|

市场调查报告书

商品编码

1644273

云端 POS(销售点) -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Cloud Point of Sale (PoS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

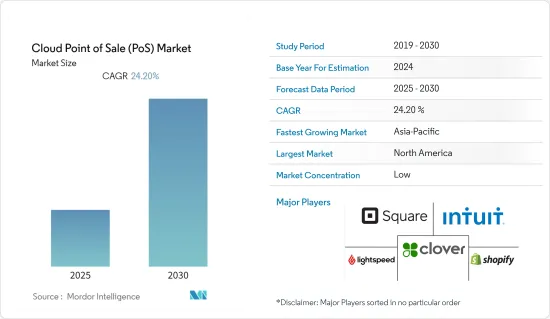

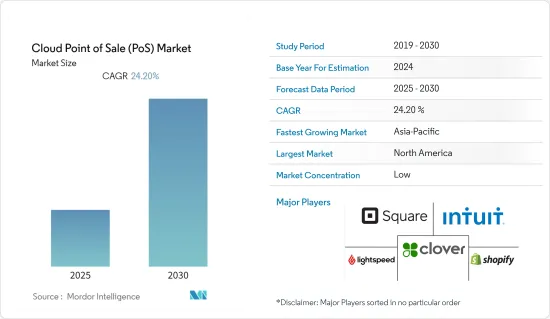

预测期内,云端 POS 市场预计将实现 24.2% 的复合年增长率

关键亮点

- 云端 POS(销售点)是一种基于网路的解决方案,可让您透过网路处理付款。该系统将交易处理资料储存在云端。透过网路随时随地存取的能力有助于使该解决方案更加普及。电子商务和无现金交易在零售和消费品行业的日益普及是推动市场成长的关键因素。

- 云端 POS 系统在零售和电子商务行业中发展势头强劲,以提供更好的客户服务。对多通路销售的日益重视,加上行动化趋势,预计将推动云端 POS 市场的扩张。

- 业务流程优化、电子商务全球化以及无现金交易的增加等某些因素正在推动零售、娱乐和酒店等行业采用自动化的速度。 POS 系统正在推动零售业自动化的发展。低初始成本、资料安全、灵活性和可扩展性等优势日益增强,正在推动市场对云端 POS 终端的需求。

- 由于零售、旅游和医疗保健等行业的需求激增,先进技术正在蓬勃发展。对自动化、人工智慧、资料分析和改进客户服务的不断增长的需求正在对云端 POS 行业产生积极影响。在当前情况下,物联网在转变 POS 生态系统、推动更多互联网连接设备方面发挥关键作用,并直接影响全球云端 POS 市场。预计基础设施的持续发展和云端技术的进步将极大地推动市场的发展。

- 云端 POS 市场的主要企业正致力于改进他们的解决方案并建立策略伙伴关係关係,以增强他们在全球的能力和影响力。 2022 年 6 月,Lightspeed Commerce Inc. 宣布推出全新的 Lightspeed B2B 平台,该公司是一家面向全球商家的商务平台,致力于简化、扩展和创造卓越的客户体验。该平台目前对北美的时尚、户外和体育零售商开放,并计划在未来几个月内扩展到其他垂直领域和功能。随着这项突破性新解决方案的推出,全球数以千计的领先品牌和零售商现在可以使用尖端的供应商网路工具,将 B2B 订单直接送达销售点。

- 新冠疫情加速了从现金支付转向数位和非接触式付款方式的转变。因此,现在可以利用电子商务和其他互联网服务等新的收益来源。

云端 POS 市场趋势

零售业预计将占很大份额

- 零售业越来越多地采用先进的数位技术来提高店内效率,从而推动了对云端 POS 服务的需求。该系统将使商店经理能够远端监控各种业务活动。

- 市场的主要企业正在采用新技术并推出新的云端基础的POS 服务。 2022 年 5 月,企业技术供应商 NCR Corporation 宣布推出 NCR Aloha Cloud,这是一款云端基础的销售点 (POS) 解决方案,提供强大的功能,并以业界领先的 Aloha 品牌进入市场。

- 全球各地的零售商都在应对新冠疫情以及由此引发的劳动力短缺、供应链问题和客户期望的提高。 2022 年 1 月,NCR 公司与 Google Cloud 联手,将这些障碍转化为机会。透过策略伙伴关係关係,NCR 和 Google Cloud 推出了额外的平台和云端功能,包括 AI 和机器学习解决方案。此次伙伴关係为零售商提供了一流的工具和无与伦比的灵活性,以提供卓越的店内顾客体验。

- 由于全球行动模式和对多通路销售的日益重视,行动 POS 系统越来越受欢迎。由于需要同步销售和库存、改善客户体验和客户维繫,无现金交易技术的出现导致云端 POS 的采用率增加。

- 线上食品配送应用程式的日益使用预计将推动云端 POS 市场的扩张。餐厅老闆正在采用云端基础的解决方案在单一平台上管理各种订购、交易和交付细节。这些解决方案提供了有关您的业务的宝贵资讯。

- 销售报告、库存管理、财务管理和客户分析等云端 POS 功能可协助企业克服客户维繫挑战。因此,客户维繫的需求和日益激烈的行业竞争正在推动POS终端的成长。此外,由于 POS 供应商在远端、安全的位置管理资料,因此云端 POS 消除了资料储存、安全性问题和软体维护问题。

预计北美将占据主要份额

- 美国在北美POS终端产业占据主导地位。全国各地的商店已经使用各种 POS 终端多年,使用新技术替换它们的需求日益增长。北美的硬体销售、数位 POS、云端订阅和 mPOS 交易正在成长,产品包括整合付款终端的未来派手持平板电脑和时尚的一体化设备。

- 全部区域的付款方式正在按照更新趋势不断改进。 2020年,信用卡是北美最常用的POS付款方式,占所有POS付款的38.60%。预计到 2024 年,它仍将是北美最受欢迎的 POS付款方式,占所有 POS 支付的 38.40%。付款到 2023 年,数位和行动钱包付款将占 POS付款的 15.5%,这反映了全球数位钱包付款的趋势。

- 对最新触控萤幕硬体、全功能云端 POS 软体的需求以及中小型商家的高需求正在改变该地区的 POS 市场。

- 随着云端基础的应用程式的兴起,预计未来将取代机器驻留程序,像 POS-n-go 这样强大、可靠且经过验证的混合多功能可配置 POS 系统将满足北美各地中小型商家和餐厅的业务需求。北美大多数便利商店都依赖 NCR 的销售点硬体和软体。

- 该地区的主要企业正在建立战略伙伴关係关係,以提高其市场知名度并保持竞争力。

- 例如,2021年10月,消费金融公司Synchrony扩大了与付款和金融服务技术解决方案供应商Fiserv, Inc.的策略合作伙伴关係。这使得小型企业能够使用 Fiserv 的 Clover POS 和业务管理平台来存取 Synchrony 的产品和服务并接受自有品牌卡片付款。这也为消费者的购买提供了更多的自由和选择。随着 Synchrony 的功能和产品在 Clover App Marketplace 上线,Synchrony 商家现在可以吸引更多消费者,并透过各种借贷服务创造更多收益。

云端 POS(销售点)产业概览

云端POS(销售点)市场高度细分,众多参与企业占据了近一半的市场占有率。 Square, Inc.、Intuit, Inc.、Shopify, Inc.、Vend Limited 和 Lightspeed POS Inc. 是该市场的一些主要企业。这些参与企业正大力投资研发活动,以将创新的付款技术推向市场。

2021 年 10 月,现金技术解决方案供应商 Glory Global Solutions 宣布与 HRS Hospitality &Retail Systems 合作,提供完整的即插即用整合。此次整合是在 CASHINFINITY 销售点现金循环解决方案和领先的云端 POS 平台 Oracle MICROS Simphony 软体之间实现的。 HRS Hospitality &Retail Systems 是 Oracle 的合作伙伴,也是该公司最大的全球饭店合作伙伴,为全球超过 9,500 家饭店、餐饮和零售客户提供 IT 解决方案。

2021 年 6 月,Ascent360 推出了其 Lightspeed 互联应用程式商店,让 POS 和电子商务资料变得生动有趣。这些技术的结合使企业能够吸收关键的消费者资料、细分客户并提供个人化的全通路通信,从而实现更好的参与度和客户维繫。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- 无现金交易增加

- 提高业务敏捷性和灵活性

- 市场限制

- 缺乏基础设施且高度依赖旧有系统

- 评估新冠肺炎对市场的影响

第五章 市场区隔

- 按组件

- 硬体

- 软体与服务

- 按类型

- 固定 POS

- 行动 POS

- 按最终用户产业

- 娱乐

- 饭店业

- 医疗

- 零售

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Block, Inc.

- Intuit Inc.

- Shopify Inc.

- Lightspeed POS Inc.

- Clover Network, Inc.

- Vend Limited

- Toshiba Global Commerce Solutions

- Seiko Epson Corp.

- Samsung Electronics Co. Ltd

- Micros Retail Systems Inc.(Oracle)

- Hewlett Packard Enterprise

- Panasonic Corporation

- NEC Corporation

- Casio Computer Co. Ltd

- NCR Corporation

- Dell Corporation

第七章投资分析

第八章 市场机会与未来趋势

The Cloud Point of Sale Market is expected to register a CAGR of 24.2% during the forecast period.

Key Highlights

- The cloud point of sale (PoS) is a web-based solution that allows the processing of payments via the internet. This system stores transaction processing data in the cloud. The solution's capability to access it anytime and anywhere through the internet drives its adoption. The increasing prevalence of e-commerce and cashless transactions in the retail and consumer goods industries is a key factor driving the market's growth.

- Because of better customer service delivery, the cloud PoS system is gaining momentum in the retail and e-commerce industries. The increased emphasis on multi-channel selling, combined with mobility trends, is expected to drive the expansion of the cloud PoS market.

- Certain factors, such as increased emphasis on business process optimization, globalization of e-commerce, and growth in cashless transactions, drive the rate of automation adoption in retail, entertainment, hospitality, and other such industries. PoS systems are driving the growth in automation in the retail sector. Increased benefits, such as cheaper upfront costs, data security, flexibility, and scalability, drive the market demand for cloud PoS terminals.

- Because of the spike in demand in various industries, such as retail, travel and tourism, and healthcare, advanced technology is shooting up. The growing demand for automation, artificial learning, data analysis, and improved customer service is positively influencing the cloud PoS industry. In the current scenario, IoT plays a vital role in revolutionizing the PoS ecosystem, which is being pushed by more internet-connected devices, directly impacting the worldwide cloud PoS market. Continuous infrastructure development and cloud technology advancements are projected to drive the market considerably.

- The prominent players in the cloud PoS market are focusing on improving their solutions and involving themselves in strategic partnerships to increase their global capability and footprint. In June 2022, Lightspeed Commerce Inc., a commerce platform for merchants worldwide to simplify, scale, and create exceptional customer experiences, announced the launch of the new Lightspeed B2B platform. The platform was to serve North American fashion, outdoor, and sports retailers, with additional vertical and feature availability in the coming months. With the debut of this game-changing new solution, thousands of the world's finest brands and retailers were able to access a cutting-edge supplier network tool that combined B2B orders straight into the PoS.

- The COVID-19 pandemic accelerated the switch from cash-based to digital and contactless payment options. As a result, new revenue streams, such as e-commerce and other internet services, are now available for utilization.

Cloud Point of Sale (PoS) Market Trends

Retail Segment is Expected to Hold Major Share

- The retail sector's growing adoption of advanced digital technology to improve store efficiency will drive demand for cloud PoS services. The system enables store administrations to monitor a variety of operational activities remotely.

- The significant players in the market are adopting new technologies and launching new cloud-based PoS services. In May 2022, NCR Corporation, an enterprise technology supplier, unveiled NCR Aloha Cloud, a cloud-based point of sale (POS) solution that provided robust capabilities to come to market under the industry-leading Aloha brand.

- Retailers worldwide dealt with COVID-19 and consequent labor shortages, supply chain concerns, and increased customer expectations. In January 2022, NCR Corporation and Google Cloud collaborated to help turn these obstacles into opportunities. With their strategic partnership, NCR and Google Cloud introduced additional platforms and cloud capabilities, including AI and machine-learning solutions. The partnership provided retailers with best-in-class tools and unparalleled flexibility to deliver exceptional in-store customer experiences.

- Mobile POS systems are gaining traction due to global mobility patterns and a growing emphasis on multichannel selling. With the emergence of cashless transactional technology, the adoption rate of cloud PoS has increased due to the requirement for sales and inventory synchronization, improved customer experience, and retention.

- The increasing use of online food delivery apps will drive the expansion of the cloud PoS market. Restaurant operators are implementing cloud-based solutions to manage various orders, transactions, and delivery details from a single platform. These solutions provide helpful information regarding their business.

- Cloud PoS capabilities, such as sales reporting, inventory management, financial management, and customer analytics, help firms overcome client retention challenges. Thus, the demand for client retention and the expansion of industry competition drive the growth of PoS terminals. Furthermore, because the PoS provider manages the data at a remote and secure location, Cloud PoS eliminates data storage, security difficulties, and software maintenance issues.

North America is Expected to Hold Major Share

- The United States dominates the PoS terminal industry in North America. For many years, various PoS terminals have been used in outlets around the country, increasing the demand for replacement with new technology. Hardware sales, digital PoS, cloud subscriptions, and mPoS transactions are on the rise in North America, with anything from futuristic hand-held tablets with payment terminals to sleek all-in-one equipment.

- The payment methods across the region are improving with the updating trends. In 2020, credit cards were North America's most commonly used Point of Sale payment method, accounting for 38.60% of all PoS payments. It is also expected to be the most popular PoS payment option in North America in 2024, accounting for 38.40% of payments. Digital and mobile wallet payments are expected to account for 15.5% of PoS payments by 2023, mirroring a global trend toward digital wallet payments.

- There is a considerable need for modern touchscreen hardware, fully loaded Cloud PoS software, and small and medium-sized merchant demand, resulting in a significant transformation in the region's PoS market.

- With cloud-based apps on the rise, which are expected to replace machine resident programs in the future, robustly reliable and proven hybrid multi-function configurable PoS systems, like PoS-n-go, will meet the business needs of small and medium-sized merchants and restaurants across North America. Most of the convenience retailers in North America depend on NCR PoS hardware and software.

- The key players across the region are involved in strategic partnerships to increase their visibility and remain competitive in the market.

- For instance, in October 2021, Synchrony, a consumer finance company, expanded its strategic alliance with Fiserv, Inc., a payment and financial services technology solutions supplier. This enabled small companies to access Synchrony goods and services and accept private label credit card payments using Fiserv's Clover Point of Sale and business management platform. It also provided more freedom and choices in consumer purchases. The Clover App market's availability of Synchrony's capabilities and products assisted Synchrony's merchants in attracting more consumers and driving more revenue through a diverse array of financing offerings.

Cloud Point of Sale (PoS) Industry Overview

The Cloud Point of Sale (PoS) market is highly fragmented, with a large number of players occupying almost half the market share. Square, Inc., Intuit, Inc., Shopify, Inc., Vend Limited, and Lightspeed POS Inc. are some major players in the market. These players are investing large amounts of money in R&D activities to introduce innovative payment technologies in the market.

In October 2021, Glory Global Solutions, a provider of cash technology solutions, announced a collaboration with HRS Hospitality & Retail Systems to provide a complete plug-and-play integration. The integration was delivered between CASHINFINITY Point of Sale Cash Recycling Solutions and Oracle MICROS Simphony Software, a significant cloud PoS platform. HRS Hospitality & Retail Systems is an Oracle Partner and the company's largest global hotel partner, delivering IT solutions to over 9500 hospitality, food and beverage, and retail customers worldwide.

In June 2021, Ascent360 announced an app store connected with Lightspeed to bring PoS and e-commerce data to life. Because of the combined power of these technologies, businesses were able to absorb critical consumer data, segment customers, and provide personalized omnichannel communications to engage better and retain customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions And Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Increasing Cashless Transaction

- 4.4.2 Increased Business Mobility and Flexibility

- 4.5 Market Restraints

- 4.5.1 Lack of Infrastructure and High Dependence on Legacy Systems

- 4.6 Assessment Of The Impact Of Covid-19 On The Market

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software & Services

- 5.2 By Type

- 5.2.1 Fixed Point of Sale

- 5.2.2 Mobile Point of Sale

- 5.3 By End-user Industry

- 5.3.1 Entertainment

- 5.3.2 Hospitality

- 5.3.3 Healthcare

- 5.3.4 Retail

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Block, Inc.

- 6.1.2 Intuit Inc.

- 6.1.3 Shopify Inc.

- 6.1.4 Lightspeed POS Inc.

- 6.1.5 Clover Network, Inc.

- 6.1.6 Vend Limited

- 6.1.7 Toshiba Global Commerce Solutions

- 6.1.8 Seiko Epson Corp.

- 6.1.9 Samsung Electronics Co. Ltd

- 6.1.10 Micros Retail Systems Inc. (Oracle)

- 6.1.11 Hewlett Packard Enterprise

- 6.1.12 Panasonic Corporation

- 6.1.13 NEC Corporation

- 6.1.14 Casio Computer Co. Ltd

- 6.1.15 NCR Corporation

- 6.1.16 Dell Corporation