|

市场调查报告书

商品编码

1644463

亚太地区玻璃瓶和容器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Asia-Pacific Glass Bottles And Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

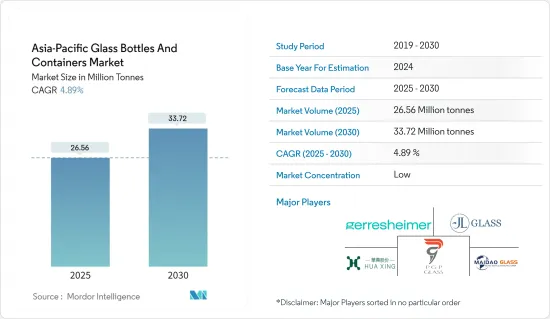

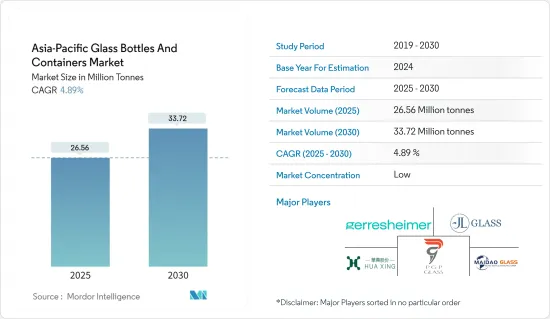

预计 2025 年亚太地区玻璃瓶和容器市场规模将达到 2,656 万吨,预计到 2030 年将达到 3,372 万吨,预测期内(2025-2030 年)的复合年增长率为 4.89%。

主要亮点

- 在亚太地区,食品饮料和製药业正在推动玻璃包装需求的快速成长。需求的成长主要归功于全部区域的塑胶包装禁令、永续性倡议和完善的回收基础设施。

- 国际贸易中心的资料显示,中国在亚洲玻璃包装出口中占据主导地位,2023 年出口量为 1,898,260 吨,其次是印度,出口量为 357,747 吨。随着两国扩大出口,也增加对尖端生产技术的投资。除了卓越的产品品质外,这种先进的包装还能简化流程、降低成本,使玻璃相对于其他包装替代品更具竞争力。

- 在印度,由于人们对酒精饮料的偏好日益增长,玻璃包装行业预计将扩张。玻璃酒瓶尤其受欢迎,因为它们可以防止葡萄酒因阳光照射而变质。加拿大农业和食品部预测,到 2025 年印度的葡萄酒消费量将达到 5,220 万公升,这将进一步增加对玻璃包装的需求。

- 对一次性塑胶的严厉打击导致人们对玻璃等替代品的关注度增加。在日本,与其他包装材料相比,回收玻璃瓶的财务支出非常经济。日本容器包装回收协会的资料显示,2023年玻璃瓶的回收成本为琥珀色瓶每公斤约8.2日圆(0.058美元),无色透明瓶每公斤约6日圆(0.042美元)。这些成本效益促使製造商转向玻璃包装。

- 製造玻璃是一项能源密集产业,需要高温来熔化原料。这种能源需求可能会推高营运成本,特别是在能源价格上涨和环境法规严格的地区。此外,硅石、碱灰和石灰石等主要原料价格波动可能会进一步增加生产成本。

亚太地区容器玻璃市场趋势

饮料占市场占有率最大

- 在亚太包装玻璃市场中,饮料业占据约60%的市场占有率,在推动市场成长方面发挥着举足轻重的作用。

- 消费者越来越意识到使用玻璃容器而非塑胶容器对健康的益处,尤其是用于盛装饮料。玻璃无毒,不会将化学物质渗入产品中,长期使用是安全的,尤其是盛装酒精饮料时。预计消费者偏好的这些变化将推动容器玻璃市场的成长。

- 随着经济的不断发展和中阶的壮大以及购买力的提高,中国的包装产业正在快速且稳定地成长。饮料市场的扩大推动了包装需求的增加,尤其是玻璃容器领域。虽然每种饮料类别都有其独特的挑战和机会,但中国消费者生活方式的新趋势正在塑造对玻璃包装的需求。

- 中国都市区的酒精和非酒精饮料消费量正在增加。具有古老根源的酒精饮料包括米酒、葡萄酒、啤酒、威士忌和各种蒸馏酒。白酒仍是中国消费量最大的蒸馏酒。

- 根据港交所披露,2021年浓香型白酒销售额约2,860亿元(404.2亿美元),占中国白酒销售额的一半以上。预计到 2026 年浓香型白酒销售额将达到 3,129 亿元(442.2 亿美元)。

- 韩国饮酒文化不仅限于饮酒,也涵盖传统的搭配食物。韩国料理以其浓烈、辛辣的口味而闻名,常与酒搭配。从传统的米酒到日益流行的日本烧酒,酒在韩国社会和文化中扮演着重要的角色。该市场的主要特征是生产供大众消费的低成本日本烧酒品牌。

- 玻璃包装对于饮料储存有几个优点。它是永续的、可无限回收的、可重复使用的、可再填充的、不含合成化学物质且惰性。这些特性使玻璃成为安全包装饮料的可行选择。

- 日本可口可乐公司正在实施各种永续性,例如去除饮料上的塑胶标籤和降低自动贩卖机的耗电量。这符合该公司在 2030 年全球回收 25% 的包装并推出可重复使用的包装(包括玻璃瓶)的承诺。这些努力正在促进该地区玻璃容器市场的成长。

- 消费者健康意识的不断增强推动了对具有多种健康益处的机能饮料的需求。玻璃包装符合这一趋势,因为它被认为是一种安全卫生的选择,可以保存饮料的营养价值,从而支持玻璃包装市场的成长。

- 根据香港交易及结算所有限公司的资料,2019年中国机能饮料零售额达约158.2亿美元,预计至2024年将达248.2亿美元。

印度占据了显着的市场成长

- 对乳製品的需求不断增加,推动了玻璃包装设计的创新。製造商可能会投资研发来开发更方便、耐用和美观的玻璃瓶和容器。预计此类技术创新将促进亚太地区玻璃包装市场的成长。

- 乳製品行业对永续性和环保包装解决方案的关注正在推动可回收并可多次重复使用的玻璃容器的进一步应用。

- 印度在全球牛奶生产中的主导地位进一步支持了这一趋势。根据Invest India统计,印度的原乳产量居世界首位,占世界牛奶产量的25%。 2014-15 年至 2022-23 年间,印度的原乳产量预计将增加 58%,达到 2.3058 亿吨。牛奶产量的大幅成长导致对优质包装解决方案的需求增加,玻璃瓶成为优质乳製品的首选包装瓶。

- 软性饮料製造商正在积极推广使用玻璃瓶。 2023年3月,可口可乐印度公司 Thumbs Up 发起了一项名为「Toofan Glass Mein Nahin, Glass Se Peete Hain」的电视宣传活动,鼓励消费者体验可回收玻璃瓶装的饮料。该公司的目标是到 2030 年,全球销售的饮料中至少有 25% 采用可重复使用或可回收的容器,包括汽水供应机和玻璃瓶装饮料。

- 此项倡议不仅促进了永续性,而且还提升了消费者体验,因为众所周知,玻璃瓶比其他包装材料更能保存饮料的碳酸化和风味。

- 非酒精饮料,尤其是软性饮料的成长预计也将影响玻璃包装的市场需求。随着消费者健康意识的增强,天然和有机饮料的消费量也随之增加,这些饮料通常采用玻璃瓶包装以保持其纯度和新鲜度。此外,精酿苏打水和手工饮料等高端非酒精饮料通常选择玻璃包装来传达品质和奢华感。

- 酒精饮料出口的增加推动了对玻璃瓶和容器的需求。玻璃包装因能够保持风味和品质而成为酒精饮料的首选。据APEDA称,印度23财年的酒精饮料出口额预计将达3.16亿美元,比上年度增加3,800万美元。

- 由于国际市场通常对进口酒精饮料的品质和包装有严格的要求,出口的成长导致对优质玻璃包装的需求增加。此外,该地区精酿啤酒厂和酿酒厂的兴起为特殊玻璃瓶和容器创造了一个利基市场,进一步推动了玻璃包装行业的成长。

亚太地区容器玻璃产业概况

亚太地区容器玻璃市场较为分散,几家主要参与者争夺市场占有率。这些公司不断投资于策略伙伴关係和产品开发,以巩固其市场地位。

市场的主要企业包括跨国公司和区域製造商。这些公司专注于扩大生产能力、加强分销网络和开发创新包装解决方案,以满足客户的多样化需求。其他公司进行併购是为了加强其市场地位并获得新技术或细分市场的机会。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 容器玻璃进出口资料

- 容器玻璃市场的PESTEL分析

- 玻璃包装行业标准和法规

- 包装玻璃的原料分析及材料考量

- 玻璃包装的永续性趋势

- 亚太地区容器玻璃熔炉和位置

第五章 市场动态

- 市场驱动因素

- 永续包装解决方案需求不断增长推动玻璃使用

- 製药业对玻璃包装的偏好日益增加

- 市场挑战

- 高製造成本和能源成本限制了容器玻璃市场的成长

- 贸易概况 - 亚太地区容器玻璃产业进出口模式的历史与现状分析

第六章 市场细分

- 按最终用户产业

- 饮料

- 酒精

- 啤酒和苹果酒

- 葡萄酒和烈酒

- 非酒精性

- 碳酸饮料

- 汁

- 水

- 乳类饮料

- 调味饮料

- 食物

- 化妆品

- 药品(不含管瓶和安瓿瓶)

- 其他最终用户产业

- 饮料

- 按国家

- 中国

- 印度

- 日本

- 泰国

- 澳洲和纽西兰

- 韩国

- 越南

第七章 竞争格局

- 公司简介

- Gerresheimer AG

- Guangdong Huaxing Glass Co., LTD

- Maidao Industry Co. Ltd

- JL Glass Co., Ltd

- PGP Glass Private Limited

- KOA GLASS CO., LTD.

- AGI glaspac

- CANPACK GROUP

- Emerge Glass

- JAPAN SEIKO GLASS CO.,LTD.

第八章 补充资料:区域内主要容器玻璃厂主要窑炉供应商分析

第九章:未来市场展望

The Asia-Pacific Glass Bottles And Containers Market size is estimated at 26.56 million tonnes in 2025, and is expected to reach 33.72 million tonnes by 2030, at a CAGR of 4.89% during the forecast period (2025-2030).

Key Highlights

- In the Asia-Pacific region, the food, beverage, and pharmaceutical sectors are driving a surge in demand for glass containers. This uptick is largely attributed to bans on plastic packaging, a push for sustainability, and a well-established recycling infrastructure throughout the region.

- Data from the International Trade Centre highlights China's dominance in Asia's glass container exports, tallying 1,898,260 tons in 2023, with India trailing at 357,747 tons. As both nations ramp up their export activities, they're poised to channel investments into cutting-edge production technologies. Such advancements promise not only superior product quality but also streamlined processes, potentially slashing costs and bolstering the competitiveness of glass containers against other packaging alternatives.

- In India, the rising appetite for alcoholic beverages is set to propel the glass container industry's expansion. Glass bottles, especially for wine, are favored for their protective qualities against sunlight-induced spoilage. Agriculture and Agri-Food Canada forecasts India's wine consumption to hit 52.2 million liters by 2025, further amplifying the demand for glass packaging.

- With the crackdown on single-use plastics, there's been a notable pivot towards alternatives like glass. In Japan, the financial outlay for recycling glass bottles stands out as more economical compared to other packaging materials. Data from the Japan Containers and Packaging Recycling Association reveals that in 2023, recycling costs for amber and colorless glass bottles were about JPY 8.2 (USD 0.058) and JPY 6 (USD 0.042) per kilogram, respectively. Such cost benefits are nudging manufacturers towards glass packaging.

- Producing glass is an energy-intensive endeavor, demanding elevated temperatures to melt raw materials. This energy requirement can inflate operational costs, particularly in areas grappling with surging energy prices or stringent environmental mandates. Moreover, fluctuations in the prices of key raw materials like silica, soda ash, and limestone can further escalate production expenses.

Asia-Pacific Container Glass Market Trends

Beverage Occupies the Largest Market Share

- The beverage industry's dominance, accounting for approximately 60% of the market share in the Asia-Pacific container glass market, plays a pivotal role in driving the market's growth.

- Consumers are increasingly aware of the health benefits of using glass over plastic, particularly for beverages. Glass is non-toxic, does not leach chemicals into the product, and is considered safer for long-term use, especially in alcoholic beverages. This shift in consumer preference is expected to fuel growth in the container glass market.

- China's packaging industry is experiencing rapid and steady growth, fueled by the country's expanding economy and a growing middle class with increased purchasing power. The beverage market's expansion is driving a heightened demand for packaging, particularly in the glass container segment. While each beverage category presents unique challenges and opportunities, emerging trends in Chinese consumer lifestyles are shaping the demand for glass packaging.

- China's major urban areas have witnessed an increase in the consumption of both alcoholic and non-alcoholic beverages. Alcoholic beverages, with roots in ancient times, include rice wine, grape wine, beer, whiskey, and various spirits. Baijiu remains the most consumed distilled spirit in China.

- According to HKEXnews, in 2021, Nongxiang flavor baijiu generated revenue of approximately CNY 286 billion (USD 40.42 billion), accounting for over half of China's baijiu sales revenue. The revenue from Nongxiang flavor baijiu is projected to reach CNY 312.9 billion (USD 44.22 billion) by 2026.

- Korean drinking culture extends beyond alcohol consumption to include traditional accompanying foods. Korean cuisine, known for its intense and spicy flavors, often complements alcohol consumption. From traditional rice wines to the increasingly popular soju, alcohol plays a central role in Korean society and culture. The market is predominantly characterized by low-priced brands producing soju for mass consumption.

- Glass packaging offers several advantages for beverage storage. It is sustainable, infinitely recyclable, reusable, refillable, and inert, containing no synthetic chemicals. These properties make glass a viable option for packaging beverages safely.

- Coca-Cola Japan has implemented various sustainability initiatives, including removing plastic labels from drinks and reducing power consumption in vending machines. This aligns with the company's global commitment to recycle 25% of packaging worldwide by 2030 and implement reusable packaging, including glass bottles. Such initiatives are contributing to the growth of the glass container market in the region.

- Increasing health and wellness awareness among consumers is driving demand for functional beverages, which are perceived to offer various health benefits. Glass packaging aligns with this trend as it is considered a safe and hygienic option for preserving the nutritional integrity of beverages, thus supporting the growth of the glass containers market.

- According to Hong Kong Exchanges and Clearing Limited, the retail sales of functional beverages in China reached nearly USD 15.82 billion in 2019 and are projected to reach USD 24.82 billion by 2024.

India to Account for Significant Market Growth

- The increasing demand for dairy products is driving innovation in glass packaging design. Manufacturers are likely to invest in research and development to create glass bottles and containers that offer improved convenience, durability, and aesthetic appeal. This innovation is expected to contribute to the growth of the Asia-Pacific glass packaging market.

- The dairy industry's focus on sustainability and eco-friendly packaging solutions further propels the adoption of glass containers, as they are recyclable and can be reused multiple times.

- India's dominant position in global milk production further supports this trend. According to Invest India, the country leads worldwide milk production, contributing 25% of the global output. India's milk production increased by 58% between 2014-15 and 2022-23, reaching 230.58 million tonnes in 2022-23. This significant growth in milk production has led to an increased demand for high-quality packaging solutions, with glass bottles being a preferred choice for premium dairy products.

- Soft drink manufacturers are actively promoting the use of glass bottles. In March 2023, Coca-Cola India's Thumbs Up launched a television campaign, 'Toofan Glass Mein Nahin, Glass Se Peete Hain,' encouraging consumers to experience the beverage from returnable glass bottles. The company aims to sell at least 25% of its beverages globally in reusable or returnable containers by 2030, including drinks sold at soda fountains and in glass bottles.

- This initiative not only promotes sustainability but also enhances the consumer experience, as glass bottles are known to maintain the beverage's carbonation and flavor better than other packaging materials.

- The growth in non-alcoholic beverages, particularly soft drinks, is also expected to impact the market demand for glass packaging. The rising health consciousness among consumers has led to an increase in the consumption of natural and organic beverages, which are often packaged in glass bottles to maintain their purity and freshness. Additionally, the premium segment of non-alcoholic beverages, including craft sodas and artisanal drinks, often opts for glass packaging to convey a sense of quality and luxury.

- Increased exports of alcoholic beverages are driving demand for glass bottles and containers. Glass packaging is preferred for alcoholic beverages due to its ability to preserve flavor and quality. According to APEDA, in the financial year 2023, India's export value of alcoholic beverages reached USD 316 million, an increase of USD 38 million from the previous year.

- This growth in exports has led to a higher demand for premium glass packaging, as international markets often have stringent quality and packaging requirements for imported alcoholic beverages. Furthermore, the rise of craft breweries and distilleries in the region has created a niche market for specialized glass bottles and containers, further driving the growth of the glass packaging industry.

Asia-Pacific Container Glass Industry Overview

The Asia-Pacific container glass market is characterized by fragmented, with several major companies competing for market share. These companies consistently invest in strategic partnerships and product development initiatives to strengthen their positions in the market.

Key players in the market include multinational corporations and regional manufacturers. These companies often focus on expanding their production capacities, enhancing their distribution networks, and developing innovative packaging solutions to meet diverse customer needs. Some firms also engage in mergers and acquisitions to consolidate their market presence and gain access to new technologies or market segments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Export-Import Data of Container Glass

- 4.3 PESTEL Analysis of Container Glass Market

- 4.4 Industry Standard and Regulation for Container Glass Use for Packaging

- 4.5 Raw Material Analysis and Material Consideration for Packaging

- 4.6 Sustainability Trends for Glass Packaging

- 4.7 Container Glass Furnace and Location in Asia- Pacific Region

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Sustainable Packaging Solutions Boosting Glass Use

- 5.1.2 Growing Pharmaceutical Industry Preference for Glass Packaging

- 5.2 Market Challenge

- 5.2.1 High Manufacturing and Energy Costs Limiting Growth in the Container Glass Market

- 5.3 Trade Scenerio - Analysis of the Historical and Current Export Import Paradigm for Container Glass Industry in Asia-Pacific

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Bevarages

- 6.1.1.1 Alcoholic

- 6.1.1.1.1 Beer and Cider

- 6.1.1.1.2 Wine and Spirits

- 6.1.1.2 Non-Alcoholic

- 6.1.1.2.1 Carbonated Soft Drinks

- 6.1.1.2.2 Juices

- 6.1.1.2.3 Water

- 6.1.1.2.4 Dairy Based Drinks

- 6.1.1.2.5 Flavored Drinks

- 6.1.2 Food

- 6.1.3 Cosmetics

- 6.1.4 Pharmaceutical (Excluding Vials and Ampoules)

- 6.1.5 Other End-User Vertical

- 6.1.1 Bevarages

- 6.2 By Country

- 6.2.1 China

- 6.2.2 India

- 6.2.3 Japan

- 6.2.4 Thailand

- 6.2.5 Australia and New Zealand

- 6.2.6 South Korea

- 6.2.7 Vietnam

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Gerresheimer AG

- 7.1.2 Guangdong Huaxing Glass Co., LTD

- 7.1.3 Maidao Industry Co. Ltd

- 7.1.4 JL Glass Co., Ltd

- 7.1.5 PGP Glass Private Limited

- 7.1.6 KOA GLASS CO., LTD.

- 7.1.7 AGI glaspac

- 7.1.8 CANPACK GROUP

- 7.1.9 Emerge Glass

- 7.1.10 JAPAN SEIKO GLASS CO.,LTD.