|

市场调查报告书

商品编码

1643132

印度智慧型电视与 OTT -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)India Smart TV and OTT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

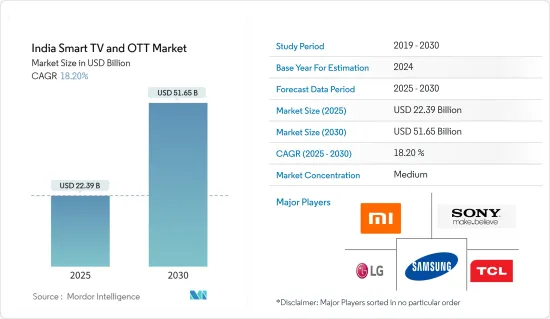

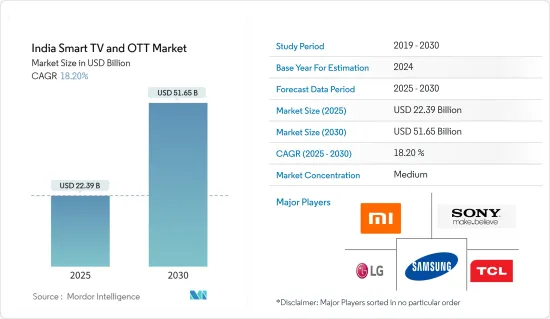

印度智慧型电视和 OTT 市场规模预计在 2025 年为 223.9 亿美元,预计到 2030 年将达到 516.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 18.2%。

随着高速网路的普及,热衷于高品质内容的观众/听众开始更喜欢智慧电视而不是其他电视系统。此外,对视听内容 OTT 串流媒体的需求日益增长,对印度的整体智慧型电视市场产生了积极影响。

关键亮点

- 印度大部分地区的高速网路普及以及消费者对线上内容偏好的转变正在推动市场成长。 Netflix、Amazon Prime 和 Hotstar 等串流影片公司的大量投资带动付费电视用户数量的增加。

- 此外,可支配收入水准的提高和互联网普及率的提高也促进了智慧型电视销售的成长,从而促进了市场成长。此外,根据 IBEF 的数据,印度 OTT 视讯串流市场规模预计到 2023 年将达到 50 亿美元,到 2022 年将达到 8.23 亿美元,成为全球十大 OTT 市场之一。

- 印度家庭正在经历转型,其偏好从传统电视转向智慧电视。中等收入阶级生活方式的改变源自于收入水准的提高、意识的增强、新技术的采用和网路普及率的提高。此外,政府措施(主要在二线和三线城市)也是预测期内推动印度智慧型电视市场成长的主要因素之一。

- 同时,线上串流媒体的需求不断增长,为服务供应商进入 OTT 领域并透过网路提供内容提供了机会。 Netflix、亚马逊、Hotstar、Sony Liv 等 OTT 内容参与企业以及其他几家串流媒体服务正在增加对行销和本地内容的支出,以扩大客户群并吸引客户放弃 DTH 和有线电视服务。许多此类平台也与宽频供应商合作,透过提供免费捆绑优惠来吸引现有资料用户。这些持续的努力加上消费行为的改变,正在帮助推动该市场的需求。

- 新冠肺炎疫情对显示器产业带来了不利影响,主要製造地的生产业务暂停,生产速度大幅放缓。三星、LG Display和小米等各大製造商已停止在中国、印度、韩国和欧洲的生产业务。然而,疫情期间,由于人们长时间待在家中,市场消费需求大幅增加。此外,疫情导致的电视收视率上升也预计将持续影响市场,进而推动市场成长。

印度智慧电视与 OTT 市场趋势

物联网生态系统中智慧型设备的普及正在推动市场成长

- 根据爱立信的《物联网连接展望》报告,2021年,透过物联网技术连接的设备数量将增加80%左右,达到3.3亿台。这种增长可归因于连接功能到许多设备和应用程式中的整合以及各种网路通讯协定的发展,这些发展推动了各个终端用户行业的消费者物联网市场的成长。

- 网路普及率的提高也促进了印度越来越多地采用支援物联网的家用电子电器,例如智慧型电视。根据贝恩公司发布的《为印度解锁数位技术:500 亿美元的机会》报告,印度拥有全球第二大活跃网路用户群,约有 3.9 亿居民每月至少造访一次网路。此外,根据爱立信连接展望报告,物联网技术的成长将透过增加实现大规模物联网与4G和5G共存的网路功能而得到促进。

- 此外,环境智慧和自动用户帮助等功能使得智慧型电视在物联网生态系统中变得越来越重要,再加上印度人民的可支配收入的增加,进一步推动了市场成长。

- 家用电子电器製造商三星印度公司最近表示,预计 LED 电视领域的成长率将接近 25%。该公司旨在透过提供具有正确提案和新技术的产品来占据约 36% 的电视市场总量。为此,该公司于 2022 年 4 月在印度推出了超高阶 2022 Neo QLED 8K 和 Neo QLED 电视。

- 此外,小米最近还增加了三家新的智慧型手机和智慧型电视合作伙伴,扩大了其在印度的生产规模。新的合作伙伴关係预计将进一步提升小米在印度的製造能力。预计这些领先供应商的发展将在预测期内推动市场成长。

网际网路通讯协定电视(IPTV)推动市场成长

- 视讯点播 (VOD) 是 IPTV 提供的动态功能之一。视讯资料透过即时串流通讯协定传输。 VOD 最近变得非常流行。因此,智慧型电视的普及率正在上升。此外,随着智慧型手机普及率的提高和资料通讯资费的降低,透过 OTT 平台提供的 VoD 服务在印度呈现出良好的成长动能。

- 由于该地区宽频普及率的提高和内容消费行为的改变,OTT 和 IPTV 正在获得发展动力。这种影响在印度等亚洲国家尤其明显,这些国家21财年的GDP成长率为8.9%。该地区的快速都市化(印度为35.39%)和不断增长的消费能力在家庭采用 IPTV 方面发挥关键作用。

- 此外,印度政府在有线电视数位化、直接到户(DTH)服务等数位转型方面的努力也支持了IPTV在该国的普及。随着网路服务供应商的出现,向其客户免费提供即时 IPTV 串流服务,印度的 IPTV 格局正在改变。其他公司也纷纷效仿,预计该地区对行动 IPTV 服务的需求将会增加。

- 为了维持市场竞争力,各个供应商都在进行策略性投资。例如,2022年7月,印度政府宣布核准索尼影视网路印度公司与Zee Entertainment的合併。

印度智慧型电视和OTT产业概况

印度智慧型电视和 OTT 市场由多个参与企业组成。由于近期消费者兴趣的激增,该行业被视为一个有利可图的投资机会。公司正在投资未来技术并获得真正的专业知识,以实现可持续的竞争优势。

- 2022 年 3 月:印度公共广播公司DD India 与电视观众入口网站 OTT 平台 Yupp TV 签署了一份谅解备忘录,以扩大 DD India 频道的全球影响力。印度资讯广播部表示,此举旨在将印度对各类国际情势的观点投射到全球平台上,向世界展示印度文化和价值观。

- 2022 年 1 月:Sony电子推出 BRAVIA XR 电视系列,包括 MASTER 系列 Z9K 8K、X95K 4K Mini LED 型号、MASTER 系列 A95K、MASTER 系列 A90K、A80K 4K OLED 型号和 X90K 4K LED 型号。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 调查结果

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 印度家庭数量庞大,普及率相对较低

- 消费者能力的提升和智慧型手机普及率的提高推动了对 OTT 的需求

- 较低的单价和本地参与企业的进入增强了买家的议价能力

- 市场限制

- 製造商面临税收挑战和相对较高的更换率

第六章 全球智慧电视市场概述(出货量预测、主要供应商的成长策略、市场展望、印度市场的关键指标)

第七章 市场区隔

- 作业系统类型(Tizen、WebOS、Android TV 等)

- 价格分布

第八章 印度OTT情况分析

- 历史背景和当前市场状况

- 市场区隔-广播公司(Hotstar 和 ZEE)、独立公司(Alt Balaji 和 Viu)、国际参与企业(Netflix 和 Amazon Prime)、通讯业者(Jio、Airtel、Vodafone Play)

- 主要OTT参与企业用户规模(单位:10万)

- OTT参与企业采用的关键策略——内容在地化、可负担性、策略合作伙伴关係、个人化以及利用数位转型吸引观众

- 印度OTT与DTH用户群比较研究

- 各大供应商重点客户获取策略

- 服务捆绑和通讯业者合作

- 优质化和内容驱动计划

- 针对年轻人的经济实惠的订阅计划

- 目前 OTT 供应商确定的其他关键策略主题

- 在对本地内容的强劲需求的支持下,预计本地参与企业将崛起

第九章 供应商市场占有率分析-印度智慧电视(小米、三星、LG、索尼等)

第十章 竞争格局

- 公司简介

- Xiaomi Corporation

- Samsung Electronics

- LG Corporation

- Sony Corporation

- TCL Technology

- Vu Technologies

- Honor

- Panasonic Corporation

- Haier

- OnePlus

- Sansui

第十一章 投资展望

第十二章 市场展望市场展望

The India Smart TV and OTT Market size is estimated at USD 22.39 billion in 2025, and is expected to reach USD 51.65 billion by 2030, at a CAGR of 18.2% during the forecast period (2025-2030).

As high-speed internet has become easily affordable, viewers/audiences that prefer good quality content prefer smart TVs over other television systems. Also, the increasing admiration for OTT streaming in audiovisual content is impacting the overall smart TV market in a positive manner in India.

Key Highlights

- The shifting consumer preferences toward online content due to the increasing proliferation of high-speed internet in most parts of India provides an impetus to market growth. Substantial investment flows by video streaming media companies, like Netflix, Amazon Prime, and Hotstar, led to an increase in Pay-TV subscribers.

- Furthermore, a rise in disposable income levels and growing internet penetration in the country also contribute to an increase in sales of smart TVs and hence fuelling the market growth. Moreover, according to IBEF, the market size of the OTT video streaming market of India is forecasted to reach USD 5 billion by 2023, and India is projected to become one of the top 10 global OTT markets to reach USD 823 million by 2022.

- Households in India are at a cusp of transition, and a shift in preference has been witnessed from conventional TV sets to smart TV sets. Changing the lifestyle of the middle-income population is attributed to rising income levels, increasing awareness, adoption of new technology, and growing internet penetration. Additionally, government initiatives, primarily in tier-II and tier-III cities, are some of the key factors likely to bolster the growth of the Indian smart TV market during the forecast period.

- On the other hand, the growing demand for online streaming has opened opportunities for service providers to venture into the OTT space and distribute content via the internet. OTT content players, such as Netflix, Amazon, Hotstar, Sony Liv, and several other streaming services, are increasing their spending on marketing and local content to expand their customer base by luring them away from DTH and TV Cable services. Many of these platforms also partner with broadband providers to get the existing data users onboard by offering free bundled subscriptions. These continued efforts, coupled with changing consumer behavior, are driving the increased demand for the market.

- The COVID-19 outbreak affected the display industry negatively, with manufacturing operations temporarily suspended across major manufacturing hubs, leading to a substantial slowdown in production. Various key manufacturers, including Samsung, LG Display, and Xiaomi, suspended their manufacturing operations in China, India, South Korea, and Europe. However, the market has witnessed considerable growth in consumer demand during the pandemic as people stayed at their homes for extended periods. Further, the increased tendency to watch television due to the pandemic is also expected to continue impacting the market, resulting in its growth.

India Smart TV & OTT Market Trends

Increasing Adoption of Smart Devices Across IoT Ecosystem to Drive the Market Growth

- According to Ericsson's IoT Connections Outlook report, the number of devices connected by IoT technologies increased by approximately 80% and reached 330 million in 2021. The growth can be attributed to the integration of connectivity competence in many devices and applications, along with the development of various networking protocols that have advanced the growth of the consumer IoT market across various end-user industries.

- Increasing internet penetration can also contribute to India's widespread expansion of IoT-enabled consumer electronics, such as smart TV. According to Bain and Company's, Unlocking Digital for Bharat: USD 50 billion Opportunity, the report stated India has the second-highest number of active internet users, with about 390 million residents who use the web at least once a month. Further, the Ericsson connection outlook report stated that the growth of IoT technologies is enhanced by an added network capability that enables massive IoT co-existence with 4G and 5G.

- Additionally, the increasing significance of smart TV in the IoT ecosystem, due to the features like ambient intelligence and automatic user assistance, along with the rising disposable income of the people in India, is further boosting the market growth.

- Samsung India, a consumer electronics firm, has recently announced that it expects a nearly 25% growth in the LED TV segment. The company aims to capture around 36% share of the overall TV market by bringing products with the right proposition and new technologies. Owing to this, the company, in April 2022, launched its ultra-premium 2022 Neo QLED 8K and Neo QLED TVs in India.

- Moreover, recently, Xiaomi expanded its manufacturing in India by adding three new partners for smartphones and smart TVs. The new partnerships are expected further to increase Mi India's manufacturing capacity in India. Such developments by the major vendors are expected to boost market growth over the forecast period.

Internet Protocol Television (IPTV) to Boost the Market Growth

- Video on demand (VOD) is one of the dynamic features offered by IPTV. The video data is transmitted via Real-Time Streaming Protocol. VOD has gained a tremendous amount of popularity in the recent past. This has resulted in the increased adoption rates of Smart TVs. Moreover, with growing smartphone penetration and lower data tariffs, VoD services through OTT platforms show promising growth in India.

- OTT and IPTV are gaining traction driven by increasing broadband penetration and changing content consumption behaviors in the region. The effect can be significantly observed in Asian countries, like India, which represented an 8.9% GDP growth rate in FY 2021. Rapid urbanization in the region, standing at 35.39% in India, and the increase in spending power play a significant role in adopting IPTV in households.

- Moreover, the Government of India's initiatives toward digital transformation, such as digitization of cable TV and direct-to-home (DTH) services, are also favoring the adoption of IPTV in the country. The IPTV scenario in India is witnessing change owing to the advent of the network services provider, with the company providing free IPTV live subscriptions to its customers. With other companies following suit, the demand for mobile-based IPTV services is expected to increase in the region.

- The market is witnessing strategic investments from various vendors to remain competitive. For instance, in July 2022, the Government of India announced the approval of the merger between Sony Pictures Networks India and Zee Entertainment.

India Smart TV & OTT Industry Overview

The Indian smart TV and OTT market consists of several players. This industry is viewed as a lucrative investment opportunity due to the recent huge consumer interest. The companies are investing in future technologies to gain substantial expertise, enabling them to achieve sustainable competitive advantage.

- March 2022: India's public broadcaster, DD India, signed an MoU with Yupp TV, an OTT platform that is a gateway for television viewers, to expand the global reach of the DD India channel. According to the Ministry of Information and Broadcasting, this is an attempt to put forth India's perspective on various international developments on global platforms and to showcase India's culture and values to the world.

- January 2022: Sony Electronics announced a Bravia XR television series, including MASTER Series Z9K 8K and X95K 4K Mini LED models, MASTER Series A95K, MASTER Series A90K and A80K 4K OLED models, and X90K 4K LED model.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Study Deliverables

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the market

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Large Volume of the Indian Households and Relative Less Levels of Penetration

- 5.1.2 Growing Spending Power and Growth in Smartphone Adoption to boost OTT Demand

- 5.1.3 Declining Unit Prices Coupled with Entry of Several Regional Players to Drive Bargaining Leverage of Buyers

- 5.2 Market Restraints

- 5.2.1 Manufacturers Faced with Taxation Challenges and Relatively Higher Replacement Rate

6 GLOBAL SMART TV MARKET SNAPSHOT (Unit Shipment Forecasts, Growth Strategies Adopted by Key Vendors, Market Outlook, and Major Cues for the Indian Market)

7 MARKET SEGMENTATION

- 7.1 OS Type (Tizen, WebOS, Android TV, etc.)

- 7.2 Price Range

8 ANALYSIS OF THE OTT LANDSCAPE IN INDIA

- 8.1 Historical Context and Current Market Scenario

- 8.2 Market Categorization - Broadcaster (Hotstar and ZEE), Independent (Alt Balaji and Viu), International Players (Netflix and Amazon Prime), and Telco (Jio, Airtel, and Vodafone Play)

- 8.3 Subscriber Base of Key OTT Players (in million)

- 8.4 Key strategies adopted by OTT players -Localization of Content, Affordable Pricing, Strategic Collaborations, Personalization and Use of Digital Transformation for View Engagement

- 8.5 A comparative Study of OTT and DTH User Base in India

- 8.6 Key Customer Acquisition Strategies of Major Vendors

- 8.6.1 Bundling of Services and collaboration with Telcos

- 8.6.2 Premiumization and Emphasis on Content-driven Programs

- 8.6.3 Affordable Subscription Plans Targeted at Young Populace

- 8.6.4 Other Key Strategic Themes Identified from the Current OTT Vendors

- 8.7 Local Players expected to Catch Ground Aided by Strong Demand for Regional Content

9 VENDOR MARKET SHARE ANALYSIS - INDIA SMART TV (Xiaomi, Samsung, LG, Sony, etc.)

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 Xiaomi Corporation

- 10.1.2 Samsung Electronics

- 10.1.3 LG Corporation

- 10.1.4 Sony Corporation

- 10.1.5 TCL Technology

- 10.1.6 Vu Technologies

- 10.1.7 Honor

- 10.1.8 Panasonic Corporation

- 10.1.9 Haier

- 10.1.10 OnePlus

- 10.1.11 Sansui