|

市场调查报告书

商品编码

1643188

北美测试、检验和认证 (TIC) -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)North America Testing, Inspection and Certification (TIC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

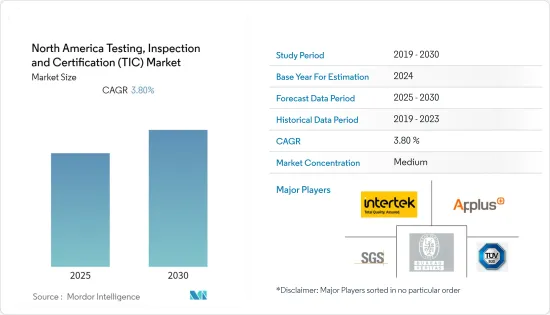

北美测试、检验和认证 (TIC) 市场预计在预测期内实现 3.8% 的复合年增长率

关键亮点

- 新技术的出现、更严格的环境规范以及加强的健康和安全措施改变了整个行业对遵守标准和法规的观点。测试、检验和认证 (TIC) 在确保基础设施、服务和产品符合安全和品质标准和法规方面发挥关键作用。在某些行业,例如石油和天然气行业,对定期检查流程的需求正在上升,因此无论行业的季节性如何,市场预计都会成长。

- 除进出口外,随着技术的快速进步导致产品更加多样化,在某些情况下,生命週期也更短,TIC 服务的使用预计也会增加。连网型设备(物联网)、行动付款、智慧城市和联网汽车等新兴技术趋势使得软体测试与硬体测试同等重要。随着这些技术成为主流,我们预计对 TIC 服务的依赖将会增加。

- 在美国等国家,食品安全审核的加强正在推动市场的发展。美国食品药物管理局(FDA)推出了《食品安全现代化法案》,旨在改造该国的食品安全体系,主要重点是预防食源性疾病。根据该法案,政府对不同食品製定了不同的标准。因此,该国的测试、检验和认证活动迅速发展。

- 新进入市场的企业面临着 TIC 市场的高进入门槛。这些投资包括扩大我们的业务范围、投资现代化实验室以跟上各行业日益激烈的竞争和自动化趋势,最后,投资加强我们的工业网络。

- 此外,由于新冠疫情爆发,市场需求整体下降。儘管 2020 年第一季和去年的收入有所下降,但一些知名参与企业发现某些终端用户行业对测试、检验和认证服务的需求显着增加。疫情促使传统现场检查转向远端测试、检查和认证。这一转变得到了多个组织的支持,包括 TIC Council Americas(TIC Council 的美国分支机构)。此外,自疫情爆发以来,TUV莱茵等供应商已经引入了远端检查和虚拟评估,以减少现场检查并确保检查人员的健康和安全。

北美 TIC 市场趋势

汽车业占有较大市场占有率

- 汽车製造业的復苏以及电动车和自动驾驶汽车等趋势是未来几年推动北美汽车产业对 TIC 需求的关键因素之一。此外,ADAS(高级驾驶辅助系统)等安全技术以及使用感测器、摄影机和雷射扫描仪的车辆的成长可能会为未来几年所研究的市场供应商带来巨大的成长机会。

- 随着软体和硬体测试变得越来越重要,汽车领域的联网汽车预计将推动对 TIC 服务的需求。此外,各公司都已在汽车领域推出了远端检查服务。

- 今年 3 月,沃尔沃汽车 UAS 启动了一项计划,为美国经销商安装自动驾驶汽车检查站,可在几秒钟内检测出结构、机械和轮胎缺陷。以色列科技公司 Uveye 生产了该检查系统,该系统采用人工智慧和机器学习构建,可产生有价值的报告并减少人为错误。因此,在所调查的市场中,自动化预计会稍微阻碍现有手动 TIC 服务的成长。同样,据 Uveye tech 称,该公司今年已与美国 15,000 家汽车经销商签订了协议。

- 然而,随着电动车在北美越来越受欢迎,对 TIC 服务的需求预计会增加。摩根大通估计,未来三年北美将售出约 120 万辆电动车。

- 随着半导体性能的提高和汽车中各种感测器的采用,软体安全标准和复杂性变得越来越重要。今年2月,面向自动驾驶汽车和ADAS的基于AI的影像处理技术公司StradVision,获得了全球知名第三方检测、检验和认证公司TUV莱茵颁发的汽车功能安全ISO 26262认证。

预计美国将占据主要市场占有率

- 由于石油和天然气等某些行业对定期检查流程的需求不断增加,预计北美的 TIC 市场将会成长,而不受该地区工业季节性的影响。

- 国际进出口量也在增加,尤其是食品和医疗用品等产品。食品和饮料、农业、家用电子电器产品和汽车(电动车)市场预计将为 TIC 服务提供更多空间。根据美国贸易代表办公室统计,美国目前与20个国家签订了14项自由贸易协定。

- 此外,以环境为重点的措施也正在推动采用新的测试标准,主要是藉助新技术。例如,绿色和平组织在美国各地开展的「危险化学品零排放」(ZDHC)宣传活动等排毒宣传活动旨在减少主要在纺织业(世界第二大淡水污染源)的危险化学品的使用。

- 在美国,新兴市场的竞争日益激烈以及消费者对品质的要求不断提高,使得品质保证和合规解决方案对消费者至关重要。大多数消费群和零售服务都依赖检验和认证。

- 在美国,《消费品安全改进法》要求某些产品在推出市场之前必须进行第三方测试和认证,对市场成长产生正面影响。今年12月,全球测试、检验和认证(TIC)公司Kiwa宣布与位于美国圣路易斯的ASI LLC合併,组成Kiwa集团。此次合併大大增强了 Kiwa 在美国食品、饲料和农场认证领域的影响力。

- 此外,随着消费家用电子电器家用电子电器、智慧型装置和无线设备提供各种产品认证计划,以帮助其客户遵守行业标准。这些项目涵盖了多种技术,包括蓝牙 SIG、NFC 论坛、LoRa 联盟、GCF 和蜂窝 PTCRB。如果您的产品采用蜂窝或无线技术,则需要这些认证。根据美国人口普查局和消费科技协会今年发布的预测显示,美国智慧型手机销售额预计将增加17亿美元,总合销售额达747亿美元。

北美测试、检验和认证 (TIC) 行业概览

北美测试、检验和认证 (TIC) 市场正在温和成长,其中包括 SGS SA、Intertek Group Plc、Bureau Veritas、TUV SUD 和 Applus Services, SA 等大型参与者。此外,测试、检验和认证 (TIC) 应用于各行各业,为供应商提供了成长机会。市场参与企业正在采取伙伴关係、创新、合併和收购等策略来增强其产品供应并获得可持续的竞争优势。

2022 年 11 月,TUV Rheinland 收购了检验和检验专家 Inspection Verification Bureau Ltd (IVB)。 IVB 为全球天然气、可再生能源、石油和电力产业提供独立、专业的检验和检验服务。透过此次收购,德国莱茵 TUV 将进一步巩固其作为提供互补服务的全方位服务供应商的地位,特别是在自我检验服务领域。

2022年1月,SGS宣布与微软合作,共同开发先进的资料解决方案和生产力平台,为跨产业的客户开发检测、检验和认证的创新解决方案。此外,两家公司都旨在藉助物联网和人工智慧来个人化客户体验。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- PESTEL 分析

- 市场机会

- 产业生态系统分析

- COVID-19 对北美 TIC 产业的影响

第五章 市场动态

- 市场驱动因素

- 高度发达的法规结构

- 外包服务需求不断成长

- 市场限制

- 进入障碍和对标准化的担忧,尤其是在跨境贸易中

第六章 市场细分

- 按类型

- 外包

- 内部

- 按行业

- 消费品和零售

- 环境(废水、水、土壤、空气)

- 食品和农业

- 製造业和工业产品

- 石油和天然气

- 建筑与工程

- 其他最终用户产业

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- SGS SA

- Intertek Group Plc

- Bureau Veritas

- TUV SUD

- Applus Services, SA

- UL LLC

- DNV GL

- Mistras Group

- Avomeen LLC

- Envigo Corporation

- AB Sciex LLC

- DEKRA SE

- ALS Limited

第八章投资分析

第九章:市场的未来

The North America Testing, Inspection and Certification Market is expected to register a CAGR of 3.8% during the forecast period.

Key Highlights

- The advent of new technologies, stringent environmental norms, and increasing health safety measures changed the entire industry's viewpoint on compliance with standards and regulations. Testing, inspection, and certification (TIC) play a significant role in ensuring that the infrastructure, services, and products meet the standards and regulations on safety and quality. Due to the increasing demand for inspection and testing processes at regular intervals across a few industries, such as oil and gas, the market is expected to witness growth, irrespective of the industrial seasonality.

- In addition to imports and exports, rapid technological advancements, which led to product diversity, and in some cases, shorter life cycles, are expected to increase the usage of TIC services. Emerging technological trends, like connected devices (IoT), mobile payments, smart cities, and connected cars, are driving the importance of software testing and inspection, on par with hardware testing and inspection. As these technologies become mainstream, the dependency on TIC services is expected to increase.

- The increasing food safety audits drive the market in countries such as the United States. The Food and Drug Administration Authority (FDA) of the United States introduced the Food Safety Modernization Act to transform the country's food safety system, primarily focusing on preventing foodborne illnesses. Under this act, the government set different standards for various food products. This resulted in rapid growth in the country's tests, inspections, and certification activities.

- The new entrants in the market witness high barriers to entry at the TIC market, which requires more significant investments to grow and operate in the studied region. Some investments include expansion of presence, investments for modern laboratories to match the growing competition and automation trends across industries, and, lastly, investments for stronger industry networks.

- Further, owing to the COVID-19 pandemic, the market witnessed an overall decline in demand. Though revenues decreased in the first quarter of 2020 and last year, a few prominent players saw significantly high demand for testing, inspection, and certification services from select end-user industries. The pandemic has encouraged a shift from traditional on-site testing to remote testing, inspection, and certification. The transition is supported by various organizations, including TIC Council Americas, the Americas' branch of the TIC Council. Further, post-pandemic, vendors like TUV Rheinland introduced remote inspection and virtual assessment to reduce in-person inspection and ensure the health and safety of inspectors.

North America TIC Market Trends

Automotive Industry Holds Significant Market Share

- The recovery in automotive manufacturing and trends like electric vehicles and autonomous cars are some of the significant factors driving the demand for TIC in the North American automotive industry during the coming years. Furthermore, growth in safety technologies such as advanced driver-assistance systems (ADAS) and vehicles that use sensors, cameras, and laser scanners, among others, would further create massive growth opportunities for the studied market vendors in the coming years.

- Connected cars in the automotive sector are expected to drive the need for TIC services as software, and hardware testing becomes more crucial. In addition, various companies have begun remote services for inspection and testing in the automotive sectors.

- In march this year, Volvo Car UAS launched a program for its US dealers to install automated drive-through vehicle inspection stations to detect structural, mechanical, and tire defects in seconds. Israeli tech company Uveye manufactures the inspection system, and the system is built with artificial intelligence and machine learning to produce valuable reports and mitigate human errors. Therefore, automation is expected to slightly hamper the growth of existing manual TIC services for the market studied. Similarly, according to Uveye tech, the company signed a deal with 15,000 car dealers across the United States in the current year.

- However, the increased adoption of Electric Vehicles across North America is expected to drive the need for TIC services. According to JPMorgan Chase, the battery electric vehicles sold to customers in North America are estimated at some 1.2 million by the next three years.

- As the performance of semiconductors and the adoption of diverse sensors in vehicles continue to increase, the importance of safety standards for software and their level of sophistication has also risen. In february this year, StradVision, an AI-based vision processing technology company for Autonomous Vehicles and ADAS, obtained the ISO 26262 certification for automotive functional safety from TUV Rheinland, a globally renowned third-party testing, inspection, and certification company.

United States is Expected to Hold Major Market Share

- Due to the increasing demand for inspection and testing processes at regular intervals across a few industries, such as oil and gas, the North America TIC market is expected to witness growth, irrespective of the regional industrial seasonality.

- There is also an increase in the volume of international imports and exports, especially for the products such as food and medical products. The markets of food and beverage, agriculture, consumer electronics, and automotive (electrical vehicles) are expected to provide more scope for TIC services. According to United States Trade Representative, Currently, the United States has 14 free trade agreements with 20 countries.

- Moreover, environment-focused initiatives are also driving the adoption of newer testing standards, primarily with the aid of new technologies. For instance, the Detox campaigns, such as Greenpeace's ZDHC (Zero Discharge of Hazardous Chemicals) campaign across the U.S. region, primarily aim to reduce the usage of harmful chemical substances in the textile industry (the second largest polluter of freshwater worldwide).

- In the United States, due to the growing competition from newer markets and the increased demand for quality from consumers, quality assurance and compliance solutions have become vital for consumers. Most consumer-based goods and retail services make use of testing and certification.

- In the United States, the Consumer Product Safety Improvement Act specifies that the third-party testing and certification of certain products is mandatory before being placed on the market, positively impacting the market's growth. In December this year, Kiwa, a global Testing, Inspection, and Certification (TIC) company, announced the merger with St. Louis (USA) based ASI LLC to the Kiwa Group. The merger would significantly strengthen Kiwa's presence in the United States by providing Food, Feed & Farm certifications.

- The increasing adoption of consumer electronics, smart and wireless devices in the sector are also attracting many vendors to offer a range of product certification programs for consumer electronics, smart and wireless devices to help customers meet the industry standards. These programs address various technologies, including Bluetooth SIG, NFC Forum, LoRa Alliance, GCF, and PTCRB for cellular. These certifications are required if products leverage cellular and wireless technologies. According to U.S. Census Bureau and Consumer Technology Association, the forecast released this year anticipated a USD 1.7 billion increase in the sales value of smartphones sold in the United States, for a total of USD 74.7 billion in sales.

North America TIC Industry Overview

The North America Testing, Inspection, and Certification (TIC) Market is moderately growing with major players like SGS SA, Intertek Group Plc, Bureau Veritas, TUV SUD, and Applus Services, SA, among others. Moreover, Testing, Inspection, and Certification (TIC) are used in various industries to provide vendors with growth opportunities. Players in the market are adopting strategies such as partnerships, innovations, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In November 2022, TUV Rheinland acquired a specialist inspection and verification company Inspection Verification Bureau Ltd (IVB). IVB would provide independent and specialist inspection and verification services to the global gas, renewable energy, oil, and power industries. The acquisition would further strengthen TUV Rheinland'sposition as a full-service provider to the industry with complimentary services, particularly in the voluntary inspection services sector.

In January 2022, SGS announced its collaboration with Microsoft to advance the advanced data solutions and productivity platforms to develop innovative solutions for testing, inspection, and certification for its customers in industries. In addition, the companies aim to personalize the customer experience with the help of IoT and artificial intelligence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 PESTEL Analysis

- 4.4 Market Opportunities

- 4.5 Industry Ecosystem Analysis

- 4.6 Impact of COVID-19 on the TIC Industry in North America

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Highly Developed Regulatory Framework

- 5.1.2 Growing Demand For Outsourced Servic

- 5.2 Market Restraints

- 5.2.1 Entry Barriers for New Players and Standardization Concerns Especially in the Case of Inter-border Transactions

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Outsourced

- 6.1.2 In-house

- 6.2 By End-User Vertical

- 6.2.1 Consumer Goods and Retail

- 6.2.2 Environmental (Effluent, Water, Soil, Air)

- 6.2.3 Food and Agriculture

- 6.2.4 Manufacturing and Industrial Goods

- 6.2.5 Oil and Gas

- 6.2.6 Construction and Engineering

- 6.2.7 Other End-user Verticals

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SGS SA

- 7.1.2 Intertek Group Plc

- 7.1.3 Bureau Veritas

- 7.1.4 TUV SUD

- 7.1.5 Applus Services, SA

- 7.1.6 UL LLC

- 7.1.7 DNV GL

- 7.1.8 Mistras Group

- 7.1.9 Avomeen LLC

- 7.1.10 Envigo Corporation

- 7.1.11 AB Sciex LLC

- 7.1.12 DEKRA SE

- 7.1.13 ALS Limited