|

市场调查报告书

商品编码

1644270

云端工作流程:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Cloud Workflow - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

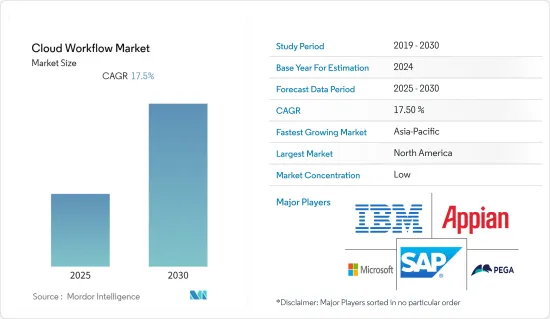

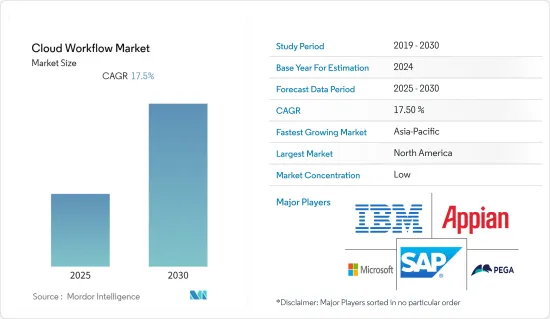

预测期内,云端工作流程市场预计将以 17.5% 的复合年增长率成长。

主要亮点

- 中小型企业正迅速从传统的内部部署解决方案迁移到云端。由于小型、中型和大型企业以及大型企业选择采用云端基础的工作流程解决方案,云端基础的工作流程解决方案市场正在见证越来越多的采用。

- 此外,政府机构越来越多地采用云端服务来实现工作流程自动化、资料分析、提高生产力和增强效率,预计也将有助于市场的成长。

- 随着企业寻求支援远距工作,SaaS 解决方案的使用正在急剧增加。预计该行业还将受益于数位付款、网路购物和 OTT 串流服务的普及。

- 云端工作流程市场正在大幅扩张。然而,安全云的稀缺或缺失可能会限制市场的成长。此外,对数位转型计划的日益重视和人工智慧技术的采用等因素为市场提供了广阔的前景。

- 由于 COVID-19 的爆发,许多企业被迫转向全球远端劳动力。随着越来越多的企业从传统工作流程转向云端工作流程解决方案,预计疫情期间和疫情后云端工作流程市场将大幅成长。

云端工作流程市场趋势

越来越多地采用云端基础的解决方案将推动市场成长

- 由于优化企业业务的需求不断增加,云端工作流程市场正在快速成长。因此,越来越多的企业正在考虑转型到现代云端工作流程,以简化业务流程并帮助经营团队做出更有效的决策。传统上,该过程是手动的,耗时、成本高且容易出错。云端工作流程解决方案使企业能够实现流程自动化并提高生产力。

- 云端运算随着业务需求的变化而提供灵活性,提供根据需要缩减业务和储存设施的能力。此外,计量收费的定价策略使大大小小的企业都能享受到云端运算解决方案的优势。

- 中小型企业正迅速从传统的内部部署解决方案转向云端解决方案。随着可以选择在云端上使用工作流程解决方案,云端工作流程市场正在见证小型、中型和大型企业对云端基础的工作流程解决方案的采用的增加。

- 然而,科技在许多行业中变得越来越重要,包括BFSI、IT和通讯、零售和电子商务、政府和医疗保健。为了维持组织高效运转,一些企业越来越多地采用云端技术。

- 此外,随着企业从传统工作流程转向基于云端基础的工作流程程序,它降低了企业内部IT系统的营运和维护成本,从而推动了云端工作流程市场的成长。

北美预计将创下最大市场规模

- 北美占据云端工作流程市场的大部分份额。在云端运算采用方面,北美是最具前瞻性的地区之一。形成了美国、加拿大等新兴经济体。此外,由于北美国家越来越多地采用最新技术、对数位转型的投资不断增加以及国内生产总值(GDP) 不断扩大,北美占据了最大的市场占有率。

- 根据思科的一项调查,69% 的 IT 决策者支援将 BYOD 视为职场政策的真正关注点,因为它可以节省操作员的时间。在过去三年中,美国IT部门预计BYOD采用率将达到44.42%。随着企业和职场的行动工作者,产生和管理的资料量也随之增加。预计这将在预测期内推动云端工作流程市场的成长。

- 美国和加拿大等该地区的国家正在快速创新。随着企业越来越多地采用云端运算以及市场竞争加剧,预计未来市场将进一步成长。由于工作流程管理技术的新采用、顶级公司进入该行业以及云端服务的全球化,该地区预计将出现最大的市场规模。此外,该地区在技术部署及其应用方面也取得了长足的发展。

- 透过研究和开发,该地区的一些知名企业已经能够进一步开发这项技术。谷歌推出了首个Google云端平台 (GCP) 产品,为该地区用户降低了谷歌云端储存不常存取、冷储存类和近线储存功能的价格。

- 美国的中小型企业 (SME) 通常有独特的 IT 需求。他们通常需要强大的整合工具,但又不需要大型企业解决方案的复杂性。在这种情况下,云端 ERP 是典型的 SaaS 解决方案:简单、经济实惠且高度扩充性。其旨在帮助中小型企业满足不断增长的业务需求并保持竞争力。

云端工作流程产业概览

由于 SAP SE、Pegasystems Inc.、IBM Corporation、Microsoft Corporation 和 Appian Corporation 等主要参与者的存在,云端工作流程市场变得分散。公司透过合作、合併、收购、创新和投资来保持其在市场中的地位。

2023 年 1 月,CenTrak 推出了 WorkflowRT,这是一个可扩展的云端基础的平台,可自动化工作流程和通信,减轻每个护理阶段所需的手动文书工作负担。团队可以使用平台的内建报告监控关键患者流量资料,以发现异常或瓶颈。医疗机构已经证明,使用历史分析来推动业务改善可以减少病患等待时间,增加病患互动时间,并提高员工和病患的满意度。

2022 年 7 月,针对中小型企业 (SMB) 的领先会计、财务、人力资源和薪资解决方案提供商 Sage 宣布与微软扩大合作伙伴关係。此次伙伴关係旨在将 Microsoft 365 和 Microsoft Teams 等 Microsoft 商业产品作为整合服务嵌入到 Sage 产品和 Sage 数位网路中。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 提高云端采用率

- 中小型企业越来越多地采用云端基础的工作流程

- 市场限制

- 没有安全的云

第六章 市场细分

- 按云类型

- 公共云端

- 私有云端

- 混合云端

- 按组织规模

- 中小型企业

- 大型企业

- 按行业

- BFSI

- 通讯和 IT

- 零售与电子商务

- 政府

- 卫生保健

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- SAP SE

- Pegasystems Inc.

- IBM Corporation

- Microsoft Corporation

- Appian Corporation

- Ricoh Company Ltd

- Micro Focus International PLC

- K2 Software Inc.

- Nintex UK Ltd

- Viavi Solutions

- BP Logix Inc.

- Kissflow Inc.

- Cavintek Software Private Limited

- Integrify Inc.

第八章投资分析

第九章:市场的未来

The Cloud Workflow Market is expected to register a CAGR of 17.5% during the forecast period.

Key Highlights

- SMEs are quickly moving their conventional on-premises solutions to the cloud. The market for cloud-based workflow solutions has seen an improvement in the use of cloud-based workflow solutions by SMEs and large businesses due to the option of adopting them.

- Another factor anticipated to contribute to the market's growth is the rising use of cloud services by the government vertical to automate workflow processes, analyze data, increase productivity, and enhance efficiency.

- As businesses want to support a remote workforce, there has been a surge in the use of SaaS solutions. The industry is also predicted to benefit from the usage of digital payment, online shopping, and OTT streaming services.

- The market for cloud workflows has been expanding significantly. However, the scarcity of a secure cloud and the absence of a secure cloud may limit market expansion. In addition, factors including the growing emphasis on digital transformation projects and the adoption of AI technology provide the market with considerable prospects.

- Many businesses were forced to switch to a globally remote workforce as a result of COVID-19's introduction. As more businesses switch from conventional workflow processes to cloud workflow solutions, the market for cloud workflow is predicted to soar both during and after the epidemic.

Cloud Workflow Market Trends

Growing Adoption of Cloud Based Solutions Drive the Market Growth

- Because of the increased need for optimized corporate operations, the cloud workflow market is growing pace. Organizations are burdened with repetitive work procedures that reduce productivity and increase the time it takes to complete business operations; as a result, they are increasingly considering transforming modern cloud workflows to simplify business processes and assist management in making effective decisions. Processes were traditionally carried out manually, which took a long time and money and was prone to errors due to the manual work involved. Businesses can automate processes due to cloud workflow solutions, resulting in enhanced productivity.

- Cloud computing offers enterprises flexibility when their requirements change and the ability to scale down operations and storage facilities as needed. Furthermore, the pay-per-use pricing strategy allows large organizations and SMEs to leverage cloud computing solutions benefits.

- SMEs are rapidly moving from their traditional on-premises solutions to the cloud. With the choice of using workflow solutions on the cloud, the Cloud workflow market has witnessed an increase in the deployment of cloud-based workflow solutions by SMEs and large enterprises.

- However, technology is becoming increasingly important in numerous industries, including BFSI, Telecommunications and IT, Retail and E-Commerce, Government, and Healthcare. Several businesses have been increasingly adopting cloud technologies to maintain effective organizational functioning.

- Furthermore, when firms migrate from conventional workflow to cloud-based workflow procedures, the cost of operating and maintaining IT systems in a company is reduced, which propels the growth of the cloud workflow market.

North America is Expected to Register the Largest Market

- North America considers a significant chunk of the cloud workflow market. It is one of the most forward-looking regions in terms of cloud adoption. It forms developed economies such as the United States and Canada. Besides, North America accounts for the largest market share due to the growing adoption of the latest technologies, growing investments in digital transformation, and expanding gross domestic product (GDP) in North American countries.

- A survey by Cisco stated that 69% of the IT decision-makers support BYOD as a real interest in workplace policy as it saves operators time. In the United States' IT sector, it was anticipated that in the past three years, BYOD adoption saw 44.42%. With the expanding number of mobile workers in businesses and workplaces, there has been a consequent increase in the data generated and managed. This will encourage the cloud workflow market's growth over the forecast period.

- Countries in the region, such as America and Canada, are quickly advancing in technological transformation. The expanding adoption of cloud computing amongst companies and mounting competition are anticipated to propel the market. It is expected to hold the highest market size due to the new selection of workflow management technology, the residence of top players, and the globalization of cloud services in the region. Furthermore, this region is significantly developed regarding technologies and their application deployments.

- Through research and development, some of the notable players in the region have been able to further the technology. Google inaugurated its first Google Cloud Platform (GCP) field in Canada, with decreased rates for Google Cloud Storage infrequent access and cold storage classes and its nearline storage features for users in the region.

- Small and mid-size enterprises (SMEs) in the US often have IT requirements that are unique in themselves. In most cases, they require powerful, integrated tools without the complexity of larger corporations' solutions. In such instances, cloud ERP is a classic SaaS solution that is simple, affordable, and scalable. It is designed to meet SMEs' growing business needs and retain their competitiveness.

Cloud Workflow Industry Overview

The cloud workflow market is fragmented, owing to the presence of significant players such as SAP SE, Pegasystems Inc., IBM Corporation, Microsoft Corporation, and Appian Corporation, among others. The companies are making partnerships, mergers, acquisitions, innovations, and investments to retain their market position.

In January 2023, CenTrak launched WorkflowRT, a scalable, cloud-based platform that automates workflow and communications to lessen the load of manual paperwork necessary during each phase of clinical treatment. Teams may monitor crucial patient flow data using the platform's built-in reporting to spot anomalies or bottlenecks. Healthcare facilities have demonstrated decreased patient wait times, greater time spent with patients, and higher staff and patient satisfaction by utilizing historical analytics to encourage operational improvements.

In July 2022, Sage, one of the leading players in accounting, finance, human resources, and payroll solutions for small and medium-sized businesses (SMBs) announced an expanded partnership with Microsoft. The partnership aims to incorporate Microsoft Business Products, such as Microsoft 365 and Microsoft Teams, as integrated services in Sage products and the Sage Digital Network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Cloud

- 5.1.2 Increased Adoption of Cloud-Based Workflows Among SMEs

- 5.2 Market Restraints

- 5.2.1 Absence of Secure Cloud

6 MARKET SEGMENTATION

- 6.1 By Cloud Type

- 6.1.1 Public Cloud

- 6.1.2 Private Cloud

- 6.1.3 Hybrid Cloud

- 6.2 By Organization Size

- 6.2.1 Small and Medium-Sized Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By End-User Vertical

- 6.3.1 BFSI

- 6.3.2 Telecommunications and IT

- 6.3.3 Retail and E-Commerce

- 6.3.4 Government

- 6.3.5 Healthcare

- 6.3.6 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 Pegasystems Inc.

- 7.1.3 IBM Corporation

- 7.1.4 Microsoft Corporation

- 7.1.5 Appian Corporation

- 7.1.6 Ricoh Company Ltd

- 7.1.7 Micro Focus International PLC

- 7.1.8 K2 Software Inc.

- 7.1.9 Nintex UK Ltd

- 7.1.10 Viavi Solutions

- 7.1.11 BP Logix Inc.

- 7.1.12 Kissflow Inc.

- 7.1.13 Cavintek Software Private Limited

- 7.1.14 Integrify Inc.