|

市场调查报告书

商品编码

1643232

微学习-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Microlearning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

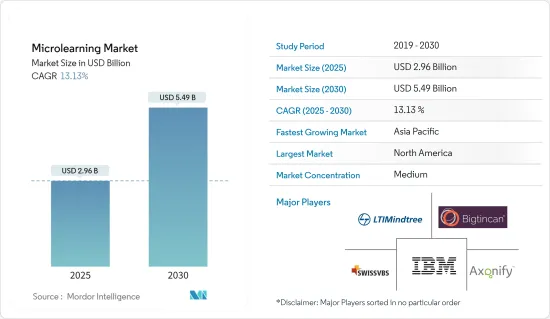

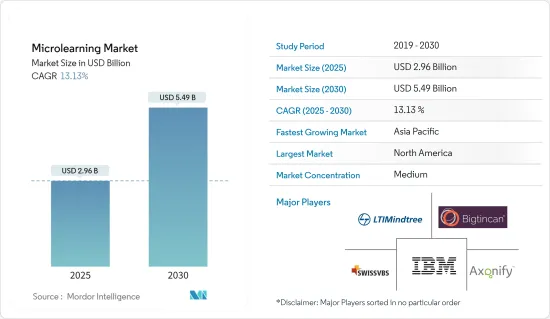

微学习市场规模预计在 2025 年为 29.6 亿美元,预计到 2030 年将达到 54.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.13%。

关键亮点

- 微学习在职场、家庭和教育机构的应用正在迅速成长。根据NTL应用行为科学研究所的学习金字塔模型,透过听、读、观察等传统的学习方式是无效的。人们可能只记得20%到30%的内容。模拟学习技术的进步正以高比例的学习成果有效地推动市场成长。

- 众多全球组织对行动工作者的培训需求是推动全球微学习市场成长的关键因素。另一个主要的市场驱动力是对能够为企业带来可衡量成果的以技能为基础、以结果为导向的培训的需求日益增长。

- 微学习是一种整体的数位学习方法,主要涉及使用小型学习单元进行培训。微学习涉及设计小块的学习内容,每个学习内容都满足特定的学习结果,以帮助学习者更好地获取和保留知识。微学习是数位学习中一种很有前景的学习方法,因为它为学习者和教师提供了几个优势:

- 此外,云端基础的解决方案的日益普及和可用性也是市场的主要驱动力。云端解决方案提供平台和必要的基础设施来解决传统内部微学习的可扩展性限制。此外,微学习越来越多地被应用到现有的应用程式和平台中,包括游戏化,以促进客户参与和创造价值。

- 此外,千禧世代对工作弹性和多样性的需求日益增长,这显着导致了由自由工作者组成的庞大劳动力队伍,他们不再是长时间、常规地工作,而是频繁更换职位,为不同的组织从事不同的计划。因此,这些自由工作者是微学习解决方案提供者的潜在目标受众。

- 此外,培训和教育的游戏化可以提高微学习的接受度,这可能会为微学习产业的进一步发展创造机会。然而,学习者缺乏动力可能会对微学习市场的扩张带来额外的挑战。

- 疫情期间,多个行业采用微学习方法来教导员工如何使用最新技术和程序来开展业务,从而带动微学习市场显着成长。微学习计画利用各行业专家的视讯、音讯和亲身经历帮助人们获得新技能。 COVID-19 为各个终端用户行业的微学习提供了巨大的机会,因此市场可能会长期成长。

微学习市场趋势

云端运算市场预计将以更快的速度成长

- 企业发现基于技能的流程有效地解决了疫情爆发以来日益增加的挑战。雇主需要帮助来为关键的空缺职位招募合格的申请人并留住他们僱用的人才。采用基于技能的方法的公司可以提高申请空缺职位的候选人的数量和质量,并透过为员工提供更多在公司内部晋升的机会来帮助提高员工保留率。

- 此外,千禧世代对工作更大灵活性和多样性的要求导致劳动力队伍中自由工作者的数量显着增加,他们频繁地更换工作,为不同的组织从事不同的计划,而不是长时间、固定地工作。因此,这些自由工作者是微学习解决方案提供者的潜在目标受众。

- 基于技能的方法有助于公司找到并吸引更大的人才库,这些人才由适合长期担任这些职位的人组成。这种方法也为那些履历上可能没有具体或典型资格的非典型申请人打开了大门。

- 2022 年 9 月,Coursera, Inc. 宣布扩展 Clips。 Clips 为员工提供约 20 万个短影片和课程,旨在帮助他们在 10 分钟或更短的时间内开始学习热门技能。

- 《培训》杂誌在美国进行的一项调查发现,今年的大多数线上培训都是出于强制性或合规目的。超过一半的培训机构提供强制性培训或合规培训。不到 10% 的公司仅提供此类培训,但其中 17% 的公司表示今年将亲自提供此类培训。

预计北美将占很大份额

- 北美数位学习市场占有该行业的大部分份额。这是因为许多组织正在迅速采用技术为员工提供适当的培训。数位学习的成长为该地区的微学习提供者提供了巨大的机会。

- 另一个影响因素是数位设备的普及率不断提高。根据GSMA预测,2025年北美智慧型手机用户数将达到3.28亿。此外,到 2025 年,该地区的行动用户(86%) 和网路普及率 (80%) 可能会上升至世界第二。预计设备采用率的提高将对该地区的虚拟实境市场产生正面影响。

- 专注于现代学习的政府支持的组织正在推动市场扩张。加拿大 21 世纪学习与创新组织 (C21 Canada) 是一个全国性的非营利组织,致力于推动 21 世纪教育学习模式。倡议致力于为加拿大人创造激励21世纪学习的愿景和框架。

- 微学习解决方案中的游戏化也可以成为一种有用的工具,透过各种技术来提高员工整体生产力,例如计划管理中对任务完成的奖励或知识管理中对资料贡献和存取的奖励。然而,业界也面临游戏化应用缺乏标准化指南的困境。

- 根据 IBM 的一份报告,75% 的 Z 世代更喜欢智慧型手机而不是其他行动装置。因此,微学习中针对行动装置的特定培训策略在未来可能会有所发展,以增加他们的学习兴趣。经济、社会和行为方面的这些变化将导致技术的采用呈指数级增长,从而推动该地区微学习市场的成长作为可持续的解决方案。

微学习行业概况

市场是细分的,许多本地和地区参与企业在蓬勃发展的微学习市场中竞争。微学习市场的参与企业正在致力于透过互动式媒介传递内容,以吸引大量学习者参与这些培训平台。该市场的参与企业正在采用合作和收购等策略来增强其服务产品并获得可持续的竞争优势。该市场的参与企业包括 Mindtree Limited、IBM Corporation、SwissVBS、Axonify 和 Bigtincan。

2023 年 9 月,领先的第一线员工支援参与企业和 Zebra 註册 ISV 合作伙伴 Axonify 与 Zebra Technologies 建立了合作关係。此外,作为 Zebra 的首个软体解决方案联合销售合作伙伴,Axonify 将为 Zebra 提供新的学习平台。 Axonify 和 Zebra 正在合作为第一线员工提供培训,培训内容可直接在他们每天使用的 Zebra 行动装置上进行。作为加强伙伴关係的一部分,Zebra 将把即时任务管理功能与 Axonify 的个人化学习和训练模组结合。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

第五章 市场动态

- 市场驱动因素

- 无办公桌和行动工作者的培训需求不断增加

- 对以技能和成果为导向的培训的需求日益增加

- 游戏化培训和教育

- 市场限制

- 企业不愿意花费庞大资金将现有培训内容转换为微内容

第六章 市场细分

- 按组件

- 解决方案

- 按服务

- 按组织规模

- 大型企业

- 中小型企业

- 依实施类型

- 本地

- 云

- 按最终用户

- 零售

- 製造业

- 银行、金融服务和保险

- 通讯和 IT

- 其他最终使用者(医疗生命科学、物流)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- Mindtree Limited

- IBM Corporation

- SwissVBS

- Axonify Inc

- Bigtincan

- Saba Software

- iSpring Solutions Inc.

- Epignosis

- Qstream, Inc.

- Cornerstone OnDemand, Inc.

第八章投资分析

第九章 市场机会与未来趋势

The Microlearning Market size is estimated at USD 2.96 billion in 2025, and is expected to reach USD 5.49 billion by 2030, at a CAGR of 13.13% during the forecast period (2025-2030).

Key Highlights

- The use of microlearning is rapidly becoming more common across workplaces, homes, and educational institutions. According to the NTL Institute of Applied Behavioral Science Learning Pyramid model, the traditional learning methods based on listening, reading, and observing are ineffective. The person might recall only 20% to 30% of the contents. The advancement in technology based on simulation learning is effectively driving the market's growth, with a high percentage of learning outcomes.

- The need to train mobile workers in numerous global organizations is a crucial element driving the growth of the global microlearning market. Another major market-driving factor is the expansion of the growing need for skill-based and result-oriented training that may give measurable results for businesses.

- Microlearning is a holistic approach toward e-learning that majorly deals with using small learning units to deliver training. Microlearning involves designing bite-sized learning nuggets to help learners acquire and retain knowledge better, each meeting a specific learning outcome. It is a promising learning approach in e-learning because of its several benefits to learners and instructors.

- Also, the increased adoption and availability of cloud-based solutions have been significant drivers for the market. They provide the platform and necessary infrastructure to address the scalability limitation of the traditional on-premise microlearning experiences. Moreover, microlearning has been witnessing an increased implementation in existing applications and platforms, which includes gamification for customer engagement and value creation.

- Furthermore, the growing demand from millennials for higher flexibility and variation of jobs has significantly resulted in a considerable workforce consisting of freelancers changing their positions frequently and working on different projects at different organizations instead of doing routine long-hour jobs. Therefore, these freelancers have become a potential target audience for microlearning solution providers.

- Furthermore, the gamification of training and education to enhance microlearning acceptability will create further opportunities for the microlearning industry to develop. However, a lack of motivation among learners could further challenge the expansion of the microlearning market.

- During the pandemic, several industry verticals used micro-learning approaches to teach their staff about using the latest technology and procedures to run company activities, leading to considerable micro-learning market growth. The micro-learning program helped people acquire new skills by utilizing videos, audio, and the personal experiences of diverse industry experts. COVID-19 provided immense opportunities for microlearning in various end-user industries, and thus, the market will grow in the long run.

Microlearning Market Trends

Cloud segment is expected to grow at a higher pace

- Companies have realized that skills-based processes effectively solve the increased difficulties since the epidemic. Employers need help to recruit qualified applicants for critical open positions and keep the talent they have hired. Companies that use a skills-based approach can increase the quantity and quality of people who apply for available jobs and help employees discover more possibilities to progress internally, which can help employers improve retention.

- Furthermore, the growing demand from millennials for higher flexibility and variation of jobs has significantly resulted in a considerable workforce consisting of freelancers changing their positions frequently and working on different projects at different organizations instead of doing routine long-hour jobs. Therefore, these freelancers have become a potential target audience for microlearning solution providers.

- Skills-based methods assist companies in locating and attracting a larger pool of talent comprised of individuals who are more equipped to fill these roles in the long run. Such approaches also open doors for atypical applicants, such as those who lack particular or usual qualifications on their resumes.

- In September 2022, Coursera, Inc. announced the expansion of Clips, which provides employees access to nearly 2,00,000 short videos and lessons designed to help them begin learning high-demand skills in less than 10 minutes.

- According to a survey conducted by Training Magazine in the United States, most online trainings were offered for compulsory or compliance training this year. More than half of the training businesses supplied mandatory or compliance training. Less than ten percent of organizations in this category supplied only online executive development training, whereas 17 percent of the same companies said they would offer such training in person this year.

North America is Expected to Hold Major Share

- The North American eLearning market accounts for a significant share of the industry. It is increasing due to the fast technological adoption by numerous organizations to provide adequate training to their employees. The growth of e-learning will provide immense opportunities to microlearning providers in the region.

- Another influencing factor is the increased penetration of digital devices. According to GSMA, the number of smartphone subscribers in North America is expected to reach 328 million by 2025. Moreover, by 2025, the region may witness an increase in the penetration rates of mobile subscribers (86%) and the internet (80%), the second-highest in the world. Increased device penetration will positively impact the virtual reality market in the region.

- Organizations that are focusing on modern learning, supported by the government, are leading to market expansion. Canadians for 21st Century Learning and Innovation (C21 Canada) is a national, non-profit organization that aims to 21st-century models of learning in education. It handles initiatives dedicated to creating a 21st-century learning vision and framework that inspires Canadians.

- Gamification in microlearning solutions is also a handy tool for increasing the overall productivity of employees by using various methods, such as rewards for task completion in case of project management or data contribution or access in case of knowledge management. However, the industry is also facing an absence of standardized guidelines for applying gamification due to the need for substantial academic research.

- According to a report from IBM, 75% of Gen Z'ers prefer to use a smartphone compared to other mobile devices. So, a mobile-focused training strategy in microlearning will grow in the future to interest them in learning. Changing economic, social, and behavioral aspects such as these leading to acceptance of technology at an exponential rate will only boost the market growth of microlearning in the region, making them sustainable solutions.

Microlearning Industry Overview

The market is fragmented, with many local and regional players competing in a fast-growing microlearning market. Players in the microlearning market are engaged to offer their content through the interactive medium that will develop a high interest of the learners in these training platforms. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their service offerings and gain sustainable competitive advantage. Some market players are Mindtree Limited, IBM Corporation, SwissVBS, Axonify, and Bigtincan.

September 2023: Axonify, a player in frontline employee enablement and Zebra Registered ISV partner, has developed its work with Zebra Technologies. Further, being among the first co-sale associates for Zebra's software solutions, Axonify also provides {Zebra with a new learning platform. Together, Axonify and Zebra will work to obtain available training for frontline workers directly on the Zebra mobile devices they use every day. Zebra will blend its real-time task management capabilities with Axonify's personalized learning and training modules as part of the enhanced partnership.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Training Deskless and Mobile Workers

- 5.1.2 Growing Need for Skills-Based and Result-Oriented Training

- 5.1.3 Gamification of Training and Education

- 5.2 Market Restraints

- 5.2.1 Reluctance of enterprises to spend huge amount on transforming existing training content into microcontent

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution

- 6.1.2 Services

- 6.2 By Organization Size

- 6.2.1 Large Enterprises

- 6.2.2 Small and Medium-Sized Enterprises

- 6.3 By Deployment Mode

- 6.3.1 On-Premise

- 6.3.2 Cloud

- 6.4 By End User

- 6.4.1 Retail

- 6.4.2 Manufacturing

- 6.4.3 Banking, Financial Services and Insurance

- 6.4.4 Telecom and IT

- 6.4.5 Other End Users (Healthcare and Life Sciences, Logistics)

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mindtree Limited

- 7.1.2 IBM Corporation

- 7.1.3 SwissVBS

- 7.1.4 Axonify Inc

- 7.1.5 Bigtincan

- 7.1.6 Saba Software

- 7.1.7 iSpring Solutions Inc.

- 7.1.8 Epignosis

- 7.1.9 Qstream, Inc.

- 7.1.10 Cornerstone OnDemand, Inc.