|

市场调查报告书

商品编码

1644384

游戏 GPU:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Gaming GPU - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

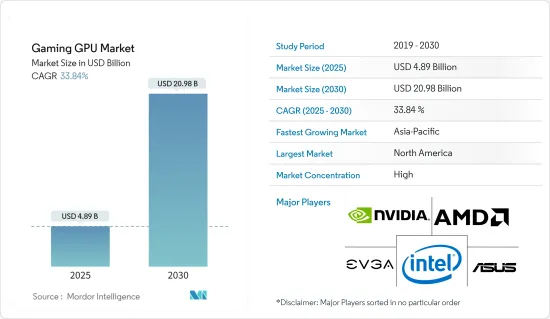

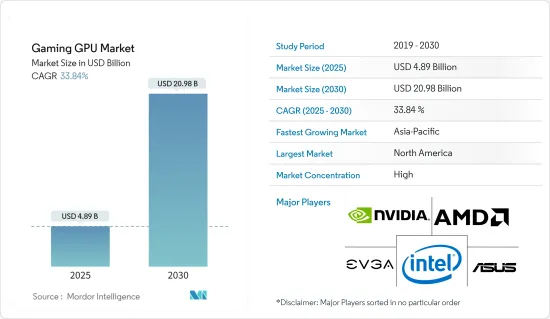

游戏 GPU 市场规模预计在 2025 年为 48.9 亿美元,预计到 2030 年将达到 209.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 33.84%。

千禧世代中游戏化的趋势日益增长,为电玩玩家引入了虚拟世界。游戏设备也从餐厅、游乐场和酒吧中强大的基于位置的设备演变为游戏机和个人电脑形式的家用设备。由于摩尔定律的影响,晶片价格下降、性能提升,人们购买了更多的家用游戏机,这产生了正的价格弹性效应,但以牺牲基于位置的游戏机为代价。随着近年来游戏机销售量的增加,游戏 GPU 的需求也大幅成长。

主要亮点

- 随着智慧型手机、平板电脑、个人电脑和游戏机在游戏方面的日益普及,对图形密集型游戏的高阶运算系统的需求也日益增加。对于能够处理游戏所需的 2D 和 3D 图形相关的复杂数学计算的专用处理器的需求不断增长,推动了 GPU 市场的需求。

- 高效能运算的技术进步也可能为 GPU 供应商带来机会。例如,今年 4 月,Nvidia 宣布研究人员利用搭载 NVIDIA GPU 的超级电脑在 4 月 25 日发现了哈伯资料中的趋势。高效能运算使用 NVIDIA GPU 来更好地了解每个行星并分析其恶劣的大气。

- 其他市场驱动因素包括汽车、製造、房地产和医疗保健等行业,这些行业对支援图形应用和 3D 内容的处理器的使用正在增加。例如,在汽车製造和设计应用中,CAD 和模拟软体使用 GPU 为关键应用创建逼真的图像和动画。

- 游戏 GPU 使用先进的技术和材料。当前 GPU 如此昂贵的主要因素之一是其製造成本高。生产者只能生产他们能负担的材料。由于生产成本上升,生产商希望在不牺牲产品品质或数量的情况下实现利润最大化,这导致 GPU 的销售价格上涨。由于前期投资庞大,消费者更愿意为他们的装置配备最新的游戏 GPU 以外的其他产品,这对市场成长构成了挑战。

- 现代游戏机和伺服器利用许多包含游戏 GPU 电路的元件。由于供应链问题,COVID-19 已经威胁到许多零件的平均产量。不过,随着半导体代工厂开始恢復生产,市场上厂商的热情又重新高涨。对云端运算、游戏、资料中心伺服器、自动化和人工智慧技术的需求可能有助于 GPU 製造商在疫情后半段恢復成长。

游戏 GPU 市场趋势

对游戏主机、扩增实境(AR) 和虚拟实境 (VR) 的需求不断增长,推动着市场

随着电子竞技和其他线上游戏的兴起,主机电玩游戏也呈现成长势头,并将在未来几年带来进一步的成长机会。由于这一趋势,连接和娱乐提供商将能够透过提供与主机相关的视讯服务(例如高速宽频和现场体育赛事)来瞄准主机玩家,并透过 OTT 服务最佳地将观众收益。电玩游戏开发商可以为游戏发送服务提供溢价,包括访问电子竞技活动和原创内容。

- 近年来,由于云端游戏的兴起,GPU 市场一直呈现上升趋势。 Shadow 由法国新兴企业Blade 经营,这是一家为游戏玩家提供云端处理服务的公司,玩家只需每月支付一定费用即可存取资料中心的游戏电脑。与其他云端游戏服务相比,该公司提供完整的 Windows 11 功能。该公司目前提供的单一配置包括英特尔至强 2620 处理器、Nvidia Quadro P5000 GPU、八个 Nvidia GeForce GTX 1080 线程、12GB RAM 和 256GB 储存空间,每月收费 35 美元。

- 此外,各大游戏开发公司也专注于开发高画质的主机游戏,进而促进游戏产业的成长。SONY和微软并没有将其游戏机宣传为具有 8K 功能,而是优先考虑高达 120fps 的刷新率,以使游戏体验更加无缝。 Nvidia 希望透过其强大的 RTX 3090 显示卡超越 4K,该显示卡有望在 PC 上实现 8K 游戏体验。

- 游戏机製造商也致力于开发新产品,以提高市场竞争力。SONY的目标是实现 10.28 兆次浮点运算的效能,比 Xbox Series X 低近 15%。在散热和架构方面也存在根本区别,SONY允许可变的 GPU 和 CPU 速度,而微软则坚持更传统的固定速度,4K 效能与SONY非常接近。

- 随着 AR 和 VR 越来越多地被引入到各种应用中,GPU 的采用预计会增加。图形技术的进步使得实现真正的 AR 和 VR 成为可能,从而创造了引人注目的用户体验。许多公司正在开发 VR 解决方案,主要是为了重新定义人们体验运算和游戏的方式,他们也正在为 AR 和 VR 应用开发 GPU 系统。

预计北美将占很大份额

过去几年,北美千禧世代的游戏热潮迅速发展。据 Limelight Networks 称,超过 30% 的美国电玩玩家会为游戏发送服务付费,超过 35% 的玩家每周至少玩一次线上游戏。

- 领先的技术开发人员正在北美游戏市场投资网路游戏,进一步推动该地区的市场成长。今年1月,美国跨国企业微软宣布计画收购知名游戏开发商和互动娱乐内容发行商动视暴雪。此次收购可能会加速微软在行动、个人电脑、主机和云端游戏业务的成长,预计将增加对其 Xbox 产品的需求。

- 此外,今年 3 月,英特尔发布了用于笔记型电脑和桌上型电脑的 Arc 系列图形处理单元 (GPU)。配备 Arc 3 GPU 的笔记型电脑专为增强游戏和内容创作而设计,现已开放预订,而配备 Arc 5 和 Arc 7 GPU 的笔记型电脑专为高级高效能游戏而设计,将于今年稍后上市。

- 云端游戏公司将受益于与通讯业者合作开发更好的端到端网络,并加快该地区 5G 的采用。通讯业者需要增加上游容量以满足电子竞技玩家的需求,这是另一个驱动因素,各种供应商正在合作满足游戏需求。

该地区的游戏 GPU 製造商也专注于开发 GPU 产品,进一步推动该地区的成长。例如,AMD 于去年 7 月推出了 AMD Radeon RX 6600XT 系列显示卡产品,充分利用 AMD RDNA 架构的强大功能,同时透过 9.6 teraflops 的 RDNA 2 技术和 8GB GDDR6 RAM 提供更好的效能。

游戏 GPU 产业概览

游戏 GPU 市场高度整合,由少数全球和区域参与者组成。这些参与者占有相当大的市场占有率并致力于扩大基本客群。这些供应商正专注于研发投资,以推出新的解决方案、策略联盟以及其他有机和无机成长策略,以在预测期内获得竞争优势。

2022 年 11 月,华硕更新了其 TUF Gaming GeForce RTX 3060 Ti 和 Dual GeForce RTX 3060 Ti 显示卡,配备 GDDR6X 内存,以获得更好的性能。 GDDR6X RAM 的加入增强了 3060 Ti 的功能,扩大了挑剔的 PC DIY 建造者可用的选项。华硕生产了配备 8GB GDDR6 VRAM 的新款 GeForce RTX 3060,为 GPU 提供了更多的客製化和组装能力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 产业影响评估

- 市场驱动因素

- 产业对游戏机、扩增实境(AR) 和虚拟实境 (VR) 的需求增加

- 对更高刷新率的高级显示器的需求不断增加

- 市场限制

- 初期投资高

第五章 市场区隔

- 按类型

- 独立显示卡

- 整合图形解决方案

- 其他市场类型

- 按设备

- 行动装置

- 个人电脑和工作站

- 游戏机

- 车

- 其他设备

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Intel Corporation

- Advanced Micro Devices Inc.

- Nvidia Corporation

- ASUSTEK Computer Inc

- GIGA-BYTE Technology Co., Ltd.

- Arm Limited

- Qualcomm Technologies Inc.

- Imagination Technologies Group

- EVGA Corporation

- SAPPHIRE Technology Limited

第七章投资分析

第 8 章:市场的未来

The Gaming GPU Market size is estimated at USD 4.89 billion in 2025, and is expected to reach USD 20.98 billion by 2030, at a CAGR of 33.84% during the forecast period (2025-2030).

The rising gamification trend among millennials has led to the increasing adoption of a virtual world for video gamers. Gaming machines have also evolved from powerful location-based devices found in restaurants, arcades, and bars to in-home machines in the form of gaming consoles and then PCs. As Moore's Law drove down chip prices and increased performance, people bought more gaming machines for the home, which has a positive price elasticity effect at the expense of location-based gaming machines. As gaming machine sales have increased in the last few years, the demand for gaming GPUs has grown significantly.

Key Highlights

- The demand for high-end computing systems for graphics-intensive gaming applications has increased with the rising adoption of smartphones, tablets, PCs, and consoles for gaming purposes. The growing demand for specialized processors that can handle complex mathematical calculations related to the 2D and 3D graphics required for gaming drives the GPU market demand.

- Technological advancement in high-performing computing may also develop an opportunity for GPU vendors. For instance, in April this year, Nvidia stated that researchers discovered trends in Hubble data on April 25 using a supercomputer with NVIDIA GPUs. Also, high-performance computing is used with NVIDIA GPUs to increase the understanding of all planets and analyze their torrid atmospheres.

- Other drivers for the market include industry verticals such as automotive, manufacturing, real estate, and healthcare, with the rising usage of processors to support graphics applications and 3D content. For instance, in manufacturing and design applications in the automotive sector, CAD and simulation software uses GPUs to create realistic images and animations for critical applications.

- Gaming GPUs use advanced technologies and materials. One of the primary factors contributing to the high price of current GPUs is higher manufacturing expenses. Only the materials that producers can afford can be produced. Producers are thinking of maximizing their profits without sacrificing a product's quality or quantity due to rising manufacturing costs, which cause a rise in the selling price of the GPU. Due to this huge initial investment, consumers prefer to use something other than the latest gaming GPU in their devices, which is a challenge for market growth.

- Modern-day video game consoles and servers utilize many components, including gaming GPU circuits. COVID-19 threatened the average production of many of these components due to supply chain problems. However, semiconductor foundries started resuming production, which motivated manufacturers in the market. Demand in cloud computing, gaming, data center servers, automation, and AI technologies could help GPU manufacturers revive growth in the later part of the pandemic.

Gaming GPU Market Trends

Rising Demand for Gaming Consoles, Augmented Reality (AR), and Virtual Reality (VR) in the industry are Driving the Market

With the increasing adoption of esports and other types of online gaming, video games on consoles are rising and will show more growth opportunities in the coming years. As a result of this trend, connectivity and entertainment providers could target console gamers by offering console-related video services offerings, like fast broadband and live sports, and optimally monetizing the audience through OTT services. Video game developers could provide premium pricing for gaming subscription services, including access to esports events and original content.

- With the rising trend of cloud gaming, the GPU market has seen an upward trend in recent years. Blade, the French startup behind Shadow, is a cloud computing service for gamers that allows a player to access a gaming PC in a data centre for a monthly subscription fee. The company provides full Windows 11 features compared to other cloud gaming services. The company currently offers a single configuration for USD 35 per month with eight threads on an Intel Xeon 2620 processor, an Nvidia Quadro P5000 GPU, and an Nvidia GeForce GTX 1080, 12GB of RAM, and 256GB of storage.

- Further, major game developers are also focusing on developing console-based games with high graphic quality, contributing to the gaming segment's growth. Sony and Microsoft prioritize refresh rates up to 120 fps instead of trying to market the consoles as 8K capable, making the gaming experience seamless. Nvidia is trying to move beyond 4K with its monster RTX 3090 graphics card, which delivers 8K gaming for PCs.

- Console developers are also focusing on new product development to raise the bar for the competition in the market. Sony is aiming for 10.28 teraflops of performance, which is almost 15% less than the Xbox Series X. There are also some fundamental differences in cooling and architecture that allow Sony to offer variable GPU and CPU speeds, while Microsoft sticks to the more traditional fixed speeds and is very close to Sony in terms of 4K performance.

- The increasing incorporation of AR and VR in various applications is expected to drive the adoption of GPUs. Due to improvements in graphics technology, it is now possible to achieve true AR or VR and create a compelling user experience. Many companies are developing VR solutions primarily to redefine the way people experience computing and gaming, and the companies are also developing GPU systems for AR and VR applications.

North America is Expected to Hold a Significant Share

The rise in gaming among millennials in the North American region has been dramatic and swift in the past few years. In the United States, over 30% of video gamers pay for gaming subscription services, and more than 35% play online video games at least once a week, according to Limelight Networks.

- Major technology developers are investing in online gaming in the North American gaming market, further bolstering the region's market growth. In January of this year, Microsoft, an American MNC, announced plans to acquire Activision Blizzard Inc., a prominent player in game development and interactive entertainment content publishing. This acquisition may accelerate the growth of Microsoft's gaming business across mobile, PC, console, and cloud and is expected to drive demand for the company's Xbox offerings.

- Additionally, in March of this year, Intel launched the Arc series of Graphics Processing Units (GPU) for laptops and desktop PCs. Laptops with the Arc 3 GPU, designed for enhanced gaming and content production, are available for pre-order, while laptops with the Arc 5 and Arc 7 GPUs, designed for advanced and high-performance gaming, will come later in the current year.

- Cloud gaming companies benefit from collaborating with telecoms to develop better end-to-end networks and encourage 5G adoption in the region. The need for telecoms to increase their upstream capacity to meet the demands of esports players is a further driving force, and various vendors are collaborating to meet their gaming needs.

Gaming GPU players in the region also focus on developing GPU products, further driving the region's growth. For instance, in July last year, AMD introduced the AMD Radeon RX 6600XT series graphics products, harnessing the power of the AMD RDNA architecture while providing better performance with its 9.6 teraflops of RDNA 2 technology and 8 GB of GDDR6 RAM.

Gaming GPU Industry Overview

The gaming GPU market is significantly consolidated and consists of fewer global and regional players. These players account for a significant market share and focus on expanding their customer base globally. These vendors focus on research and development investment in introducing new solutions, strategic alliances, and other organic & inorganic growth strategies to earn a competitive edge over the forecast period.

In November 2022, ASUS updated its TUF Gaming GeForce RTX 3060 Ti and Dual GeForce RTX 3060 Ti graphics cards to include GDDR6X memory for better performance. The 3060 Ti's capabilities have been improved by the addition of GDDR6X RAM, which expands the options available to discerning PC DIY builders. ASUS has produced a new GeForce RTX 3060 with 8 GB of GDDR6 VRAM to increase the GPU's capacity for customization and assembly.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

- 4.5 Market Drivers

- 4.5.1 Rising Demand for Gaming Consoles, Augmented Reality (AR), and Virtual Reality (VR) in the industry

- 4.5.2 Increasing Demand for Advanced Displays with Higher Refresh Rates

- 4.6 Market Restraints

- 4.6.1 High Initial Investment

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Dedicated Graphic Cards

- 5.1.2 Integrated Graphics Solutions

- 5.1.3 Other Market Types

- 5.2 Device

- 5.2.1 Mobile Devices

- 5.2.2 PCs and Workstations

- 5.2.3 Gaming Consoles

- 5.2.4 Automotive

- 5.2.5 Other Devices

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Intel Corporation

- 6.1.2 Advanced Micro Devices Inc.

- 6.1.3 Nvidia Corporation

- 6.1.4 ASUSTEK Computer Inc

- 6.1.5 GIGA-BYTE Technology Co., Ltd.

- 6.1.6 Arm Limited

- 6.1.7 Qualcomm Technologies Inc.

- 6.1.8 Imagination Technologies Group

- 6.1.9 EVGA Corporation

- 6.1.10 SAPPHIRE Technology Limited