|

市场调查报告书

商品编码

1687259

亚太地区 AMH:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)APAC AMH - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

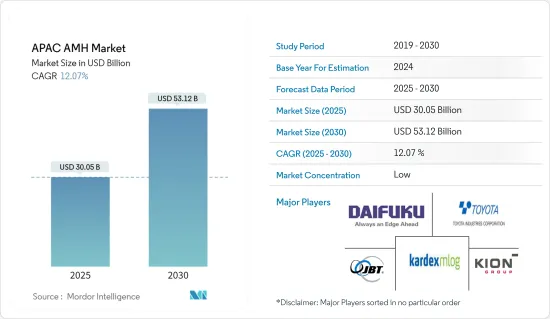

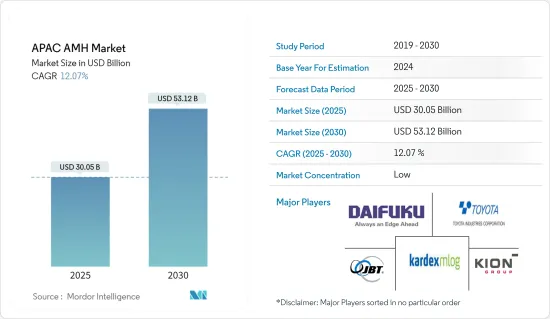

预计 2025 年亚太地区 AMH 市场规模为 300.5 亿美元,预计到 2030 年将达到 531.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.07%。

亚太地区自动化物料输送市场正日益以中国为核心,推动其强劲的经济成长。製造业等产业推动了大部分经济活动,供应链也变得越来越复杂。

主要亮点

- 一些亚太国家的仓库空间变得越来越有限。预计这些地区将会出现更多的多层设施和走道狭窄的高层仓库。这些趋势预计将推动对物料输送系统的需求。

- 印度等新兴亚洲国家正大力投资物料输送设备。据威斯康辛州经济发展局称,印度物料输送设备(MHE)市场约占该国施工机械行业13%的市场占有率,近期呈现显着成长趋势。

- 亚太地区已成为全球最大的电子商务中心之一。受中国、印度和印尼中产阶级人口不断增长以及行动小工具普及的推动,该地区零售电子商务迅速增长。光是中国就占全球零售电子商务销售额的40%。

- 在食品和饮料行业,由于对自动化的需求不断增长,自动化的引入正在增加。自动化技术使这些公司能够以相对较少的时间和精力进行业务。例如,可口可乐在新加坡开设了一个价值约 5700 万美元的仓库,并安装了自动储存和搜寻系统。

- 印度等新兴亚洲国家正大力投资物料输送设备。据威斯康辛州经济发展局称,印度物料输送设备(MHE)市场约占该国施工机械行业13%的市场占有率,近期呈现显着成长趋势。

- 新冠疫情重创了中国、日本和印度等主要国家,由于几乎所有生产、物流和仓储都处于封锁状态,预计将影响整个 2022 年的市场成长。标准操作程序已经发生了变化,带来了社交距离和非接触式操作的独特挑战。组织被迫限制劳动力以应对日益增长的需求。

亚太地区自动化物料输送(AMH) 市场趋势

机场占据最大的市场占有率

- 许多国家已经意识到投资机场的重要性,因为乘客更有可能在舒适、无压力的环境中度过他们的时间和金钱。大型和小型机场使用输送机和分类系统有效地减少了从报到登机过程中的许多不便。这确保客户拥有无忧的体验。

- 印度和中国由于人均GDP的不断增长和国内航空连通性的不断提高,成为该地区航空业发展的主要贡献者。例如,根据国际民航组织的数据,亚太地区国内交通运输份额为70%。

- 预计未来几年中国航空市场将经历显着增长,因为中国三大航空公司——中国国际航空、中国南方航空和中国东方航空——均制定了雄心勃勃的机队计划,将使它们跻身全球最大航空公司之列。中国上海和北京等主要机场也正在进行大规模扩建计画。

- 根据中国旅游出境研究所预测,到2030年终,中国游客出境旅游人数预计将达到约4亿人次,光是中国游客就将占到国际观光的四分之一。为了全面支持这一成长,机场需要先进的系统。预计这将对预测期内的市场成长产生积极影响。

中国占很大市场占有率

- 中国是亚太地区 AMH 市场成长的主要贡献者。製造业、汽车业和电子商务等行业对 AMH 产品的需求不断增加,积极推动了市场成长。

- 中国人口众多,推行产业政策。以PPP(购买力平价)计算,中国是世界最大经济体和出口大国。中国目前正在从製造业和建设业主导的经济转型为消费主导的经济。

- 该十年规划于2015年5月出台,是中国政府为推动产业向全球价值链中高端转移和培育若干先进製造业丛集製定的一项竞标。

- 透过引入自动化製造,中国预计2025年将生产成本降低30%。技术纯熟劳工的短缺,加上独生子女政策和劳动力老化,要求企业适度减少工作活动以维持职场的生产效率。

亚太地区自动化物料输送(AMH) 产业概况

亚太地区自动化物料输送市场分散且竞争激烈。推出产品、高额研发支出、伙伴关係和收购是国内公司为维持激烈竞争所采取的主要成长策略。

- 2022 年 1 月 - Wise Robotics 与 VisionNav Robotics 合作,为英国仓库带来进一步创新。透过此次合作,VisionNavi 的创新技术将成为 Wise Robotics 产品组合的一部分。这有望帮助英国企业降低营运面临供应链挑战的仓库的持续成本并提高其订单履行能力。

- 2021 年 12 月-凯傲集团宣布在中国开设新的堆高机工厂,进军亚太地区。此次扩建属于直接资金筹措活动,预计中期将为济南创造1,000多个新的就业机会。 Geek 平衡重型卡车工厂和附近的供应链解决方案附加工厂以及研发和技术中心总价值约为 1.4 亿欧元。就业机会的创造和直接投资表明该地区研究市场的经济正在健康成长。

- 2021 年 11 月-永恆力集团 (Jungheinrich AG) 收购了位于慕尼黑的自主移动机器人 (AMR) 开发商 arculus GmbH,收购金额未公开。 Arclas 设计和製造用于行动自动化的 AMR、模组化製造平台和软体解决方案。透过此次收购,永恆力为其自动化系统产品组合添加了针对快速成长的 AMR 领域的硬体和软体解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 技术进步不断推动市场成长

- 工业 4.0 投资推动对自动化和物料输送的需求

- 电子商务快速成长

- 市场挑战/限制

- 初期成本高

- 技术纯熟劳工短缺

第六章 市场细分

- 依产品类型

- 硬体

- 软体

- 服务

- 依设备类型

- 移动机器人

- 自动导引运输车(AGV)

- 自动堆高机

- 汽车牵引车/拖拉机/拖曳船

- 单元货载

- 组装

- 特殊用途

- 自主移动机器人(AMR)

- 雷射导引车

- 自动储存和搜寻系统 (ASRS)

- 固定巷道(堆垛机高机+穿梭车系统)

- 旋转木马(水平旋转木马+垂直旋转木马)

- 垂直升降模组

- 自动输送机

- 腰带

- 滚筒

- 调色盘

- 开卖

- 堆垛机

- 常规型(高电位+低电位)

- 机器人

- 分类系统

- 移动机器人

- 按最终用户产业

- 飞机场

- 车

- 饮食

- 零售/仓储/配送中心/物流中心

- 一般製造业

- 药品

- 邮政和小包裹

- 其他最终用户

- 按国家

- 中国

- 日本

- 印尼

- 印度

- 澳洲

- 泰国

- 韩国

- 新加坡

- 马来西亚

- 台湾

- 其他亚太地区

第七章 竞争格局

- 公司简介

- DAIFUKU Co. Ltd.

- Kardex Group

- KION Group

- JBT Corporation

- Jungheinrich AG

- SSI Schaefer AG

- VisionNav Robotics

- System Logistics

- BEUMER Group GmbH & Co. KG

- Interroll Group

- Witron Logistik

- Kuka AG

- Honeywell Intelligrated Inc.

- Murata Machinery Ltd

- Toyota Industries Corporation

第八章投资分析

第九章:市场的未来

The APAC AMH Market size is estimated at USD 30.05 billion in 2025, and is expected to reach USD 53.12 billion by 2030, at a CAGR of 12.07% during the forecast period (2025-2030).

The automated material handling market in the Asia Pacific region is becoming increasingly integrated, with China as the core, bolstering its strong economic growth. Sectors, such as manufacturing, have driven much of this economic activity and have increasingly made supply chains complex.

Key Highlights

- In some Asia Pacific countries, the land for warehousing is becoming increasingly limited. In these areas, warehouses are expected to increase, with multi-story facilities and taller, narrower aisles. These trends are expected to drive the demand for material handling systems.

- Developing countries in Asia, such as India, significantly invest in material handling equipment. According to the Wisconsin Economic Development Corporation, the Indian market for materials handling equipment (MHE), accounting for about 13% of the market share of the country's construction equipment industry, witnessed significant growth in the recent past.

- The Asia Pacific emerged as one of the world's largest e-commerce hubs. The region witnessed a rapid growth in retail e-commerce, owing to the rising middle-class population in China, India, and Indonesia, along with the popularity of mobile gadgets. China alone accounts for 40% of the world's retail e-commerce sales.

- The food & beverage industry is witnessing high adoption of equipment due to the rising demand for automation. The automated technologies will allow these companies to perform their tasks in comparatively less time and effort. For instance, the Coca-Cola company has opened warehouses in Singapore valued at around USD 57 million to have automated storage and retrieval systems.

- Developing countries in Asia, such as India, significantly invest in material handling equipment. According to the Wisconsin Economic Development Corporation, the Indian market for materials handling equipment (MHE), accounting for about 13% of the market share of the country's construction equipment industry, witnessed significant growth in the recent past.

- The COVID-19 pandemic, which hit major countries like China, Japan, and India severely, is expected to influence the market's growth during 2022, as almost all production, logistics, and warehouses are under lockdown. Bringing unique challenges of social distancing and contactless operation has changed the standard operating procedure. Organizations were forced to limit the workforce and deal with the increasing demand.

APAC Automated Material Handling (AMH) Market Trends

Airports to Hold a Dominant Market Share

- Several countries realize the importance of investing in airports, as passengers are more likely to spend time and money in a pleasant and stress-free ambiance. The use of conveyors and sortation systems in major and small airports effectively reduces several inconveniences, from check-in to onboarding. This provides customers with a hassle-free experience.

- India and China are major contributors to the aviation industry developments in the region, owing to increasing per capita GDP and domestic air connectivity. For instance, according to the ICAO, Asia Pacific recorded 70% of the domestic traffic share.

- The Chinese aviation market is expected to witness significant growth over the next few years, as its three largest airlines, such as Air China, China Southern, and China Eastern, have ambitious fleet plans that will put their sizes at the top of airlines globally. China's major airports in Shanghai and Beijing are also undergoing major expansion plans.

- According to the Chinese Tourism Outbound Research Institute, by the end of 2030, the number of outbound trips made by Chinese travelers is expected to reach approximately 400 million, and Chinese tourists alone are likely to account for a quarter of international tourism. To ensure adequate support for such growth, airports need to have advanced systems. This is expected to impact the market's growth positively over the forecast period.

China to Hold Significant Market Share

- China has been a prominent contributor to the growth of the AMH market in the Asia Pacific region. The increasing demand for AMH products across industries, such as manufacturing, automotive, and e-commerce, is positively boosting the market's growth.

- China has a vast population and pursues an industrial policy. Measured on the PPP basis, the country became the world's largest economy and exporter, and trader during the current decade. The country is currently passing through the transition state of being manufacturing- and construction-led economy to a consumer-led economy.

- The ten-year plan, introduced in May 2015, is the government's bid to shift the industries up to the medium-high end of the global value chain and foster several advanced manufacturing clusters.

- With the adoption of automation in manufacturing, China is expected to cut manufacturing costs by 30% by 2025. The dearth of skilled labor, complicated by the one-child policy and an aging workforce, requires job activities to be eased to maintain productivity at work.

APAC Automated Material Handling (AMH) Industry Overview

The Asia Pacific automated material handling market is fragmented and highly competitive in nature. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the country to sustain the intense competition.

- January 2022 - Wise Robotics partnered VisionNavRobotics to bring greater innovation to UK warehouses. The collaboration means VisionNav'sinnovative technology is expected to be available as part of the Wise Robotics range. This is expected to help UK operators increase order fulfillment and reduce the ongoing costs related to running a warehouse in the face of well-documented supply chain challenges.

- December 2021- KION Group announced the expansion in its Asia Pacific operations by opening a new forklift plant in China. Such expansion indicates direct funding activities and is expected to create more than 1,000 new jobs in Jinan in the medium term. The total volume for the Geek's counterbalance truck plant and an additional plant for supply chain solutions in the immediate vicinity, plus an R&D center and a technology center, comes to around EUR 140 million. Alongside the direct investment, the creation of jobs indicates the growth of a healthy economy surrounding the studied market in the region.

- November 2021 - Jungheinrich AG acquired arculus GmbH, a Munich-based autonomous mobile robot (AMR) developer, for an undisclosed amount. Arculus designs and manufactures AMRs, modular production platforms, and software solutions for mobile automation. Through this acquisition, Jungheinrich added hardware and software solutions in the rapidly-growing AMR sector to its portfolio of automation systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Technological Advancments Aiding Market Growth

- 5.1.2 Industry 4.0 Investments Driving The Demand For Automation And Material Handling

- 5.1.3 Rapid Growth In E-commerce

- 5.2 Market Challenges/restraints

- 5.2.1 High Initial Costs

- 5.2.2 Unavailability Of Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Equipment Type

- 6.2.1 Mobile Robots

- 6.2.1.1 Automated Guided Vehicle (AGV)

- 6.2.1.1.1 Automated Forklift

- 6.2.1.1.2 Automated Tow/Tractor/Tug

- 6.2.1.1.3 Unit Load

- 6.2.1.1.4 Assembly Line

- 6.2.1.1.5 Special Purpose

- 6.2.1.2 Autonomous Mobile Robots (AMR)

- 6.2.1.3 Laser Guided Vehicle

- 6.2.2 Automated Storage and Retrieval System (ASRS)

- 6.2.2.1 Fixed Aisle (Stacker Crane + Shuttle System)

- 6.2.2.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 6.2.2.3 Vertical Lift Module

- 6.2.3 Automated Conveyor

- 6.2.3.1 Belt

- 6.2.3.2 Roller

- 6.2.3.3 Pallet

- 6.2.3.4 Overhead

- 6.2.4 Palletizer

- 6.2.4.1 Conventional (High Level + Low Level)

- 6.2.4.2 Robotic

- 6.2.5 Sortation System

- 6.2.1 Mobile Robots

- 6.3 By End-user Vertical

- 6.3.1 Airport

- 6.3.2 Automotive

- 6.3.3 Food and Beverage

- 6.3.4 Retail/Warehousing/ Distribution Centers/Logistic Centers

- 6.3.5 General Manufacturing

- 6.3.6 Pharmaceuticals

- 6.3.7 Post and Parcel

- 6.3.8 Other End-Users

- 6.4 By Country

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 Indonesia

- 6.4.4 India

- 6.4.5 Australia

- 6.4.6 Thailand

- 6.4.7 South Korea

- 6.4.8 Singapore

- 6.4.9 Malaysia

- 6.4.10 Taiwan

- 6.4.11 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DAIFUKU Co. Ltd.

- 7.1.2 Kardex Group

- 7.1.3 KION Group

- 7.1.4 JBT Corporation

- 7.1.5 Jungheinrich AG

- 7.1.6 SSI Schaefer AG

- 7.1.7 VisionNav Robotics

- 7.1.8 System Logistics

- 7.1.9 BEUMER Group GmbH & Co. KG

- 7.1.10 Interroll Group

- 7.1.11 Witron Logistik

- 7.1.12 Kuka AG

- 7.1.13 Honeywell Intelligrated Inc.

- 7.1.14 Murata Machinery Ltd

- 7.1.15 Toyota Industries Corporation