves in the process industries. Industrial valves are often built of carbon steel, cast iron, stainless steel, and other high-functioning metal alloys to achieve effective flow control in water and wastewater, oil and power, food and beverage, chemicals, and others.

- Additionally, the oil and gas sector uses industrial valves in downstream, midstream, and upstream process applications, making it the largest consumer of industrial valves worldwide.

- When choosing components for fluid systems used in oil and gas applications, the type of hydraulic valve can significantly impact how consistently the equipment performs. Whether installed to control compressors' oil pressure or lubrication for bearings, guided piston valves offer specific flow and stability characteristics for dependable performance without chatter. If users are aware of the relative benefits of guided piston valves, pumps, and other oil and gas processing equipment, it will have a long service life.

- In July 2022, Conex Banninger launched pressure-independent control valves in the Middle East. Conex Banninger, with its launch, expanded its wide range of products with the addition of a new kind of valve. The newest addition aims to increase energy efficiency to provide a more lasting and economical solution. PICVs offer a "three-in-one" solution, with volume flow control, differential pressure control, and two-port control and actuation.

Asia-Pacific to Drive Market Growth

- The market is primarily driven by the demand for oil in developing nations, which is anticipated to surpass that in industrialized nations soon, primarily due to strong demand from China, India, and other developing nations throughout Asia, which are continuing to experience strong economic growth. The market is anticipated to expand as more wells are dug due to increased efforts to find coal seam gas and shale gas and favorable oil and gas prices.

- India's investment in the petrochemicals and refining sectors is anticipated to open up the country's market for high-pressure control equipment. The refining industry in India has grown dramatically over the past year. With a 248.9 MMTPA refining capacity, India is the world's fourth-largest refiner after the United States, China, and Russia.

- China's refining capacity is also increasing with a deal for 1 MTA ethylene and a refinery development project by Sinochem Quanzhou Petrochemical. Additionally, according to BP Plc., China's oil refinery capacity increased from roughly 16.7 million barrels per day in 2021 to almost 17 million barrels per day in 2021. The capacity of the country's oil refineries expanded by around 16.4 million barrels per day between 1970 and 2021, reaching a peak in the latter year. These factors will help to open up new potential for pressure control equipment growth.

- According to the IFRI Centre for Energy & Climate, China's natural gas demand is also expected to continue to climb, rising by 7% to 9% yearly to reach up to 500 bcm by 2025. Due to a boom in shale gas production, domestic gas production has also continued to increase significantly. According to China's five-year plans, the government intends to boost domestic exploration and production efforts in order to raise the share of natural gas in the country's energy consumption mix. One of the factors fueling the expansion of the market for pressure control equipment is such government efforts.

- During the forecast period, China is also anticipated to expand its network of gas pipelines to increase the proportion of clean fuels in the nation's energy mix. The oil and gas pipeline network in China is anticipated to reach 240,000 km in the next few years, with natural gas pipes totaling 123,000 km, according to the National Development and Reform Commission of China. Therefore, some of the key factors propelling the growth of the pressure control equipment market are the rising demand and new pipeline infrastructure in the Asia-Pacific region.

Pressure Control Equipment Industry Overview

The global pressure control equipment market is highly fragmented. The major companies include Schlumberger Limited (previously Cameron International), Emerson Electric Co., Flowserve Corporation, IMI PLC, and Crane Co., among others.

- October 2022 - Emerson announced that a customer in China recently purchased the 3 millionths Fisher FIELDVUE digital valve controller for use in their membrane plant's water treatment pressure control valve. A digital valve controller regulates and monitors the opening and closing of a control valve, and it also provides a wealth of information about the status and health of the valve.

- June 2022 - Pressure Tech Ltd. and Malaysian authorized reseller, ENE Petro Services Sdn Bhd, celebrated a significant milestone reached in Southeast Asia. Pressure Tech was given a contract by Petronas/MMHE to install pressure regulators in the Kasawari Gas Field. A 1,034 bar (15,000 PSI) rated Inconel 625 back pressure regulator for a wellhead control system is included in the box.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Technological Advancement in Oilfield Equipment

- 4.4.2 Increase in Global Investments in Exploration & Production (E&P)

- 4.5 Market Restraints

- 4.5.1 Customized Demands by Drillers

- 4.5.2 Decline in Drilling Activities and Rig Counts

- 4.6 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Component

- 5.1.1 Valves

- 5.1.2 Control Head

- 5.1.3 Wellhead Flange

- 5.1.4 Christmas Tree (Flow Tee)

- 5.1.5 Adapter Flange

- 5.1.6 Quick Unions

- 5.1.7 Others

- 5.2 Application

- 5.2.1 Offshore

- 5.2.2 Onshore

- 5.3 Type

- 5.3.1 High Pressure (Above 10,000 PSI)

- 5.3.2 Low Pressure (Below 10,000 PSI)

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Middle East & Africa

- 5.4.5 Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Allied Valves, Inc.

- 6.1.2 Baker Hughes (A GE Company)

- 6.1.3 Brace Tool Inc.

- 6.1.4 Emerson Electric Co.

- 6.1.5 FHE USA LLC

- 6.1.6 GKD Industries Ltd

- 6.1.7 Hunting PLC

- 6.1.8 IKM Pressure Control AS

- 6.1.9 Schlumberger Ltd

- 6.1.10 Weatherford International PLC

- 6.1.11 National Oilwell Varco Inc.

- 6.1.12 Kirloskar Brothers Ltd

- 6.1.13 Lee Specialties Inc.

- 6.1.14 TIS Manufacturing Ltd

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219