|

市场调查报告书

商品编码

1643117

中东电池:市场占有率分析、行业趋势和成长预测(2025-2030 年)Middle-East Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

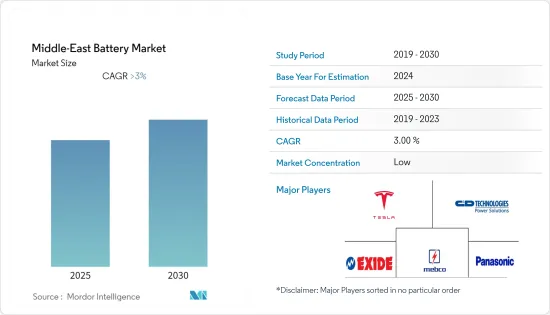

预计预测期内中东电池市场的复合年增长率将超过 3%。

由于当地实施封锁,市场受到 COVID-19 疫情的负面影响,导致电池需求下降。目前,市场已恢復至疫情前的水准。

关键亮点

- 在预测期内,中东电池市场将受到锂离子电池价格下降、电动车购买者数量增加以及可再生能源领域成长的推动。

- 另一方面,原材料的供需差距可能会减缓市场成长。

- 人们对技术先进的电池的日益关注以及在电池製造研发阶段使用人工智慧可能会为电池公司投资和分配资源以实现电池技术的突破提供巨大的机会。

- 预计阿拉伯联合大公国将引领市场成长。这是因为该国年轻且多元化的人口大量购买智慧型手机和汽车等家用电子电器产品。

中东电池市场趋势

铅酸电池占据市场主导地位

- 预测期内,铅酸电池市场预计将在中东地区已开发经济体和新兴经济体中占据主导地位。预计这一成长主要受铅酸电池低成本、可再生能源目标以及工业领域采用自动导引车的推动。

- 铅酸电池的能量重量比较低,但高功率,这使得它们主要用于 SLI(启动照明点火)应用,因为它们可以提供大的突波电流。此外,由于成本低,当价格比能量重量比更重要时,铅酸电池是首选。铅酸电池的应用领域包括行动电话塔、医院和离网远端储存的备用电源。

- 汽车铅酸电池占据了一半以上的市场。大多数汽车(电动车除外)电池都是 SLI 电池,而铅酸电池也可用于车上娱乐系统系统、动力方向盘、电动锁和电动车窗系统等应用。

- 截至 2022 年,中东地区用于启动活塞引擎的铅酸电池进口额约为 5.38 亿美元。

- 因此,由于上述因素,预测期内铅酸电池产业预计将保持成长动能并在中东地区占据主导地位。

阿拉伯联合大公国主导市场成长

- 阿拉伯联合大公国很可能在未来几年引领市场成长。这是因为,随着家用电子电器需求的增加和汽车销售的成长,对一次电池电池和二次电池的需求预计都会增加。

- 阿联酋人口年轻且背景多元化,这使得他们更有可能购买智慧型手机和汽车等家用电子电器产品。例如,2022年第一季对阿联酋的行动电话总出货量约为150万部,价值约4.946亿美元。从市占率来看,传统行动电话占比为9.3%,智慧型手机占比高达90.7%。随着阿联酋越来越多的人购买家用电子电器产品,对方形和圆柱形电池的需求预计将增加。

- 由于人口的增加,建筑业是快速成长的行业之一。预计2020年世博会等基础设施建设计划(例如阿布达比地铁和阿提哈德铁路网)、蓬勃发展的工业化和建设活动将在该国达到更高水平,从而补充备用、照明和电动工具等活动对电池的需求,这很可能在不久的将来推动对袋装电池(用于钻头等无绳形电动工具)和圆柱电池市场的需求。

- 2022年3月,M Glory控股集团投入资金,将阿联酋打造为适合生产电动车的地点。该工厂总投资约4.1亿美元。该工厂的产能预计约为每年 55,000 辆电动车,是中东地区最高的。此外,该公司已向市场推出了首款电动车 Al Damani DMV300。因此,汽车领域对圆柱形和方形电池的需求日益增加。

- 阿联酋拥有广泛的充电基础设施,截至 2021 年,杜拜拥有约 530 个充电站,全国约有 120 个充电站。主要电动车製造商正在阿联酋推出新的电动车车型。其中包括BMW i8、宾士 GLC 350e、雷诺 Zoe 和雪佛兰 Bolt。

- 因此,基于上述因素,阿联酋预计将在预测期内主导中东电池市场的成长。

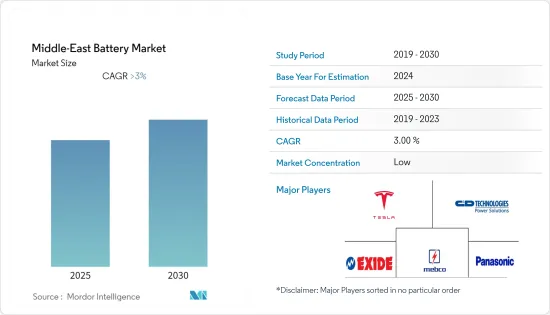

中东电池产业概况

中东电池市场呈现分化态势。主要企业(不分先后顺序)包括特斯拉公司、C&D Technologies Inc.、Exide Industries Ltd.、中东电池公司 (MEBCO) 和松下公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2028 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 类型

- 一次电池

- 二次电池

- 科技

- 铅酸电池

- 锂离子电池

- 其他的

- 应用

- 汽车领域

- 工业电力(电力、固定(电信、UPS、能源储存系统(ESS) 等))

- 消费性电子产品

- 其他的

- 地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Tesla Inc.

- Panasonic Corporation

- Saft Groupe SA

- Middle East Battery Company(MEBCO)

- C&D Technologies Inc.

- EnerSys

- Exide Industries Ltd

- FIAMM Energy Technology SpA

- Statron Ltd

第七章 市场机会与未来趋势

The Middle-East Battery Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was negatively impacted by the outbreak of COVID-19 due to regional lockdowns, leading to a decrease in demand for batteries. Currently, the market has rebounded from pre-pandemic levels.

Key Highlights

- During the forecast period, the Middle-East battery market will be driven by things like falling prices for lithium-ion batteries, more people buying electric cars, and the growth of the renewable energy sector.

- On the other hand, the difference between raw material demand and supply is likely to slow market growth.

- Nevertheless, the rising focus on technologically advanced batteries and the use of artificial intelligence in the R&D phase of battery manufacturing is likely to create a massive opportunity for the battery companies to invest and redirect their resources to make a breakthrough in battery technology.

- The growth of the market is expected to be led by the United Arab Emirates. This is because the country's young and diverse population buys a lot of consumer electronics, like smartphones and cars.

Middle East Battery Market Trends

Lead-acid Batteries to Dominate the Market

- The lead-acid batteries segment is expected to dominate the market in both developed and emerging economies in the Middle East region during the forecast period. The growth is expected to be mainly due to the low cost of lead-acid batteries, renewable targets, and the adoption of automated guided vehicles in industrial spaces.

- The energy-to-weight ratio of the lead-acid battery is low, but it can supply large surge currents, indicating a high power-to-weight ratio primarily useful for SLI (Starting Lighting Ignition) applications. Also, due to their low cost, lead-acid batteries are preferred when the price is more important than the energy-to-weight ratio. Some areas where lead-acid batteries can be used are backup supplies for mobile phone towers, hospitals, off-grid remote storage, etc.

- Lead-acid batteries in automotive applications contribute to more than half of the market. Automotive (excluding electric vehicles) batteries are mostly SLI batteries, and the lead-acid battery can also be used for applications like in-vehicle entertainment systems, power steering, power locking, power window systems, etc.

- As of 2022, the import value of lead-acid accumulators of the kind used for starting piston engines across the Middle East was about USD 538 million.

- Therefore, based on the abovementioned factors, the lead-acid battery segment is expected to maintain its growth momentum and dominate the Middle East region during the forecast period.

The United Arab Emirates to Dominate the Market Growth

- The United Arab Emirates is likely to lead the growth of the market over the next few years. This is because there is more demand for consumer electronics and more sales of cars, which are expected to increase the demand for both primary and secondary batteries.

- People in the United Arab Emirates, who are mostly young and from different backgrounds, are likely to buy a lot of consumer electronics, like smartphones and cars. For instance, the total shipments of mobile phones to the United Arab Emirates in the first quarter of 2022 were around 1.5 million units, worth about USD 494.6 million. In terms of share, smartphones accounted for 90.7% of the total number of shipments, compared to 9.3% for traditional phones. In the United Arab Emirates, the demand for prismatic and cylindrical battery cells is likely to rise as more and more people buy consumer electronics.

- Due to the growing population, the construction and building industry is also one of the fastest-growing industries. Infrastructure development projects in line with Expo 2020 (such as the Abu Dhabi Metro and Etihad Rail Network), booming industrialization, and construction activities are expected to be on the higher side in the country, which in turn is expected to supplement the demand for batteries for activities such as backup, lighting, and power tools, which is likely to propel demand for pouch batteries (used in cordless power tools such as drilling tools) and the cylindrical battery cell market in the near future.

- In March 2022, M Glory Holding Group put money into making the United Arab Emirates a better place to make EVs. The total investment in the plant is around USD 410 million. The plant's capacity would be around 55,000 EVs a year, expected to be the highest in the Middle East region. Furthermore, the company also introduced its first electric car, the Al Damani DMV300, to the market. resulting in more demand for the prismatic as well as cylindrical battery cell in the automobile sector.

- The United Arab Emirates has a better charging infrastructure, with Dubai having around 530 charging stations and around 120 spread across the country as of 2021. Major EV manufacturers are launching their new models of EV in the United Arab Emirates. Some of these are the BMW i8, Mercedes-Benz GLC 350e, Renault Zoe, and Chevrolet Bolt.

- Therefore, based on the abovementioned factors, the United Arab Emirates is expected to dominate Middle-East battery market growth during the forecast period.

Middle East Battery Industry Overview

The Middle East battery market is fragmented. Some of the major players (in no particular order) include Tesla Inc., C&D Technologies Inc., Exide Industries Ltd., the Middle East Battery Company (MEBCO), and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lead-acid Battery

- 5.2.2 Lithium-ion Battery

- 5.2.3 Other Technologies

- 5.3 Application

- 5.3.1 Automotive

- 5.3.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.3.3 Consumer Electronics

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 United Arab Emirates

- 5.4.2 Saudi Arabia

- 5.4.3 Rest of the Middle-East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Tesla Inc.

- 6.3.2 Panasonic Corporation

- 6.3.3 Saft Groupe SA

- 6.3.4 Middle East Battery Company (MEBCO)

- 6.3.5 C&D Technologies Inc.

- 6.3.6 EnerSys

- 6.3.7 Exide Industries Ltd

- 6.3.8 FIAMM Energy Technology SpA

- 6.3.9 Statron Ltd