|

市场调查报告书

商品编码

1644408

非洲玻璃瓶和容器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Africa Glass Bottles And Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

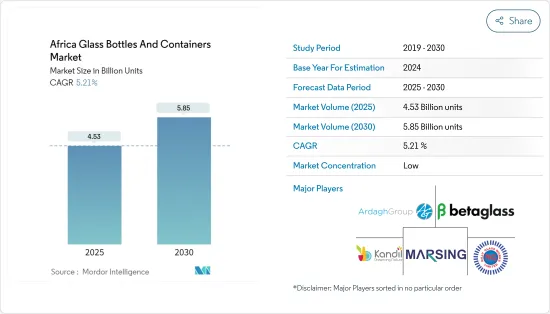

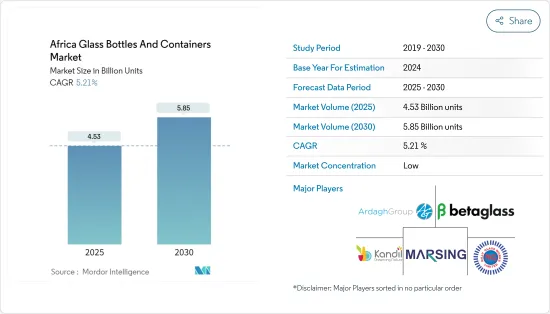

预计 2025 年非洲玻璃瓶和容器市场规模为 45.3 亿个单位,到 2030 年将达到 58.5 亿个单位,预测期内(2025-2030 年)的复合年增长率为 5.21%。

主要亮点

- 在非洲,消费者对安全健康包装的需求不断增长,推动了玻璃包装在食品饮料、化妆品和药品等各个终端用户行业的扩张。压花、模塑和艺术加工等先进包装技术正在增加玻璃包装对最终用户的吸引力。此外,人们对环保产品的偏好日益增长以及食品和饮料行业的需求不断增长也促进了市场的成长。

- 玻璃包装仍然是最传统和最值得信赖的包装材料之一。透过提供卓越的品质、耐用性和永续性,它继续影响着生产趋势。食品级玻璃将食品安全性和保鲜性能独特地结合在一起,使其成为品牌提升产品品质的热门材料。食品级玻璃提供多种包装选择,包括不同的形状、环尺寸和配件,以适应各种食品和饮料。

- 此外,玻璃瓶和透明容器以其永恆而优雅的设计吸引消费者。玻璃的透明度使产品具有高檔的感觉,使其在货架上或展示时具有吸引力。预计这些因素将在预测期内推动非洲玻璃包装产业的成长。

- 非洲的製药业正在扩大,导致对感染疾病和非感染疾病治疗包装的需求增加。这种成长推动了药品製造对玻璃包装的需求增加。玻璃包装可保护药品免受损坏、污染和环境因素的影响。药品和医疗用品的需求不断增加,加上产业技术的进步,直接推动了对瓶子、管瓶和其他玻璃包装解决方案的需求。

- 永续包装越来越影响消费者的购买决策。随着人们对一次性塑胶和合成纤维等材料对环境的影响的认识不断提高,预计这一趋势将会成长。各国也都在努力製定与塑胶相关的立法。例如,2024年1月,奈及利亚当局着手解决塑胶污染造成的生态系统恶化问题。联邦环境部和拉各斯州政府宣布禁止使用一次性塑胶。玻璃常被描述为一种可无限回收的材料,透过反覆回收仍能保持其品质、纯度和耐用性。玻璃可以分解成玻璃玻璃屑,然后可以将其熔化并重新製成新的玻璃产品。用于包装的玻璃的回收率高于其他材料,从而推动了非洲国家对玻璃包装的需求。

- 消费者对安全和环保包装的偏好日益增加,推动了非洲各领域的玻璃包装成长。压花、模压和艺术加工等先进技术增强了玻璃包装的吸引力。对环保解决方案的需求不断增长以及食品和饮料行业的消费不断增加,进一步刺激了非洲的玻璃包装市场。此外,不断增加的研发投入带来玻璃包装的创新也推动了这个市场的发展。例如,美国跨国饮料公司可口可乐的专利权可口可乐非洲饮料公司(CCBA)宣布计划推出新的1.25公升可回收玻璃瓶。此项倡议符合公司的永续性和透明度目标。这一转变也支持了可口可乐的愿景,到 2030 年,收集和回收其销售的每个瓶子和罐子的等效材料,并使用 50% 的再生材料进行包装。

非洲玻璃瓶和容器市场的趋势

预计南非将占据主要市场份额

- 南非的快速都市化推动了对多样化食品和饮料的需求。该国正经历从传统的家庭烹饪和杂货店购物向外出就餐和方便食品的转变。这项转变主要受中产阶级和年轻人口快速扩张的所推动。随着便利商店、咖啡店、小吃店以及各种零售和餐旅服务业的蓬勃发展,对玻璃瓶包装的需求预计将大幅增长。

- 南非位于非洲大陆南端的战略位置,使其成为通往非洲大陆的门户,有利于企业进入其他非洲市场并在区域内扩张。该国发达的物流和交通网络,包括成熟的航线、现代化的港口以及广泛的公路和铁路系统,极大地促进了全球贸易。这种基础设施优势使得包括玻璃製品在内的货物能够在国内和国际市场上有效流通。这一独特的定位支持了南非玻璃製造业的成长,并加强了其作为区域贸易重要枢纽的地位。此外,由于其靠近主要航道,因此能够以具有成本效益的方式进入全球市场,对于寻求服务非洲和国际客户的玻璃製造商来说,它具有很大的吸引力。

- 受零售和电子商务销售激增的推动,南非的酒精和非酒精饮料市场正在崛起。这种成长主要得益于消费者对便利性的偏好以及网路购物平台的日益普及。预计2023年南非葡萄酒消费量为450万百升,较2022年的尖峰时段460万百升下降1.8%。儘管下降幅度很小,但凸显了酒类市场的强劲需求,尤其是对玻璃包装的需求。随着饮料消费量的成长,对包装解决方案的需求也在成长,尤其是玻璃瓶。玻璃用于多种饮料,包括软性饮料、啤酒、葡萄酒和烈酒,因为它可以保留风味和品质。

- 国内消费者越来越意识到包装材料对环境的影响。玻璃完全可回收,与塑胶相比被认为是永续的选择。人们对环保包装的日益偏好预计将推动对容器玻璃的需求。政府法规和提倡永续的倡议进一步推动了这一趋势,鼓励製造商采用玻璃包装解决方案。

饮料业预计将占据市场的大部分份额

- 非洲饮料消费量的增加推动了对包括玻璃瓶在内的包装解决方案的需求。这一趋势是由非洲大陆不断增长的人口、都市化和不断变化的消费者偏好所推动的。玻璃是软性饮料、啤酒、葡萄酒和烈酒等饮料的首选包装材料,主要是因为它可以保持口感和品质。此外,玻璃瓶可回收且环保,符合人们对永续性日益增长的关注。此外,非洲饮料产业正在向高级产品和精酿产品转变,进一步增加了对高品质玻璃包装的需求。因此,玻璃瓶製造商正在扩大规模并投资新技术以满足该地区的需求。

- 非洲的啤酒和苹果酒子区隔受到国内生产和进口的影响,以满足不同消费者的偏好。在非洲的饮料市场,由于对品质和永续性的认知,玻璃瓶仍然是首选的包装。这种偏好在拥有悠久酿酒传统的国家尤其普遍。非洲各地的啤酒品牌都青睐透明玻璃瓶,因为这能突显饮料的色彩和清澈度,增强其对消费者的吸引力。非洲多元的文化和经济背景导致地区对包装偏好有差异。然而,玻璃瓶的整体趋势继续支持非洲容器玻璃市场的成长,本地和国际製造商都在扩大其业务以满足日益增长的需求。

- 啤酒製造商正在推出玻璃瓶装的新版本产品,希望对市场产生正面影响。这项转变旨在利用玻璃包装的高端形象来提高产品的吸引力、永续性和消费者的认知度。 2024 年 2 月,喜力啤酒承诺向南非可回收瓶计画投资 23 亿南非兰特(1.2 亿美元)。这项投资使喜力可回收玻璃啤酒瓶的份额增加了一倍多,使该公司达到了向 65% 可回收玻璃啤酒瓶过渡的目标。该倡议支持喜力啤酒在 2040 年实现净零碳排放的全球承诺,这是其「酿造更美好的世界」策略的关键要素。

- 2020 年,摩洛哥饮料零售额估计将达到 31 亿美元以上。其中非酒精饮料出口额超过 27 亿美元,酒精饮料出口额近 4.42 亿美元。预测到 2024 年,非酒精饮料的零售将达到约 31 亿美元,而酒精饮料的零售额预计将超过 5.13 亿美元。由于零售和电子商务销售额的增加,该地区的饮料市场正在成长。这一趋势是由消费者对便利性日益增长的需求和网路购物平台日益普及所推动的。

非洲玻璃瓶和容器产业概况

非洲玻璃瓶和容器市场较为分散,有几个全球和区域参与者争夺市场注意力,其中包括 Ardagh Group SA、Beta Glass PLC、Marsing &Co Africa (Pty) Ltd 和 Milly Glass Works Ltd。该市场的特点是产品差异化程度低、产品采用广泛、竞争激烈。

- 2024 年 6 月 Beta Glass PLC 是 Frigoglass Group 的子公司,也是西非和中非着名的玻璃包装解决方案、皇冠珠宝和木箱製造商,推出了其网站的法语版本。该计划旨在加强对法语非洲市场的服务。法国网站提供了有关 Beta Glass 系列玻璃包装和创新解决方案的详细资讯。它还强调了公司对环境永续性的承诺,并强调了其环保倡议和回收计划。新平台将允许法语客户获取有关 Beta Glass 产品和永续性的全面资讯。

- 2024 年 2 月,Ardagh 集团的子公司 Ardagh Glass Packaging-Africa(AGP-Africa)已在南非豪登省尼格尔的玻璃容器生产厂完成了第三座熔炉的建造。尼格尔 3 (N3) 扩建计划宣布将于 2022 年开工,这是继同年完工的尼格尔 2 (N2) 扩建计画之后的另一个计画。 N3计划投资额为8,039万美元,使工厂的生产能力提高了50%,成为AGP-Africa网路中以及非洲最大的工厂。此次扩建将使 AGP-Africa 的生产能力提高 10%,使公司能够满足客户对永续包装解决方案日益增长的需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 饮料消费量不断增长,玻璃瓶和容器在高端包装中的应用

- 监管压力偏好

- 市场挑战

- 替代包装选择挑战市场成长

第六章 市场细分

- 按最终用户产业

- 饮料

- 葡萄酒和烈酒

- 啤酒和苹果酒

- 其他饮料(不含酒精和含酒精)

- 食物

- 化妆品

- 药品

- 其他最终用户产业

- 饮料

- 按国家

- 埃及

- 奈及利亚

- 摩洛哥

- 南非

第七章 竞争格局

- 公司简介

- Middle East Glass Manufacturing Company

- Ardagh Group SA

- Beta Glass PLC

- Plastimed Pty(Ltd)

- Marsing & Co Africa(Pty)Ltd

- Milly Glass Works Ltd

- The National Company for Glass and Crystal

- Arab Pharmaceutical Glass Co.

- Dalgen Packaging

- Kandil Glass

第八章投资分析

第九章:未来市场展望

The Africa Glass Bottles And Containers Market size is estimated at 4.53 billion units in 2025, and is expected to reach 5.85 billion units by 2030, at a CAGR of 5.21% during the forecast period (2025-2030).

Key Highlights

- The increasing demand from consumers for safe and healthy packaging in Africa is driving the expansion of glass packaging across various end-user industries, including food and beverage, cosmetics, and pharmaceuticals. Advanced technologies for embossing, shaping, and adding artistic finishes enhance the appeal of glass packaging among end users. Additionally, the increasing preference for eco-friendly products and rising demand from the food and beverage sector contribute to the market's growth.

- Glass packaging remains one of the most traditional and trusted packaging materials. It continues influencing production trends, offering superior quality, durability, and sustainability. Food glass uniquely combines food safety with preservation, making it a highly sought-after material for brands to enhance their products. Food glass provides various packaging options, including different shapes, ring diameters, and accessories, suitable for diverse food and beverage products.

- Further, glass bottles and transparent containers offer a timeless, elegant design that appeals to consumers. The glass's transparency enhances the products' premium appearance, making them attractive on shelves and displays. These factors are expected to drive the growth of the African glass packaging segment during the forecast period.

- The African pharmaceutical industry is expanding, leading to increased demand for packaging for communicable and non-communicable disease treatments. This growth has resulted in a rising need for glass packaging in pharmaceutical manufacturing. Glass packaging protects medicinal products from damage, contamination, and environmental factors. The increasing demand for pharmaceutical drugs and medicines, coupled with technological advancements in the industry, directly drives the need for bottles, vials, and other glass packaging solutions.

- Sustainable packaging is increasingly influencing consumer purchasing decisions. This trend is expected to grow as awareness of environmental impacts from materials like single-use plastic and synthetic fibers increases. Countries are also implementing plastic-related legislation. For instance, in January 2024, Nigerian authorities addressed ecological degradation caused by plastic pollution. The Federal Ministry of Environment and the Lagos State government announced bans on single-use plastics. Glass is often described as an infinitely recyclable material, maintaining its quality, purity, and durability through repeated recycling. It can be broken down into glass cullets, which can be melted and reformed into new glass products. The higher recycling rate of glass used in packaging than other materials is driving the demand for glass packaging in African countries.

- The increasing consumer preference for safe and environmentally friendly packaging is driving the growth of glass packaging across various segments in Africa. Technological advancements, such as embossing, shaping, and artistic finishes, are enhancing the appeal of glass packaging. The increasing demand for eco-conscious solutions and increased consumption in the food and beverage sector are further stimulating Africa's glass packaging market. The market is also benefiting from heightened investments in research and development, leading to innovations in glass packaging. For instance, Coca-Cola Beverages Africa (CCBA), a franchise of the American multinational beverage company Coca-Cola, announced its plans to introduce new 1.25 L returnable glass bottles. This initiative aligns with the company's sustainability and transparency goals. The transition also supports Coca-Cola's vision to collect and recycle the equivalent of bottles or cans it sells by 2030 and to use 50% recycled content in all its packaging.

Africa Glass Bottles and Containers Market Trends

South Africa is Expected to Hold a Significant Share of the Market

- South Africa's rapid urbanization is driving the demand for diverse food and beverages. The country is shifting from traditional home-cooked meals and grocery shopping toward dining out and convenience foods. This transition is primarily driven by the rapid expansion of the middle-income group and the country's young demographic. As convenience stores, coffee shops, snack outlets, and the broader retail and hospitality sector flourish, the demand for glass bottle packaging is expected to rise significantly.

- South Africa's strategic location at the southern tip of Africa positions it as a gateway to the continent, benefiting businesses aiming to access other African markets and regional expansion. The country's well-developed logistics and transportation networks, including established sea routes, modern ports, and an extensive road and rail system, significantly facilitate global trade. These infrastructural advantages enable the efficient movement of goods, including glass products, within the country and international markets. This unique positioning supports the growth of South Africa's glass manufacturing sector and reinforces its role as a key regional trading hub. In addition, the country's proximity to major shipping lanes provides cost-effective access to global markets, making it an attractive base for glass manufacturers looking to serve African and international clients.

- South Africa's alcohol and non-alcoholic drinks market is on the rise, supported by surging retail and e-commerce sales. This upswing is largely attributed to consumers favoring convenience and the escalating popularity of online shopping platforms. In 2023, wine consumption in South Africa dipped marginally to 4.5 million hectoliters, marking a 1.8% decrease from its peak of 4.6 million hectoliters in 2022. This dip, albeit slight, underscores the robust demand in the alcohol market, particularly for glass packaging. As beverage consumption escalates, so does the need for packaging solutions, prominently glass bottles. Glass, favored for its ability to preserve taste and quality, is the go-to material for a wide array of beverages, spanning soft drinks, beer, wine, and spirits.

- Consumers in the country are increasingly conscious of packaging materials' environmental impact. Glass, being fully recyclable, is perceived as a sustainable option compared to plastics. This growing preference for eco-friendly packaging is expected to boost the demand for container glass. Government regulations and initiatives promoting sustainable practices further support this trend, encouraging manufacturers to adopt glass packaging solutions.

The Beverages Segment is Expected to Hold a Significant Share of the Market

- The rising beverage consumption in Africa has increased the demand for packaging solutions, including glass bottles. This trend is driven by population growth, urbanization, and changing consumer preferences across the continent. Glass remains a preferred packaging material for beverages such as soft drinks, beer, wine, and spirits, primarily due to its ability to preserve taste and quality. Additionally, glass bottles are recyclable and environmentally friendly, aligning with growing sustainability concerns. The beverage industry in Africa is also experiencing a shift toward premium and craft products, further boosting the demand for high-quality glass packaging. As a result, glass bottle manufacturers are expanding their operations and investing in new technologies to meet the demand in the region.

- The African beer and cider sub-segment is influenced by domestic production and imports, addressing varied consumer preferences. Glass bottles remain the preferred packaging choice in the African beverages segment, driven by perceptions of quality and sustainability. This preference is extreme in countries with established brewing traditions. Beer brands across Africa favor clear glass bottles, which showcase the beverage's color and clarity, enhancing consumer appeal. The diverse cultural and economic landscape of Africa contributes to regional variations in packaging preferences. However, the overall trend toward glass bottles continues to support the growth of the African container glass market, with local and international manufacturers expanding their presence to meet the increasing demand.

- Beer manufacturers are introducing new versions of their products in glass bottles, anticipating a positive market impact. This shift aims to enhance product appeal, sustainability, and consumer perception by leveraging the premium image associated with glass packaging. In February 2024, Heineken invested ZAR 2.3 billion (USD 0.12 billion) in its returnable bottle program in South Africa. This investment has more than doubled the company's share of returnable glass beer bottles, aligning with its goal to transition to 65% returnable glass bottles. This initiative supports Heineken's global commitment to achieving net-zero carbon emissions by 2040, a key component of its 'Brew a Better World' strategy.

- Retail sales of beverages in Morocco reached an estimated value of over USD 3.1 billion in 2020. This total comprised more than USD 2.7 billion in non-alcoholic beverage sales and nearly USD 442 million in alcoholic beverage sales. Projections indicate that by 2024, the retail sales value for non-alcoholic beverages is expected to reach approximately USD 3.1 billion, while alcoholic beverages exceed USD 513 million. The region's beverage market is experiencing growth, driven by increased retail and e-commerce sales. This trend is supported by rising consumer demand for convenience and the growing popularity of online shopping platforms.

Africa Glass Bottles and Containers Industry Overview

The African glass bottles and containers market is fragmented, with several global and regional players, such as Ardagh Group SA, Beta Glass PLC, Marsing & Co Africa (Pty) Ltd, and Milly Glass Works Ltd, contesting for attention in the market space. This market is characterized by low product differentiation, growing levels of product penetration, and high levels of competition.

- June 2024: Beta Glass PLC, a subsidiary of the Frigoglass Group and a prominent manufacturer of glass packaging solutions, crowns, and crates in West and Central Africa, introduced a French version of its website. This initiative aims to enhance its service to the extensive Francophone African market. The French website provides detailed information about Beta Glass' diverse range of glass containers and innovative solutions. It also highlights the company's commitment to environmental sustainability, showcasing its eco-friendly practices and recycling programs. This new platform enables French-speaking customers to access comprehensive information about Beta Glass' products and sustainability efforts.

- February 2024: Ardagh Glass Packaging-Africa (AGP-Africa), a subsidiary of Ardagh Group, constructed a third furnace at its glass container production facility in Nigel, Gauteng, South Africa. The Nigel 3 (N3) expansion project, announced in 2022, follows the previous Nigel 2 (N2) expansion completed in the same year. With an investment of USD 80.39 million, the N3 project increased the site's capacity by 50%, making it the largest facility in AGP-Africa's network and Africa. This expansion boosted AGP-Africa's production capacity by 10%, enabling the company to meet growing customer demand for sustainable packaging solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Beverage Consumption and Integration of Glass Bottles and Containers in Premium Packaging

- 5.1.2 Growing Preference for Glass Bottles and Containers Driven by Regulatory Pressures

- 5.2 Market Challenges

- 5.2.1 Alternative Packaging Options Challenging the Market's Growth

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Beverages**

- 6.1.1.1 Wine and Spirits

- 6.1.1.2 Beer and Cider

- 6.1.1.3 Other Beverages (Non-alcoholic and Alcoholic)

- 6.1.2 Food

- 6.1.3 Cosmetics

- 6.1.4 Pharmaceuticals

- 6.1.5 Other End-user Industries

- 6.1.1 Beverages**

- 6.2 By Country

- 6.2.1 Egypt

- 6.2.2 Nigeria

- 6.2.3 Morocco

- 6.2.4 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Middle East Glass Manufacturing Company

- 7.1.2 Ardagh Group SA

- 7.1.3 Beta Glass PLC

- 7.1.4 Plastimed Pty (Ltd)

- 7.1.5 Marsing & Co Africa (Pty) Ltd

- 7.1.6 Milly Glass Works Ltd

- 7.1.7 The National Company for Glass and Crystal

- 7.1.8 Arab Pharmaceutical Glass Co.

- 7.1.9 Dalgen Packaging

- 7.1.10 Kandil Glass