|

市场调查报告书

商品编码

1686666

物料输送(AMH) -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Automated Material Handling (AMH) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

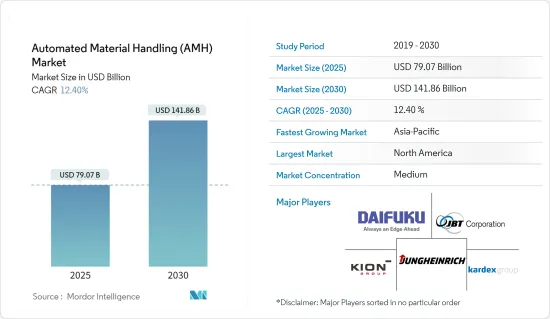

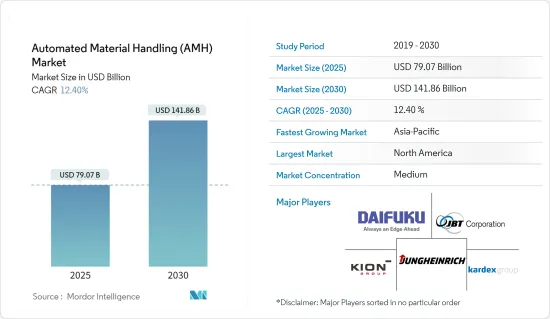

物料输送市场规模预计在 2025 年为 790.7 亿美元,预计到 2030 年将达到 1,418.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.4%。

主要亮点

- 技术进步、人事费用和安全问题的上升、製造和仓储业务效率的提高、全球製造业的显着復苏、工业部门对自动化的需求不断增长、製造单位和仓储设施对机器人的需求不断增加以及新兴市场的成长是推动物料输送市场发展的关键因素。其他优势包括供应链业务数位化以及订单客製化和个人化程度的提高,将在预测期内进一步推动市场发展。

- 物料输送(AMH) 系统简化了各种环境中的物料运输,包括製造工厂、仓库、零售店、机场和物流中心。这些系统促进了同一区域内、部门之间甚至不同建筑物之间的材料无缝移动。 AMH 系统依赖製造执行系统 (MES) 指定的路线。这些系统采用多种技术,包括光学字元辨识 (OCR)、条码、RFID、超宽频室内追踪和近距离通讯。

- 在过去的 70 年里,物料输送发生了重大变革,重塑了产业格局。机器和机器人正在取代体力劳动,刺激各行业的成长。汽车产业尤其突出,实现了令人印象深刻的十倍扩张。加拿大在工业 4.0 和先进製造业方面的进步正在彻底改变各种气候条件下产品的设计、交货和维护方式。从机器人和自动化到积层製造(3D 列印),这些技术正在电子商务、汽车、农业和製药等广泛的领域中得到效用。加拿大的创新者不仅在国内市场,而且在竞争激烈的全球舞台上,在创造尖端、高价值产品方面都处于领先地位。他们的努力不仅改善了当地的做法,而且为确定先进自动化技术发展轨蹟的合作项目奠定了基础。

- 儘管第一台 AGV 于 1953 年首次亮相,但各种因素阻碍了其在生产和仓库管理企业中的广泛应用。典型的自动导引运输车的成本在 6 万至 10 万美元之间,但具有导航辅助设备和感测器等先进功能的系统的成本可能会高得多。这些高昂的前期成本加上维护挑战正在减缓市场成长。大公司正在努力控製成本,同时不影响创新和研发投资。

- COVID-19 疫情对各行业的自动化应用产生了重大影响,重塑了业务规范,并带来了社交距离和非接触式操作等挑战。各组织面临需求激增和劳动力减少的问题,促使他们实施加强的安全通讯协定。自2020年以来,病毒在美国工人中的蔓延迫使企业迅速实施新的安全措施。虽然食品製造业等一些行业因病毒严重程度而停工,但许多其他行业采取了严格的卫生措施来维持营运。

物料输送(AMH) 市场趋势

工业 4.0 投资正在推动市场成长

- 随着各国采用工业 4.0 和物联网技术,市场的发展受到推动。透过使用机器人技术,工业 4.0 正在彻底改变物料输送的方式。机器人技术在仓库和配送设施中变得越来越普遍。例如,国际机器人联合会报告称,美国製造商将大力投资自动化,到 2023 年,安装的工业机器人总合将增加 12%,达到 44,303 台。除了挑选和包装订单、装卸卡车,甚至清洁仓库地板之外,机器人还可以用于这些任务。机器人提高了职场的准确性和生产力。机器人还可以帮助公司减少所需的体力劳动量,从而降低成本。

- 例如,仓库太大,员工必须走很远的距离才能找到 SKU 并将订单送到包装和运输区域。每年,平均每个仓库因不必要的走动和其他移动而浪费 6.9 週的时间,相当于 2.65 亿个工时和 43 亿美元的成本。协作机器人也最大限度地减少了分类过程每个阶段在功能区域之间长途行走的需要。物料输送设备订单的增加可能会极大地推动所研究的市场。

- 此外,机器人、自动化和积层製造(3D列印)等技术在加拿大电子商务、汽车、农业和製药等行业有着广泛的应用。加拿大的创新者正在为国内市场和竞争激烈的全球市场整合技术复杂、高价值的产品,共用成熟的实务经验,并为塑造先进自动化技术未来的合作奠定基础。

- 德国也正从自主性、互通性和永续性三个策略行动领域着力实现2030年工业4.0愿景。在2030愿景中,工业4.0平台相关人员提出了形成数位生态系统的整体方法。目标是根据社会市场经济的要求来建构未来资料经济的框架,强调开放的生态系统、多样性并支持所有市场相关人员之间的竞争,同时结合德国工业基础在自动化市场的具体情况和既有优势。

- 此外,政府对收购项目的大力支持使中国能够迈向工业4.0。例如,中国工业机器人製造商新松科技隶属于中国科学院,并与政府合作。各企业采用工业控制系统是国内的显着趋势。先进的系统使工厂生产变得更加容易。这也显示公司正逐渐从依赖体力劳动转向能够实现设备自动化的先进技术系统。

- 影响所研究市场的关键趋势是对智慧製造技术的关注。根据 IBEF 的资料,印度政府设定了一个雄心勃勃的目标,即到 2025 年将製造业产出国内生产总值) 的贡献从 16% 提高到 25%。智慧先进製造和快速转型中心 (SAMARTH) Udyog Bharat 4.0倡议旨在提高印度製造业对工业 4.0 的认识,并使相关人员能够应对与自动化和物料输送相关的挑战。

亚太地区可望成为成长最快的市场

- 中国是亚太地区 AMH 市场成长的主要贡献者。製造业、汽车业和电子商务等行业对 AMH 产品的需求不断增长,推动着市场的成长。中国人口众多,推行产业政策。以购买力平价(PPP)计算,过去十年来,中国已成为世界最大经济体、世界最大出口国和贸易国。中国目前正在从製造业和建设业主导的经济转型为消费主导的经济。

- 根据中国国家统计局的预测,2023年中国社会消费品市场零售总额约为418,605亿元人民币(57,863.1亿美元)。中国网购人数正在迅速增加,从2006年的不到3,400万人增加到2023年的9.15亿多人,推动了中国电子商务业务的蓬勃发展。因此,随着电子商务的成长,预测几年内对物料输送设备的需求可能会增加。

- 日本主要是製造业国家。日本製造业对名义GDP的贡献率接近20%,而其他已开发国家这一数字接近10%。国际货币基金组织表示,由于资讯通信技术的广泛应用,日本製造业的工业生产力成长速度超过了服务业。汽车和电子产业是全国生产力最高的製造业产业。

- 在工业贡献和「印度製造」宣传活动的推动下,政府增加了对基础设施的投资,这可能会刺激对自动化物料输送(AMH) 系统的需求。鑑于製造业占印度GDP的17%并僱用了超过2730万人,其在该国经济状况中的重要性是不可否认的。印度政府已设定了2025年实现製造业占经济产出的25%的愿景,并正在实施各种措施和政策。因此,製造业正准备迎接工业 4.0 和其他数位转型,以实现这一雄心勃勃的目标。

- 韩国已经迎来了第四次工业革命。在韩国,智慧工厂将是最重要的领域之一。在韩国,私营和公共部门都致力于增加该国智慧工厂的数量。韩国的目标是雄心勃勃:到 2023 年,在全国范围内运作30,000 家配备最新数位和分析技术的尖端工厂。此外,还计划在 2030 年建立 20 个智慧工业,以应对韩国劳动年龄人口的下降。作为该计划的一部分,目标是到 2030 年建立 2,000 家新的人工智慧智慧工厂,以跟上第四次工业革命数位化和自动化的快速步伐。

物料输送(AMH) 产业概览

物料输送(AMH) 市场具有半刚性和高度竞争的特性。为了在激烈的竞争中生存,市场的主要企业主要依靠产品发布、大量投资研发、建立伙伴关係和收购等策略。

- 2024 年 5 月,林德物料输送设备着名製造商 KION North America(KION NA)与 Fox Robotics 建立策略性、非独家伙伴关係。作为合作的一部分,KION NA 将在其位于南卡罗来纳州萨默维尔的最先进的工厂製造和组装FoxBot 的自动拖车装载机/卸载机 (ATL)。

- 2023 年 11 月,物料输送的先驱丰田物料输送(TMH) 推出了三款尖端电动堆高机车型。这些新模型增强了 TMH 已经广泛的物料输送解决方案系列。这三种型号包括侧入式端部驾驶室、中心驾驶式堆垛机和工业牵引车。这些车型承诺提高效率、多功能性和一流的性能,同时注重驾驶员的舒适度。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 疫情对市场的影响

第五章市场动态

- 市场驱动因素

- 技术进步不断推动市场成长

- 工业 4.0 投资推动自动化和物料输送需求

- 电子商务领域快速成长

- 市场挑战

- 初始设备成本高

- 技术纯熟劳工短缺

第六章市场区隔

- 依产品类型

- 硬体

- 软体

- 服务

- 依设备类型

- 移动机器人

- 自动导引运输车(AGV)

- 自主移动机器人(AMR)

- 自动储存和搜寻系统

- 固定通道

- 旋转木马

- 垂直升降模组

- 自动输送机

- 腰带

- 滚筒

- 调色盘

- 开卖

- 堆垛机

- 传统的

- 机器人

- 分类系统

- 移动机器人

- 按最终用户

- 飞机场

- 车

- 食品和饮料

- 零售/仓储/配送中心/物流中心

- 一般製造业

- 製药

- 邮政和小包裹

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 法国

- 义大利

- 西班牙

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章竞争格局

- 公司简介

- Daifuku Co. Ltd

- Kardex Group

- KION Group AG

- JBT Corporation

- Jungheinrich AG

- TGW Logistics Group GmbH

- SSI Schaefer AG

- KNAPP AG

- Mecalux SA

- System Logistics SpA

- Viastore Systems GmbH

- BEUMER Group GmbH & Co. KG

- Interroll Holding AG

- WITRON Logistik

- Siemens AG

- KUKA AG

- Honeywell Intelligrated Inc.(Honeywell International Inc.)

- Murata Machinery Ltd

- Toyota Industries Corporation

- Visionnav Robotics

- Dearborn Mid-West Company

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 53959

The Automated Material Handling Market size is estimated at USD 79.07 billion in 2025, and is expected to reach USD 141.86 billion by 2030, at a CAGR of 12.4% during the forecast period (2025-2030).

Key Highlights

- Technological advancements, rising labor costs and safety concerns, improved efficiency in manufacturing and warehouse operations, a significant recovery in global manufacturing, increasing demand for automation in industries, growing need for robots in manufacturing units and warehousing facilities, and the growth of emerging markets are key factors driving the automated material handling market. Additionally, the market will benefit from the expanding digitization of supply chain operations, further supported by increasing order customization and personalization during the forecast period.

- Automated Material Handling (AMH) systems streamline the movement of materials across various settings, including manufacturing facilities, warehouses, retail outlets, airports, and logistics centers. These systems facilitate the seamless transfer of materials, whether within the same area, across departments, or even between distinct buildings. AMH systems rely on routes designated by the manufacturing execution system (MES). These systems employ various technologies, including optical character recognition (OCR), barcodes, RFID, ultra-wideband indoor tracking, and near-field communication.

- Over the past seven decades, material handling has undergone significant transformations, reshaping the industry's landscape. Machines and robots have largely supplanted manual labor, catalyzing growth across sectors. Notably, the automotive industry stands out, boasting a remarkable tenfold expansion. Canada's advancements in Industry 4.0 and cutting-edge manufacturing are revolutionizing product design, delivery, and maintenance, even in diverse climates. From robotics and automation to additive manufacturing (3D printing), these technologies find broad utility in sectors spanning e-commerce, automotive, agriculture, and pharmaceuticals. Canadian innovators are spearheading the creation of sophisticated, high-value products, not only for domestic markets but also for a fiercely competitive global arena. Their initiatives not only elevate local practices but also set the stage for collaborative ventures that will define the trajectory of advanced automation technologies.

- While the first AGV debuted in 1953, widespread adoption across production and warehousing firms has been hindered by various factors, with cost being a primary concern. A typical guided vehicle is priced between USD 60,000 and 100,000, but systems with advanced features like navigation aids and sensors can be considerably pricier. These high upfront costs, coupled with maintenance challenges, are dampening the market's growth. Leading firms are striving to control costs without compromising on innovation or R&D investments.

- The COVID-19 pandemic has significantly impacted the adoption of automation across sectors, reshaping operational norms and introducing challenges such as social distancing and contactless operations. Organizations faced surging demands and reduced workforces, prompting the implementation of enhanced safety protocols. Since 2020, the outbreak affected the US workers, compelling companies to adopt new safety measures swiftly. While some industries, like food production, experienced shutdowns due to the virus's severity, many others adapted by incorporating stringent health measures to sustain operations.

Automated Material Handling (AMH) Market Trends

Industry 4.0 Investments Significantly Drive the Market's Growth

- The market is driven by the developments occurring due to countries adopting Industry 4.0 and IOT technologies. Through the use of robotics, industry 4.0 is revolutionizing how material handling is done. In warehouses and distribution facilities, robotics is becoming more and more prevalent. For instance, the International Federation of Robotics reported that US manufacturers heavily invested in automation, leading to a 12% increase in industrial robot installations, totaling 44,303 units in 2023. In addition to picking and packaging orders, loading and unloading trucks, and even cleaning the warehouse floor, they can also be employed for these activities. Workplace accuracy and productivity can both be enhanced by robotics. Robots can also enable company save money by lowering the quantity of necessary manual work.

- For instance, as warehouses are huge, associates must walk considerable distances to locate SKUs and deliver orders to the packing and shipping regions. Every year, an average warehouse wastes 6.9 weeks on unnecessary walking and other movements, equating to 265 million hours of work at the cost of USD 4.3 billion. During each stage of the selection process, collaborative robots also minimize the need for extended walks between functional areas. The rise in material handling equipment orders will significantly drive the studied market.

- Moreover, robotics, automation, and technologies like additive manufacturing (3D printing) have a wide range of applications in Canadian industries such as e-commerce, automotive, agriculture, and pharmaceuticals. Canadian innovators are producing a comprehensive range of technologically complex, increased-value products for domestic and competitive global markets, sharing enhanced practices and laying the groundwork for collaborations that shape the future of advanced automation technologies.

- Germany is also focused on the 2030 vision for Industry 4.0 in three strategic fields of action: autonomy, interoperability, and sustainability. In this 2030 vision, the stakeholders of the platform Industry 4.0 present a holistic approach to shaping the digital ecosystem. The goal is to create a framework for a future data economy that is by the demands of a social market economy, emphasizing open ecosystems, diversity, and supporting competition between all market stakeholders based on the specific situation and established strengths of the German industry base for the automation market.

- Furthermore, the government's strong support in the acquisition program has enabled China to move toward Industry 4.0. For instance, Siasun, a China-based industrial robot maker, is affiliated with the Chinese Academy of Sciences, which is further linked to the government. The country's adoption of industrial control systems by various companies is a notable trend. The advanced systems allow ease of production in factories. This also points to the gradual shift of companies from depending on manual labor to advanced technology-based systems that will enable the facility's automation.

- A significant trend impacting the market studied is the focus on smart manufacturing practices. According to the data from IBEF, the Government of India set an ambitious target of increasing manufacturing output contribution to 25% of the gross domestic product (GDP) by 2025 from 16%. The Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0 initiative aims to enhance awareness about Industry 4.0 within the Indian manufacturing industry and enable stakeholders to address challenges related to automation material handling.

Asia-Pacific is Expected to be the Fastest Growing Market

- China has been a prominent contributor to the growth of the Asia-Pacific AMH market. The increasing demand for AMH products across industries, such as manufacturing, automotive, and e-commerce, boosts the market's growth. China has a vast population and pursues an industrial policy. Measured on the PPP basis, the country became the largest global economy and the largest global exporter and trader during the current decade. The country is currently transitioning from a manufacturing and construction-led economy to a consumer-led economy.

- According to China's National Bureau of Statistics, total retail sales in China's consumer products market were around CNY 41,860.5 billion (USD 5786.31 billion) in 2023. The number of Chinese online buyers has risen rapidly from under 34 million in 2006 to over 915 million in 2023, enabling China's e-commerce business to proliferate. Hence, with growing e-commerce, the demand for material-handling equipment will likely rise in the forecasted years.

- Japan is predominantly a manufacturing nation. Its manufacturing industry contributes close to 20% to the nominal GDP, whereas it is close to 10% for other developed countries. According to the IMF, the country's manufacturing sector has achieved significant industrial productivity gains over the services sector, owing to the increased adoption of ICT. The automotive and electronics sectors are the most productive manufacturing sectors in the country.

- The government's heightened infrastructure investments, bolstered by industry contributions and the 'Make in India' campaign, are set to propel the demand for automated material handling (AMH) systems. Given that the manufacturing sector accounts for 17% of India's GDP and employs over 27.3 million individuals, its significance in the nation's economic landscape is undeniable. With a vision to derive 25% of the economy's output from manufacturing by 2025, the Indian government is rolling out various initiatives and policies. Consequently, manufacturers are gearing up to embrace Industry 4.0 and other digital innovations to meet this ambitious goal.

- South Korea adopted the 4th Industrial Revolution. In Korea, smart factories will be one of the most important fields. Both the private and public sectors in Korea have committed to ramping up the number of domestic smart factories. Their target is ambitious: they aim to have 30,000 such cutting-edge factories equipped with the latest digital and analytical technologies up and running across the nation by 2023. Furthermore, in a bid to counteract Korea's shrinking working-age population, there are plans to establish 20 smart industrial zones by 2030. As part of this initiative, the goal is to set up 2,000 new AI-powered smart factories by 2030, aligning with the rapid pace of digitalization and automation characteristic of the fourth industrial revolution.

Automated Material Handling (AMH) Industry Overview

The automated material handling (AMH) market is characterized by semi-consolidation and high competitiveness. Key players in the market primarily rely on strategies like product launches, significant investments in R&D, and forming partnerships or making acquisitions to navigate the fierce competition.

- In May 2024, KION North America (KION NA), a prominent manufacturer of Linde Material Handling equipment, and Fox Robotics entered into a strategic non-exclusive partnership. As part of this collaboration, KION NA is expected to manufacture and assemble FoxBot autonomous trailer loader/unloaders (ATLs) at its state-of-the-art facilities in Summerville, South Carolina.

- In November 2023, Toyota Material Handling (TMH), a pioneer in material handling, unveiled three cutting-edge electric forklift models. These additions bolster TMH's already extensive range of material handling solutions. The trio includes a Side-Entry End Rider, a Center Rider Stacker, and an Industrial Tow Tractor. These models promise heightened efficiency, versatility, and top-tier performance, all while emphasizing operator comfort.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Incremental Technological Advancements aiding the Market's Growth

- 5.1.2 Industry 4.0 Investments driving the Demand for Automation and Material Handling

- 5.1.3 Rapid Growth of the E-commerce Sector

- 5.2 Market Challenges

- 5.2.1 High Initial Equipment Costs

- 5.2.2 Unavailability for Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Equipment Type

- 6.2.1 Mobile Robots

- 6.2.1.1 Automated Guided Vehicle (AGV)

- 6.2.1.2 Autonomous Mobile Robot (AMR)

- 6.2.2 Automated Storage and Retrieval System

- 6.2.2.1 Fixed Aisle

- 6.2.2.2 Carousel

- 6.2.2.3 Vertical Lift Module

- 6.2.3 Automated Conveyor

- 6.2.3.1 Belt

- 6.2.3.2 Roller

- 6.2.3.3 Pallet

- 6.2.3.4 Overhead

- 6.2.4 Palletizer

- 6.2.4.1 Conventional

- 6.2.4.2 Robotic

- 6.2.5 Sortation System

- 6.2.1 Mobile Robots

- 6.3 By End User

- 6.3.1 Airport

- 6.3.2 Automotive

- 6.3.3 Food And Beverages

- 6.3.4 Retail/Warehousing/Distribution Centers/Logistic Centers

- 6.3.5 General Manufacturing

- 6.3.6 Pharmaceuticals

- 6.3.7 Post and Parcel

- 6.3.8 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 France

- 6.4.2.3 Italy

- 6.4.2.4 Spain

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 United Arab Emirates

- 6.4.6.2 Saudi Arabia

- 6.4.6.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daifuku Co. Ltd

- 7.1.2 Kardex Group

- 7.1.3 KION Group AG

- 7.1.4 JBT Corporation

- 7.1.5 Jungheinrich AG

- 7.1.6 TGW Logistics Group GmbH

- 7.1.7 SSI Schaefer AG

- 7.1.8 KNAPP AG

- 7.1.9 Mecalux SA

- 7.1.10 System Logistics SpA

- 7.1.11 Viastore Systems GmbH

- 7.1.12 BEUMER Group GmbH & Co. KG

- 7.1.13 Interroll Holding AG

- 7.1.14 WITRON Logistik

- 7.1.15 Siemens AG

- 7.1.16 KUKA AG

- 7.1.17 Honeywell Intelligrated Inc. (Honeywell International Inc.)

- 7.1.18 Murata Machinery Ltd

- 7.1.19 Toyota Industries Corporation

- 7.1.20 Visionnav Robotics

- 7.1.21 Dearborn Mid-West Company

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219