|

市场调查报告书

商品编码

1644443

印尼硬质塑胶包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Indonesia Rigid Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

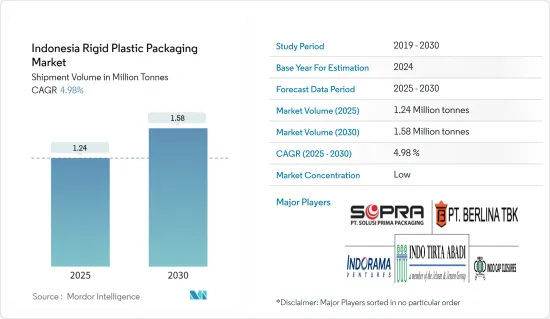

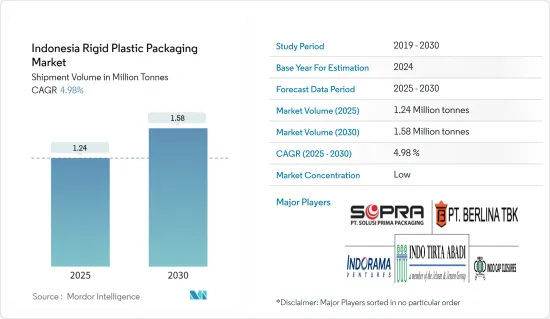

以出货量为准,印尼硬质塑胶包装市场规模预计将从 2025 年的 124 万吨成长到 2030 年的 158 万吨,预测期间(2025-2030 年)的复合年增长率为 4.98%。

由于塑胶包装的演变和采用,印尼硬质塑胶包装市场目前的表现有所不同。印尼下游硬质塑胶包装市场高度发达,但由于依赖进口原料,成长潜力有限。

主要亮点

- 印尼的工业部门对于支撑该国的经济成长至关重要。在过去几年里,该产业的产量和产值显着成长。这背后的主要因素包括政府对投资者的激励措施、友善的商业环境、技术进步和熟练的劳动力。在消费支出不断增长的推动下,预计未来几年印尼硬质塑胶包装市场将继续成长。

- 塑胶包装重量轻、易于处理,比其他类型的包装更受消费者欢迎。甚至大型製造商也因其生产成本低而更喜欢塑胶包装解决方案。此外,聚对苯二甲酸乙二酯(PET)、高密度聚苯乙烯(HDPE)等聚合物的出现扩大了塑胶包装的应用范围。各行各业对宝特瓶的需求正在增加。

- 印尼在亚洲不断扩大的消费市场中发挥关键作用,而包装材料方面的投资稳步涌入也凸显了这一作用,这与全部区域高端包装日益增长的需求相一致。例如,2023年1月,BASF扩大了位于印尼Merak工厂的聚合物分散体生产能力。

- 印尼对硬质塑胶包装的需求正在增加。硬质塑胶包装应用于工业、零售和医疗保健等多个领域。由于其优异的阻隔性、较长的保质期和耐用性,塑胶包装在医疗保健领域正经历显着的成长。

- 全国各地的製造商都倾向于使用硬质塑胶包装,因为它是一种经济有效的解决方案,可以在从农场到餐桌的运输过程中保护食品和饮料,并长期保存食品。这些包装还支援各种形状和形式的创新,并且重量轻。

- 然而,预测期内监管标准的变化、原材料成本的波动、废物量的增加以及环境废弃物法规的日益严格预计将阻碍市场的成长。这也有望鼓励企业开发具有颠覆性潜力的新产品,并降低当前市场的风险。

印尼硬质塑胶包装市场的趋势

聚对苯二甲酸乙二醇酯(PET)预计将出现强劲成长

- 印尼包装产业对 PET 的需求正在增加。良好的阻隔性、高抗拉强度、优异的表面光洁度和低成本使 PET 成为许多塑胶包装应用的理想产品。

- 与玻璃相比,PET 的引入可节省高达 90% 的重量,使运输过程更加经济。 宝特瓶现在为矿泉水和其他饮料提供可重复使用的包装,取代了沉重而易碎的玻璃瓶。

- 在硬质塑胶包装市场,PET 用于製造微波食品托盘、软性饮料、水、果汁、运动饮料、啤酒、漱口水、番茄酱、沙拉酱和食品罐的塑胶瓶。家庭护理、饮料和个人护理等各个终端用户行业对宝特瓶的需求正在增长。这种成长是由消费者偏好和 PET 的特性(例如重量轻、可回收性高)所推动的。

- 为了符合要求并建立闭合迴路回收週期,当地市场供应商也致力于使 PET 一次性包装更加可回收。随着人们对 PET 一次性包装回收的重视程度不断提高,预计 PET 一次性包装将迎来成长机会。

- 随着牛奶饮料需求的不断增长,製造商正在生产轻质、透明的塑胶瓶。这不仅提高了产品的知名度,而且解决了成本效益和永续性的担忧。其中, 宝特瓶是牛奶的首选包装,因为其重量轻,降低了运输成本,而且易于消费者拿取。

- 根据印尼统计局 2023 年 6 月发布的资料,2022 年,印尼乳牛厂生产了约 1.3 亿公升牛奶,比 2020 年有所成长。在研究期间,印尼这些产品的产量保持相对稳定。全国稳定的牛奶产量可能会在未来几年增加牛奶包装用宝特瓶的需求。

食品领域可望占据主要市场占有率

- 硬质塑胶包装,包括宝特瓶和容器,在食品包装应用中仍然很受欢迎。容器用于包装消费品,包装用的是HDPE和LDPE。

- 印尼食品业采用各种硬质塑胶包装。印尼人对食用有机食品的兴趣越来越大,导致有机农产品的采购和出口增加。印尼包装的主要最终用途之一是食品。然而,印尼长期以来一直进口大量加工食品和基本食品原料。

- 用于製造瓶子和容器产品的材料包括聚对苯二甲酸乙二酯(PET)和聚丙烯(PP)。 PP 经过吹塑成型可製成木箱、木瓶和木锅。由PP製成的薄壁容器是印尼各地的标准,用于食品包装。

- 印尼政府推出了新的食品接触包装法,以更新该国的包装标准,并使其与美国FDA 和欧盟食品立法等国际标准保持一致。修订后的法规涵盖了五种包装类别的国产和进口食品包装,包括硬质塑胶。

- 随着印尼食品产业的商机不断成长,一些国际参与者不断投资该市场,为硬质塑胶製造商创造更多创新和推出塑胶食品包装选择的途径。根据印尼统计局2024年2月发布的报告,2023年印尼食品业的外国直接投资达到约22.6亿美元,高于2020年的15.9亿美元。

印尼硬质塑胶包装产业概况

印尼硬质塑胶包装市场比较分散。由于大量製造公司在该国运营,分散化现象正在加剧。市场参与者正在寻求透过投资研发、将新技术融入其产品以及提供改进的消费产品来保持优势。策略联盟、协议、合併和伙伴关係关係是所采用的一些策略。

- 2024 年 7 月,领先的塑胶薄片供应商 PT ALBA Tridi 宣布建立最先进的 rPET 工厂,反映了政府促进平衡和支持绿色投资的政策。该工厂是中爪哇省第一家食品级 rPET 製造商,预计将增强当地经济并促进当地中小微型企业的发展。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 贸易情景

- 贸易分析(前 5 名进出口国)

第五章 市场动态

- 市场驱动因素

- 食品饮料包装产业需求强劲

- 市场限制

- 与软质塑胶包装的竞争

第六章 市场细分

- 依树脂类型

- 聚乙烯 (PE)

- 低密度聚乙烯 (LDPE) 和线型低密度聚乙烯(LLDPE)

- 高密度聚苯乙烯(HDPE)

- 聚对苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 聚苯乙烯 (PS) 和发泡聚苯乙烯 (EPS)

- 聚氯乙烯(PVC)

- 其他树脂类型

- 聚乙烯 (PE)

- 依产品类型

- 瓶子和罐子

- 托盘和容器

- 盖子与封口装置

- 中型散装容器 (IBC)

- 鼓

- 调色盘

- 其他产品类型

- 按最终用途行业

- 食物

- 糖果零食

- 冷冻食品

- 生鲜食品

- 乳製品

- 干粮

- 肉类、家禽、鱼贝类

- 宠物食品

- 其他食品

- 食品服务

- 饮料

- 卫生保健

- 化妆品和个人护理

- 工业

- 建筑和施工

- 汽车

- 其他最终用户产业

- 食物

第七章 竞争格局

- 公司简介

- PT. Berlina Tbk

- PT Indo Tirta Abadi

- PT.Solusi Prima Packaging

- PT. Indorama Ventures Indonesia

- Indo Cap Closures

- PT. Hasil Raya Industries

- PT. Hokkan Deltapack Industri

- PT Rheem Indonesia

- PT. Neilsen

- PT. Namasindo Plus

- 热图分析

- 竞争分析:新兴企业与现有公司

第 8 章回收与永续性展望

第九章:未来展望

The Indonesia Rigid Plastic Packaging Market size in terms of shipment volume is expected to grow from 1.24 million tonnes in 2025 to 1.58 million tonnes by 2030, at a CAGR of 4.98% during the forecast period (2025-2030).

The Indonesian rigid plastic packaging market now operates differently as a result of the evolution and adoption of plastic packaging. Although Indonesia's downstream rigid plastic packaging market is highly developed, its reliance on imported raw materials has limited its growth potential.

Key Highlights

- Indonesia's industrial sector has been pivotal in bolstering the nation's economic growth. Over the past few years, this sector has seen a notable uptick in both production volume and value. Key drivers of this include government incentives for investors, a business-friendly environment, technological advancements, and a skilled workforce. The rigid plastics packaging market in Indonesia is poised for continued growth in the coming years, fueled by surging consumer spending.

- Plastic packaging is more popular with consumers than other types of packaging because plastic is lightweight and easy to handle. Even large manufacturers prefer plastic packaging solutions due to their low production costs. In addition, the emergence of polymers such as polyethylene terephthalate (PET) and high-density polyethylene (HDPE) has expanded the applications of plastic packaging. The demand for PET bottles is increasing across various industries.

- Indonesia's pivotal role in Asia's expansive consumer market is underscored by a steady influx of investments in packaging materials, aligning with the rising demand for premium packaging across the region. For instance, in January 2023, BASF expanded its production capacity for polymer dispersions at its Merak facility in Indonesia.

- In Indonesia, the demand for rigid plastic packaging is on the rise. Rigid plastic packaging is used in various sectors, including industrial, retail, and healthcare. Due to its excellent barrier qualities, lengthy shelf life, and durability, plastic packaging has seen substantial growth in the healthcare sector.

- Various manufacturers in the country prefer rigid plastic packaging as it is a cost-effective solution to protect food and beverages during delivery from farm to table and preserve food over longer durations. These packages also support innovations through different forms and shapes and are lighter in weight.

- However, changing regulatory standards, fluctuating raw material costs, increasing waste volumes, and rising environmental waste regulations are expected to hinder market growth during the forecast period. This is also expected to encourage companies to develop new products that are potentially disruptive and reduce the current risks in the market.

Indonesia Rigid Plastic Packaging Market Trends

Polyethylene Terephthalate (PET) is Expected to Witness Significant Growth

- The demand for PET from the packaging industry is increasing in Indonesia. Superior barrier properties, high tensile strength, better surface finish, and low cost allow PET to be an ideal product for numerous plastic packaging applications.

- The introduction of PET allows weight reductions of up to 90% compared to glass, enabling a more economical transportation process. PET plastic bottles are now replacing heavy and fragile glass bottles to provide reusable packaging for mineral water and other beverages.

- In the rigid plastic packaging market, PET is used to manufacture microwavable food trays and plastic bottles for soft drinks, water, juices, sports drinks, beer, mouthwash, ketchup, salad dressings, and food jars. There is a growing demand for PET bottles from various end-user industries, such as home care, beverages, and personal care. The growth can be attributed to consumer preference and the properties of PET, such as its lightweight nature and high recycling rate.

- In order to comply with requirements and establish a closed-loop recycling cycle, regional market vendors are also concentrating on making PET single-use packaging more recyclable. Growth opportunities for PET single-use packaging are anticipated due to the growing emphasis on recycling these materials.

- Driven by rising demand for milk-based drinks, manufacturers are producing lightweight and transparent plastic bottles. This not only enhances product visibility but also addresses concerns about cost-effectiveness and sustainability. Notably, PET bottles, being lightweight, cut down transportation costs and are easier for consumers to handle, making them the preferred choice for milk packaging.

- As per Statistics Indonesia data published in June 2023, in 2022, Indonesian dairy cow establishments produced nearly 130 million liters of milk, marking an increase from 2020. During the study period, Indonesia's production volume for these products remained relatively stable. Consistent milk production across the country may increase the demand for PET bottles for milk packaging in the upcoming years.

The Food Segment is Expected to Hold a Significant Market Share

- Rigid plastic packaging, including plastic bottles and containers, continues to be popular in food packaging applications. Containers are used to pack consumer goods, and HDPE and LDPE are used for the packaging.

- Indonesia's food industry employs a range of rigid plastic packaging options. Indonesians are becoming more interested in eating organic food, leading to stores stocking and exporting more organic produce. One of the primary end uses of packaging in Indonesia is food. However, Indonesia has long imported many processed and essential food components.

- Some materials used for making bottles and container products include polyethylene terephthalate (PET) and polypropylene (PP). PP is blow-molded to produce crates, bottles, and pots. PP thin-walled containers are standard across the country and used for food packaging.

- The Indonesian government introduced a new food contact packaging legislation to update the domestic packaging standards and align them with international standards, such as those used by the US FDA (Food and Drug Association) and EU food legislation. The revised regulation covers domestic and imported food packaging across five packaging categories, including rigid plastics.

- Owing to the growing opportunities in the Indonesian food industry, several international players are constantly investing in the market, creating more avenues for rigid plastic manufacturers to innovate and launch plastic food packaging options. According to the Statistics Indonesia report published in February 2024, in 2023, foreign direct investment in Indonesia's food industry reached around USD 2.26 billion, marking an increase from USD 1.59 billion in 2020.

Indonesia Rigid Plastic Packaging Industry Overview

The rigid plastic packaging market in Indonesia is fragmented. Numerous manufacturing companies operate in the country, leading to high fragmentation. Market players are trying to maintain dominance by investing in R&D, incorporating new technology into their products, and delivering improved consumer products. Strategic alliances, agreements, mergers, and partnerships are a few of the strategies employed.

- July 2024: PT ALBA Tridi, a key plastic flakes supplier, announced the establishment of a cutting-edge rPET facility, echoing the government's push to balance and champion green investments. This facility, marking Central Java's inaugural food-grade rPET producer, is poised to bolster the regional economy and uplift local micro, small, and medium enterprises.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Trade Scenario

- 4.4.1 Trade Analysis (Top 5 Import-Export Countries)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Demand From the Food and Beverage Packaging Industry

- 5.2 Market Restraints

- 5.2.1 Competition From Flexible Plastic Packaging

6 MARKET SEGMENTATION

- 6.1 By Resin Type

- 6.1.1 Polyethylene (PE)

- 6.1.1.1 Low-Density Polyethylene (LDPE) & Linear Low-Density Polyethylene (LLDPE)

- 6.1.1.2 High Density Polyethylene (HDPE)

- 6.1.2 Polyethylene terephthalate (PET)

- 6.1.3 Polypropylene (PP)

- 6.1.4 Polystyrene (PS) and Expanded polystyrene (EPS)

- 6.1.5 Polyvinyl chloride (PVC)

- 6.1.6 Other Resin Types

- 6.1.1 Polyethylene (PE)

- 6.2 By Product Type

- 6.2.1 Bottles and Jars

- 6.2.2 Trays and Containers

- 6.2.3 Caps and Closures

- 6.2.4 Intermediate Bulk Containers (IBCs)

- 6.2.5 Drums

- 6.2.6 Pallets

- 6.2.7 Other Product Types

- 6.3 By End-use Industries

- 6.3.1 Food

- 6.3.1.1 Candy & Confectionery

- 6.3.1.2 Frozen Foods

- 6.3.1.3 Fresh Produce

- 6.3.1.4 Dairy Products

- 6.3.1.5 Dry Foods

- 6.3.1.6 Meat, Poultry, And Seafood

- 6.3.1.7 Pet Food

- 6.3.1.8 Other Food Products

- 6.3.2 Foodservice

- 6.3.3 Beverage

- 6.3.4 Healthcare

- 6.3.5 Cosmetics and Personal Care

- 6.3.6 Industrial

- 6.3.7 Building and Construction

- 6.3.8 Automotive

- 6.3.9 Other End User Industries

- 6.3.1 Food

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PT. Berlina Tbk

- 7.1.2 PT Indo Tirta Abadi

- 7.1.3 PT.Solusi Prima Packaging

- 7.1.4 PT. Indorama Ventures Indonesia

- 7.1.5 Indo Cap Closures

- 7.1.6 PT. Hasil Raya Industries

- 7.1.7 PT. Hokkan Deltapack Industri

- 7.1.8 PT Rheem Indonesia

- 7.1.9 PT. Neilsen

- 7.1.10 PT. Namasindo Plus

- 7.2 Heat Map Analysis

- 7.3 Competitor Analysis - Emerging vs. Established Players