|

市场调查报告书

商品编码

1644347

乙烯基地板覆盖材料:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Vinyl Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

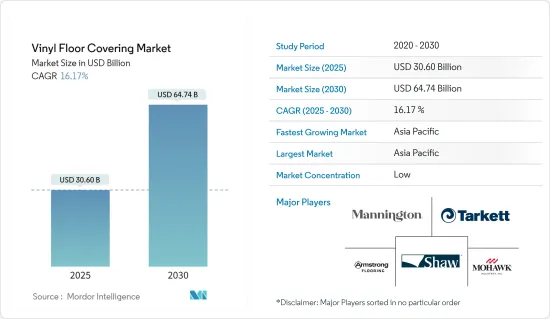

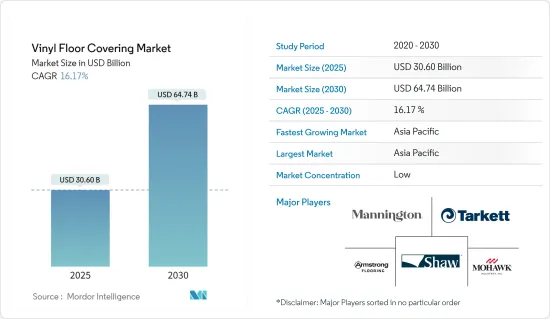

预计 2025 年乙烯基地板覆盖材料市场规模将达到 306 亿美元,到 2030 年将达到 647.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.17%。

乙烯基地板材料因其耐用性、易于维护和价格实惠而受到住宅和商业用途的欢迎。推动市场发展的因素包括对环保地板材料解决方案的需求不断增长、改造和装修数量的增加以及豪华乙烯基瓷砖 (LVT) 和乙烯基复合瓷砖 (VCT) 日益普及。此外,医疗机构、学校和其他公共建筑中乙烯基地板材料的使用也推动了市场的成长。

过去几年,推出自黏地板材料的製造商的技术进步促进了该行业的成长。为了满足不断增长的人口的需求,多户住宅的增加预计将对乙烯基地板材料市场的成长产生积极影响。此外,主要製造商增加投资,提供各种颜色、设计图案、纹理和尺寸的客製化产品解决方案,推动了该产品在建筑领域的普及。

由于投资高、建设活动增加以及本地製造商众多,豪华乙烯基瓷砖(LVT)地板材料是成长最快的市场。由于其耐用性和易于安装,加固办公室、医院和学校等商业空间的需求日益增长,推动了市场成长。

不断增长的成长机会正在增加中国、澳洲、印度、日本、泰国、越南和印尼等国家对豪华乙烯基瓷砖的需求,从而推动市场的发展。

生活水准提高和广阔的市场机会等因素吸引了大量劳动力。由于住宅、独户住宅和公寓的同步增加,对豪华乙烯基瓷砖的需求也将增加。由于豪华乙烯基瓷砖环保且能改善室内空气品质 (IAQ) 性能,因此对豪华乙烯基瓷砖的需求正在增加。

乙烯基地板覆盖材料市场趋势

豪华乙烯基瓷砖仍然是最受欢迎的类别

- 预计豪华乙烯基瓷砖仍将是乙烯基地板材料解决方案中最受欢迎的类别,并且预计在预测期内,该细分市场的收益将以更高的复合年增长率增长。与标准乙烯基瓷砖相比,豪华乙烯基瓷砖具有更高的耐用性和更优异的性能,从而具有竞争优势。

- 近年来,豪华乙烯基瓷砖市场因产品具有多种设计和纹理而受到消费者的关注。地板材料产业引入数位印刷技术,能够在瓷砖上轻鬆印刷纹理,这可能会在预测期内支持市场的成长。

商业领域占据最大市场占有率

- 在乙烯基地板市场中,商业应用领域贡献了最大的份额,并且预计在收益和预测期内将以更高的复合年增长率成长。预计酒店和购物中心等商业建筑领域将成为这些瓷砖的主要用户,因为它们既具有成本效益又具有出色的美观性。

- 设计师和建筑师在商业应用中使用乙烯基地板材料的影响力日益增强,预计将推动对该产品的需求。易于清洁和消毒、时尚的设计、防滑性能和防水等特点可能会在预测期内推动商业应用的需求。

乙烯基地板覆盖材料产业概况

该报告介绍了在乙烯基地板覆盖材料市场运营的各大国际公司。从市场占有率来看,目前少数几家大公司占据着市场主导地位。然而,随着技术进步和产品创新,中小企业透过赢得新契约和探索新市场来扩大其市场占有率。市场的主要参与者包括 Armstrong Flooring, Inc.、Mohawk Industries, Inc.、Shaw Industries Group, Inc.、Tarkett SA、Mannington Mills, Inc. 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况

- 市场驱动因素

- 建设活动活性化

- 对豪华乙烯基瓷砖的需求不断增长推动了市场

- 市场限制

- 原物料价格波动

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 市场创新洞察

- COVID-19 市场影响

第五章 市场区隔

- 按产品

- 乙烯基片材

- 乙烯基复合砖

- 豪华乙烯基瓷砖

- 按最终用户

- 住宅

- 商业的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 市场竞争概况

- 公司简介

- Armstrong Flooring, Inc.

- Mannington Mills, Inc.

- Mohawk Industries, Inc.

- Tarkett SA

- Forbo Flooring Systems

- Shaw Industries Group, Inc.

- Polyflor Ltd

- Beaulieu International Group

- Fatra as

- Gerflor

- Forbo

第七章 市场机会与未来趋势

第八章 免责声明及发布者

The Vinyl Floor Covering Market size is estimated at USD 30.60 billion in 2025, and is expected to reach USD 64.74 billion by 2030, at a CAGR of 16.17% during the forecast period (2025-2030).

Vinyl flooring is a popular choice for residential and commercial applications due to its durability, ease of maintenance, and affordability. The market is being driven by factors such as the rising demand for eco-friendly flooring solutions, the increasing number of renovation and remodeling activities, and the growing popularity of luxury vinyl tiles (LVTs) and vinyl composite tiles (VCTs). Additionally, the use of vinyl flooring in healthcare facilities, schools, and other public buildings is also driving market growth.

Technological advancements by manufacturers to introduce self-adhesive floorings have benefited the industry's growth over the past few years. A rising number of multifamily houses to accommodate the growing population is expected to have a positive impact on vinyl flooring market growth. Moreover, increasing investments by key manufacturers to offer customized product solutions in different colors, design patterns, textures, and dimensions are fuelling product penetration in the construction sector.

Luxury vinyl tiles (LVT) flooring is the fastest-growing market due to significant investments, increased construction activities, and many regional manufacturers. The increased need to enhance commercial spaces such as offices, hospitals, schools, etc., because of their durability and ease of installation, boosts the market's growth.

Due to the rising growth opportunities, the demand for luxury vinyl tiles is increasing in countries like China, Australia, India, Japan, Thailand, Vietnam, and Indonesia, which drive the market.

Factors like an increasing standard of living and the market's offerings of vast opportunities attract a considerable workforce. The demand for luxury vinyl tiles also increases since the demand is increasing among residential units, single houses, and apartments simultaneously. The reason for the increasing demand for the luxury vinyl tile market is that luxury vinyl tiles are eco-friendly and provide improved indoor air quality (IAQ) performance.

Vinyl Floor Covering Market Trends

Luxury Vinyl Tile Segment to Remain the most Popular Category

- Luxury vinyl tile is expected to remain the most popular category of vinyl flooring solutions, and the segment is likely to grow at a higher CAGR, in terms of revenue, over the forecast period. Luxury vinyl tile is more durable and offers better performance in comparison to standard vinyl tiles, which offers them a competitive advantage over their counterparts.

- The luxury vinyl tile segment has caught the attention of consumers in the past few years owing to the availability of the product in numerous designs and textures. The introduction of digital printing technology to the flooring industry, which enables easy texture printing on these tiles, is likely to support the market growth over the projected period.

Commercial Segment Hold the Largest Market Share

- The commercial application segment accounted for the largest share of the vinyl floor market, and the segment is anticipated to grow at a higher compound annual growth rate (CAGR), in terms of revenue, over the forecast period. Commercial construction segments such as hotels and shopping malls are expected to be the key users of these tiles as they offer cost-effectiveness along with superior aesthetics.

- The rising influence of designers and architects for the use of vinyl flooring in commercial applications is expected to boost product demand. Easy cleaning and sterilization and, stylish designs, and slip & water resistance offered by these products are likely to propel their demand in commercial application over the projected period.

Vinyl Floor Covering Industry Overview

The report covers major international players operating in the Vinyl floor covering market. In terms of market share, some of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and by tapping new markets. Some major players in the market are Armstrong Flooring, Inc., Mohawk Industries, Inc., Shaw Industries Group, Inc., Tarkett S.A., and Mannington Mills, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Construction Activities

- 4.2.2 Increase in Demand for Luxury Vinyl Tiles is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Fluctuations in Raw Material Prices

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights into Technological Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Vinyl Sheet

- 5.1.2 Vinyl Composite Tile

- 5.1.3 Luxury Vinyl Tile

- 5.2 End-Use

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

- 6.2 Company Profiles

- 6.2.1 Armstrong Flooring, Inc.

- 6.2.2 Mannington Mills, Inc.

- 6.2.3 Mohawk Industries, Inc.

- 6.2.4 Tarkett S.A.

- 6.2.5 Forbo Flooring Systems

- 6.2.6 Shaw Industries Group, Inc.

- 6.2.7 Polyflor Ltd

- 6.2.8 Beaulieu International Group

- 6.2.9 Fatra a.s.

- 6.2.10 Gerflor

- 6.2.11 Forbo*