|

市场调查报告书

商品编码

1694042

能源与电力产业的测试、检验与认证 (TIC) -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Testing, Inspection, And Certification (TIC) In The Energy And Power Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

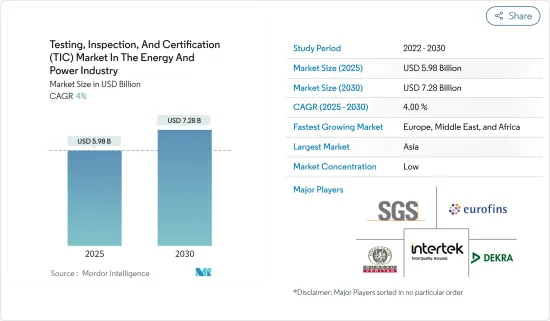

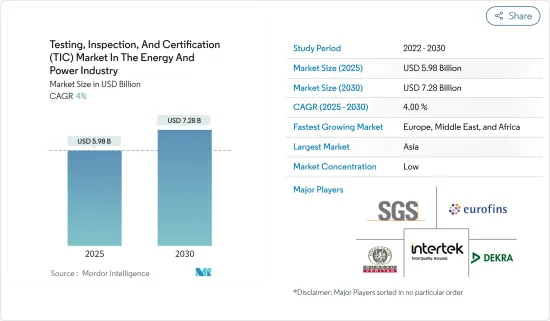

能源和电力测试、检验和认证市场预计将从 2025 年的 59.8 亿美元增长到 2030 年的 72.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 4%。

关键亮点

- TIC(测试、检验和认证)公司的主要角色是维护客户产品的健康、安全和品质要求。此外,测试、检验和认证供应商从事测试、检验和认证服务,以帮助提高生产力并协助当地製造商遵守全球标准。

- 测试、检验和认证 (TIC) 确保服务、基础设施和产品符合品质和安全标准。这对于电力和能源等需要定期检查的产业尤其重要。无论行业季节性如何,TIC 服务市场预计都将实现稳定成长。

- 能源和电力产业支撑着全球经济。为了维持能源成长并提供环境支持,越来越需要有效率、有效地运作能源电力计划。都市化加快和农村人口向都市区迁移正在推动能源和电力产业 TIC 市场的发展。

- 可再生能源需求的不断增长、政府法规的严格、遏制环境污染的环境倡议以及电力行业越来越多地采用先进和数位技术是推动市场成长的一些关键因素。欧洲电力能源产业正在经历快速转型,数位化和互联互通成为新常态。到2050年成为世界上第一个气候中和大陆的目标正在推动工业界拥抱低碳未来。 TIC 服务可促进竞争、资产安全并符合严格的环境标准。

- 监管机构和政府的严格规定,特别是针对高端工业设备认证的规定,迫使能源和电力行业的公司转向外包测试、检验和认证 (TIC) 服务。此外,发电供应商可能不愿意外包 TIC 服务,因为这会带来一些隐私和安全风险。因此,由于这些抑制因素,采用 TIC 服务可能需要付出很多努力。

- 德国有许多私人合格评定机构,包括技术检验局(TUV)集团。认证让客户对合格评定充满信心。认可机构证明合格评定机构的技术能力和客观性。欧盟合格评定机构只需获得一个国家认可机构颁发的认可,且该认可在整个单一市场得到认可。德国认证机构(Deutsche Akkreditierungsstelle GmbH-DAkkS)是德国最重要的认证机构。

- 影响能源电力产业 TIC 市场的宏观经济因素是全球和地区的整体经济成长。经济活动的活性化通常会导致对能源计划的投资增加,这反过来又会增加对 TIC 服务的需求,以确保合规性、安全性和可靠性。

测试、检验和认证(TIC)市场趋势

发电量大幅成长

- 发电产业为各行各业和日常生活提供所需的能源,在全球经济发展中发挥基础性作用。随着对永续和可靠电力的需求不断增长,实用的测试、检验和认证 (TIC) 服务至关重要。

- 法规遵循是发电领域 TIC 服务的主要市场驱动力之一。世界各国政府都实施严格的法规,以确保发电设施的安全、可靠和环境永续性。

- 这些法规要求发电厂营运商接受全面的测试、检查和认证,以满足规定的标准。不遵守严格的规定可能会使电力生产商面临严重的法律后果、处罚和声誉损害。由于发电厂努力遵守这些法规并保持平稳运行,这导致对 TIC 服务的需求大幅增加。

- 发电业涉及复杂机械、高电压和危险材料,因此安全是重中之重。测试、检验和认证 (TIC) 服务对于识别潜在的安全风险和确保发电资产在可接受的安全标准内运作至关重要。这些服务包括电气系统、机械部件、消防安全、辐射暴露等。发电业对 TIC 服务的市场需求是由降低风险、预防事故和保护工人和周边社区福祉的需求所驱动。

- 此外,发电设施是资本密集投资,其高效运作对于满足能源需求至关重要。检验、测试和认证服务有助于确保用于发电的设备和系统符合所需的品质标准。透过进行严格的检查和测试,TIC 服务有助于识别发电基础设施中的缺陷、故障和低效率。这使发电厂营运商能够快速纠正问题、优化性能并提高整体可靠性。因此,对品质保证和卓越营运的需求正在推动发电领域对 TIC 服务的市场需求。

亚洲占最大市场占有率

- 中国是亚太地区成长最快的经济体之一,这使其成为蓬勃发展的TIC(检验与认证)市场的一个有吸引力的地方。此外,消费者对产品安全和品质的认识不断提高,预计将刺激能源和电力领域的设备检查等领域的成长。

- 根据中国电力企业联合会预测,到2023年,中国的发电装置容量将达到约2,920千兆瓦,高于2022年的约3,000千兆瓦。火力发电主要来自燃煤,煤炭是中国发电容量最大的能源来源。此外,根据中国电力联合会预测,2023年中国电力消耗量约9,220兆瓦时。与 2022 年相比,这是一个显着的增长,当时的消费量约为 8,640兆瓦。预计电力消耗的成长将推动该国的研究市场。

- 印度是亚太地区成长最快的经济体之一,也是最具活力的测试市场之一。印度能源管理局的数据显示,火力发电是印度最大的能源结构,截至 2023 年 2 月,其装置容量超过 236,000 兆瓦。该国约70%的发电量来自火力发电厂。煤炭占电力供应的大部分,其中火力发电厂的贡献率超过86%。除了煤炭以外,褐煤、柴油和天然气也可以用来发电。

- 在第二波 COVID-19 疫情期间,UL 宣布将为印度太阳能光电 (PV) 逆变器製造商推出测试服务。 UL 已扩建其在班加罗尔的设施,以协助满足新和可再生能源部 (MNRE) 规定的标准要求。该实验室被国家认可委员会认可为测试和校准实验室 (NABL)。根据强制註册计划 (CRS),BIS 允许在代表性模型测试的基础上对太阳能光电逆变器进行测试。

- 由于日本国内发电量较低,日本政府一直鼓励能源企业在全球范围内加大探勘开发计划,以确保稳定的电力供应。这些努力使日本成为能源领域领先的资本设备出口国之一,也是领先的TIC服务采用国之一。

- 2023 年 11 月,日本冲绳电力公司 (9511.T) 宣布计划在其商用燃气发电厂开始试验性地共燃氢气,以减少二氧化碳 (CO2)排放。目标是使冲绳本岛南部吉野浦火力发电厂 35 兆瓦 (MW) 机组的氢气共燃率达到 30%。建立氢混燃技术是实现扩大可再生能源和减少排放双重目标的重要措施。

测试、检验和认证(TIC)行业概览

能源和电力产业的 TIC 市场较为分散,主要企业包括 SGS SA、Eurofins Scientific SE、Bureau Veritas SA、Intertek Group PLC、DEKRA SE 和 DNV Group AS。所研究市场的参与企业正在采取联盟和收购等策略来增强其产品供应并获得可持续的竞争优势。

- 2023 年 9 月 - Intertek 与法国独立检验和工程专家 Emitech Group 合作。 Emitech Group 获得 EN 17025 和 EN 17065 认证,是公告机构和 CB 计画参与者,为一系列最终用户行业的组织提供培训、检验和工程专业知识。此次策略合作将为 Emitech 集团和 Intertek 的欧洲客户提供先进的设施和更广泛的业务范围。

- 2023 年 6 月-Applus+ 收购法国知名材料测试和研发技术合作伙伴 Rescoll 100% 的股份。 Lescole 约有 170 名员工,年销售额超过 2,100 万欧元。该公司声称,其设备齐全的实验室、专家和多样化的能力将支持能源、医疗、航太和工业领域的发展。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 新冠疫情及其他宏观经济因素对市场的影响

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 预计未来会有需求的主要标准/认证和服务类型

第五章市场动态

- 市场驱动因素

- 确保产品安全和环境保护的政府法规和规定

- 增加对能源效率流程的投资,并增加能源和电力领域对智慧电网的采用

- 市场限制

- 标准多样化,非保险公司难以确保合规

第六章市场区隔

- 按服务类型

- 检查

- 认证

- 按地区

- 中国

- 美国

- 印度

- 日本

- 巴西

- 加拿大

- 韩国

- 德国

- 法国

- 沙乌地阿拉伯

- 按应用

- 发电

- 贮存

- 分销和销售

第七章竞争格局

- 公司简介

- DNV Group AS

- SGS SA

- Bureau Veritas SA

- Applus Services SA

- Intertek Group PLC

- DEKRA SE

- Eurofins Scientific SE

- Advanced Technology Group,spol.s ro

- TUV SUD AG

- Element Materials Technology Group Limited

8.供应商市场占有率分析

第九章:未来市场展望

The Testing, Inspection, And Certification Market In The Energy And Power Industry is expected to grow from USD 5.98 billion in 2025 to USD 7.28 billion by 2030, at a CAGR of 4% during the forecast period (2025-2030).

Key Highlights

- The primary role of TIC (testing, inspection, and certification) companies is to sustain the health, safety, and quality requirements of their client's products. Moreover, testing, inspection, and certification vendors are engaged in verification, inspection, testing, and certification services to help improve productivity and also help local manufacturers comply with global standards.

- Testing, inspection, and certification (TIC) ensure that services, infrastructure, and products meet quality and safety standards. This is especially crucial in industries like power and energy, where regular inspections are required. The TIC services market is expected to grow consistently regardless of industrial seasonality.

- The energy and power industry feeds the world's economy. There is a rising need to efficiently and effectively operate energy and power projects to sustain energy growth and provide environmental support. Increasing urbanization and people migrating from rural areas to urban areas are driving the development of the TIC market in the energy and power industry.

- The growing demand for renewable energy, the government's stringent regulation, environmental concerns initiative for controlling environmental pollution and increasing adoption of advanced and digital technologies in the power sector are some of the major factors driving the market's growth. The European power and energy sector is rapidly reinventing itself, where digitalization and interconnection are the new norms. The goal of becoming the world's first climate-neutral continent by 2050 is pushing the industry to adopt a low-carbon future. TIC services enable the competitiveness and asset's safety and compliance with stringent environmental standards.

- Stringent regulations from regulatory bodies and government, especially in high-end industrial equipment certification, compel energy and power sector companies to adopt outsourced testing, inspection, and certification (TIC) services. The power generation vendors may also be reluctant to outsource TIC services as they pose several risks related to privacy and security, as it involves sharing confidential supply chain information with third parties. Hence, adopting TIC services might take a lot of work due to these restraining factors.

- In Germany, there are many private conformity assessment bodies, including the group of Technical Inspection Agencies (TUV). Accreditation ensures that customers can trust in conformity assessment. Accreditation bodies attest to the technical competence of conformity assessment bodies and their objectivity. Conformity bodies in the EU require just one accreditation issued by their national accreditation body, which is recognized across the single market. The German Accreditation Body (Deutsche Akkreditierungsstelle GmbH - DAkkS) is the foremost accreditation body in Germany.

- The macroeconomic factors impacting the TIC market in the energy and power industry is the overall economic growth, both globally and regionally, as it plays a significant role in driving the demand for energy and power infrastructure, products, and services. Higher economic activity typically leads to increased investment in energy projects, which, in turn, drives the demand for TIC services to ensure compliance, safety, and reliability.

Testing, Inspection, and Certification (TIC) Market Trends

Power Generation to Witness Significant Growth

- The power generation sector plays a fundamental role in global economic development, providing the energy required for various industries and everyday life. With the rising demand for sustainable and reliable power, practical testing, inspection, and certification (TIC) services have become paramount.

- Regulatory compliance is one of the primary market drivers for TIC services in the power generation sector. Governments globally have implemented stringent regulations to ensure power generation facilities' safety, reliability, and environmental sustainability.

- These regulations require power plant operators to undergo comprehensive testing, inspection, and certification to meet the specified standards. Failure to comply with the stringent rules can result in severe legal consequences, penalties, and reputational damage for power generation companies. The demand for TIC services has thus increased significantly as power plants seek to comply with these regulations and maintain their operations smoothly.

- The power generation sector involves complex machinery, high voltages, and hazardous materials, making safety a top priority. Testing, inspection, and certification (TIC) services are crucial in identifying potential safety risks and ensuring that power generation facilities operate within acceptable safety standards. These services include electrical systems, mechanical components, fire safety, radiation exposure, and more. The market demand for TIC services in the power generation sector is driven by the need to mitigate risks, prevent accidents, and safeguard the well-being of workers and surrounding communities.

- Moreover, power generation facilities are capital-intensive investments, and their efficient operation is crucial for meeting energy demands. Testing, inspection, and certification services help ensure that the equipment and systems used in power generation meet the required quality standards. By conducting rigorous testing and inspections, TIC services help identify defects, malfunctions, or inefficiencies in the power generation infrastructure. This enables power plant operators to rectify issues promptly, optimize performance, and improve overall reliability. The need for quality assurance and operational excellence thus drives the market demand for TIC services in the power generation sector.

Asia Holds the Largest Market Share

- China is among the rapidly growing economies in the Asia-Pacific area, making it an appealing location for the TIC (testing, inspection, and certification) market to thrive. Increasing consumer knowledge about product safety and quality is also anticipated to spur growth in sectors like equipment testing in the energy and power field.

- According to CEC, approximately 2,920 gigawatts of electricity generation capacity had been installed in China as of 2023, up from some 3,000 gigawatts in 2022. Most thermal power is coal-based and is the energy source with the country's most significant power generation capacity. Moreover, according to CEC, China had a total electricity consumption of around 9,220 terawatt hours in 2023. This was a notable increase compared to 2022, when consumption amounted to approximately 8,640 terawatt hours. This increase in electricity consumption will drive the studied market in the country.

- India is one of the most dynamic markets for testing and inspection in the Asia-Pacific region, as it is one of the fastest emerging economies in the region. According to CEA, India's highest energy capacity came from thermal energy, amounting to an installed capacity of over 236 thousand megawatts as of February 2023. Approximately 70% of the country's electricity generation was from thermal power plants. Coal dominated power supply with a contribution of over 86% through thermal power plants. Along with coal, thermal power is generated from lignite, diesel, and gas.

- During the second wave of the COVID-19 pandemic, UL announced the launch of testing services for India's solar photovoltaic (PV) inverter manufacturers. UL has expanded its facility in Bengaluru to help manufacturers comply with the requirements of the standards mandated by the Ministry of New and Renewable Energy (MNRE). The National Accreditation Board accredits the laboratory for Testing and Calibration Laboratories (NABL). The BIS recognizes it under the Compulsory Registration Scheme (CRS) to conduct testing of solar PV inverters based on testing of representative models.

- Owing to low domestic production in the country, the Japanese government always encouraged its energy companies to increase exploration and development projects globally to secure a stable power generation supply. These initiatives make Japan one of the major exporters of energy-sector capital equipment, making it one of the primary adopters of TIC services.

- In November 2023, Japan's Okinawa Electric Power (9511.T) opened new tab plans to start co-firing hydrogen on a trial basis at a commercial gas-fired power plant in a bid to reduce carbon dioxide (CO2) emissions. The utility aims to achieve a hydrogen co-firing rate of 30% at the 35 megawatts (MW) unit of its Yoshinoura thermal power station in the southern island of Okinawa. Establishing hydrogen co-firing technology is a critical initiative to help achieve two goals: expanding renewable energy and slashing CO2 emissions.

Testing, Inspection, and Certification (TIC) Industry Overview

The TIC market in the energy and power industry is fragmented, with major players like SGS SA, Eurofins Scientific SE, Bureau Veritas SA, Intertek Group PLC, DEKRA SE, and DNV Group AS. Players in the market studied are adopting strategies such as partnerships and acquisitions to enhance product offerings and gain sustainable competitive advantage.

- September 2023 - Intertek partnered with Emitech Group, the French independent testing and engineering specialist. Accredited to EN 17025 and EN 17065, a notified body, and a participant in the CB scheme, the Emitech Group offers its expertise in training, testing, and engineering to organizations operating across a diverse range of end-user industries. This strategic alliance will bring advanced facilities and expanded coverage to Emitech Group and Intertek's European customers.

- June 2023 - Applus+ acquired the entire share capital of Rescoll, a prominent materials testing and research and development technological partner based in France. Rescoll has approximately 170 employees and an annual revenue of over EUR 21 million. Its well-equipped laboratories, experts, and diverse capabilities are claimed to support the development of the energy, medical, aerospace, and industry sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Key Standards/Certifications and Type of Services that Might be in Demand in the Future

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Regulations and Mandates to Ensure Product Safety and Environmental Protection

- 5.1.2 Rising Investments in Energy Efficiency Process and Increasing Usage of Smart Grids in the Energy and Power Sector

- 5.2 Market Restraints

- 5.2.1 The Presence of Diverse Standards Makes It Complicated for Non-incumbents to Ensure Compliance

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Testing and Inspection

- 6.1.2 Certification

- 6.2 By Geography

- 6.2.1 China

- 6.2.2 United States

- 6.2.3 India

- 6.2.4 Japan

- 6.2.5 Brazil

- 6.2.6 Canada

- 6.2.7 South Korea

- 6.2.8 Germany

- 6.2.9 France

- 6.2.10 Saudi Arabia

- 6.3 By Application

- 6.3.1 Power Generation

- 6.3.2 Storage

- 6.3.3 Distribution and Sales

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DNV Group AS

- 7.1.2 SGS SA

- 7.1.3 Bureau Veritas SA

- 7.1.4 Applus Services SA

- 7.1.5 Intertek Group PLC

- 7.1.6 DEKRA SE

- 7.1.7 Eurofins Scientific SE

- 7.1.8 Advanced Technology Group,spol.s r.o.

- 7.1.9 TUV SUD AG

- 7.1.10 Element Materials Technology Group Limited