|

市场调查报告书

商品编码

1644372

印度的自动化物料输送(AMH):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)India Automated Material Handling (AMH) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

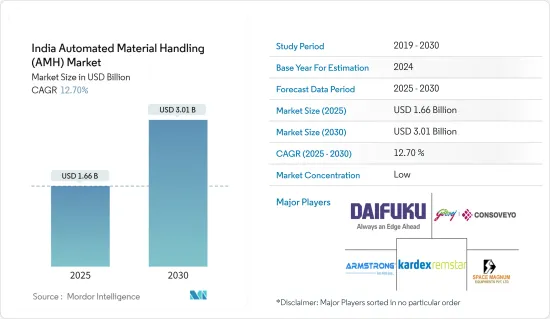

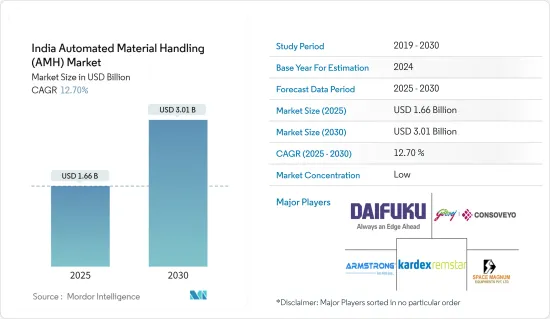

印度自动化物料输送(AMH) 市场规模预计在 2025 年为 16.6 亿美元,预计到 2030 年将达到 30.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.7%。

从物料输送程序发展而来的一个想法是自动化物料输送(AMH)。它使用各种机器协助製造工厂的工人将成品运送到仓库或在组装站之间移动组装产品。

主要亮点

- 由于电子商务产业的成长,预测期内对自动化物料输送(AMH) 设备的需求预计将大幅成长。随着越来越多的人转向网路购物,客户期望不断变化,以及网上零售商之间的激烈竞争,对准确、快速、高效的客户服务以提供所购买的产品的需求日益增加。

- 由于产品选择的增加以及关键产业对自动化物料输送(AMH) 设备的需求不断增加,整个全部区域的市场正在扩大。

- 生产商还可以采用工业 4.0 和其他数位技术(例如在零售业)来实现这一目标。印度的产品消费方式发生了重大变化。预计不断增长的中阶人口将推动对分类系统的需求,以满足整体零售市场的扩张。

- 此外,由于许多行业的产品供应和新兴企业的增加,对自动化物料输送(AMH) 设备的需求也在增加。

- 然而,价格上涨、高资本投入、设备和系统维护成本高以及AMH设备市场的崩溃等问题可能会对公司的整体收益不利影响,因为生产会延迟整个生产过程,导致解决方案损失和工厂性能不佳,从而阻碍市场成长。

- 印度各地的新冠疫情和封锁规定对工业活动产生了影响。封锁造成的一些后果包括供应链中断、製造所需原材料短缺、劳动力短缺、价格波动可能推高生产成本并超出预算以及运输问题。

印度自动化物料输送(AMH) 市场趋势

工业 4.0 投资预计将推动对自动化和物料输送的需求,从而推动市场

- 製造业对COVID-19危机的因应将导致对工业4.0的投资增加,从而大大提升製造自动化市场的成长潜力。工业公司将越来越多地采用自动化组装、即时工厂监控工具和製造资料收集系统,以便用更少的员工来管理他们的设施。

- 此外,机器人系统和其他自动化物料输送(AMH) 设备在航空领域也被广泛应用。由于安全需求的不断增加和随之而来的更严格标准的采用,自动行李处理系统在机场变得越来越普遍。

- 汽车产业在物料输送方面投入了更多资金,主要包括用于点焊和相关操作的机器人等自动化设备。在食品和饮料行业,自动化系统越来越多地被引入製造、包装和分销过程中。

- 此外,Honeywell国际公司去年 11 月推出了一种新型自动储存和搜寻系统,该系统利用人工智慧和机器学习来帮助仓库和配送中心营运商跟上电子商务前所未有的成长。

- 另一方面,物料输送机器人可以将工具或零件从一个位置或机器供应、运输或卸载到另一个位置或机器。机器人技术如今在包装领域得到更广泛的应用,因为它们可以连续工作而不会感到疲劳。

零售/仓储/物流中心预计将占很大份额

- 电子商务预计将受到数位化的推动,这将增加对 AMH 的需求。印度都市区中超级市场和大卖场的兴起以及都市区房地产价格的上涨,促使仓库和物流中心选择自动化,以保持竞争力并降低与长期储存相关的成本。

- 随着众多新参与企业,印度零售业正在发展成为最具活力和发展最快的行业之一。它占国内生产总值的10%以上,并提供了约8%的就业机会。印度是全球第五大零售业目的地。根据IBEF预测,到2026年印度电子商务市场规模将成长至2,000亿美元。

- 印度约有 1.62 亿公吨的农业仓库、冷冻车设施、冷藏设施等。 NABARD 将对它们进行地图绘製和地理标记工作。政府还提案按照仓库发展监管局 (WDRA) 的规范建造仓库。

- 此外,自动导引车 (AVG)、堆高机、拣选机、步行式堆高机和其他相关动力仓库设备通常用于运输各种产品。需要考虑的重要设计因素是地板的平整度和平整度、动态和地板负载。印度的物流中心对此类设备的需求很高。

印度自动化物料输送(AMH) 产业概况

印度自动化物料输送(AMH) 市场竞争激烈。这个市场有些分散,有一些大型参与者,例如 Godrej Consoveyo Logistics Automation Ltd、Daifuku India Private Limited、Kardex India Storage Solutions Private Limited 和 Armstrong Ltd。市场参与企业正在透过推出新产品和策略併购来扩大市场占有率。

2022 年 8 月,Godrej Consoveyo Logistics Automation Ltd 与德国合资伙伴 Korber Supply Chain 合作,扩展其自动化供应链解决方案。自疫情爆发以来,工业领域自动化的应用发生了重大转变。由于製造业的扩张、有组织的第三方物流、製药、零售、电子商务、餐饮服务的发展以及消费模式的改变,亚洲逐渐成为供应链自动化的发展引擎,此外,各国政府也在投资低温运输和冷藏仓库。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对产业生态系统的影响

- 印度仓储业的发展

第五章 市场动态

- 市场驱动因素

- 工业 4.0 投资推动对自动化和物料输送的需求

- 市场挑战

- 恶劣的工作条件和

获得廉价劳动力

第六章 市场细分

- 解决方案类型

- 自动输送机

- 自动储存和搜寻系统 (AS/RS)

- 自动导引运输车(AGV)

- 堆垛机/分类系统

- WMS/WCS解决方案

- 最终用户

- 飞机场

- 製造业

- 零售/仓储/物流中心

- 其他最终用户

第七章 竞争格局

- 公司简介

- Daifuku India Private Limited(Incl. Vega Conveyors & Automation)

- Space Magnum Equipment Pvt. Ltd

- Godrej Consoveyo Logistics Automation Ltd(GCLA)

- Kardex India Storage Solutions Private Limited

- Armstrong Ltd.

- Falcon Autotech Private Limited

- GreyOrange Pte. Ltd.

- Addverb Technologies Inc.

- Hinditron Group

- The Hi-Tech Robotic Systemz Limited

- Bastian Solution Private Limited

第八章投资分析

第九章:未来市场展望

The India Automated Material Handling Market size is estimated at USD 1.66 billion in 2025, and is expected to reach USD 3.01 billion by 2030, at a CAGR of 12.7% during the forecast period (2025-2030).

An idea that evolved from material handling procedures is automated material handling. It uses a variety of machinery to assist workers in a manufacturing facility in moving the finished product to storage facilities or moving the product assembled between assembly stations.

Key Highlights

- A substantial increase in demand for automated material handling equipment is also anticipated throughout the projection period due to the growing e-commerce sector. There is an increasing need for precise, quick, and efficient customer service to deliver the acquired product as more people turn to online shopping, customer expectations are continuously changing, and there is fierce rivalry among online retailing companies.

- The market is expanding across the region due to the expansion of product options and the increased demand for automated material-handling equipment among significant industries.

- Producers may also embrace Industry 4.0 and other digital technologies, such as retail, to accomplish this goal. The way that products are consumed in India is evolving significantly. The necessity and demand for sortation systems to meet the increased market across the retail industry are projected to be driven by the growing middle-class population.

- Additionally, the need for automated material handling equipment is being augmented by the growing number of product offerings and start-ups in numerous industries.

- However, issues similar to the rise in prices, high expenditure on capital, and high maintenance costs of equipment and systems, along with the breakdown of AMH equipment, can negatively impact the company's overall earnings as production delays the entire production process, which resolution losses and decline in plant performance which may hamper the market growth.

- The COVID-19 outbreak and lockdown restrictions across India affected industrial activities. Supply chain interruptions, a scarcity of raw materials needed for manufacture, workforce shortages, pricing fluctuations that could drive up production costs and push them beyond budget, and shipping issues are a few consequences of a lockdown.

India Automated Material Handling Market Trends

Industry 4.0 Investments Driving the Demand for Automation and Material Handling is Expected to Drive Market

- Manufacturing's response to the COVID-19 crisis has increased investments in Industry 4.0, which will significantly boost the market's growth potential for manufacturing automation. Industrial enterprises will increasingly turn to automated assembly lines, real-time plant monitoring tools, and manufacturing data collection systems to manage their facilities with fewer employees.

- Additionally, the aircraft sector extensively uses robotic systems and other automated material-handling equipment. Because of the increased requirement for security and the ensuing adoption of strict criteria for achieving it, automated baggage handling systems are becoming more common in airports.

- The automotive sector has been growing its investments in material handling, mainly consisting of automated equipment like robots used for spot welding and associated operations. Players in the food and beverage business are employing automated systems more frequently for various manufacturing, packaging, and distribution processes in the area.

- Moreover, in November last year, Honeywell International Inc. announced a new automated storage and retrieval system that uses artificial intelligence and machine learning to allow warehouse and distribution center operators to better keep up with unprecedented e-commerce growth.

- In contrast, material-handling robots can feed, transport, or detach tools and components from one place or a machine to another. Robotics now has a wider range of uses in packaging since they can work continuously without getting tired.

Retail/Warehouse/Logistics Center is Expected to Hold Significant Share

- E-commerce is predicted to be fueled by digitization, and this will increase demand for AMH. To remain competitive and reduce the expenses associated with prolonged storage, warehouses and distribution centers are choosing automation due to the rise in supermarkets and hypermarkets in Indian cities and the rising cost of real estate in urban areas.

- The Indian retail industry has developed into one of the most dynamic and fast-paced sectors due to several new players' entries. It accounts for over 10% of the country's GDP and around 8% of the employment ratio. India is the world's fifth-largest global destination in retail space. According to IBEF, the Indian e-commerce market is expected to grow to USD 200 billion by 2026.

- India has an estimated USD 162 million MT of Agri warehousing, reefer van facilities, cold storage, etc. NABARD will take exercises to map and geo-tag them. Besides, the Government proposed to create warehousing in line with the Warehouse Development and Regulatory Authority (WDRA) norms.

- Further, Automated guided vehicles (AVGs), forklifts, order pickers, walkie-rider pallet jacks, and other related powered warehouse equipment are typically used in various product movements. The critical design factors to consider are floor levelness and flatness, power, and floor loading. Such equipment has a significant demand trend in the logistics centers in India.

India Automated Material Handling Industry Overview

The India Automated Material Handling (AMH) Market is quite competitive. It is a somewhat fragmented market with large individual companies like Godrej Consoveyo Logistics Automation Ltd, Daifuku India Private Limited, Kardex India Storage Solutions Private Limited, and Armstrong Ltd. Market participants are expanding their market share by releasing new products or engaging in strategic mergers and acquisitions.

In August 2022, Godrej Consoveyo Logistics Automation Ltd scaled up its automated supply chain solutions in partnership with German-based joint venture partner Korber Supply Chain. Since the epidemic, there has been a significant shift in the industry's usage of automation. The government has been investing in cold chain and cold storage facilities on top of the fact that Asia is emerging as a development engine for supply chain automation due to the expansion of the manufacturing sector, the development of organized 3PLs, the pharmaceutical, retail, e-commerce, and food service industries, as well as changing consumption patterns.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Industry Ecosystem

- 4.5 Evolution of Warehousing Industry in India

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Industry 4.0 investments driving the demand for automation and material handling

- 5.2 Market Challenges

- 5.2.1 Harsh Operating Conditions and

Availability of Cheap Labor

6 MARKET SEGMENTATION

- 6.1 Solution Type

- 6.1.1 Automated Conveyor

- 6.1.2 Automated Storage & Retrieval System (AS/RS)

- 6.1.3 Automated Guided Vehicles (AGV)

- 6.1.4 Palletizer/Sortation Systems

- 6.1.5 WMS/WCS Solutions

- 6.2 End-User

- 6.2.1 Airport

- 6.2.2 Manufacturing

- 6.2.3 Retail/Warehouse/Logistics Center

- 6.2.4 Other End-User

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daifuku India Private Limited (Incl. Vega Conveyors & Automation)

- 7.1.2 Space Magnum Equipment Pvt. Ltd

- 7.1.3 Godrej Consoveyo Logistics Automation Ltd (GCLA)

- 7.1.4 Kardex India Storage Solutions Private Limited

- 7.1.5 Armstrong Ltd.

- 7.1.6 Falcon Autotech Private Limited

- 7.1.7 GreyOrange Pte. Ltd.

- 7.1.8 Addverb Technologies Inc.

- 7.1.9 Hinditron Group

- 7.1.10 The Hi-Tech Robotic Systemz Limited

- 7.1.11 Bastian Solution Private Limited