|

市场调查报告书

商品编码

1643150

教育中的虚拟实境 (VR) -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Virtual Reality (VR) in Education - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

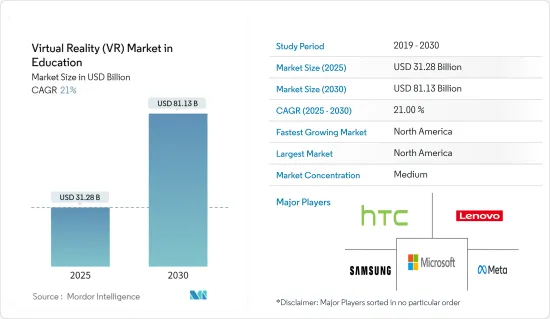

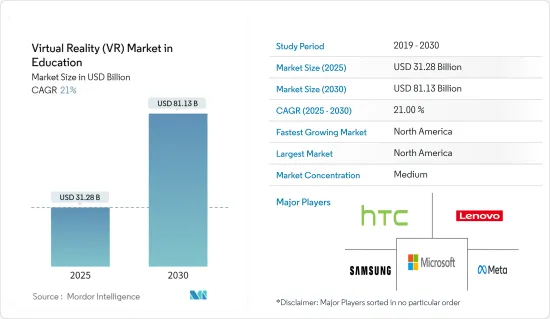

预计教育市场虚拟实境将从 2025 年的 312.8 亿美元成长到 2030 年的 811.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 21%。

过去几年来,VR技术得到了越来越广泛的认可和采用。该领域的最新技术进步已使领先的大学、学院和学校为获得先进的学习体验而开展新的业务并招募人才。此外,预计未来几年市场对企业学习计画的需求将大幅增加。

关键亮点

- 过去几年来,虚拟实境在教育领域获得了巨大的发展空间。学习者可以沉浸在模拟现实的虚拟世界中学习复杂的主题,在虚拟世界中他们可以移动、交谈、做出决策并与周围的世界互动。这样的案例导致教育领域对虚拟实境的需求日益增长。

- 教育机构已经开始透过实地考察、实验室实验、小组活动、计划等方式融入实践学习。虚拟实境在教育中的应用将学习提升到了一个全新的水平。事实证明,透过虚拟实境进行身临其境型学习是扩展知识的有效工具。虚拟实境涉及数位化创建的资讯和情况,反映了学习者在传统学校环境中很少能接触到的真实生活体验。

- 许多公司正在将游戏化元素添加到教科书学习材料中,透过 VR 技术使学习具有互动性和吸引力。例如,Curiscope 的 Virtuali-tee 是一款 T 恤和应用程序,可以教你了解人体。一个人穿着 T 恤,另一个人使用智慧型手机上的虚拟实境应用程式来虚拟展示和探索身体的不同层次。

- 此外,VR 在生物学领域也得到了广泛的应用,世界各地的大学都使用虚拟实境耳机进行身临其境型学习。例如,去年亚利桑那州立大学的学生透过独特的虚拟实境体验学习了生物学。穿越太空,与小城市大小的星际野生动物保护区中的生物互动,并揭开动物死亡的秘密。

- 在 COVID-19 封锁期间,AR、VR 和 MR 等技术见证了巨大的需求,因为它们使人们能够使用这些身临其境型平台购物、交谈和社交。新冠肺炎疫情让学习者和年轻学生从课堂转移到了远端教育的虚拟世界。目前,许多大学和学校正在使用虚拟实境技术来改善教育机会,既为有学习困难或残疾的学生提供支持,又使学习不受地点限制。

教育领域的虚拟实境 (VR) 市场趋势

对互动和个人化学习体验的需求日益增加

- 线上教育的日益普及以及虚拟学习环境的好处(例如灵活的时间表、更强的个人课责、移动性和以学生为中心的学习)正在推动市场的成长。 VR可以取代实体的纸模型、海报、教科书和印刷手册。它提供更便宜、更便携的学习材料,使教育更加便利、更行动化。

- 在过去的几年里,采用 VR 的成本大幅下降,这项技术在财富 500 强公司中越来越普遍地应用,零售、物流和客户服务员工越来越多地使用VR头戴装置来练习和更好地完成工作。

- 全球各地的各种企业都在使用 VR 技术为员工提供个人化的学习体验,从而推动市场的成长。例如,在美国,沃尔玛正在使用 STRIVR 技术来提升员工的技能,同时该技术也被 Visa、美国银行、宝马、Google和 ABC 等公司采用。培训模拟器将员工置于真实的环境中,以测试他们处理各种职场情况的能力。

- 在 K-12 学习中,虚拟实境和扩增实扩增实境正在帮助教师让学生参与内容并有助于知识保留。透过基于网路的门户,教师可以控制和管理耳机、规划课程并监控学生的进度。教师可以在学生的耳机上设定兴趣点,引导他们到课程的特定部分,并查看每个学生所看到内容的缩图。

此外,随着 VR 系统价格下降以及越来越多的人对这项新技术产生兴趣,预计其在教育领域的应用将会越来越广泛。例如,Perkins Coie 和 XR 协会对 160 多名专业人士进行的一项调查发现,63% 的受访者强烈同意身临其境型技术将在未来五年内显着推动教育发展。

预计北美将占据主要份额

- 由于美国在全球软体市场的主导地位,以及大量供应商在市场创新方面投入巨资,预计预测期内北美研究市场将大幅成长。

- 从全球来看,美国有望成为最具创新力的 VR 市场之一。大多数推广此项技术的公司都位于美国。高科技的曝光和智慧型装置的普及正在该地区创造强大的 VR 市场。

- 此外,该地区拥有最多致力于将创新 VR 技术引入各行业的新兴企业。根据 Tracxn Technologies 的资料,截至 2022 年 9 月,美国约有 1,348 家虚拟实境新兴企业。

- 根据GSMA预测,2025年北美智慧型手机用户数将达到3.28亿。此外,到 2025 年,该地区的行动用户(86%) 和网路普及率 (80%) 可能会增加,位居世界第二。设备普及率的提高预计将对该地区的教育虚拟实境市场产生积极影响。

该地区的通讯业者正在积极吸引客户使用其 5G 网路。因此,这些地区的供应商正在对软体和平台进行投资和创新,以利用即将到来的 5G 技术开发 VR 应用程式。预计此类活动将促进该地区的市场成长。

教育领域虚拟实境(VR)产业概况

教育领域的虚拟实境(VR)市场竞争适中。此外,旨在提高身临其境型虚拟环境的品质、效能和有效性的研究和开发工作预计将在未来几年推动市场需求,并加剧领先供应商之间的竞争。

在印度,2022年1月,中央中等教育委员会(CBSE)与科技巨头Meta合作,在未来三年内为10,000名教师和1000万名学生提供虚拟实境(VR)和扩增实境(AR)培训。作为合作的一部分,Meta 提供了有关数位安全、线上健康、VR 和 AR 的课程。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 生态系分析

- 硬体

- 软体和应用程式开发

- 内容创作者

- 服务供应商

- 网路供应商

- 最终用户

- 市场驱动因素

- 对互动和个人化学习体验的需求日益增加

- 混合式学习技术的参与度和覆盖率更高,从而更受相关人员的接受

- 基于虚拟实境 (VR) 的技术将受益于教育和企业领域的先驱地位。

- 数位化参与度的提高和内容的吸引力正在改变教育和培训在企业中的作用

- 市场限制

- 消费级应用的内容和成本效益的限制

- 依赖频宽、网路等外部因素来保证最佳体验

- 市场机会

- 教育机构和企业正在为互动学习分配更多预算

- 技术进步让更多人获得内容

- 教育领域VR应用分布及定价模式分析

- 主要使用案例和实施案例

- 将VR引入中国课堂

- 企业部门推出 VR 培训计画 协助服务标准化

- Google 提供的虚拟实地考察

- 技术简介

- COVID-19 工业影响评估

第五章 市场区隔

- 类型

- 硬体

- 软体

- 服务(培训与咨询、託管服务)

- 最终用户

- 教育机构

- K-12 教育机构

- 高等教育

- 企业培训

- 资讯科技和电讯

- 医疗

- 零售与电子商务

- 其他的

- 教育机构

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第六章 竞争格局

- 公司简介

- HTC Corporation

- Lenovo Group Limited

- Samsung Electronics Co. Ltd

- Microsoft Corporation

- Meta Platforms, Inc.

- Avantis Systems Limited

- Unity Teach

- Nearpod Inc

- zSpace Inc

- Virtalis Holdings Limited

- EON Reality

- Veative Labs

- Alchemy VR Limited

- VR Education Holdings

第七章投资分析

第八章 市场机会与未来趋势

The Virtual Reality Market in Education Industry is expected to grow from USD 31.28 billion in 2025 to USD 81.13 billion by 2030, at a CAGR of 21% during the forecast period (2025-2030).

VR technology has gained widespread recognition and adoption over the past few years. Recent technological advancements in this field have revealed new enterprises and adoption among major universities, colleges, and schools for advanced learning experiences. In addition, the market is expected to gain significant demand from corporations for corporate learning programs in the coming years.

Key Highlights

- Virtual reality has gained significant traction in the education world over the past few years. It offers learners an immersive experience: they can learn complicated subject matters by entering a reality-imitating virtual world where they can move, talk, make decisions, and interact with the world around them. Such an instance led to increased demand for virtual reality in education.

- Educational institutions have started incorporating practical learning through excursions, lab experiments, group activities, and projects. The introduction of virtual reality in education has taken learning to an entirely new dimension. Immersive learning through Virtual Reality has proven to be an effective tool for expanding knowledge. It delivers digitally created information and situations that mirror real-life experiences that are mostly inaccessible to learners in traditional school settings.

- Many companies are making learning interactive and more engaging through VR technologies by adding gaming elements to textbook material. For instance, Curiscope's Virtuali-tee is a t-shirt and app that lets users learn about the human body. One person puts on the t-shirt while the other uses a virtual reality app on a smartphone to virtually reveal and explore the various layers inside the body.

- Further, VR is finding extensive applications in biology, with universities and colleges worldwide using virtual reality headsets for immersive learning. For instance, last year, students at Arizona State University were learning biology in a unique virtual reality experience, hurtling through space to interact with creatures in an intergalactic wildlife sanctuary the size of a small city and to solve the mystery of why the animals are dying.

- During the COVID-19 lockdown, technologies like AR, VR, and MR witnessed significant demand as they allowed people to shop, talk, and socialize using these immersive platforms. The COVID-19 pandemic moved learners and young students out of the classroom and into the virtual world of remote education. Many universities and schools are now taking advantage of virtual reality technology to improve access to education, both in terms of helping pupils with learning difficulties or disabilities and making learning less location-dependent.

Virtual Reality (VR) in Education Market Trends

Increasing Demand For Interactive and Personalized Learning Experience

- Increasing adoption of online education and the benefits of a virtual learning environment, such as flexible schedules, more individual accountability, mobility, student-centered learning, and others, are driving the market's growth. VR can replace physical paper models, posters, textbooks, and printed manuals. It offers less expensive and portable learning materials, making education more accessible and mobile.

- Over the past few years, the cost of deploying VR has plunged, and the technology has expanded into more general use at almost Fortune 500 corporations, where employees working in retail, logistics, and customer service are practicing with VR headsets to get better at their jobs.

- Various businesses worldwide use VR technology to provide their employees with a personalized learning experience, thus driving the market's growth. For instance, across the U.S., Walmart is training its employees to improve their skills using STRIVR technology, which has also worked for companies like Visa, Bank of America, BMW, Google, ABC, and more. The training simulators place the employee in a realistic setting, which tests their ability to handle different situations at the workplace.

- In K-12 learning, virtual and augmented reality help teachers engage students in content to assist them in retaining knowledge. By using a web-based portal, teachers can control and manage the headsets, plan lessons, and monitor student progress. Teachers can set points of interest on students' headsets to direct them to certain parts of the lesson and may view thumbnail images of what each student is seeing.

Further, as the prices of VR systems drop and more people become interested in this new technology, adoption in the education sector is expected to grow. For instance, a Perkins Coie and XR Association survey of over 160 professionals found that 63% of respondents strongly agreed that immersive technology will significantly advance education over the next five years.

North America is Expected to Hold Major Share

- The North American segment of the market studied is expected to grow significantly during the forecast period, owing to the presence of a large number of vendors, who are also investing heavily in market innovation, coupled with the dominance of the United States in the global software market.

- Globally, it is expected that the United States will be one of the most innovative VR markets. Most of the companies advancing this technology are based in the United States. High technology exposure and the ease of availability of smart devices have created a strong VR market in the region.

- Further, the region has the highest number of emerging startups focusing on bringing innovative VR technologies to various industries. According to data from Tracxn Technologies, as of September 2022, there were approximately 1,348 Virtual Reality startups in the United States.

- According to the GSMA, the number of smartphone subscribers in North America is expected to reach 328 million by 2025. Moreover, by 2025, the region may witness an increase in the penetration rates of mobile subscribers (86%) and the internet (80%), the second-highest in the world. Increased device penetration will positively impact the region's virtual reality market for education.

The telecom companies in the region are aggressively making efforts to attract customers to use their 5G network. Hence, these regional vendors are investing in and innovating the software and platform for the development of VR applications by leveraging the upcoming 5G technology. Such events are expected to boost the growth of the market in the region.

Virtual Reality (VR) in Education Industry Overview

The virtual reality market in education is moderately competitive. Furthermore, research and development initiatives aimed at improving immersive virtual environments' quality, performance, and effectiveness are projected to propel market demand in the coming years, increasing competition among the key vendors.

India in January 2022, had the Central Board of Secondary Education (CBSE) collaborate with the tech giant, Meta, to train 10 lakh teachers and one crore students in Virtual Reality (VR) and Augmented Reality (AR) for the next three years. As part of this partnership, Meta provided a curriculum on digital safety, online well-being, VR, and AR.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

- 4.3.1 Hardware

- 4.3.2 Software and App Development

- 4.3.3 Content Creators

- 4.3.4 Service Providers

- 4.3.5 Network Providers

- 4.3.6 End Users

- 4.4 Market Drivers

- 4.4.1 Increasing demand for interactive and personalized learning experience

- 4.4.2 Higher acceptance among stakeholders owing to higher engagement and scope for blended learning technology

- 4.4.3 VR-based technology benefits from being the first entrant in the education & corporate category

- 4.4.4 The role of education and training among corporates has transformed with the growth in digital engagement and compelling content

- 4.5 Market Restraints

- 4.5.1 Limited content and cost efficiency of consumer-grade applications

- 4.5.2 Dependence on external factors, such as bandwidth and network, for ensuring optimal experience

- 4.6 Market Opportunities

- 4.6.1 Growth in budget allocation on interactive learning by education bodies and the corporate sector

- 4.6.2 Technological advancements to make content accessible to a wider audience

- 4.7 VR App Distribution and Pricing Model Analysis in the Education Sector

- 4.8 Key-use cases and Implementation case studies

- 4.8.1 China's implementation of VR in classrooms

- 4.8.2 The Corporate sector initiatives toward VR training for service standardization

- 4.8.3 Implementation of virtual field trips through Google's offering

- 4.9 Technology Snapshot

- 4.10 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services (Training and Consulting and Managed Services)

- 5.2 End User

- 5.2.1 Academic Institutions

- 5.2.1.1 K-12 Learning

- 5.2.1.2 Higher Education

- 5.2.2 Corporate Training

- 5.2.2.1 IT and Telecom

- 5.2.2.2 Healthcare

- 5.2.2.3 Retail and E-commerce

- 5.2.2.4 Other End users

- 5.2.1 Academic Institutions

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 HTC Corporation

- 6.1.2 Lenovo Group Limited

- 6.1.3 Samsung Electronics Co. Ltd

- 6.1.4 Microsoft Corporation

- 6.1.5 Meta Platforms, Inc.

- 6.1.6 Avantis Systems Limited

- 6.1.7 Unity Teach

- 6.1.8 Nearpod Inc

- 6.1.9 zSpace Inc

- 6.1.10 Virtalis Holdings Limited

- 6.1.11 EON Reality

- 6.1.12 Veative Labs

- 6.1.13 Alchemy VR Limited

- 6.1.14 VR Education Holdings