|

市场调查报告书

商品编码

1643143

亚太地区远端资讯处理 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)APAC Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

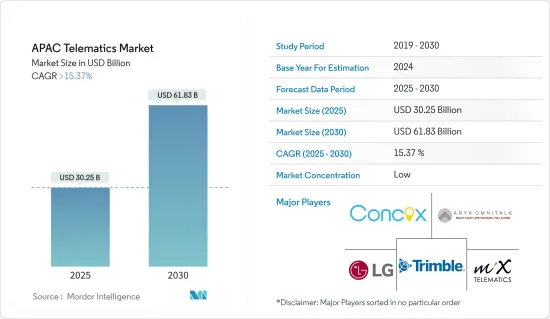

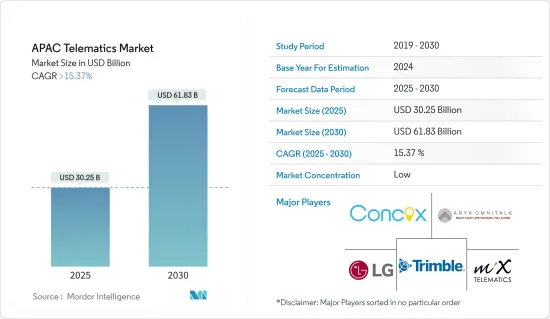

亚太地区远端资讯处理市场规模预计在 2025 年为 302.5 亿美元,预计到 2030 年将达到 618.3 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 15.37%。

远端资讯处理透过向车队管理公司和汽车保险公司提供资讯来监控车辆的位置和行为,从而有助于基于使用情况的保险 (UBI)。政府透过商用车和智慧型运输系统(ITS) 强制导航来保障道路安全,对电动车的需求不断增长,以及透过价格实惠的感测器不断上升的连接趋势,主要推动了亚太地区远端资讯处理市场的成长。中国、日本、韩国等国家5G基础设施的发展也将推动亚太地区车联网产业的发展。

关键亮点

- 高通技术公司宣布推出“连接即服务”,这是其骁龙车到云端服务的一项功能。它汇集了支援云端和设备开发环境的新技术合作,旨在向世界提供开箱即用的连接、整合分析、新技术功能、内容和服务。 Cognizant 正在与 Qualcomm Technologies Inc. 合作,为汽车製造商整合和客製化 Snapdragon 车到云端服务。目标是提供丰富、身临其境和个性化的车载体验、新的连接解决方案和更好的按需服务。

- 随着联网汽车服务的日益普及推动市场的发展,各家公司正在建立策略伙伴关係,将服务送到您家门口。印度汽车科技新兴企业ReadyAssist 宣布与 iTriangle Infotech 建立策略合作伙伴关係,后者是一家为远端资讯处理解决方案提供车辆追踪和车队管理的技术提供商。该合作伙伴关係将利用每家公司现有的远端资讯处理和服务网路功能,实现在客户家门口安装、维修和保固更换物联网设备。

- 由于都市化、生活水准提高和经济成长,亚太地区的汽车持有正在大幅增加。随着越来越多的车辆上路,对高效能车队管理和维护解决方案的需求也随之增加。根据国际能源总署预测,2022年中国将成为亚太地区电动车销量最大的国家,销量约600万辆。远端资讯处理在管理和监控电动车性能以优化驾驶体验和提高效率方面发挥关键作用。

- 然而,远端资讯处理系统成本高、产品标准化缺乏以及日益严重的网路安全威胁是限制该市场成长的主要因素。此外,个人商用/乘用车和小型车队营运商的认知度较低也对研究市场的成长构成了挑战。

亚太地区车联网市场趋势

乘用车市场预计将占据主要市场占有率

- 由于汽车销售量高,乘用车领域预计将引领亚洲的远端资讯处理市场。对安全、便利的远端资讯处理服务的需求不断增长,刺激了乘用车市场的发展。由于过去十年的重大技术发展,联网汽车已经推出,并有望进一步发展。中国、印度、澳洲和日本等国家拥有主要的乘用车市场,这些国家的更严格的车辆安全法规推动了对高端远端资讯处理服务和连接解决方案的需求。

- 2000 年 4 月至 2022 年 9 月期间,印度汽车产业获得股权外国直接投资流入约 337.7 亿美元。印度政府预计到2023年汽车业将吸引80亿至100亿美元的国内外投资。

- OICA预计,2023年中国将主导亚太乘用车市场,销售超过2,600万辆。印度位居第二,销量接近 410 万台。预计乘用车产销量的成长将推动该地区市场的发展。

- 中国是亚太地区远端资讯处理市场成长的主要贡献者。一些中国较新的汽车新兴企业,如蔚来汽车、飞驰汽车、雷霆动力和观致汽车,在其最新的产品组合中都包含导航和即时交通资讯系统。中国的车辆失窃案日益增多,推动了被盗车辆追踪 (SVT) 技术的需求稳定成长。

- 高阶驾驶辅助系统(ADAS)也是推动亚太地区远距资讯处理市场发展的因素之一。日本是最早发明和实施大多数汽车ADAS的国家之一。这家日本汽车公司正在开发用于远端资讯处理和车辆连接技术的先进设备。

预计中国市场将大幅成长

- 中国的远端资讯处理市场正在经历显着的成长,该国的汽车产业正在迅速采用远端资讯处理技术,导致道路上出现大量联网汽车。联网汽车支援多种服务,例如导航、远距离诊断、资讯娱乐和安全功能。

- 中国政府在推动远端资讯处理方面发挥关键作用。 2022 年 1 月,中国政府定期修改法规,以规范自动驾驶的采用和适应。配备 ADAS 和其他联网汽车功能的汽车必须配备一个类似飞机的装置,该装置带有一个后箱,可以记录指挥自动驾驶系统的所有变数。中国在汽车微控制器和微处理器领域的全球主导地位,使其在远端资讯处理控制单元 (TCU) 製造方面具有优势。此外,最近对 5G 基础设施市场的投资(作为从 COVID-19 疫情中恢復的措施)将进一步推动 5G TCU 的本地生产。

- 物联网(IoT)的普及和中国5G网路的推出大大提高了远端资讯处理系统的功能。更快、更可靠的连接可实现即时资料传输,从而实现先进的远端资讯处理服务,例如远端监控、无线更新和车对车 (V2X)通讯。

- 中国基地台数量的增加将推动市场发展,实现更快、更可靠的资料通讯,扩大应用范围,并刺激汽车和运输业的创新。据工信部预计,到2023年终,我国5G基地台数量将达338万个左右。由于大规模的基础设施投资和雄心勃勃的推广计划,中国正在实现 5G 的广泛应用。预计到2024年基地台数量将达到约600万个。

- 远端资讯处理提供的车队管理解决方案在中国需求旺盛,尤其是在物流、运输和电子商务领域。这些解决方案可协助公司优化车队、降低营运成本、提高燃油效率并增强驾驶员安全性。

亚太地区车联网产业概况

亚太地区远端资讯处理市场高度细分,主要参与者包括 LG Corporation、MiX Telematics Ltd、Concox Information Technology、Trimble Inc. 和 Arya Omnitalk Wireless Solutions Private Limited。市场参与企业正在采取联盟和收购等策略来增强其产品供应并获得可持续的竞争优势。

- 2022 年 12 月 - OCTO Telematics 宣布在日本东京开设办事处,加强其在技术、机器人和自动化战略中心的地位。 OCTO 的日本子公司将进一步协助发展日本和邻国的连网行动市场,为合作伙伴提供技术和销售支援。

- 2022 年 10 月 - Asia Mobiliti 与 Truck It 合作,列出全面的远程信息处理和地理映射技术,使广告购买者能够定位并提供每辆卡车、路线的实时跟踪信息,并显示适合他们选择的卡车类型。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

- 技术简介

第五章 市场动态

- 市场驱动因素

- 联网汽车服务的使用增加

- 对便利车辆诊断的需求日益增加

- 市场限制

- 资料骇客对资料安全的威胁

第六章 市场细分

- 按车型

- 商用车(卡车)LCV 与 M/HCV

- 搭乘用车

- 按频道

- OEM

- 报纸

- 售后市场

- 按国家

- 中国

- 日本

- 韩国

- 东南亚

第七章 竞争格局

- 公司简介

- LG Corporation

- MiX Telematics Ltd

- Concox Information Technology Co. Ltd

- Trimble Inc.

- Arya Omnitalk Wireless Solutions Private Limited

- iData Kft(iTrack)

- Bright Box Hungary Kft

- Tata Consultancy Services Ltd

- Efkon India Pvt Ltd

- Tech Mahindra Limited

- Meitrack Group

- Octo Group SpA

- Asia Mobility Technologies Sdn Bhd

第八章投资分析

第九章:市场的未来

The APAC Telematics Market size is estimated at USD 30.25 billion in 2025, and is expected to reach USD 61.83 billion by 2030, at a CAGR of greater than 15.37% during the forecast period (2025-2030).

Telematics helps in usage-based insurance (UBI) by providing information to fleet management companies and automobile insurance companies to monitor the location and behavior of vehicles. Government initiatives towards road safety with mandatory navigation for commercial vehicles and Intelligent Transport System (ITS), rising demand for EVs, and increasing trend of connectivity with affordable sensor prices are mainly driving the growth in the Asia-Pacific telematics market. The development of 5G infrastructure in countries such as China, Japan, and South Korea will also boost the telematics industry in the Asia Pacific.

Key Highlights

- Qualcomm Technologies introduced a feature for Snapdragon Car-to-Cloud Services - Connectivity-as-a-Service - that brings new technology collaborations to support out-of-the-box connectivity, integrated analytics, and a cloud and device developer environment aimed to deliver new technology features, content, and services globally. Cognizant will work with Qualcomm Technologies to integrate and tailor Snapdragon Car-to-Cloud Services for automakers, with the goal of delivering rich, immersive, personalized in-vehicle experiences, new connected solutions, and better on-demand services.

- With the increase in usage of connected car services driving the market, companies are making strategic partnerships to offer services at the doorstep. Indian AutoTech startup ReadyAssist announced its strategic partnership with iTriangle Infotech, a technology provider for vehicle tracking and fleet management for telematics solutions. The partnership will cross-leverage the companies' existing capabilities of telematics and service networks to bring installation, service, and warranty replacements of IoT devices to their customers at the doorstep.

- The Asia Pacific region has witnessed a substantial increase in vehicle ownership due to urbanization, improved living standards, and economic growth. With more vehicles on the road, there is a growing need for efficient vehicle management and maintenance solutions. According to IEA, in 2022, China witnessed the highest number of electric car sales across the Asia Pacific region, with around six million electric car sales, and nearly 28,000 electric cars were sold in 2022 in New Zealand. The growth in EVs is anticipated to drive the telematics market, as these advanced systems play a crucial role in managing and monitoring EV performance, enhancing optimization and efficiency of the driving experience.

- However, the higher cost of telematics systems, lack of standardization of products, and increasing cybersecurity threats are among the major factors restraining the growth of the market studied. Additionally, a lower awareness among individual commercial/passenger vehicles and small vehicle fleet operators also challenges the growth of the market studied.

APAC Telematics Market Trends

Passenger Type of Vehicles Segment is Expected to Hold Significant Market Share

- The passenger car segment is expected to drive the Asian telematics market owing to a high sales rate. Increased demand for safety and convenience telematics services is fueling the passenger car segment. Significant technological developments over the last decade have resulted in the launch of connected cars, which are expected to evolve further. Countries like China, India, Australia, and Japan have major passenger vehicle markets, and the safety regulations for these vehicles are more stringent in these countries, leading to the demand for high-end telematics services and connectivity solutions.

- The automobile sector in India got a cumulative equity FDI inflow of around USD 33.77 billion between April 2000 and September 2022. The Indian government expects the automobile industry to attract USD 8-10 billion in foreign and local investments by 2023.

- According to OICA, in 2023, China dominated the Asia-Pacific passenger car market, selling over 26 million units. India followed as the second-largest market, with sales nearing 4.1 million units.. The growing production and sale of passenger vehicles are expected to drive the market in the region.

- China is a major contributor to the growth of the APAC telematics market. Some of the new automotive start-ups in China, like Nio, FutureMove, ThunderPower, and Qoros, use navigation and real-time traffic information systems in their latest portfolios. There is a steady increase in the demand for Stolen Vehicle Tracking (SVT) technology as vehicle thefts rise in China.

- The Advanced Driver Assistance System (ADAS) is another factor driving the APAC telematics market. Japan was one of the first countries to invent and implement most car ADAS. Japanese automotive companies are developing advanced devices for telematics and vehicle connectivity technologies.

China Expected to Witness Significant Growth in the Market

- The telematics market in China is significantly growing, and the country's automotive industry has quickly adopted telematics technology, resulting in a substantial number of connected vehicles on the road. Connected cars enable various services such as navigation, remote diagnostics, infotainment, and safety features.

- The Chinese government has played a crucial role in promoting telematics adoption. In January 2022, the Chinese government changed the rules regularly to shape the country's introduction and adaptation of autonomous driving. The cars with ADAS and other connected car features must be fitted with devices similar to aircraft having back boxes, recording all the variables directing the autonomous driving systems. China's dominance in global automotive microcontrollers and microprocessors also gives them the upper hand in manufacturing telematics control units (TCU). Also, the country's recent investment in the 5G infrastructure market (as a recovery step from the COVID-19 outbreak) further promotes the local production of 5G TCUs.

- The proliferation of the Internet of Things (IoT) and the deployment of 5G networks in China have significantly enhanced the capabilities of telematics systems. Faster and more reliable connectivity allows for real-time data transmission, enabling advanced telematics services such as remote monitoring, over-the-air updates, and vehicle-to-everything (V2X) communication.

- The increasing number of base stations in China drives the market, enabling faster and more reliable data communication, expanding the range of possible applications, and fostering innovation in the automotive and transportation industries. According to MIIT, by the end of 2023, the number of 5G base stations in China is approximately 3.38 million. With extensive infrastructure investments and ambitious rollout plans, China has achieved significant 5G coverage. The forecasted number of base stations was projected to reach about six million by 2024.

- Fleet management solutions offered by telematics are in high demand in China, particularly in the logistics, transportation, and e-commerce sectors. These solutions help companies optimize their fleets, reduce operating costs, improve fuel efficiency, and enhance driver safety.

APAC Telematics Industry Overview

The Asia Pacific Telematics market is highly fragmented, with the presence of major players like LG Corporation, MiX Telematics Ltd, Concox Information Technology Co. Ltd, Trimble Inc., and Arya Omnitalk Wireless Solutions Private Limited. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2022 - OCTO Telematics announced an opening in Tokyo, Japan, to strengthen its presence in a strategic hub for technology, robotics, and automation. The Japanese subsidiary of OCTO will further help the development of the connected mobility market throughout Japan and surrounding countries, providing technical and sales support to partners.

- October 2022 - Asia Mobiliti collaborated with Truck It to provide comprehensive telematics and geo-mapping technologies that would offer advertisement buyers the capability to target their customers, offer them real-time tracking information of all trucks, routes, and display the type of truck that suits their choice.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Usage of Connected Cars Services

- 5.1.2 Growing Demand for Easy Vehicle Diagnostics

- 5.2 Market Restraints

- 5.2.1 Threats to Data Security in the form of Data Hacking

6 MARKET SEGMENTATION

- 6.1 By Type of Vehicle

- 6.1.1 Commercial (Truck) LCV Vs. M/HCV

- 6.1.2 Passenger (Car)

- 6.2 By Channel

- 6.2.1 OEM

- 6.2.2 Newsprint

- 6.2.3 Aftermarket

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 South Korea

- 6.3.4 South East Asia

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 LG Corporation

- 7.1.2 MiX Telematics Ltd

- 7.1.3 Concox Information Technology Co. Ltd

- 7.1.4 Trimble Inc.

- 7.1.5 Arya Omnitalk Wireless Solutions Private Limited

- 7.1.6 iData Kft (iTrack)

- 7.1.7 Bright Box Hungary Kft

- 7.1.8 Tata Consultancy Services Ltd

- 7.1.9 Efkon India Pvt Ltd

- 7.1.10 Tech Mahindra Limited

- 7.1.11 Meitrack Group

- 7.1.12 Octo Group S.p.A

- 7.1.13 Asia Mobility Technologies Sdn Bhd