|

市场调查报告书

商品编码

1644435

宝特瓶:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)PET Bottles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

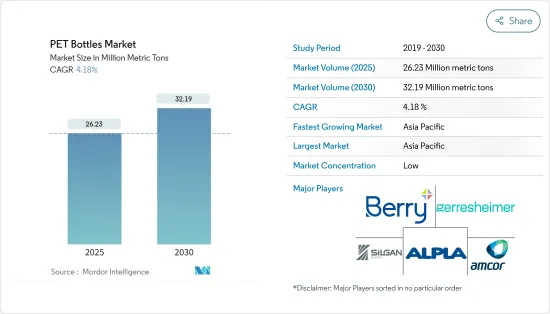

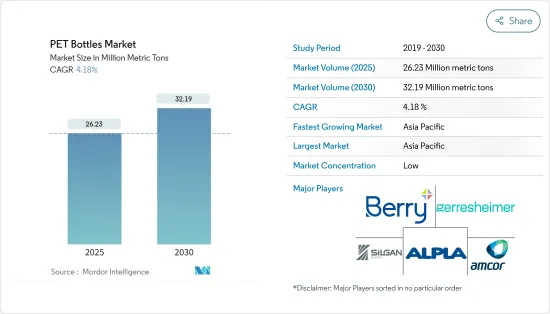

2025 年宝特瓶市场规模预计为 2,623 万吨,预计到 2030 年将达到 3,219 万吨,预测期内(2025-2030 年)的复合年增长率为 4.18%。

主要亮点

- 塑胶瓶和容器主要由聚对苯二甲酸乙二酯製成,因其重量轻、耐用且易于处理而被广泛使用。製造商更喜欢塑胶包装,因为它的生产成本较低。受塑胶包装成本效益和包装食品和饮料需求不断增长的推动,预测期内市场预计将实现成长。此外,聚对苯二甲酸乙二酯(PET)容器因其耐用性、多功能性和成本效益而受到青睐。随着食品饮料、药局等终端用户产业的扩大和技术创新的进步,对塑胶瓶和容器包装的需求正在增长。在行业内,各种口味和包装形式的新饮料的推出继续推动对硬质塑胶瓶的需求。

- 宝特瓶正日益取代玻璃瓶,因为它们更轻、更耐用。这些瓶子可以用来包装矿泉水和其他饮料,使其运输更具成本效率。 PET 的透明度和固有的二氧化碳阻隔性能使其适用于各种应用。 PET 可以轻鬆塑造成各种形状并吹成瓶子。製造商可以透过添加着色剂、紫外线防护剂和氧气阻隔剂等添加剂来客製化 PET 的特性,从而生产出符合特定品牌需求的瓶子。

- 由于日益增长的环境问题导致监管标准不断演变, 宝特瓶包装市场面临重大挑战。世界各国政府正在透过实施法规来尽量减少对环境的影响并改善废弃物管理流程,以回应公众对塑胶包装废弃物的担忧。此类监管变化通常包括限制一次性塑胶、增加回收目标和扩大生产者责任计画。因此,PET 包装製造商正在调整其生产流程,投资环保替代品并开发更永续的包装解决方案以符合这些新标准。这种监管环境影响了产业的营运成本,同时也影响了消费者的偏好,因为有环保意识的消费者寻求更永续的包装选择。

- 随着消费者越来越意识到环保包装的环境效益,永续包装解决方案变得越来越受到关注。 PET因可回收、循环性,已成为环保包装材料中不可或缺的树脂。闭合迴路回收通常应用于宝特瓶,即将塑胶回收并用于製造同一类别的新产品。这种方法使得公司优先选择 PET,而不是其他塑胶材料。因此, 宝特瓶回收预计将对市场产生正面影响。

- 企业正在进行创新以满足终端用户对 rPET 日益增长的需求。永续包装的激增是由消费者偏好和控制塑胶废弃物的监管要求所推动的。例如,2024 年 6 月,卡夫亨氏为其 12 盎司和 22 盎司容量的 Kraft Real Mayo 和 Miracle Whip 推出了 100% 再生宝特瓶。此举遵循了该公司在 2023 年宣布的目标,即到 2030 年将其全球包装产品中的原生塑胶使用量减少 20%。 rPET 在食品包装中的应用证明了这种材料的多功能性及其在工业中日益增长的接受度。其他公司可能也会效仿,这可能导致对 rPET 的需求大幅增加,并需要进一步创新回收技术以满足这种需求。

宝特瓶市场趋势

饮料业预计将强劲成长

- 由于其耐用性和可回收性, 宝特瓶在水包装行业中比玻璃瓶和其他塑胶瓶占据主导地位。这一趋势表明,PET 因其重量轻、耐用且成本低廉,正成为越来越受欢迎的水包装介质。这种转变是由消费者对便利性和永续性的需求以及製造商对高效、经济的包装解决方案的需求所推动的。由于宝特瓶可成型,它们可以快速响应不断变化的包装趋势和标籤需求,并为设计和品牌推广提供多功能的画布。它们重量轻、耐用,非常适合宝特瓶饮料,可以实现经济高效的运输并减少碳排放。

- 聚对苯二甲酸乙二醇酯(PET)瓶在各种产品领域越来越受欢迎。它的吸引力在于价格便宜、重量轻以及印刷技术的不断进步。这些因素大大提高了宝特瓶的受欢迎程度,尤其是在挑剔的消费者中。 Indorama Ventures 预测,聚对苯二甲酸乙二醇酯树脂的需求量将从 2023 年的 3,000 万吨激增至 2030 年的 4,200 万吨。

- 由于瓶装水和非酒精饮料的需求不断增加, 宝特瓶市场的饮料部分预计将会成长。这种需求是由消费者对更高品质饮用水的偏好、对自来水污染的担忧以及便携式瓶装水的便利性所驱动。全球对包装饮用水的需求可能会进一步推动塑胶瓶包装产业饮料类别的发展。与其他包装方式相比,宝特瓶因其成本效益、保质期长和易于使用而广受欢迎。

- 世界各国政府正加强鼓励一次性塑胶瓶的回收。这些策略包括鼓励消费者用可重复使用的宝特瓶、在製造过程中使用生物分解性或可回收的 PET、设计环保产品以及成立宝特瓶回收专家委员会。製造商正在透过技术创新来应对这一趋势。我们努力满足政府法规和企业永续性目标,并将自己定位为永续生产的领导者。

预计亚太地区将占据主要市场份额

- 近年来,亚太地区的饮料包装产业经历了显着的成长。推动这一成长的关键因素包括全部区域包装趋势的快速变化。饮料包装的新兴趋势重点在于结构变化、消费后回收等再生材料的开发、顾客接受度、安全性、较新的填充技术以及耐热宝特瓶的开发。这些进步正在延长各种饮料的保质期,同时为市场提供新的可能性和选择。

- 人口成长和生活方式的改变推动了中国和印度瓶装水消费量的增加。这一趋势导致了对各种重量轻、便携、易于存放且符合永续性法规的瓶子形式的需求。印度作为一个人口大国和新兴经济体,瓶装水消费量大幅增加。印度铁路餐饮和旅游有限公司推出了宝特瓶饮用水品牌“Rail Neer”,主要在火车上和火车站销售。为了满足瓶装水消费量的不断增长和铁路行业的扩张,该公司正在增加产量。 2021年产量将达7,530万瓶,2023年将增加至3.577亿瓶。

- 该地区各国正将重点转向永续和环保实践,以推广再生塑胶的使用。这种转变促使可口可乐等饮料公司将再生塑胶纳入其策略,以减少对环境的影响。 2024年4月,美国饮料公司可口可乐公司在香港推出了由回收聚对苯二甲酸乙二醇酯 (rPET) 製成的可口可乐原味瓶、无糖可口可乐和可口可乐 Plus 瓶。在北京,INCOM宣布将于2023年6月在天津启动其rPET工厂第二期工程。计划拟设立一条年处理废旧宝特瓶5万吨的食品级包装生产线。

- 此外,2023 年 6 月,可口可乐印度公司宣布与奥地利包装解决方案提供商 ALPLA 合作,在印度推出 Kinrei 品牌的开创性倡议。着名瓶装水品牌 Kinley 现已转向仅使用 100% 可回收的 rPET 瓶,这是印度饮料行业的开创性倡议。值得注意的是,这款一公升瓶装饮料是印度食品和饮料行业首个采用此类永续材料製成的饮料瓶。此次策略合作彰显了 Alpla 和可口可乐对推动循环经济的承诺。

- 印尼、柬埔寨、新加坡、泰国和越南等东南亚国家各产业对宝特瓶的需求日益增加。这种成长在食品和饮料行业尤为明显, 宝特瓶被广泛用于包装饮料和流质食品。在製药业, 宝特瓶因其耐用性和抗化学反应性而受到青睐。化妆品和个人护理行业也满足了这种需求,利用宝特瓶来盛装洗髮精、乳液和其他个人保健产品。这种跨多个垂直领域的广泛采用是推动亚太地区市场成长的关键因素。

宝特瓶产业概况

宝特瓶市场比较分散,Amcor Group GmbH、Gerresheimer AG、Alpla Group 和 Berry Global Inc. 等多家全球和地区参与者在竞争激烈的市场领域争夺关注。该市场的特点是产品差异化程度低、产品渗透率高、竞争激烈。

- 2024 年 5 月 - Alpura 推出可回收的 PET 葡萄酒瓶,与传统玻璃瓶相比具有多种优势。这种创新的包装解决方案重量约为玻璃瓶的八分之一,碳排放减少高达50%,成本降低高达30%。瓶子完全由再生 PET(rPET)製成。

- 2024 年 4 月 - 负责任包装解决方案的开发商和製造商 Amcor 宣布推出一款 1L 聚对苯二甲酸乙二醇酯 (PET) 瓶,用于盛装碳酸软性饮料 (CSD),该瓶完全由消费后回收 (PCR) 材料製成。安姆科硬质包装 (ARP) 将把 1L CSD 100% PCR 瓶加入其由再生材料製成的负责任包装产品组合中。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 评估地缘政治趋势对产业的影响

第五章 市场动态

- 市场驱动因素

- 越来越多地采用轻量化包装方法

- 瓶装水产业对 PET 包装的需求不断增加

- 市场挑战

- 与塑胶使用相关的环境问题

第六章 技术简介

- 拉伸吹塑成型

- 射出成型

- 挤出吹塑成型

- 热成型

第七章 市场区隔

- 按行业

- 饮料

- 包装饮用水

- 碳酸饮料

- 果汁

- 能量饮料

- 其他饮料

- 食物

- 个人护理

- 家居用品

- 药品

- 其他最终用户产业

- 饮料

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 亚洲

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 墨西哥

- 巴西

- 哥伦比亚

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 北美洲

第八章 竞争格局

- 公司简介

- Gerresheimer AG

- Pact Group Holdings Limited

- Alpla Group

- Berry Global Inc.

- Alpha Packaging Pvt. Ltd

- Greiner Packaging International GmbH

- Retal Industries Limited

- Zhejiang Xinlei Packaging Co. Ltd

- Shenzhen Zhenghao Plastic & Mold Co. Ltd

- Manjushree Technopack Limited

- Resilux NV

- Greiner Packaging International GmbH

- Comar Packaging LLC

- Retal Industries Limited

- SILGAN PLASTICS LLC(Silgan Holdings Inc.)

- Nampak Ltd.

- Amcor Group GmbH

- Graham Packaging

- Container Corporation of Canada

- Altium Packaging

- Apex Plastics

第九章投资分析

第十章 市场机会与未来趋势

The PET Bottles Market size is estimated at 26.23 million metric tons in 2025, and is expected to reach 32.19 million metric tons by 2030, at a CAGR of 4.18% during the forecast period (2025-2030).

Key Highlights

- Plastic bottles and containers, primarily made of polyethylene terephthalate, are widely used because they are lightweight and durable, facilitating easier handling. Manufacturers prefer plastic packaging because of its lower production costs. During the forecast period, the market studied is poised for growth, propelled by the cost-effectiveness of plastic packaging and the rising demand for packaged food and beverages. Furthermore, polyethylene terephthalate (PET) containers are favored for their durability, versatility, and cost-effectiveness. As end-user industries such as food, beverage, and pharmacy expand and innovate, the demand for plastic bottles and container packaging grows. The introduction of new drinks with various flavors and packaging formats in the industry continues to drive the need for rigid plastic bottles.

- PET bottles are increasingly replacing glass bottles due to their lightweight and durable nature. These bottles can be used to pack mineral water and other beverages, enabling more cost-effective transportation. PET's transparency and inherent CO2 barrier properties suit it for various applications. PET can readily be molded into different shapes or blown into bottles. Manufacturers can customize PET's properties by incorporating additives like colorants, UV blockers, and oxygen barriers, enabling the creation of bottles tailored to specific brand needs.

- The PET packaging market faces significant challenges due to evolving regulatory standards, primarily driven by growing environmental concerns. Governments worldwide are responding to public apprehension about plastic packaging waste by implementing regulations to minimize environmental impact and improve waste management processes. These regulatory changes often include restrictions on single-use plastics, increased recycling targets, and extended producer responsibility programs. As a result, PET packaging manufacturers adapt their production processes, invest in eco-friendly alternatives, and develop more sustainable packaging solutions to comply with these new standards. This regulatory landscape affects the industry's operational costs and influences consumer preferences as environmentally conscious consumers increasingly demand sustainable packaging options.

- Sustainable packaging solutions have gained prominence due to increased consumer awareness regarding the environmental benefits of eco-friendly packaging. PET has become an essential resin among eco-friendly packaging materials due to its recyclability and potential for circularity. Closed-loop recycling, where plastic is recycled and used to create new products in the same category, is often applied to PET bottles. This approach has led businesses to prioritize PET over other resin materials. As a result, the recycling of plastic bottles is expected to impact the market positively.

- Companies are innovating to meet the increasing demand for rPET across end-user segments. The surge in sustainable packaging is propelled by consumer preferences and regulatory mandates to curb plastic waste. For instance, in June 2024, Kraft Heinz introduced 100% recycled PET bottles for its 12- and 22-oz Kraft Real Mayo and Miracle Whip sizes. This move followed the company's 2023 announcement of a goal to reduce virgin plastic use in its global packaging portfolio by 20% by 2030. Adopting rPET in food packaging demonstrates the material's versatility and growing acceptance in the industry. Other companies are likely to follow suit, potentially leading to a significant increase in rPET demand and further innovations in recycling technologies to meet this demand.

PET Bottles Market Trends

The Beverages Segment is Expected to Witness Significant Growth

- PET bottles dominate the water packaging industry over glass and other plastic bottles due to their durability and recyclability. The trend indicates that lightweight, durable, and cost-effective PET is increasingly becoming the preferred packaging medium for water. This shift is driven by consumer demand for convenience and sustainability and manufacturers' need for efficient and cost-effective packaging solutions. Due to their moldability, PET bottles can quickly adapt to changing packaging trends and labeling needs, providing a versatile canvas for design and branding. Their lightweight and durable properties make them a preferred choice for bottled beverages and contribute to cost-effective transportation and lower carbon emissions.

- Polyethylene terephthalate (PET) bottles are increasingly prevalent across diverse product segments. Their appeal lies in their affordability, lightweight nature, and the continuous advancements in printing technologies. These factors have notably elevated PET bottles' status, particularly among discerning consumers. Indorama Ventures projects a surge in demand for polyethylene terephthalate resins, from 30 million metric tons in 2023 to 42 million by 2030.

- The beverages segment in the PET bottles market is poised for growth due to increasing demand for bottled water and non-alcoholic beverages. This demand is driven by consumers' preference for high-quality drinking water, concerns about contaminated tap water, and the convenience of portable bottled water. The global demand for packaged drinking water may further propel the beverage category in the plastic bottle packaging industry. Plastic bottles are favored for their cost-effectiveness, extended shelf life, and ease of use compared to other packaging options.

- Governments worldwide are intensifying their efforts to promote recycling single-use plastic bottles. Strategies include encouraging consumers to refill reusable plastic bottles, utilizing biodegradable or recycled PET for manufacturing, designing eco-friendly products, and establishing dedicated councils for bottle recycling. Manufacturers are responding to this trend by innovating. They strive to meet government regulations and corporate sustainability goals and are positioning themselves as leaders in sustainable production.

Asia-Pacific Expected to Hold Significant Share in the Market

- The beverage packaging industry in the region has experienced significant growth in recent years. Key factors driving this growth include rapid changes in packaging trends across the region. New trends in beverage packaging focus on structural changes, the development of recycled materials such as post-consumer recycling, customer acceptance, safety, newer filling technologies, and the development of heat-resistant PET bottles. These advancements have provided new possibilities and options in the market while improving the preservation of various drinks.

- The consumption of bottled water is increasing across China and India due to population growth and changing lifestyles. This trend is creating demand for various bottle formats that are lightweight, portable, and easily stored while meeting sustainability regulations. With its large population and developing economy, India is experiencing a significant increase in bottled water consumption. The Indian Railway Catering and Tourism Corporation Limited introduced a PET bottled water brand, "Rail Neer," primarily sold on trains and at railway stations. The corporation is increasing production with the increase in bottled water consumption and expansion of the railway industry. In 2021, 75.30 million bottles were produced, which rose to 357.70 million in 2023.

- Countries in the region are shifting their focus toward sustainable and eco-friendly practices to promote the use of recycled plastic. This shift has prompted beverage manufacturers like Coca-Cola to incorporate recycled plastic into their strategies for reducing environmental impact. In April 2024, The Coca-Cola Company, a US-based beverage company, introduced Coca-Cola Original, Coca-Cola No Sugar, and Coca-Cola Plus bottles made from recycled polyethylene terephthalate (rPET) in Hong Kong. In Beijing, INCOM announced the commencement of phase II of its rPET plant in Tianjin in June 2023. The project aims to establish a food-grade packaging production line with an annual waste plastic bottle processing capacity of 50,000 tons.

- Furthermore, in June 2023, Coca-Cola India, in partnership with Austrian packaging solution provider ALPLA, introduced a groundbreaking initiative for its Kinley brand in India. Kinley, a prominent bottled drinking water brand, now exclusively utilizes 100% recycled rPET bottles, marking a pioneering move in India's beverage landscape. Notably, these bottles, available in one-liter variants, are the nation's inaugural offering in the food and beverage realm crafted from such sustainable materials. This strategic collaboration underscores ALPLA's and Coca-Cola's commitment to fostering a circular economy.

- Southeast Asian countries, including Indonesia, Cambodia, Singapore, Thailand, and Vietnam, experienced increased demand for PET bottles in various industries. This growth is particularly notable in the food and beverage industry, where PET bottles are widely used for packaging beverages and liquid food products. In the pharmaceutical industry, PET bottles are preferred for their durability and resistance to chemical interactions. The cosmetics and personal care industries also contribute to this demand, utilizing PET bottles for products such as shampoos, lotions, and other personal care items. This widespread adoption across multiple sectors has been a significant factor in driving market growth in Asia-Pacific.

PET Bottles Industry Overview

The PET bottles market is fragmented, with several global and regional players, such as Amcor Group GmbH, Gerresheimer AG, Alpla Group, and Berry Global Inc., vying for attention in a contested market space. This market is characterized by low product differentiation, growing levels of product penetration, and high levels of competition.

- May 2024 - ALPLA introduced a recyclable PET wine bottle that offers several advantages over traditional glass bottles. This innovative packaging solution weighs approximately one-eighth of a glass bottle, reduces carbon footprint by up to 50%, and can lower costs by up to 30%. The bottle is manufactured entirely from recycled PET (rPET).

- April 2024 - Amcor, a player in developing and producing responsible packaging solutions, announced the launch of a 1 L polyethylene terephthalate (PET) bottle for carbonated soft drinks (CSDs) made entirely from post-consumer recycled (PCR) content. Amcor Rigid Packaging (ARP) is expected to incorporate this 1 L CSD 100% PCR bottle into its growing portfolio of responsible packaging made from recycled materials.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Defintion

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Geopolitical Developments on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight Packaging Methods

- 5.1.2 Increasing Demand for PET Packaging from the Bottled Water Industry

- 5.2 Market Challenges

- 5.2.1 Environmental Concerns Regarding Use of Plastics

6 TECHNOLOGY SNAPSHOT

- 6.1 Stretch Blow Molding

- 6.2 Injection Molding

- 6.3 Extrusion Blow Molding

- 6.4 Thermoforming

7 MARKET SEGMENTATION

- 7.1 By End-user Vertical

- 7.1.1 Beverages

- 7.1.1.1 Packaged Water

- 7.1.1.2 Carbonated Soft Drinks

- 7.1.1.3 Fruit Juice

- 7.1.1.4 Energy Drinks

- 7.1.1.5 Other Beverages

- 7.1.2 Food

- 7.1.3 Personal Care

- 7.1.4 Household Care

- 7.1.5 Pharmaceuticals

- 7.1.6 Other End-user Verticals

- 7.1.1 Beverages

- 7.2 By Geography

- 7.2.1 North America

- 7.2.1.1 United States

- 7.2.1.2 Canada

- 7.2.2 Europe

- 7.2.2.1 United Kingdom

- 7.2.2.2 Germany

- 7.2.2.3 France

- 7.2.2.4 Italy

- 7.2.3 Asia

- 7.2.3.1 China

- 7.2.3.2 India

- 7.2.3.3 Japan

- 7.2.3.4 Australia and New Zealand

- 7.2.4 Latin America

- 7.2.4.1 Mexico

- 7.2.4.2 Brazil

- 7.2.4.3 Columbia

- 7.2.5 Middle East and Africa

- 7.2.5.1 Saudi Arabia

- 7.2.5.2 South Africa

- 7.2.5.3 United Arab Emirates

- 7.2.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Gerresheimer AG

- 8.1.2 Pact Group Holdings Limited

- 8.1.3 Alpla Group

- 8.1.4 Berry Global Inc.

- 8.1.5 Alpha Packaging Pvt. Ltd

- 8.1.6 Greiner Packaging International GmbH

- 8.1.7 Retal Industries Limited

- 8.1.8 Zhejiang Xinlei Packaging Co. Ltd

- 8.1.9 Shenzhen Zhenghao Plastic & Mold Co. Ltd

- 8.1.10 Manjushree Technopack Limited

- 8.1.11 Resilux NV

- 8.1.12 Greiner Packaging International GmbH

- 8.1.13 Comar Packaging LLC

- 8.1.14 Retal Industries Limited

- 8.1.15 SILGAN PLASTICS LLC (Silgan Holdings Inc.)

- 8.1.16 Nampak Ltd.

- 8.1.17 Amcor Group GmbH

- 8.1.18 Graham Packaging

- 8.1.19 Container Corporation of Canada

- 8.1.20 Altium Packaging

- 8.1.21 Apex Plastics