|

市场调查报告书

商品编码

1643189

室内定位:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Indoor Location - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

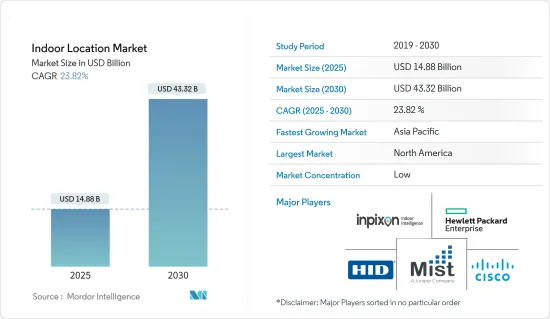

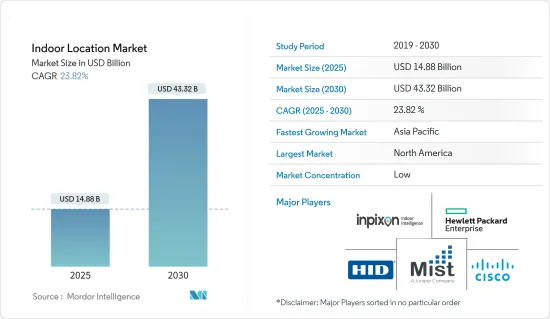

室内定位市场规模预计在 2025 年为 148.8 亿美元,预计到 2030 年将达到 433.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 23.82%。

主要亮点

- 室内定位系统(IPS)可以弥补传统 GPS 的不足,尤其是在高层建筑、机场和地下停车场等复杂环境中。这些由设备网路组成的系统在精确定位人和物体方面发挥了重要作用。

- 越来越多的企业,无论规模大小,都开始采用室内定位资讯系统来提高准确性。这些系统不仅有助于准确跟踪,而且还有助于优化生产设施的占地面积。利用信标和蓝牙 BLE 标籤的应用程式的快速增加,以及它们与摄影设备、POS 系统数位电子看板的集成,正在推动室内位置资讯市场的成长。

- 企业正在迅速采用云端处理和物联网来简化业务,其中医疗保健行业处于领先地位。随着医疗保健领域的物联网应用越来越紧密地与医疗需求相结合,该行业将迎来显着的成长。

- 此外,随着配备先进应用程式的智慧型手机的需求不断增长、数位化的推进和技术的不断改进,室内空间市场预计还将扩大。

- 然而,未来仍面临诸多挑战。基础设施不相容、互通性问题和资料安全问题会影响最终用户。此外,维护挑战也可能阻碍市场成长。

室内定位市场趋势

运输和物流行业占据主导市场占有率

- 推动这一增长的主要动力是机场和火车站对移动援助的需求,以帮助乘客找到餐厅和商店,以及铁路需要在正确的地点找到它们。

- 在交通运输领域使用室内位置资讯解决方案有助于了解消费行为。这提供了宝贵的资料,可用于建立更详细的广告宣传、选择正确的位置、优化您的服务等。透过选择室内定位解决方案,运输业还可以确保有效的库存管理,以追踪遗失的设备并降低审核成本。

- 监控和了解实体位置以节省资产管理浪费的时间的需求是物流领域室内定位解决方案发展的主要驱动力。位置分析工具使企业能够整理和解读复杂的计划,获得洞察力并快速参与。

- 成功的运输和物流运作需要复杂、持续的营运和资本密集流程。确定储存设施对于物流部门来说非常重要。此外,物流业正在采用监控和定位资产的要求,以减少管理资产位置的时间浪费,这也推动了室内定位解决方案的发展。

- 该公司使用位置分析工具来组织和分析其详细计划,提供改善客户互动的见解。

预测期内,北美将占据最高市场占有率

- 由于智慧型手机数量的增加和物联网技术的不断发展,北美预计将占据室内定位市场的很大份额。北美是全球领先的飞机生产国和航太及航海导航设备的主要製造商,也是平板电脑、智慧型手机和商用车导航系统的第二大市场。

- 除家用电器外,美国几乎占据了北美所有终端用户领域的很大份额。该国智慧型手机的普及率和销售量令人瞩目。

- 根据GSMA预测,2025年,北美行动通讯产业规模将达到3,330亿美元,成为全球最大的行动通讯市场,比中国高出50%。鑑于该国计划向 5G 服务转型,预计收入将进一步增长。预计年终, 24%的非洲人将拥有5G网络,到2025年这一比例将达到46%,即2亿个连接。

- 随着智慧型手机的普及以及消费行为购买行动电话行为的改变,企业家和现有企业正在努力开发定位服务,以吸引全部区域室内用户。利用室内位置资讯技术,零售商可以增强客户体验并提供指向正确产品和位置的导航。

- 支持北美室内位置资讯市场成长的另外两个关键因素是新技术的发展和对室内位置资讯解决方案利用的投资增加。此外,各地区室内定位相关企业的增加也有望成为市场成长的驱动力。

室内定位行业概况

由于正在进行的研究,室内定位市场正在细分,预计技术进步将成为市场的主要趋势。公司正在采取各种策略来扩大客户群并在市场上占有一席之地。

- 2024 年 3 月,即时定位服务 (RTLS) 领域的全球领导者 Arista 宣布,Gartner Inc. 将该公司定位为 2024 年室内定位服务魔力像限的领导者。 AiRISTA 致力于透过位置洞察增强客户的工作流程,从而提高客户的 RTLS 投资价值。它结合了 Wi-Fi、低功耗蓝牙 (BLE)、蜂窝、红外线 (IR)、被动 RFID 和条件感应,以简化流程、改善团队协作并确保员工安全。

- 2024 年 1 月,Tack One 在 2024 年消费性电子展 (CES) 上推出了 Tack GPS Plus。这款新一代全球追踪器将重新定义定位技术如何应用于日常消费者需求以及商业和大规模应用,包括室内和室外定位服务、增强护理、阿兹海默症患者安全以及灾难管理和回应。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对室内定位市场的影响分析

第五章 市场动态

- 市场驱动因素

- 带有信标和 BLE 标籤的应用程式数量不断增加

- 室内 GPS 技术效率低下

- 连网型设备、智慧型手机和基于位置的应用程式的成长

- 市场限制

- 资料和安全问题

- 部署和维护挑战

- 严格的政府规章制度

第六章 市场细分

- 按组件

- 解决方案

- 按服务

- 按应用

- 室内导航和地图

- 追踪和追踪应用程式

- 远端监控和应急管理

- 其他用途

- 按最终用户产业

- 零售

- 运输和物流

- 卫生保健

- 电讯

- 石油、天然气和采矿

- 政府和公共部门

- 製造业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Inpixon

- Hewlett Packard Enterprise Development LP

- Mist Systems Inc.

- HID Global Corporation

- Cisco Systems Inc.

- Google LLC

- Microsoft Corporation

- Acuity Brands Inc.

- Zebra Technologies Corporation

- CenTrak

- Ubisense Limited

- Sonitor Technologies AS

- Broadcom Corporation

- HERE Global BV

- AiRISTA

- Tack One

第八章投资分析

第九章 市场机会与未来趋势

简介目录

Product Code: 70200

The Indoor Location Market size is estimated at USD 14.88 billion in 2025, and is expected to reach USD 43.32 billion by 2030, at a CAGR of 23.82% during the forecast period (2025-2030).

Key Highlights

- Indoor positioning systems (IPS) are stepping in where traditional GPS falls short, especially in complex environments like multistory buildings, airports, and underground parking lots. These systems, comprising a network of devices, are proving crucial in pinpointing people or objects.

- Businesses, irrespective of their size, are increasingly turning to indoor location systems for enhanced precision. These systems not only aid in precise tracking but also assist production facilities in optimizing their floor space. The surge in applications leveraging beacons, Bluetooth BLE tags, and even integrating with camera equipment, point-of-sale (POS) systems, and digital signage is propelling the indoor location market's growth.

- Businesses are swiftly adopting cloud computing and IoT for streamlined operations, with the healthcare sector leading the charge. The sector is poised for substantial growth as healthcare IoT applications align more closely with medical needs.

- Furthermore, the market for indoor spaces is expected to expand, driven by the rising demand for smartphones with advanced applications, the push for digitalization, and ongoing technology enhancements.

- However, challenges loom. Incompatibilities among infrastructures, interoperability issues, and concerns over data security are casting shadows on end users. Additionally, maintenance challenges could impede market growth.

Indoor Location Market Trends

Transportation and Logistics Vertical to Hold a Dominant Market Share

- The growth can be attributed to the demand for mobile assistance for passengers at airports and railway stations to find restaurants and shops in airports, and trains have been attributed to the need to find them in the right place.

- The use of indoor location solutions in the transport sector will help to understand consumer behavior. It provides valuable data that may be used to develop more detailed advertising campaigns, select suitable locations, and optimize services. By choosing an indoor location solution, the transport industry can also trace missing equipment and ensure effective inventory control to reduce audit costs.

- The need to monitor and recognize the physical location to save time lost in asset management is a key driver for developing an indoor positioning solution within the logistics sector. A company can organize and decipher complex plans with location analytics tools, enabling it to gain insight and engage with them quickly.

- Complicated, continuously running operations and capital-intensive processes are needed to make the transport and logistics sector a success. It is important for the logistics sector to identify storage facilities. The logistics industry has also adopted the requirement to monitor and locate assets in order to reduce waste of time during asset location management, as well as promote solutions for indoor locations.

- The company can use location analysis tools to organize and analyze detailed plans, which will enable them to gain insight in order to improve their interactions with customers.

North America to Hold the Highest Market Share During the Forecast Period

- It is expected that North America will account for a significant share of the indoor location market due to the increasing number of smartphones in this region and the development of Internet of Things technologies. North America is also the second most important market for tablets, smartphones, and navigation systems on commercial vehicles compared to being the world's leading producer of airplanes and a major manufacturer of aerospace and maritime navigational equipment.

- The United States has a large market share in nearly all sectors of end users in North America, with the exception of consumer electronics. In this country, the penetration rate of smartphones and their sales is remarkable.

- According to the GSMA, the North American mobile industry will be worth USD 333 billion in 2025, which would make it the world's largest mobile market by a margin of 50% over China. Sales are expected to increase even further in view of the country's planned transition toward 5G services. By the end of this year, 24% will be on 5G networks in Africa, and by 2025, it is expected to reach 46 % or 200 million connections.

- As a result of the growing adoption of smartphones and changes in consumer behavior when purchasing mobiles, entrepreneurs and existing companies are taking steps to develop locational services that will engage indoor users throughout the region. By using indoor location technology, retailers are enhancing their customers' experience and providing appropriate product or place navigation.

- Two other important factors supporting the growth of the market for indoor locations in North America are increasing investments in developing new technologies and using indoor location solutions. Market growth is also expected to be driven by the growing number of indoor location companies in different regions.

Indoor Location Industry Overview

The indoor location market is fragmented due to continuous research, and technological advancements are anticipated to be the principal trends in the market. The firms are adopting diverse strategies to increase their customer base and mark their presence in the market.

- March 2024: Arista, one of the global leaders in real-time location services (RTLS), announced that Gartner Inc. had recognized it as a "Leader" in the 2024 Magic Quadrant for Indoor Location Services. AiRISTA is committed to increasing the value of RTLS investments by empowering customer workflows with location insights. It combines Wi-Fi, Bluetooth low energy (BLE), cellular, infrared (IR), passive RFID, and condition-sensing to increase process efficiency, improve team coordination, and provide staff safety.

- January 2024: Tack One announced the Tack GPS Plus at the Consumer Electronics Show (CES) 2024. This next-generation global tracker redefines the way location technology can be applied to consumers' daily needs as well as commercial and at-scale applications, including indoor and outdoor location services, enhanced care, safety for patients with Alzheimer's disease, and disaster management and preparedness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Analysis on the impact of COVID-19 on the Indoor Location Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Number of Applications Powered by Beacons and BLE Tags

- 5.1.2 Inefficiency of the GPS Technology in Indoor Premises

- 5.1.3 Growth of Connected Devices, Smartphones, and Location-based Applications

- 5.2 Market Restraints

- 5.2.1 Data and security related Issues

- 5.2.2 Deployment and Maintenance Challenges

- 5.2.3 Strict Rules and Regulations by Government

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Application

- 6.2.1 Indoor Navigation & Maps

- 6.2.2 Tracking and Tracing Application

- 6.2.3 Remote Monitoring and Emergency Management

- 6.2.4 Other Applications

- 6.3 By End-user Industry

- 6.3.1 Retail

- 6.3.2 Transportation and Logistics

- 6.3.3 Healthcare

- 6.3.4 Telecom

- 6.3.5 Oil and Gas and Mining

- 6.3.6 Government and Public Sector

- 6.3.7 Manufacturing

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Inpixon

- 7.1.2 Hewlett Packard Enterprise Development LP

- 7.1.3 Mist Systems Inc.

- 7.1.4 HID Global Corporation

- 7.1.5 Cisco Systems Inc.

- 7.1.6 Google LLC

- 7.1.7 Microsoft Corporation

- 7.1.8 Acuity Brands Inc.

- 7.1.9 Zebra Technologies Corporation

- 7.1.10 CenTrak

- 7.1.11 Ubisense Limited

- 7.1.12 Sonitor Technologies AS

- 7.1.13 Broadcom Corporation

- 7.1.14 HERE Global BV

- 7.1.15 AiRISTA

- 7.1.16 Tack One

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219