|

市场调查报告书

商品编码

1643194

工作订单管理-市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Work Order Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

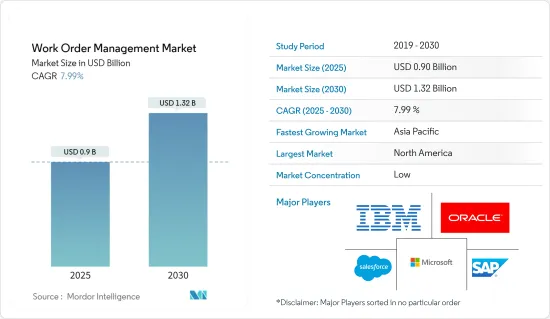

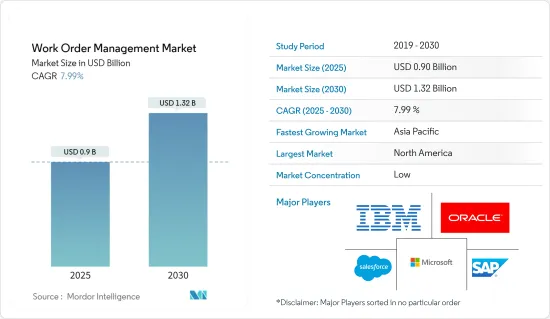

工单管理市场规模预计在 2025 年为 9 亿美元,预计到 2030 年将达到 13.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.99%。

随着世界各地的企业走向数位转型,他们正在采用各种解决方案来监督维护和管理。

关键亮点

- 工作订单管理是对企业的维护、安装和维修工作的调度、计划、追踪和管理。节省成本、减少设备停机时间和优化营运正在推动世界各地设施的数位化。采用工作订单管理系统可让企业选择预防性保养,从而更容易要求服务和获得即时更新。

- 由于越来越多的组织采用工作订单管理软体来简化维护业务、提高资产性能和优化整体业务效率,市场因不断增长的消费者需求而呈现上升趋势,从而见证了显着的成长。

- 此外,控制工作订单、更好的计划执行、跨垂直行业的企业对集中管理和追踪订单的日益增长的需求,以及对云端基础的工作订单管理系统解决方案的日益关注,都是推动市场成长的主要因素。

- 然而,业务订单管理市场的成长面临着包括与现有系统的复杂整合、资料安全问题以及熟练人才短缺等挑战。透过无缝整合不断发展的技术来应对这些挑战有望加速市场成长。

- 新冠肺炎疫情对受访市场产生了不同程度的影响。转向远端工作为存取和更新工作订单带来了挑战,影响了生产力和沟通。餐旅服务业和旅游等行业受到景气衰退的严重打击,导致对此类解决方案的需求下降。同时,云端基础的业务订单管理解决方案的采用使得远端存取和协作变得更加容易,这使得它们对于管理分散式团队和确保製造业、电子商务和医疗保健等行业的业务永续营运至关重要。

工单管理市场趋势

预计在製造业大规模采用

- 工单管理已成为製造业务不可或缺的一部分,指导生产任务的执行、资源分配和调度。然而,随着数位化的进步,製造商正在利用技术来简化和优化工单管理。

- 製造业对工单管理解决方案的采用正在激增。这一趋势背后有许多因素:效率提高、成本优化以及最终提高效力。

- 工业 4.0 正在将工业从旧有系统转变为智慧组件和机器,并促进数位化工厂以及互联工厂和企业的生态系统的发展。工业 4.0 正在说服OEM在其整个营运过程中采用物联网。物联网为製造业提供的好处,包括提高机器运转率、预测性维护和生产、资料分析、监控、自动化和成本效益,正在推动其采用率的提高。

- 此外,2022年11月,中国工业和资讯化部核准了三个新的国家製造业研发中心。这些中心也将重点放在关键共通性技术,促进这些产业的技术研发。他说,该部还将指导新的製造业创新中心加强技术创新能力,为製造业关键环节的高品质发展提供重要支撑。

- 根据製造业生产力创新联盟 (MAPI) 基金会的报告,到 2025 年,製造业预计将对生产调度和控制数位技术的投资增加 46%。这项统计数据凸显了数位转型对未来工作指令和製造流程日益增长的重要性。

北美可望主导市场

- 物联网技术正在克服製造业的劳动力短缺问题,尤其是在美国等已开发国家。美国联邦政府和私人组织正在投资工业4.0物联网技术,以扩大美国的工业基础。

- 人工智慧、物联网、智慧设备和 3D 列印等多项技术已经提高美国主要工厂的绩效指标。此外,该地区的政府正在透过支持机器人市场尖端技术发展的倡议来推动机器人技术的采用。

- 例如,美国联邦政府启动了国家机器人倡议(NRI),以加强该国本土的机器人製造能力并促进该领域的研究活动。工单管理降低了供应链风险,并全面审查入境物流,以确保运输过程中产品的品质和真实性。

- 此外,根据美国劳工统计局的数据,截至 2023 年 2 月,美国建筑业僱用了约 800 万人,高于 2021 年的 729 万人。建筑劳动力需求的增加推动了建筑工人对穿戴式装置的需求,从而加速了市场成长。

- 由于 IBM、Microsoft、Oracle 和 Salesforce 等几家主要供应商的存在,加上他们在技术采用方面的优势,为各行业提供工单管理解决方案,北美预计将主导工单管理市场。

工单管理产业概览

由于全球有多个解决方案供应商,例如销售团队 、IBM、Microsoft、SAP SE、Oracle 等,工作订单管理市场的竞争格局较为固体。市场参与企业正在确定产品发布、併购和合作等策略性倡议,以增加其在市场上的份额。

2024 年 2 月-Gooten 推出 OrderMeshTM,这是一个专为按需生产而设计的工作订单管理平台。该平台旨在帮助零售商、製造商、电子商务品牌和市场扩大其产品供应,简化订单履行流程,并大幅降低按需供应链营运的复杂性和成本。

2023 年 9 月,英国软体公司 Everfield 收购了 Depotnet,后者是一家专门针对电讯、公共产业和基础设施领域的工作订单管理软体供应商。此次收购将使 Depotnet 能够利用 Everfield 的支援和资源来投资成长和创新。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

第五章 市场动态

- 市场驱动因素

- 现场工作人员对行动和穿戴式装置的采用

- 企业趋向于优化工作以更好地交付计划

- 市场限制

- 现场工人缺乏专业知识

第六章 市场细分

- 按组件

- 解决方案

- 按服务

- 依实施类型

- 本地

- 云

- 按最终用户产业

- 製造业

- 运输和物流

- 能源公共产业

- 医疗

- BFSI

- 通讯和 IT

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Salesforce.com, Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- IFS AB

- Infor Inc.

- Hippo CMMS

- ServiceMax, Inc.

- Innovapptive Inc.

- eMaint Enterprises, LLC

第八章投资分析

第九章:市场的未来

The Work Order Management Market size is estimated at USD 0.90 billion in 2025, and is expected to reach USD 1.32 billion by 2030, at a CAGR of 7.99% during the forecast period (2025-2030).

Enterprises worldwide are increasingly moving towards digital transformation, adopting various solutions to oversee maintenance and management.

Key Highlights

- Work order management is scheduling, planning, tracking, and managing work orders for a business's maintenance, installation, and repair tasks. Reducing costs, equipment downtime, and optimizing operations are augmenting the digitalization of facilities across the globe. Adopting a work order management system allows enterprises to opt for preventive maintenance, making it easy to place service requests and gain real-time updates.

- The market is experiencing substantial growth marked by a rising trajectory fueled by increased consumer demand attributed to the growing prevalence of organizations embracing work order management software to streamline maintenance operations, enhance asset performance, and optimize overall operational efficiency.

- Furthermore, the increasing requirement to have managed work orders, better execution of projects, increasing requirement among businesses across industries to manage and centrally track orders and increasing focus towards cloud-based solutions for work order management system are key factors driving the growth of the market.

- However, the work order management market growth is challenged by the integration complexities of work order management with existing systems, data security concerns, and a lack of skilled personnel. The market growth is expected to be accelerated by addressing these challenges with seamless integration of evolving technologies.

- The COVID-19 pandemic had a mixed impact on the studied market. The transition to remote work posed challenges in accessing and updating work orders, impacting productivity and communications. The industries like hospitality and travel experienced downturns, leading to decreased demand for these solutions. Whereas the adoption of cloud-based work order management solutions facilitated remote access and collaborations, becoming essential for managing distributed teams and ensuring business continuity in industries like manufacturing, e-commerce, healthcare, and others.

Work Order Management Market Trends

Manufacturing Expected to Exhibit Significant Adoption

- Work order management becomes an integral part of manufacturing operations, guiding the execution of production tasks, resource allocation, and scheduling. However, with the rise of digitalization, manufacturers are increasingly embracing technologies to streamline and optimize work order management.

- The manufacturing industry is witnessing a significant surge in adopting work order management solutions. This trend is driven by a multitude of factors, all pointing toward enhanced efficiency, cost optimization, and ultimately, improved effectiveness.

- Industry 4.0 is transforming industries, from legacy systems to smart components and machines, to promote digital factories and the development of an ecosystem of connected plants and enterprises. Industry 4.0 has persuaded OEMs to adopt IoT across their operations. The benefits offered by IoT in the manufacturing industry drive the adoption rates, such as increased machine utilization, predictive maintenance and production, data analytics, monitoring, automation, and cost benefits.

- Moreover, in November 2022, China's Ministry of Industry and Information Technology approved three new national manufacturing innovation centers. They also stated that these centers would focus on vital generic technologies and boost technological research and development in these industries. Also, the ministry stated that it would guide the new manufacturing innovation centers in strengthening their capabilities to seek technological innovation to provide critical support for the high-quality development of primary fields in manufacturing.

- According to a report by Manufacturers Alliance for Productivity and Innovation (MAPI) Foundation, by 2025, manufacturers are projected to increase their investment in digital technologies for production scheduling and control by 46%. This statistic highlights the increasing importance of digital transformation for the future of the work order and manufacturing processes.

North America Expected to Dominate the Market

- IoT technologies are overcoming the labor shortage in the manufacturing sector, especially in developed countries such as the United States. The Federal Government and private sector organizations in the United States are investing in Industry 4.0 IoT technologies to expand the American industrial base.

- Several technologies like AI, IoT, smart devices, and 3D printing are already growing the performance metrics of major US-based factories. The government in the region is also promoting the adoption of robotics by taking initiatives to support the growth of modern technologies in the robotics market.

- For instance, the US federal government initiated the National Robotics Initiative (NRI) program to strengthen the capabilities of building domestic robots in the country and boost research activities in the field. Work order management decreases supply-chain risk and ensures the quality and authenticity of in-transit products with a full survey of inbound and outbound logistics.

- Moreover, according to the Bureau of Labor Statistics, the construction sector employed around 8 million people in the United States as of February 2023, which increased from 7.29 million in 2021. Such rising demand for construction labor has propelled the demand for wearable devices among field workers, thus accelerating market growth.

- The North American region is expected to dominate the Work Order Management Market owing to the resence of several large vendors such as IBM, Microsoft, Oracle, and Salesforce, among others, coupled with the region's dominance in technology adoption and caters work order management solutions to various industries.

Work Order Management Industry Overview

The competitive landscape of the Work Order Management Market is semi-consolidated owing to the presence of several solution providers, such as Salesforce, IBM, Microsoft, SAP SE, and Oracle, amongst others, across the world. The market players are witnessing strategic initiatives such as product launch, mergers & acquisition, collaborations, and other to enhance their market presence.

In February 2024 - Gooten launches OrderMeshTM, an order management platform designed for on-demand production. This platform is designed to support retailers, manufacturers, eCommerce brands, and marketplaces as they broaden their product offerings, streamline order processing, and substantially reduce the operational complexities and costs of a made on-demand supply chain.

In September 2023 - Everfield, the UK-based software firm acquired Depotnet, a work order management software provider that specialized in the Telecoms, Utilities, and Infrastructure sectors. With the acquisition, Depotnet will be able to invest in growth and innovation with the support and resources of Everfield.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Mobile and Wearable Devices Among Field Workers

- 5.1.2 Enterprise Propensity Towards Optimizing Work for Better Execution of Projects

- 5.2 Market Restraints

- 5.2.1 Lack of Expertise Among Field Workers

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment Mode

- 6.2.1 On-Premise

- 6.2.2 Cloud

- 6.3 By End-user Industry

- 6.3.1 Manufacturing

- 6.3.2 Transportation and Logistics

- 6.3.3 Energy & Utilities

- 6.3.4 Healthcare

- 6.3.5 BFSI

- 6.3.6 Telecom and IT

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Salesforce.com, Inc.

- 7.1.2 IBM Corporation

- 7.1.3 Microsoft Corporation

- 7.1.4 Oracle Corporation

- 7.1.5 SAP SE

- 7.1.6 IFS AB

- 7.1.7 Infor Inc.

- 7.1.8 Hippo CMMS

- 7.1.9 ServiceMax, Inc.

- 7.1.10 Innovapptive Inc.

- 7.1.11 eMaint Enterprises, LLC