|

市场调查报告书

商品编码

1644423

通讯成本管理:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Telecom Expense Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

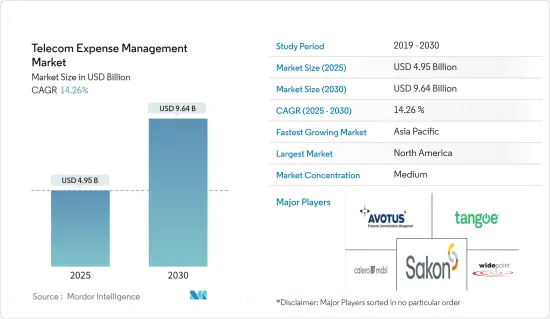

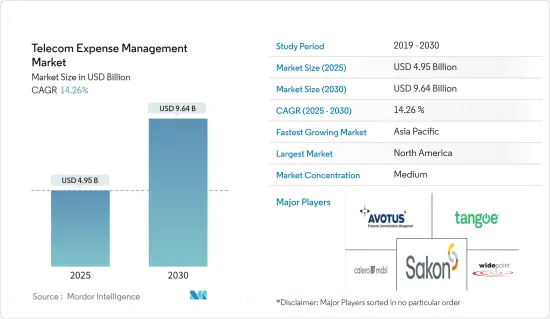

预计 2025 年通讯费用管理市场规模为 49.5 亿美元,到 2030 年将达到 96.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 14.26%。

通讯费用管理已成为任何业务领域或行业的公司的一项必不可少的业务,无论其规模大小。对高效通讯成本管理的需求不断增长,加上过去几年商业通讯基础设施的扩展,是改变市场的趋势之一。

主要亮点

- 行动应用程式需求的不断增长、行动装置在多个企业中的采用日益广泛以及通讯成本管理解决方案的技术进步正在推动通讯成本管理市场的成长。此外,行动装置的日益普及、费用管理可见性的提高以及云端基础的服务的普及也在推动市场成长。

- 在过去几年中,选择自有设备(CYD)或自备设备出行政策下,智慧型手机、笔记型电脑和平板电脑等个人行动装置的整合已成为市场的变革趋势。此外,行动装置在通讯网路中的日益整合凸显了对用于控制和监控通讯资源成本和利用率的全面系统的需求。

- 此外,随着已开发经济体和新兴经济体新兴企业文化的兴起,导致中小企业数量不断增加,愿意采用 BYOD 文化的公司正在消除或限制可能限制早期成长的初始基础设施成本。这一趋势预计将为通讯费用管理解决方案创造许多商机。

- 云端基础的技术的易于采用加速了企业对视讯会议的采用,并导致采用云端服务来满足各种业务需求。这些都对现有网路造成了巨大的压力,增加了对先进网路解决方案的需求,从而推动企业投资于通讯费用管理解决方案。

- 因此,通讯业者正在透过管理云端连接并利用其网路资产来增强和优化云端基础的解决方案和服务来参与云端价值链。此外,显然需要易于维护的网路系统,以实现医疗保健、零售和製造业等多个最终用户行业之间的有效通讯。例如,具有成本效益的云端基础的解决方案的出现,推动了 IT 预算最少的医疗保健提供者越来越多地采用该解决方案。

- 随着新冠肺炎疫情的爆发,越来越多的人在家工作进行远距办公,通讯业对网路服务的需求大幅增加。随着越来越多的人在家工作,下载、在线观看影片和透过视讯会议进行交流的需求也随之增加,所有这些都导致了网路流量和资料使用量的增加。

通讯费用管理市场趋势

BFSI 部门预计将大幅成长

- 服务供应商之间的竞争日益激烈,以改善 BFSI 行业的通讯成本管理服务。这些解决方案使金融机构和保险业能够最大限度地节省开支并降低电讯费用。例如,Cass Information Systems 帮助金融、银行和保险公司完全控制电讯,包括行动服务和 BYOD 管理。

- 此外,手机和网路银行用户的不断增加也推动了银行业对通讯成本管理的需求。例如,美国银行2022年8月发布的报告资料显示,美国银行的客户越来越多地转向该银行备受讚誉的数位工具来管理他们的帐户。 2022年7月,客户使用该公司的数位平台约10亿次。美国银行的数位客户数量达到创纪录的 5,500 万,比去年增加 5%。

- 银行客户可以追踪各分店的通讯成本以及跨分店的基准通讯成本。同时,保险公司客户很欣赏这种解决方案,因为它可以让他们追踪分配给远端员工的总合成本,从而清楚了解远端成本。

- 此外,对于银行服务更好的行动应用程式的需求不断增长、物联网设备普及率不断提高以及向 5G 网路的过渡、改进 API 以实现无缝用户体验的努力以及通讯业者对先进服务收益的需求不断增长,都是预计推动市场成长的主要因素。

- 此外,在 LTE 和 IoT 蓬勃发展的时代,先进技术的采用不断增多以及行动互联网在日常业务中的应用日益广泛,促使 BFSI 竞相保持各种技术进步的领先地位,这可能会进一步推动市场需求。

拉丁美洲可望实现强劲成长

- 预计预测期内拉丁美洲地区的通讯费用管理市场将迎来巨大的成长机会。这主要是由于网路人口的逐步增加、行动和连网装置使用者数量的增加、企业中 BYOD(自带装置)政策的日益普及以及 IT 和通讯的兴起。

- 大量IT服务和产品公司的存在、CYOD和BYOD政策的日益普及以及IT和通讯基础设施的加强可能会增加对高效通讯费用管理产品和服务的需求。

- 在拉丁美洲,从4G到5G的演进有望成为强大的经济成长引擎,尤其是在提高关键垂直产业的生产力方面。根据GSMA预测,在可预见的未来,4G仍将是拉丁美洲移动产业的支柱,到2025年将占总连结数的约70%,预计到2025年拉丁美洲移动生态系统将成长300多亿美元。

- 此外,一些拉丁美洲政府正在考虑将5G技术作为其数位转型的关键要素。因此,该地区的政府正在寻求对频宽分配和网路部署规则做出必要的监管改变,以加速其管辖范围内的部署和采用。

- 混合 IT API 架构的流行已促使该地区大多数组织将其业务关键型基础架构迁移到云端。预计医疗保健和製造业将成为预测期内采用新解决方案的知名公司,以更好地管理通讯费用并向他人提供发票。

通讯费用管理产业概况

由于有多家供应商,通讯费用管理市场呈现半刚性。市场上的几家主要企业不断注重产品创新。主要企业正在建立策略联盟并扩大其在前沿市场的影响力,以加强其市场地位。

2023 年 9 月,Crown Jewel Consultants (CJC) 宣布加强与 Calero(原 Calero-MDSL)的合作。此次合作直接源自于多家客户利用 CJC 的供应商中立专业知识来咨询和使用 MDM 解决方案,包括透过 ILM 产品进行资料发现、管理和授权管理以建立结构化资料来源,以及云端基础的託管 DACS 以便与 Calero 等外部第三方建立连结。

2022 年 8 月,Calero-MDSL 宣布收购位于爱荷华州韦弗利的通讯费用和託管行动服务供应商 Network Control。透过此次收购,Calero-MDSL 继续进行收购,巩固了其作为管理支出规模最大的通讯费用管理解决方案的地位。

2022 年 6 月,在技术费用和资产管理解决方案领域拥有 20 多年领导地位的 Tangoe 宣布推出针对其整体生命週期费用管理和优化平台 Tangoe One 的精选捆绑产品套件。新的套件旨在使中型企业能够存取 Tangoe One 平台,从而从一个统一的入口网站简化、管理和优化通讯、行动和云端资产及费用。

2022年2月,科技费用管理公司Telenium宣布其物联网管理(MoT)平台已在美国专利商标局全面註册。 MoT 是 2021 年推出的中大型组织的下一代通讯费用管理平台和服务解决方案。 MoT 是一个即时的集中式资料库,为使用者提供有关客户发票、费用、服务和资产的全面资讯。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 行动电话和其他便携式设备的日益普及

- 显着节省成本并提高费用透明度

- 市场限制

- 由于行业标准而缺乏互通性

第六章 市场细分

- 按解决方案

- 发货单管理

- 采购管理

- 商业管理

- 争议管理

- 其他解决方案

- 按服务

- 託管服务

- 託管服务

- 按最终用户产业

- BFSI

- 消费品和零售

- 製造业

- 资讯科技/通讯

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Sakon Inc.

- Avotus Corporation

- Tangoe, Inc.

- Calero-MDSL

- WidePoint Solutions Corporation

- Valicom Corporation

- Upland Software Inc.(Cimpl)

- CGI Inc.

- TeleManagement Technologies Inc.

- Auditel Inc.

第八章投资分析

第九章:市场的未来

The Telecom Expense Management Market size is estimated at USD 4.95 billion in 2025, and is expected to reach USD 9.64 billion by 2030, at a CAGR of 14.26% during the forecast period (2025-2030).

Telecom Expense Management has become an essential practice for enterprises operating across any business domain/industry, irrespective of their size. The increased requirement for efficient telecom expense management practices is one of the transforming trends in the market, coupled with the expansion that has been observed in the business telecom infrastructures in the past few years.

Key Highlights

- The increasing demand for mobile applications, the growing adoption of portable equipment in multiple enterprises, and the technological advancements in telecom expense management solutions are driving the growth of the telecom expense management market. Furthermore, increased adoption of mobile devices, visibility into expense management, and the growing popularity of cloud-based services are also aiding market growth.

- The ongoing trend of integrating individual mobile devices, such as smartphones, laptops, and tablets, under mobility policies such as the choose-your-own-device (CYD), and bring-your-own-devices for one, has been transforming the market over the past few years. Also, the augmented integration of mobile devices in the inner telecom networks has highlighted the requirement for a holistic system for managing and monitoring costs and using telecom resources.

- Further, due to the growing startup culture across developed and developing economies, the increasing number of small and medium-sized enterprises has led companies willing to adopt the BYOD culture to eliminate or restrict the initial infrastructure expenses, which may limit their early growth. Such trends are expected to create several opportunities for telecom expense management solutions.

- The ease of adoption of cloud-based technologies has boosted the adoption of video conferencing among businesses, driving the adoption of cloud services for various business needs. These are overwhelming the current networks and increasing the requirement for advanced network solutions, proliferating enterprises to invest in telecom expense management solutions.

- Thus, globally, telecom operators align themselves in the cloud value chain by managing cloud connectivity and leveraging network assets to enhance and optimize cloud-based solutions and services. Moreover, the growing need for easily maintained network systems that can enable effective communications across multiple end-user industries, including healthcare, retail, and manufacturing, is evident. For instance, the advent of cost-effective cloud-based solutions has seen increased adoption by healthcare providers, which are often categorized as having minimum IT budgets.

- With the outbreak of COVID-19, the telecom industry witnessed a significant increase in demand for internet services due to a major chunk of the population staying at home due to remote working conditions. The increase in people working from home led to an increase in demand for downloading, online video viewing, and communication through video conferencing, all of which are leading to increased network traffic and data usage.

Telecom Expense Management Market Trends

BFSI Segment is Expected to Gain Significant Traction

- There has been a growing competition among the service providers to improve telecom expense management services available for the BFSI sector, thereby helping them to gain a competitive edge over other end-users. With these solutions, financial institutions and the insurance sector can avail of maximum savings and keep their telecom bills under control. For instance, Cass Information Systems Inc. is helping finance, banking, and insurance enterprises to fully manage their telecoms, including mobility services and BYOD management.

- In addition, the growing mobile and online banking users are boosting the demand for telecom expense management in the Banking Sector. For instance, according to data from a report of Bank of America published in August 2022, Customers of Bank of America are increasingly using the company's highly regarded digital tools to manage their accounts. In July 2022, customers used the business's digital platforms nearly 1 billion times. The company has a record 55 million verified digital customers, which has increased by 5% from last year's numbers.

- Banking clients get the ability to track their telecom costs for individual branches and can also benchmark them against one another. Meanwhile, the insurance clients appreciate the solution's ability to track the total costs assigned to remote employees for clear visibility into remote costs.

- Also, the increasing demand for better mobile applications for banking services and the increased penetration of IoT devices coupled with a shift towards 5G networks, efforts made towards making improved APIs for seamless user experience, and the growing need of telecom operators to monetize their advanced services are also some of the major factors that are anticipated to drive the market growth.

- Moreover, the growing adoption of advanced technologies, along with the increasing applications of mobile internet in day-to-day operations, has fueled the cutting-edge competition among various technological advancements across BFSI in the booming era of LTE and IoT, which may further propel the demand in the market.

Latin America is Expected to Witness Significant Growth

- The Latin American region is expected to witness significant growth opportunities in the telecom expense management market during the forecast period, primarily owing to the gradual increase in the population using the internet, a growing number of mobile and connected device users, the rising popularity of bring your own device (BYOD) policies among enterprises, and the flourishing IT and telecommunication.

- The existence of a vast number of IT services and product companies, the growing popularity of CYOD and BYOD policies, and enhancing IT and telecom infrastructures may fuel the requirement for efficient telecom expense management products and services.

- In Latin America, the evolution of 4G into 5G is expected to act as a powerful economic growth engine, particularly for enhancing productivity in key vertical sectors. According to GSMA, 4G will continue to be the backbone of the Latin American mobile industry in the near future, accounting for about 70% of total connections by 2025, and the Latin American mobile ecosystem will grow by more than USD 30 billion by 2025.

- Moreover, several governments in Latin America are considering 5G technology as a significant factor in their digital transformation. Hence, governments in the region are making the necessary regulatory changes in spectrum assignment and network deployment rules in order to accelerate the deployment and adoption in their jurisdiction.

- The region is also experiencing a significant shift in the telecom front, where the majority of organizations have migrated their business-critical infrastructure to the cloud, owing to the penetration of hybrid IT API architecture. The healthcare and manufacturing sectors are expected to emerge as prominent adopters of new solutions over the forecast period in order to better manage telecom expenses and offer billing invoices to others.

Telecom Expense Management Industry Overview

The telecom expense management market is semi-consolidated due to the presence of multiple vendors. Several key players in the market are putting constant effort into bringing product innovations. Major companies are entering into strategic collaborations and are also expanding their footprints in developing regions to consolidate their positions in the market.

In Spetember 2023: Crown Jewels Consultant Ltd (CJC), has announced an enhanced collaboration with Calero (formerly Calero-MDSL), and as collaboration is a direct result of multiple clients leveraging CJC's vendor-agnostic expertise for consulting and interfacing with the MDM solution, which include Data discovery, administration, and licensing management via the ILM product to build a structured data source and Cloud-based, hosted DACS for connectivity to external third parties, like Calero.

In August 2022, Calero-MDSL announced the acquisition of Network Control, a telecom expense and managed mobility services vendor based in Waverly, Iowa. This acquisition continued the acquisitive streak of Calero-MDSL and increased its status as the largest telecom expense management solution in terms of spending under management.

In June 2022, Tangoe, the leading technology expense and asset management solution for more than 20 years, unveiled a suite of curated bundles of their full-lifecycle expense management and optimization platform, Tangoe One. The new tiered packages are designed to help mid-size businesses access the Tangoe One platform to simplify, manage, and optimize telecom, mobile, and cloud assets and expenses from one consolidated portal.

In February 2022, Tellennium, a technology expense management company, announced that its Management of Things (MoT) platform had been completely registered with the US Patent and Trademark Office. MoT is a next-generation telecom expense management platform and service solution for mid-to-large organizations, launched in 2021. MoT is a real-time centralized database that gives users comprehensive information about customer invoice expenses, services, and assets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porters Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Mobile Phones and Other Portable Devices

- 5.1.2 Significant Cost Reduction and Expense Visibility

- 5.2 Market Restraints

- 5.2.1 Lack of Interoperability Due to Set Industry Standards

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Invoice Management

- 6.1.2 Sourcing Management

- 6.1.3 Business Management

- 6.1.4 Dispute Management

- 6.1.5 Other Solutions

- 6.2 By Service

- 6.2.1 Hosted Service

- 6.2.2 Managed Service

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Consumer Goods & Retail

- 6.3.3 Manufacturing

- 6.3.4 IT & Telecom

- 6.3.5 Healthcare

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sakon Inc.

- 7.1.2 Avotus Corporation

- 7.1.3 Tangoe, Inc.

- 7.1.4 Calero-MDSL

- 7.1.5 WidePoint Solutions Corporation

- 7.1.6 Valicom Corporation

- 7.1.7 Upland Software Inc. (Cimpl)

- 7.1.8 CGI Inc.

- 7.1.9 TeleManagement Technologies Inc.

- 7.1.10 Auditel Inc.