|

市场调查报告书

商品编码

1644283

中东和非洲柴油发电机市场:份额分析、行业趋势、统计数据和 2025-2030 年预测Middle East And Africa Diesel Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

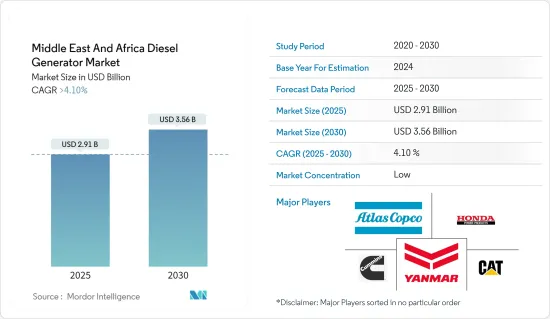

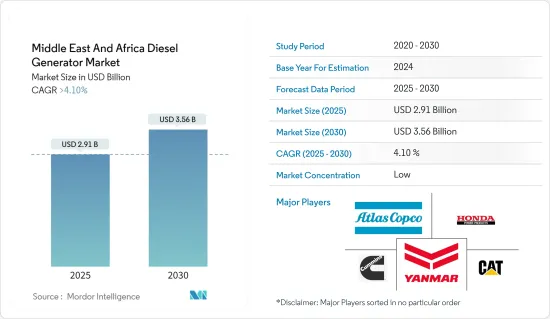

中东和非洲柴油发电机市场规模预计在 2025 年为 29.1 亿美元,预计到 2030 年将达到 35.6 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 4.1%。

关键亮点

- 从中期来看,预计预测期内配电中心的不稳定电力供应和不断增加的基础设施建设计划将推动市场发展。

- 然而,预计对二氧化碳排放日益增长的担忧将阻碍预测期内的市场成长。

- 将再生能源来源与柴油发电机结合的混合系统预计将为中东和非洲的柴油发电机市场创造巨大机会。

- 由于该地区对能源的需求不断增长,预计尼日利亚将占据市场主导地位。

中东和非洲柴油发电机市场趋势

备用发电机领域占据市场主导地位

- 中东和非洲经常遭遇频繁停电、电网不稳定以及恶劣天气条件阻碍能源供应的问题。对于维持关键业务、保护重要设备和维护基本服务的不间断电源的迫切需求凸显了备用发电机的引人注目的价值提案。

- 此外,该地区正在经历的工业成长也增加了备用发电机的重要性。随着该地区工业格局的蓬勃发展,对稳定且有弹性的电源的需求变得至关重要。备用发电机提供了可靠的保障,防止因电力中断而造成的潜在生产损失、收益影响和停机,从而增强了整体业务永续营运。

- 根据能源研究所《2023年世界能源统计评论》,2022年中东和非洲的发电量与2021年相比成长了0.6%。同时,2012年至2022年的年增率为2.2%。随着地区电力需求的增加,电力发电来源却没有集中在同一个地方,尤其是在非洲地区。因此,预计未来几年柴油发电机的需求将会增加。

- 此外,对技术和资料基础设施的依赖增加了备用发电机的重要性。资料中心、通讯设施和数位服务的激增需要持续、稳定的电源供应,以确保这些关键系统的完整性和功能。备用发电机能够在停电时迅速接管电源,已成为保障技术运作的关键组成部分。

- 例如,2023年2月,微软计画在沙乌地阿拉伯建立新的资料中心和Azure云端区域。这是在利雅德举行的 LEAP 2023 会议上宣布的。

- 预计备用柴油发电机未来将继续占据市场主导地位。这是因为与其他细分市场相比,其使用方式灵活,发电规模大。

尼日利亚占据市场主导地位

- 人口激增、都市化快速发展以及工业部门多样化使得对可靠电源的需求不断增加。尼日利亚现有电网面临挑战,需要稳定的电力供应,柴油发电机成为填补能源缺口和支持关键业务的越来越有吸引力的解决方案。

- 此外,尼日利亚基础设施发展和建设热潮也增加了柴油发电机的重要性。交通网络、房地产计划和製造设施的持续扩张需要稳定的电力供应。柴油发电机已成为满足临时和备用电力需求和支持尼日利亚雄心勃勃的发展倡议的关键推动因素。

- 例如,根据尼日利亚国际贸易部的数据,近年来尼日利亚建筑市场规模一直在上升。 2021年市场规模为1,277亿美元,预计2022年将达1,315.3亿美元,成长率略高于3%。

- 此外,奈及利亚经济活动的地理分布进一步凸显了其优势。该国多样化的地理和城市中心需要适应性电力解决方案,柴油发电机可以灵活地为都市区和偏远地区供电。这种多功能性将使奈及利亚能够发挥多种柴油发电机应用的潜力。

- 例如,2023年3月,现代重工宣布已与Mikano International Ltd签订合同,供应六台柴油发电机组。 Mikano International Ltd 正在拉各斯建造计划,该公司将使用柴油发电机作为备用电源。现代表示,柴油发电机将于2024年5月底运往奈及利亚。

- 总之,奈及利亚在中东和非洲柴油发电机市场的突出地位牢牢植根于经济成长、基础设施扩张和区域动态。随着尼日利亚应对能源供需的复杂性,柴油发电机整合已成为一种变革力量,它将重新定义能源弹性,支持基础设施发展,并为尼日利亚的能源安全和永续发展做出重大贡献。

中东及非洲柴油发电机组产业概况

中东和非洲柴油发电机市场部分细分。该市场的主要企业(不分先后顺序)包括卡特彼勒公司、康明斯有限公司、洋马控股、阿特拉斯·科普柯公司和本田西尔动力产品有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 202年市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 电源不稳定

- 建筑基础建设计划

- 限制因素

- 环境问题

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 额定功率

- 0~75kVA

- 75~375kVA

- 375kVA以上

- 应用

- 主电源

- 备用电源

- 抑低尖峰负载

- 市场分析:2028 年市场规模及需求预测(按地区)

- 奈及利亚

- 伊拉克

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 其他中东和非洲地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Cummins Inc.

- Kirloskar Oil Engines Limited

- Honda Siel Power Products Limited

- Yanmar Holdings Co. Ltd

- Caterpillar Inc.

- Mitsubishi Heavy Industries Ltd

- Perkins Engines Company Limited

- Atlas Copco AB

- 市场占有率

第七章 市场机会与未来趋势

- 混合解决方案

简介目录

Product Code: 70581

The Middle East And Africa Diesel Generator Market size is estimated at USD 2.91 billion in 2025, and is expected to reach USD 3.56 billion by 2030, at a CAGR of greater than 4.1% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the unreliable power supply from the distribution center and increasing construction and infrastructure projects are expected to drive the market during the forecasted period.

- On the other hand, increasing concerns over carbon emissions are expected to hinder the growth of the market during the forecasted period.

- Nevertheless, hybrid systems with integrated diesel generators with renewable energy sources are expected to create huge opportunities for the Middle-East and African diesel generator market.

- Nigeria is expected to be a dominant region for the market due to the increasing demand for energy in the region.

MEA Diesel Generator Market Trends

Backup Generator Segment to Dominate the Market

- The Middle-East and Africa often contend with frequent power outages, grid instability, and challenging climatic conditions that disrupt energy availability. The critical need for uninterrupted power to sustain vital operations, protect sensitive equipment, and maintain essential services underscores the compelling value proposition of backup generators.

- Moreover, the industrial growth witnessed in the region amplifies the significance of backup generators. The demand for consistent and resilient power sources becomes paramount as the region's industrial landscape flourishes. Backup generators offer a reliable safeguard against potential production losses, revenue impacts, and operational downtime resulting from power disruptions, thus enhancing overall business continuity.

- According to the Energy Institute Statistical Review Of World Energy 2023, the electricity generated in 2022 grew by 0.6% compared to 2021 in the Middle-East and African region. At the same time, an annual growth rate of 2.2% was recorded between 2012 and 2022. As the demand for electricity is increasing in the region, the power generating sources are not increasing at the same place, specifically in the African region; therefore, the demand for diesel generators is expected to rise in the coming years.

- Furthermore, the dependence on technology and data infrastructure elevates the importance of backup generators. The proliferation of data centers, telecommunications facilities, and digital services requires a continuous and stable power supply to ensure the integrity and functionality of these critical systems. Backup generators, equipped to assume power delivery during outages swiftly, emerge as a critical linchpin in safeguarding technological operations.

- For instance, in February 2023, Microsoft intended to build a new data center and Azure cloud region in Saudi Arabia. It was announced during the LEAP 2023 conference in Riyadh.

- Backup diesel generators are, thus, expected to continue dominating the market. This is due to their flexibility in usage and large size for electricity generation compared to other market segments.

Nigeria to Dominate the Market

- The nation's burgeoning population, rapid urbanization, and diverse industrial sectors create a heightened demand for reliable power sources. Nigeria's quest for uninterrupted electricity supply amid existing grid challenges enhances the appeal of diesel generators as a solution to bridge energy gaps and support critical operations.

- Moreover, Nigeria's infrastructure development and construction boom amplify the significance of diesel generators. The ongoing expansion of transportation networks, real estate projects, and manufacturing facilities necessitates a stable power supply. Diesel generators emerge as a vital enabler, catering to temporary and backup power needs and bolstering Nigeria's ambitious development initiatives.

- For instance, according to the International Trade Administration, Nigeria's construction market size has been on the rise in recent years. In 2022, the total market size was USD 131.53 billion, compared to USD 127.7 billion in 2021, while registering a growth rate of just over 3%.

- Furthermore, Nigeria's geographical distribution of economic activity further underscores its dominance. The nation's varied landscapes and urban centers call for adaptable power solutions, where diesel generators offer the flexibility to provide power in urban and remote settings. This versatility positions Nigeria to capitalize on the potential for a diverse range of diesel generator applications.

- For instance, in March 2023, Hyundai Heavy Engineering announced that the company had signed a contract with Mikano International Ltd to provide six diesel generators. Mikano International Ltd is building a project in Lagos where the company is expected to use these diesel generators as a backup power solution. Hyundai announced that the diesel generators will be shipped to Nigeria by the end of May 2024.

- In conclusion, the envisaged prominence of Nigeria within the Middle-East and African diesel generator market is firmly grounded in economic growth, infrastructure expansion, and regional dynamics. As Nigeria navigates the complexities of energy demand and supply, the integration of diesel generators emerges as a transformative force, poised to redefine energy resilience, support infrastructure development, and contribute significantly to Nigeria's journey towards energy security and sustainable progress.

MEA Diesel Generator Industry Overview

The Middle-East and African diesel generator market is partially fragmented. Some of the key players in this market (in no particular order) include Caterpillar Inc., Cummins Ltd, Yanmar Holdings Co. Ltd, Atlas Copco AB, and Honda Siel Power Products Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 202

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Unreliable Power Supply

- 4.5.1.2 Construction and Infrastructure Projects

- 4.5.2 Restraints

- 4.5.2.1 Environmental Concerns

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Ratings

- 5.1.1 0-75 kVA

- 5.1.2 75-375 kVA

- 5.1.3 Above 375 kVA

- 5.2 Application

- 5.2.1 Prime Power

- 5.2.2 Backup Power

- 5.2.3 Peak Shaving

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 Nigeria

- 5.3.2 Iraq

- 5.3.3 Saudi Arabia

- 5.3.4 United Arab Emirates

- 5.3.5 Qatar

- 5.3.6 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Cummins Inc.

- 6.3.2 Kirloskar Oil Engines Limited

- 6.3.3 Honda Siel Power Products Limited

- 6.3.4 Yanmar Holdings Co. Ltd

- 6.3.5 Caterpillar Inc.

- 6.3.6 Mitsubishi Heavy Industries Ltd

- 6.3.7 Perkins Engines Company Limited

- 6.3.8 Atlas Copco AB

- 6.4 Market Share

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Hybrid Solutions

02-2729-4219

+886-2-2729-4219