|

市场调查报告书

商品编码

1644282

北美柴油发电机市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Diesel Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

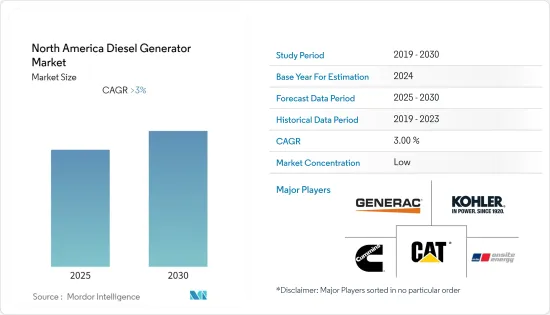

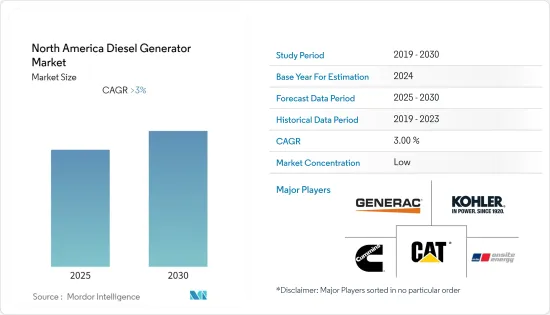

预测期内,北美柴油发电机市场预计将以超过 3% 的复合年增长率成长。

2020年,新冠肺炎疫情对市场产生了负面影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从长远来看,预计市场将受到持续电力需求成长以及自然灾害导致局部停电增加等因素的推动。

- 另一方面,向更清洁能源来源的转变是减缓市场成长的一个主要因素。

- 随着物联网(IoT)的采用,该地区资料中心的部署正在增加,预计将为柴油发电机组的部署创造巨大的机会。

- 由于计划的增加和停电次数的增加,美国预计将引领北美发电机组市场。

北美柴油发电机市场趋势

工业部门主导市场

- 工业部门可能会主导柴油发电机市场。在停电期间,生产会面临风险,或在电网连接有限的地方,工业运作严重依赖柴油发电机产生的电力。截至 2021 年,北美的主要消费量量约为 113.70 艾焦耳,比 2020 年(108.79 艾焦耳)增加约 4%。

- 新兴产业的快速发展和飓风等自然灾害导致的停电增加被认为是推动北美柴油发电机市场成长的关键因素。

- 采矿、石油和天然气探勘以及铁路等各种工业活动都需要大型发电机来运作。预计各行业应用的不断增加也将推动市场的发展。

- 柴油比汽油贵,但其能量密度更高,这意味着您可以从相同的燃料中获得更多的能量。柴油比汽油和其他燃料更不易燃,因此储存和处理更安全。

- 此外,柴油发电机更可靠,初始化柴油发电机组比燃气发电机组更经济。柴油的运输和储存十分方便,因此现场燃料随时可用,也使得柴油发电机组比燃气发电机组更受欢迎。

- 随着製造业的快速成长,预计未来几年美国和加拿大的许多行业都将经历成长。受此影响,预计预测期内工业领域对柴油发电机的需求将会增加。

预计美国将主导市场

- 由于计划不断增加、电力供需缺口不断扩大、全国製造设施不断扩张以及商业办事处不断增加,美国在北美地区的发电机组市场中处于领先地位。国家正受益于柴油发电机的成本和效益,而生活水准的提高也推动了对电力备用设备的需求。

- 此外,基础设施、通讯、资讯技术(IT)和IT支援服务等各个终端使用领域的快速成长预计将刺激美国对发电机组的需求。例如,Google在2022年4月宣布,将在2022年终前在美国投资约95亿美元建造新办公室和资料中心。这些投资可能会在预测期内增加对发电机组的需求。

- 此外,美国的石油和天然气探勘活动正在增加,由于主要的石油和天然气钻探和生产过程都在电力很少或没有电力的偏远地区进行,对柴油公共产业的需求预计会增加。因此,柴油发电机对于石油和天然气行业的正常运作是必不可少的。

- 根据《BP世界能源统计评论2022》,美国石油产量年增率为0.9%。过去10年,其成长率达7.7%。 2021年美国原油产量为1,658.5万桶/日。 2021年美国占全球原油产量的18.5%。

- 此外,近年来,柴油发电机作为重要发电来源的使用显着增加。据国家气象局称,近年来该国的天气模式发生了变化,导致飓风频繁发生。飓风会带来非常强烈和危险的风、闪电、冰雹和严重的洪水。因此,国家对备用电源柴油发电机的需求日益增加。

- 因此,鑑于上述情况,预计预测期内美国对柴油发电机的需求将会增加。

北美柴油发电机产业概况

北美柴油发电机市场需要变得更有凝聚力。市场的主要企业(不分先后顺序)包括卡特彼勒公司、康明斯公司、Generac Holdings Inc.、MTU Onsite Energy Corp. 和科勒公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2028 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 容量

- 75kVA以下

- 75~375kVA

- 375kVA以上

- 应用

- 待机功率

- 常用/连续功率

- 抑低尖峰负载

- 最终用户

- 住宅

- 商业的

- 工业的

- 地区

- 美国

- 加拿大

- 北美其他地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Caterpillar Inc.

- Cummins Inc.

- Generac Holdings Inc.

- MTU Onsite Energy Corp.

- Kohler Co.

- Aggreko plc

- Briggs & Stratton Corporation

- Winco Inc.

- Multiquip Inc.

第七章 市场机会与未来趋势

简介目录

Product Code: 70579

The North America Diesel Generator Market is expected to register a CAGR of greater than 3% during the forecast period.

In 2020, COVID-19 negatively impacted the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- In the long run, the market is likely to be driven by things like a growing need for constant power and more power outages in the region caused by natural disasters.

- On the other hand, the move toward cleaner energy sources is a major thing that slows the growth of the market.

- Nevertheless, with the increasing deployment of data centers in the region with the Internet of Things' (IoT) adoption, the demand for diesel generator sets is expected to create enormous opportunities for diesel generator deployment.

- The United States is expected to lead the generator sets market in the North American region due to the increasing number of infrastructure projects and rising number of power outages in the country.

North America Diesel Generators Market Trends

Industrial Sector is to Dominate the Market

- The industrial sector is most likely to dominate the market for diesel generators. During power outages, i.e., to prevent production risks and in places where grid connectivity is limited, industrial operations depend heavily on electricity generated by diesel generators. As of 2021, the primary consumption in North America was about 113.70 exajoules, which was around 4% higher than in 2020 (108.79 exajoules).

- The rapid development of new industries and the increasing number of power outages due to natural calamities like hurricanes are considered significant factors that are driving the North American diesel generator market's growth.

- Various industrial activities, such as mining, oil and gas exploration, and railways, require heavy-duty generators for operation. The growing number of applications in various industries is also expected to drive the market.

- Though diesel is more expensive than gas, it has a higher energy density, so more energy can be extracted from the same fuel. Diesel is less flammable than gas and other fuels, making it safer to store and handle.

- Moreover, diesel generators are more reliable, and the initialization of diesel generator sets is more economical than that of gas generator sets. Due to the ease of transportation and storage of diesel, easy on-site fuel availability has also made diesel generator sets more popular than gas generator sets.

- Due to a sharp rise in manufacturing, the United States and Canada are expected to have a lot of industrial growth in the next few years. This is expected to drive the demand for diesel generators in the industrial sector during the forecast period.

The United States is Expected to Dominate in the Market

- The United States is the leading generator sets market in the North American region due to the increasing number of infrastructure projects, widening power demand-supply gap, expansion of manufacturing facilities across the nation, and rising commercial office space. The country benefits from the cost and effectiveness of diesel generators, with improved living standards increasing the demand for power backup devices.

- In addition, the rapid growth in various end-use sectors, such as infrastructure, telecommunications, information technology (IT), and IT-enabled services, is expected to spur the demand for generator sets in the United States. For instance, in April 2022, Google announced it would invest around USD 9.5 billion in new offices and data centers in the United States by the end of 2022. Such investments are likely to increase demand for generator sets during the forecast period.

- Moreover, the rising oil and gas exploration activities in the United States are expected to boost the demand for diesel generators as the major oil and gas drilling and production processes are operated in remote areas where little or no power utility is available. Hence, diesel generators are required for proper operations in the oil and gas sector.

- According to the BP Statistical Review of World Energy 2022, oil production in the United States had an annual growth rate of 0.9%. Since the last decade, the country has registered a growth rate of 7.7%. The total amount of crude oil produced in the United States was 16,585 thousand barrels per day in 2021. The United States held an 18.5 percent share in global crude oil production in 2021.

- Furthermore, the use of diesel generators as critical power generation sources has significantly increased in recent years. According to the National Weather Service, the weather pattern in the country has changed in the past few years, contributing to the turbulent hurricanes. Hurricanes produce extremely high and dangerous winds, lightning, hail, and massive flooding. As a result, the demand for backup power diesel generators in the country is increasing.

- Therefore, as per the abovementioned points, the demand for diesel generators is estimated to increase in the United States during the forecasted period.

North America Diesel Generators Industry Overview

The North American diesel generator market needs to be more cohesive. Some of the key players in the market (not in particular order) include Caterpillar Inc., Cummins Inc., Generac Holdings Inc., MTU Onsite Energy Corp., and Kohler Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Capacity

- 5.1.1 Less than 75 kVA

- 5.1.2 Between 75-375 kVA

- 5.1.3 More than 375 kVA

- 5.2 Application

- 5.2.1 Standby Power

- 5.2.2 Prime/ Continuous Power

- 5.2.3 Peak Shaving

- 5.3 End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Caterpillar Inc.

- 6.3.2 Cummins Inc.

- 6.3.3 Generac Holdings Inc.

- 6.3.4 MTU Onsite Energy Corp.

- 6.3.5 Kohler Co.

- 6.3.6 Aggreko plc

- 6.3.7 Briggs & Stratton Corporation

- 6.3.8 Winco Inc.

- 6.3.9 Multiquip Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219