|

市场调查报告书

商品编码

1644346

柴油 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Diesel As Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

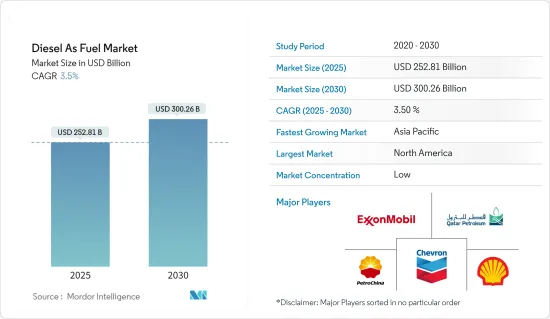

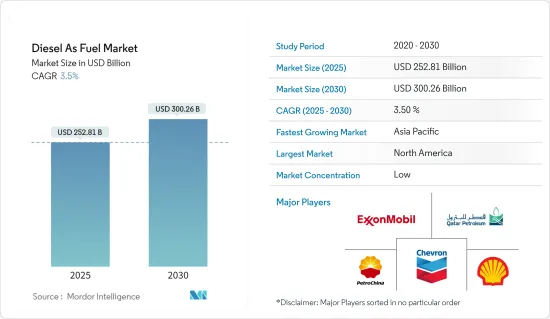

预计 2025 年柴油市场规模将达到 2,528.1 亿美元,到 2030 年预计将达到 3,002.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.5%。

关键亮点

- 从中期来看,预计预测期内工业应用中柴油使用量的增加和全球柴油基础设施的可用性将推动市场发展。

- 然而,预计预测期内人们对空气污染日益担忧将阻碍市场成长。

- 生物柴油和可再生柴油技术的不断进步预计将为柴油市场创造重大机会。

- 由于能源需求和工业基础设施活动的增加,预计亚太地区的柴油市场将显着成长。

柴油市场趋势

市场区隔预计将由运输业主导

- 柴油广泛用于卡车、巴士和机车等重型车辆。这些车辆需要能够提供高扭矩、高效率和高续航里程的能源,以便远距运输货物和人员。柴油引擎以其高功率和低油耗而闻名,非常适合这些应用。因此,交通运输部门占柴油消耗的很大一部分。

- 全球运输网路的不断扩大和流动性需求的不断增长推动了对精炼产品的需求不断增长。据国际汽车工业协会称,2021年至2022年间全球汽车产量将增加6%以上。预计汽车产量的增加将导致预测期内燃料需求的增加。

- 交通运输部门已建立柴油配送和加註基础设施。加油站随处可见,现有的柴油车辆持有也相当可观。这种基础设施,加上柴油车辆的普及,导致运输业在柴油市场占据主导地位。

- 柴油因其能量密度和续航里程而非常适合远距运输和货物运输。远距运输的卡车依靠柴油引擎的动力和效率。无需频繁加油远距行驶,这使得柴油成为这些应用的一个有吸引力的选择。这导致了燃料技术的发展。

- 例如,2023 年 5 月,Reliance Industries Ltd 和 bp Plc 的合资企业 Jio-bp 推出了混合添加剂的优质柴油,以提高燃油效率。这种优质柴油比普通柴油或纯柴油便宜。该柴油引擎采用 ACTIVE 技术,有助于最大限度地减少因污垢堆积而进行计划外维护的可能性。

- 因此,如前所述,预计运输业将在预测期内占据市场主导地位。

预计亚太地区市场将大幅成长

- 亚太地区经济快速成长,中国、印度、东南亚等国家正崛起成为经济强国。这种成长刺激了工业化、基础设施发展和运输需求的增加,从而导致对柴油的需求增加。

- 该地区人口稠密,都市化很高。这导致个人和商业用途的交通需求增加。柴油广泛应用于该地区不断扩大的交通运输领域,包括汽车、卡车、巴士和两轮车,进一步推动了市场成长。

- 亚太地区包括多元化的製造业、建设业、采矿业和农业产业。这些领域严重依赖柴油来为机械、设备和发电机动力来源。随着工业活动扩大以满足日益增长的需求,柴油消费量不断增加,从而推动市场成长。

- 例如,2023 年 4 月,包装公司 SIG 宣布将在印度帕尔加尔开设一家新的製造工厂。新工厂将专注于生产盒中袋和带嘴袋包装,之前分别以 Scholle IPN 和 Bossar 的名称出售。

- 此外,亚太地区许多国家也推出了推广柴油使用、改善燃油品质的政策和措施。这些措施旨在提高能源效率、减少排放气体并确保遵守环境标准。这些努力为柴油市场的繁荣创造了有利环境。

- 因此,预计亚太地区将在预测期内占据市场主导地位。

柴油业概况

柴油市场是细分的。市场的主要企业(不分先后顺序)包括雪佛龙公司、埃克森美孚公司、中国石油天然气股份有限公司、卡达石油公司、壳牌公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2028 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 工业应用需求增加

- 全球基础建设成长

- 限制因素

- 人们对碳排放以及向电动车和再生能源来源转变的担忧日益加剧

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 最终用户

- 运输

- 产业

- 其他的

- 2028 年市场规模与需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 俄罗斯

- 德国

- 挪威

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 印尼

- 马来西亚

- 越南

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 南美洲

- 阿根廷

- 巴西

- 委内瑞拉

- 南美洲其他地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Chevron Corporation

- Exxon Mobil Corporation

- PetroChina Company Limited

- Qatar Petroleum

- Shell Plc

- Reliance Industries Ltd

- Saudi Arabian Oil Co

- SK energy Co., Ltd.

- NK Rosneft'PAO

- BP plc

第七章 市场机会与未来趋势

- 开发生质燃料和可再生柴油等永续燃料

简介目录

Product Code: 71232

The Diesel As Fuel Market size is estimated at USD 252.81 billion in 2025, and is expected to reach USD 300.26 billion by 2030, at a CAGR of 3.5% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing industrial application of diesel fuel in the industrial application and availability of diesel infrastructure around the globe is expected to drive the market during the forecasted period.

- On the other hand, the increasing environmental concerns for air pollution are expected to hinder the market's growth during the forecasted period.

- Nevertheless, the increasing advancements in biodiesel and renewable diesel technology are expected to create huge opportunities for the Diesel as fuel market.

- Asia-Pacific is expected to witness significant growth in the diesel as fuel market due to the region's increasing energy demand and industrial infrastructure activities.

Diesel Fuel Market Trends

Transportation Segment is to Expected to Dominate in the Market

- Diesel fuel is widely used in heavy-duty vehicles, such as trucks, buses, and locomotives. These vehicles require energy that can provide high torque, efficiency, and range to transport goods and people long distances. Diesel engines are known for their ability to deliver high power output and fuel efficiency, making them well-suited for these applications. As a result, the transportation sector accounts for a significant portion of diesel fuel consumption.

- The expanding global transportation network and the increasing mobility needs contribute to the growing demand for refined products. According to the International Organization of Motor Vehicle Manufacturers, global vehicle production increased by more than 6% between 2021 and 2022. This growth in vehicle production is expected to increase fuel demand during the forecasted period.

- The transportation sector includes a well-established infrastructure for diesel fuel distribution and refueling. Fueling stations are readily available, and the existing fleet of diesel-powered vehicles is substantial. This infrastructure and the widespread use of diesel vehicles contribute to the dominance of the transportation segment in the diesel fuel market.

- Diesel fuel is favored in long-haul and freight transportation due to its energy density and range. Trucks transporting goods over significant distances rely on diesel engines for their power and efficiency. The ability to cover long distances without frequent refueling makes diesel fuel an attractive option for these applications. It led to the development of fuel technologies.

- For instance, in May 2023, Jio-bp, the joint venture between Reliance Industries Ltd and bp Plc, introduced a high-quality diesel fuel blended with additives that enhances fuel efficiency. This superior-grade diesel is priced lower than regular or additive-free diesel available. The diesel, infused with ACTIVE technology, helps minimize the likelihood of unplanned maintenance caused by dirt accumulation.

- Therefore, as mentioned above, the transportation segment is expected to dominate the market during the forecasted period.

Asia-Pacific is Expected to Witness Significant Growth in the Market

- The Asia-Pacific region is experiencing rapid economic growth, with countries like China, India, and Southeast Asian nations emerging as major economic powerhouses. This growth drives increased industrialization, infrastructure development, and transportation needs, contributing to higher demand for diesel fuel.

- The region contains a large and growing population, along with increasing urbanization. It leads to greater demand for transportation for personal and commercial purposes. Diesel fuel is widely used in the region's expanding transportation sector, including cars, trucks, buses, and motorcycles, further fueling the market growth.

- Asia-Pacific includes diverse manufacturing, construction, mining, and agriculture industries. These sectors heavily rely on diesel fuel to power machinery, equipment, and generators. As industrial activities expand to meet the growing demand, diesel fuel consumption increases, driving market growth.

- For instance, in April 2023, SIG, a packaging company, unveiled the inauguration of a new manufacturing facility in Palghar, India. The newly established plant will focus on producing bag-in-box and spouted pouch packaging, previously marketed under Scholle IPN and Bossar, respectively.

- Additionally, many countries in the Asia-Pacific region implemented policies and regulations to promote the use of diesel fuel and improve fuel quality. These measures aim to enhance energy efficiency, reduce emissions, and ensure compliance with environmental standards. Such initiatives provide a supportive environment for the diesel fuel market to thrive.

- Therefore as per the points mentioned above, the Asia-Pacific region is expected to dominate the market during the forecasted period.

Diesel Fuel Industry Overview

The diesel as fuel market is fragmented. Some of the major players in the market (in no particular order) include Chevron Corporation, Exxon Mobil Corporation, PetroChina Company Limited, Qatar Petroleum, and Shell Plc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand from Industrial Applications

- 4.5.1.2 Growing Infrastructure Across the World

- 4.5.2 Restraints

- 4.5.2.1 A Rise In Concerns Related To Carbon Emissions And A Shift Towards Electric Vehicles And Renewable Sources Of Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-User

- 5.1.1 Transporation

- 5.1.2 Industrial

- 5.1.3 Others

- 5.2 Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Russia

- 5.2.2.3 Germany

- 5.2.2.4 Norway

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Indonesia

- 5.2.3.4 Malaysia

- 5.2.3.5 Vietnam

- 5.2.4 Middle-East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 United Arab Emirates

- 5.2.4.3 South Africa

- 5.2.4.4 Nigeria

- 5.2.4.5 Egypt

- 5.2.4.6 Rest of Middle-East and Africa

- 5.2.5 South America

- 5.2.5.1 Argentina

- 5.2.5.2 Brazil

- 5.2.5.3 Venezuela

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Chevron Corporation

- 6.3.2 Exxon Mobil Corporation

- 6.3.3 PetroChina Company Limited

- 6.3.4 Qatar Petroleum

- 6.3.5 Shell Plc

- 6.3.6 Reliance Industries Ltd

- 6.3.7 Saudi Arabian Oil Co

- 6.3.8 SK energy Co., Ltd.

- 6.3.9 NK Rosneft' PAO

- 6.3.10 BP plc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Sustainable Fuels Such as Biofuels and Renewable Diesel

02-2729-4219

+886-2-2729-4219