|

市场调查报告书

商品编码

1644484

亚太内容服务平台-市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia Pacific Content Services Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

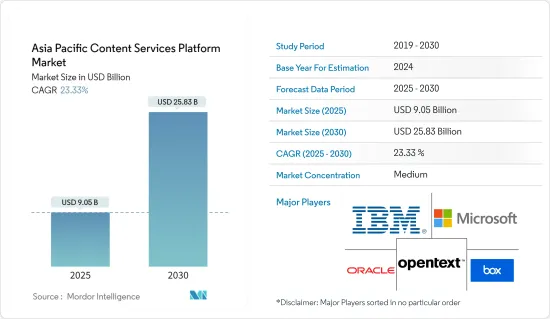

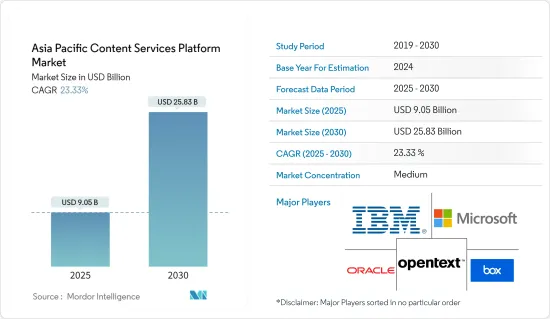

亚太内容服务平台市场规模预计在 2025 年为 90.5 亿美元,预计到 2030 年将达到 258.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 23.33%。

由于中国和印度等开发中国家的资料流量不断增加,以及需要组织的资料和资讯持续增加,预计亚太地区的市场将呈现指数级增长。

关键亮点

- 网路使用者数量的增加、中小企业数量的增加以及云端服务供应商数量的增加为亚太地区带来了巨大的成长机会。该地区的互联频宽也正在快速扩张。例如,根据 Equinix 的数据,受都市化进程加快的推动,亚太地区的网路容量预计将以每年 51% 的速度成长,占全球互连频宽的 27% 以上。

- 此外,对提供更好的客户体验的需求不断增长、民众对智慧技术的采用不断增加、提供情境化用户体验的需求不断增长以及跨多个业务的数位内容数量不断增加都是推动市场发展的一些关键因素。此外,预测期内端到端跨平台解决方案的采用率不断提高、RPA 和 CSP 解决方案的整合度不断提高以及技术发展和服务现代化的进步将为亚太内容服务平台市场提供新的成长潜力和机会。

- 此外,行动、社群媒体、分析和云端技术的日益普及,以及数位内容在各个企业的普及,正在加强该地区的内容服务平台产业。亚太地区的云端运算应用正在快速成长,预计在预测期内对研究市场的成长产生正面影响。新加坡也是亚太地区云端运算最发达的地区之一。在亚洲云端运算协会(ACCA)最新发布的云端运算就绪指数(CRI)中,中国超越香港,夺得榜首。此外,新加坡政府作为以更便宜、更快捷的方式提供公民服务的持续努力的一部分,预计将在预测期内将其大部分 IT 系统迁移到商业云端服务,从而对市场成长产生积极影响。

- 然而,对资料隐私和安全的日益担忧是阻碍市场成长的一个主要因素。此外,在整个预测期内,CSP 策略与组织策略倡议的不断加强的协调也可能对内容服务平台市场构成额外的挑战。

- COVID-19 疫情对市场研究产生了积极影响,因为人们已经转向云端基础的技术,并且随着维护和实施向员工的内容流的需求不断增加,整个流程得到了增强。政府机构也被迫将业务电脑化数位化。例如在印度,Aarogya Setu 和国家电子健康局及新的远端医疗指南等相关倡议正在共同建构国家健康堆栈,预计将于 2022 年完成。

亚太地区内容服务平台市场趋势

解决方案软体领域预计将占据最大的市场占有率

- 云端运算彻底改变了资料储存方式,并对文件管理系统产生了深远的影响。亚太地区正迅速采用数位化文件管理,以尽量减少对纸张的依赖。此外,在中国等一些国家,降低人事费用、提高工作效率已成为企业管理的重要动机。

- 近日,海关总署启动海关无纸化试验改革,允许海关申报资讯透过电脑等多种电子媒体传输、储存和自动审核。海关总署也大力推行价格审核通关单证无纸化,支持全国海关一体化改革,提升通关整体效率。此外,中国也越来越需要采用文件管理解决方案来遏制运输和贸易领域的非法采伐,这预计将推动DMS的整体需求。

- 此外,印度日益增长的环境问题以及数位转型和智慧设备的广泛应用正在推动印度走向无纸化并迅速采用文件管理解决方案。印度政府的关键部门正在全部或部分迁移到离线-线上文件管理系统。最近,印度人民院宣布议会将无纸化办公,以节省树木和削减成本,议员现在使用数位文件来撰写议题。出于安全原因,印度的教育机构也采用了文件管理解决方案。例如,印度教育机构马尼帕尔高等教育学院(MAHE)已转向无纸化文件管理系统,以更有效地管理和组织记录和资讯并储存资料。

- 此外,在日本等国家,由于人口减少和老化,人们越来越关註生产力和劳动力短缺,从而刺激了各领域的数位化。此外,日本政府计划在2026年日本新国立檔案馆开放时将大部分公共文件转为数位化管理,目的是防止限制政府整体发展的记录管理问题。此外,澳洲比其他亚太国家更早获得无纸化办公室的支持。例如,澳洲税务局(ATO)于2002年认可了数位化申报。它建立了一套税务法规,为电子记录保存提供指导方针。

- 此外,由澳洲政府理事会(COAG)医学委员会核准的《国家数位健康战略》优先消除医疗保健产业的纸本通讯。该部门一直在与软体产业和医疗保健提供者合作制定标准,以改善医疗资讯的安全交换。该系统使个人和客户受益,因为它避免了向五个不同的人反覆解释病情的麻烦,并允许医疗专业人员安全、快速地共用资讯。

IT、电讯、零售和电子商务产业将快速成长

- 通讯产业正在经历重大结构性变革,包括内容、客户管道和通讯服务的数位化,以及新的价值生态系统的形成。在当今数位时代,各种供应商都在建立高效能网路以满足客户的需求。这些结构性变化为该领域的工作流程管理服务创造了新的机会。随着网路技术和设备越来越强大,市场上不同物联网内容服务平台的范围也不断扩大。根据GSMA预测,到2026年,物联网和综合电力广域网路的早期采用预计将产生总计1.8兆美元的收入。

- 随着数位转型的实施和拥有,很大一部分是由IT部门广泛推动的。随着资料连接性的提升,供应商正在广泛地将云端和基于物联网的内容服务平台引入企业,以帮助他们管理和创建网路内容。 CMS 还允许您追踪和管理网路流量,包括访客活动和搜寻。

- 此外,Archive One 是一款文件管理软体,可自动搜寻、保护、分类和储存重要文檔,并充当审核工具。这在 IT-BPM 领域非常有用,因为该领域通常有数千名员工和大量资料需要追踪。此外,Paperless Trail Inc. 强调接受商业新常态以及有效地将文件管理和合规性转变为数位空间的重要性,以应对组织因技术进步而面临的挑战。

- 市场正看到销售交易正在进行中,主要在亚太地区,涉及云端、内部部署和混合模型。例如,2021年7月,Tech 资料和Cinity在亚太地区建立了新的经销合作伙伴关係。该合作伙伴关係将使亚太地区的企业能够以多种方式部署 Syniti 资料复製,包括云端、本地和混合模式。

- 此外,Syniti 资料复製是一种低感性、灵活的解决方案,可为资料仓储、分析和其他应用程式提供一致的资料副本,而不会中断业务关键型系统的回应能力。其多功能的变更资料撷取(CDC) 可确保业务资料更新,以支援即时效能报告和分析系统。这将有助于企业加强资料和分析能力并实现大规模的行销倡议。

亚太内容服务平台产业概览

亚太地区内容服务平台市场整体分化程度适中,微软公司、IBM 公司、甲骨文公司、OpenText 公司等少数几家参与企业占据了相当大的市场占有率。这些公司正在利用各种策略创新和合作措施来提高盈利和最大限度地扩大市场占有率。预计企业广泛采用数位内容将显着扩大所审查的市场。

- 2022 年 3 月-Adobe 宣布全面推出 Adobe Experience Cloud for Healthcare,可协助医疗保健公司提供客製化、安全的数位体验和无缝的客户旅程。

- 2021 年 9 月 - Intalio 宣布与 On-OneTech (Pty) Ltd 建立合作伙伴关係,将其地理范围扩大到非洲。该合作伙伴关係将使 Intalio 能够向非洲医疗保健行业销售产品并为其提供支持,并改变整个非洲的医疗保健组织,从而提供超出其主要市场的更广泛的地理覆盖范围。

- 2021 年 7 月-安永和 IBM 宣布建立增强的全球多年期联盟,主要旨在协助组织推动数位转型并改善客户成果。此次合作将包括利用 Red Hat OpenShift、IBM Watson、IBM Blockchain 以及 IBM 的 5G 和边缘技术的各种混合云端功能。我们的专家将共同致力于帮助客户业务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场动态

- 市场驱动因素

- SMAC 技术的应用日益广泛

- 企业数位内容的兴起

- 情境化使用者体验的需求

- 市场限制

- 资料隐私和安全问题

第六章 市场细分

- 按组件

- 解决方案/软体

- 文件和记录管理

- 资料撷取

- 工作流程管理

- 资讯安全与管治

- 案件管理

- 其他解决方案

- 按服务

- 解决方案/软体

- 依实施类型

- 本地

- 云

- 按组织规模

- 中小型企业

- 大型企业

- 按最终用户产业

- BFSI

- 政府及公共机构

- 医学生命科学

- IT、通讯、零售、电子商务

- 运输和物流

- 其他的

- 按国家

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

第七章 竞争格局

- 公司简介

- IBM Corporation

- Microsoft Corporation

- OpenText corporation

- Box Inc.

- Oracle Corporation

- Hyland Software Inc.

- Laserfiche Inc.

- Hewlett Packard enterprise(Micro Focus)

- Adobe Systems Inc.

- M-Files Inc.

第八章投资分析

第九章:市场的未来

The Asia Pacific Content Services Platform Market size is estimated at USD 9.05 billion in 2025, and is expected to reach USD 25.83 billion by 2030, at a CAGR of 23.33% during the forecast period (2025-2030).

In the Asia Pacific region, the market is expected to witness exponential growth, owing to increasing data traffic and continously growing data and information that requires to be organized in economically developing countries, such as China and India.

Key Highlights

- The rising growth of Internet-connected users, with a growing number of SMEs and cloud service vendors, provides significant growth opportunities in the Asia Pacific region. The interconnection bandwidth is also accelerating drastically in the region. For instance, according to Equinix, the Asia Pacific region is expected to expand by 51% per annum, accounting for over 27% of interconnection bandwidth globally, owing to a rise in urbanization.

- In addition, the rising demand to provide better customer experience, as well as rising usage of smart technologies among the population, growing need for delivering contextualized user experience, and rise in the of digital content across several enterprises, are among the vital factors enhancing the market. Moreover, during the projection period, rising adoption of end-to-end, cross-platform solutions, rise in the integration of RPA with CSP solutions, and growing technological developments and modernization in the services will offer new growth possibilities and apportunities for the market for Asia Pacific content services platform.

- Further, the rise in the adoption of mobile, social media, analytics, cloud technologies and the proliferation of digital content across various companies are enhancing the content services platform industry in the region. Cloud adoption in the Asia Pacific region is growing at a very rapid pace, which is anticipated to impact the growth of the market studied positively over the forecast period. In addition, Singapore is one of the most cloud-ready regions within the Asia-Pacific region. It overtook the position of Hong Kong in the latest iteration of the Asia Cloud Computing Association's (ACCA) Cloud Readiness Index (CRI). Additionally, Singapore's government is expected to move the bulk of its IT systems to commercial cloud services over the projection period as part of ongoing efforts to provide citizen services in a cheaper and faster and way, thereby positively influencing the growth of the market.

- In contrast, rising data privacy and security related concerns are significant factors, among others impeding the market growth. Also, the continously increasing aligning of CSP strategy with the strategic initiatives of organizations may further challenge the content services platforms market throughout the forecasted time period.

- The COVID-19 pandemic impacted the market studied positively, as people move to the cloud- based technologies and the whole process was enhanced with the rising need to maintain and implement content flow to employees. Also, government bodies were forced to adopt electronic means of operations and digitalization. For instance, in India, Aarogya Setu and other allied initiatives, like the National e-Health Authority and new tele-medicine guidelines, are coalescing toward a National Health Stack, which is aimed to be completed by 2022.

APAC Content Services Platform Market Trends

The Solution and Software Segment is Expected to Accounted for the Largest Market Share

- Cloud computing has well revolutionized data storage in general and has a profound impact on document management systems, thus, ensuring that documents are well available at any time, anywhere, allowing for scalability, making it a solution for both large and small businesses. The Asia Pacific region is experiencing rapid adoption of digital management of documents to minimize its dependence on paper. Also, in a several few countries, such as China, it has resulted in cutting labor costs and fueled work efficiency, which are the significant motives to run businesses.

- In the recent times, China's General Administrative of Customs (GAC) launched the Paperless Customs Clearance Pilot Reform, enabling customs declaration information to be transferred and stored through computers and various other electronic media that can be reviewed automatically. GAC also had promoted paperless customs documents for price reviews to assist China's national customs clearance integration reform and improvise customs clearance's overall efficiency. Moreover, China has also been seeing an increased need to adopt document management solutions to curtail the illegal logging in the transport and trade sectors, which is anticipated to enhance the overall demand for DMS.

- Further, there have been rising environmental concerns in line with digital transformation and growing adoption of intelligent devices in India, which is enhancing the paperless trend in India and resulting in the quick adoption of document management solutions. Some of the key sectors of the Indian Government have either entirely or partially moved to Offline and Online Document Management Systems. In the recent times, Lok Sabha declared that the lower house has become paperless to save trees and cut costs, with Members of Parliaments utilising digital documents to write questions. Educational institutions in India have also been executing document management solutions for safety purposes. For example, Manipal Academy of Higher Education (MAHE), an educational institution in India, moved to a paperless document management system to manage and organize their records and information and to build up data more effectively.

- Also, the rising concern about productivity and the lack of labor with a shrinking and greying population in countries like Japan are fueling such nations toward digitalization in every sector. Additionally, the Japanese Government plans to shift toward digital management of most public records by the time the new National Archives of Japan building opens in 2026, aiming to prevent the record management problems that have restricted the overall growth of the Government. Moreover, Australia gained the support for a paperless way back than other Asia-Pacific countries. For instance, the Australian Taxation Office (ATO) affirmed its support of digital filing in 2002. It executed a series of Tax Rulings that would act as a guideline for electronic record keeping.

- Moreover, the National Digital Health Strategy, approved by all the territories and states through the Council of Australian Governments (COAG) Health Council, prioritizes eradicating paper-based messaging in the healthcare industry. The Agency has been operating with the software industry and healthcare providers in developing standards that will improvise the secure exchange of healthcare information. This system will benefit the individuals and the customers as it will avoid the frustration of repeatedly explaining their condition to 5 different people and allow healthcare professionals to share information securely and quickly.

IT, Telecom, Retail, and E-commerce Segment to Witness Fastest Growth

- The telecommunications industry is undergoing a significant structural change, with content, customer channels, and communication services becoming digital, thereby resulting in creating a new value ecosystem. In the modern digital era, various providers are executing high-performance networks to fulfill the needs of their customers. Such structural changes are building new opportunities for workflow management services in the entire sector. The increasing enhancement of networking technologies and devices also widens the scope for various IoT content service platforms in the market. As per GSMA, early adoption of power-wide area networks integrated with IoT is anticipated to create a total sum of USD 1.8 trillion by the year 2026.

- With the implementation and ownership of digital transformation, the majority of the digital transformation is widely driven by the IT sector. With the increased data connectivity, vendors are widely adopting cloud and IoT-based content service platforms into the business to assist in managing and creating web content. CMS also allows tracking and management of web traffic, including visitor activities and searches.

- Moreover, Archive One, a document management software that acts as an auditing tool by automatically retrieving, securing, classifying, and storing critical documents. It is highly useful in the IT-BPM sector, where companies typically employ thousands of people, giving them a great amount of data to track. Also, Paperless Trail Inc. emphasizes the importance of embracing the new normal in business and effectively moving document management and compliance to the digital space in response to the challenges organizations face owing to technological advancements.

- The market is seeing an APAC-focused distribution agreement catering to the cloud, on-premises, and hybrid models. For example, in July 2021, Tech Data and Syniti have formed a new distribution alliance in the Asia-Pacific region. The collaboration allows enterprises in the Asia-Pacific to deploy Syniti Data Replication in various ways, including cloud, on-premises, and hybrid models.

- Moreover, Syniti Data Replication, a low-touch, flexible solution that offers a consistent copy of data ready for data warehousing, analytics, and other applications while not interfering with the responsiveness of business-critical systems. Its diversified Change Data Capture (CDC) ensures that business data is kept updated to assist real-time performance reporting and analytics systems. This will help the businesses in terms of strengthening their data and analytics capabilities and enabling large-scale go-to-market initiatives.

APAC Content Services Platform Industry Overview

The entire Asia Pacific content services platform market is moderately fragmented, with few participants like Microsoft Corporation, IBM Corporation, Oracle Corporation, OpenText Corporation, etc., holding a significant market share. These firms are leveraging various strategic innovations and collaborative initiatives to expand their profitability and maximise their market share. The wide adoption of digital content across enterprises is anticipated to be a significant amplifier of the market studied.

- March 2022 - Adobe declared the general availability of Adobe Experience Cloud for Healthcare, a solution that empowers healthcare enterprises to offer secure digital experiences and seamless customer journeys with customised and secured digital experiences.

- September 2021 - Intalio declares its partnership with On-OneTech (Pty) Ltd to expand its geographic reach to Africa. This partnership will provide Intalio with a wider geographic reach to go beyond its key markets, with the ability to sell to and support the African healthcare industry and transform healthcare organizations across Africa.

- July 2021 - EY and IBM stated an enhanced, global, multi-year alliance primarily designed to help organizations boost their digital transformation and improve client outcomes, which include leveraging the various hybrid cloud capabilities of Red Hat OpenShift, as well as IBM Watson, IBM Blockchain, and IBM's 5G and edge technologies. Together, both the company's professionals may focus on helping the clients in modernizing and transforming their businesses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of SMAC Technologies

- 5.1.2 Increase of Digital Content Across the Enterprises

- 5.1.3 Demand for Delivering Contextualized User Experience

- 5.2 Market Restraints

- 5.2.1 Data Privacy and Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution/Software

- 6.1.1.1 Document and Records Management

- 6.1.1.2 Data Capture

- 6.1.1.3 Workflow Management

- 6.1.1.4 Information Security and Governance

- 6.1.1.5 Case Management

- 6.1.1.6 Other Solutions

- 6.1.2 Services

- 6.1.1 Solution/Software

- 6.2 By Deployment Type

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Organization Size

- 6.3.1 Small and Medium-sized Enterprises

- 6.3.2 Large Enterprises

- 6.4 By End-user Industry

- 6.4.1 BFSI

- 6.4.2 Government and Public Sector

- 6.4.3 Healthcare and Life Sciences

- 6.4.4 IT, Telecom, Retail, & E-commerce

- 6.4.5 Transportation and Logistics

- 6.4.6 Other End-user Industries

- 6.5 By Country

- 6.5.1 India

- 6.5.2 China

- 6.5.3 Japan

- 6.5.4 South Korea

- 6.5.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 OpenText corporation

- 7.1.4 Box Inc.

- 7.1.5 Oracle Corporation

- 7.1.6 Hyland Software Inc.

- 7.1.7 Laserfiche Inc.

- 7.1.8 Hewlett Packard enterprise (Micro Focus)

- 7.1.9 Adobe Systems Inc.

- 7.1.10 M-Files Inc.