|

市场调查报告书

商品编码

1644499

印度老年生活市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)India Senior Living - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

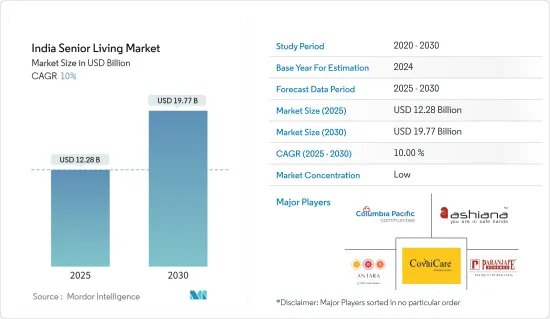

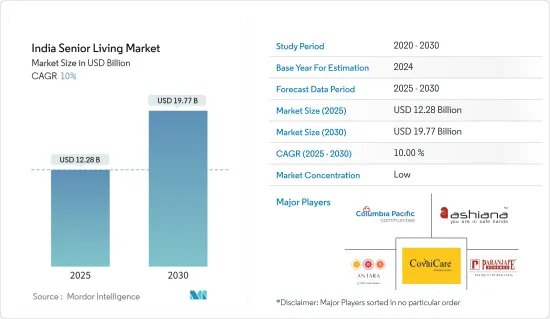

印度老年住宅市场规模预计在 2025 年为 122.8 亿美元,预计到 2030 年将达到 197.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 10%。

关键亮点

- 人口老化正在推动市场发展。此外,老年生活社区提供的服务也正在推动市场的发展。

- 随着老年人口的增加,老年人住宅需求将持续成长。随着产业的发展,我们预计这些计划提供的服务和设施类型将会增加。此类计划目前已在各大城市兴起。然而,从长远来看,即使在郊区和层级城市,供应预计也将充足。层级城市包括比瓦迪、哥印拜陀、本地治里、巴罗达、博帕尔、斋浦尔、迈索尔、德拉敦和卡索利。清奈、普纳(拉瓦萨)和班加罗尔已开始提供供应。

- 此外,印度老年人口的不断增长、预期寿命的延长、核心家庭数量的增加、经济独立且受过良好教育的老年人、老年人医疗需求的增加以及退休后返回印度的非居民印度人都是推动老年人住宅市场发展的一些因素。此外,南部城市占据了全国老年住宅市场的大部分份额,其次是西部和北部。同时,班加罗尔、清奈奈、本地治里和海德拉巴是最受欢迎的南部退休定居城市,其次是德里国家首都辖区、昌迪加尔和德拉敦。在印度西部,孟买、普纳、艾哈默德巴德、帕纳吉和苏拉特是最受欢迎的移民目的地。

- 印度是一个福利国家,在老年人问题上落后于已开发国家,制定了许多针对老年人的法律。根据印度统计和计画实施部的报告,本财年印度老年人口数量将达到近1.394亿人。此外,1961 年,5.6% 的印度人年龄在 60 岁或以上。官员表示,这一比率将在 2021 年上升至 10.1%,八年后达到 13.1%。

- 预计未来四到五年,大城市以外的老年住宅需求将增加两倍以上。造成这种情况的原因如下:由于具有吸引的融资选择、可用的土地和建造大型综合体的充足空间,这些城市变得更具吸引力。老年人也喜欢开放的空间。虽然各地区的成长率有所不同,但大多数老年人越来越倾向于居住在人口密度较低的城市。老年人迁往人口密度较低的城市的趋势也推动了这一成长。对于开发商来说,这是一个在竞争不那么激烈的市场推出新计划的机会。中长期市场预测表明,与大都市相比,这些市场将出现更多的老年生活社区。

印度老年住宅市场趋势

加大对老年住宅领域的投资

新冠疫情让印度人意识到了付费老人安养院的必要性,从而刺激了该国老年住宅市场的需求。此外,许多原本住在双薪家庭的老人现在也选择住在老人住宅。这两个因素都增加了老人对多用户住宅的需求。

为了满足印度日益增长的老年人住宅需求,印度政府宣布了一项名为「Atal Vayo Abhyuday Yojana」(AVYAY)的 2021-2022 年计划。根据该计划,政府希望建立一个老年人健康、快乐、有权力、有尊严、独立生活、拥有紧密社会和代际联繫的社会。

根据 AVYAY 计划,政府将投资超过 53 亿印度卢比(6.4287 亿美元)用于老年人福利。该预算将为老年人居住和健康计划下的老年人投资超过 30 亿印度卢比(3.6389 亿美元),该计划包括老年人综合计划(IPSrC)和老年人国家行动计划(SAPSrC)计划。

此外,IPSrC 旗下计划还包括 25 个老人安养院、50 个老人安养院、持续照护之家、阿兹海默症/失智症老人安养院以及社区资源和培训中心。该计划已启动180计划计划,惠及175,800名老年人。

南方可望实现成长

班加罗尔、清奈、科钦和哥印拜陀等印度南部城市正成为老年生活社区的中心,其次是该国西部和北部地区。这种增长得益于宜人的气候条件、便利的交通和知名的医疗保健提供者的存在。此外,南方城市占全国老年人住宅计划的 70% 以上,其中包括独立住宅、辅助住宅、辅助住宅和持续照护退休社区。

此外,2021年退休住宅开发商将透过买卖、租赁和混合模式(包括销售和租赁)营运。例如,班加罗尔是印度采用购买模式的领先城市之一。同时,哥印拜陀和清奈等其他城市正在采用购买和租赁相结合的方式来满足客户需求。

在南部地区,售价在 400 万卢比(48,518 美元)至 500 万卢比(60,648 美元)之间的中型计划占据了销售额的大部分。同时,高端计划提供大型公寓和别墅,特别注重医疗保健、酒店和设计元素,以满足老年人退休后享受舒适豪华生活的需要,这也促进了老年住宅市场的销售成长。

印度老年住宅产业概况

印度老年住宅市场较为分散,许多本土企业进入市场。分散的参与企业之间的竞争非常激烈。此外,参与企业还透过合併、收购、策略伙伴关係以及推出新计画来扩大业务,以满足客户需求。市场的主要参与企业包括 Antara Senior Care、Columbia Pacific Communities、Ashiana Housing Ltd、Paranjape Schemes (Construction) Ltd 和 Covai Property Centre (I) Pvt. Ltd。任何老年住宅计划的成功在很大程度上取决于其提供的便利设施和设备。政府需要宣布具体措施,确保这项资产类别能为所有相关人员带来成功。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 研究范围

第二章调查方法

第三章执行摘要

第 4 章 市场考量与动态

- 市场概况

- 市场动态

- 市场驱动因素

- 加大对老年住宅领域的投资

- 南部地区可望实现成长

- 市场限制

- 老年人缺乏经济资源

- 缺乏对老化问题的认知与接受

- 市场机会

- 对医疗服务和产品的需求增加

- 提高技术采用率促进市场成长

- 市场驱动因素

- 洞察养老生活领域的技术创新

- 政府法规和倡议

- 供应链/价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

第五章 市场区隔

- 房产类型

- 支撑类型

- 自主型

- 记忆护理

- 护理

第六章 竞争格局

- 公司简介

- AntaraSeniorCare

- Columbia Pacific Communities

- Ashiana Housing Ltd

- Paranjape Schemes(Construction)Ltd

- Covai Property Centre(I)Pvt. Ltd

- Oasis Senior Living

- Primus Lifespaces Pvt. Ltd

- The Golden Estate

- Vedaanta Retirement Communities

- Bahri Realty Management Services Pvt.Ltd

- Ananya's NanaNaniHomes

- Athashri*

第七章:市场的未来

第 8 章 附录

The India Senior Living Market size is estimated at USD 12.28 billion in 2025, and is expected to reach USD 19.77 billion by 2030, at a CAGR of 10% during the forecast period (2025-2030).

Key Highlights

- The market is driven by the aging population. Furthermore, the services provided by the communities for senior citizens are driving the market.

- The demand for senior living housing will continue to rise as the population of seniors grows. As the industry grows, so will the types of services and amenities available in these projects. There has already been an increase in such projects in major cities. However, supply will be plentiful in suburbs and tier II cities in the long run. Tier-II cities include, among others, Bhiwadi, Coimbatore, Puducherry, Vadodara, Bhopal, Jaipur, Mysuru, Dehradun, and Kasauli. We have seen supply in Chennai, Pune (Lavasa), and Bengaluru.

- Furthermore, the senior living market is driven by the increasing aged population in the country, growth in life expectancy, rise in nuclear families, financially independent and educated senior citizens, increasing medical needs of the senior citizens, and NRIs coming back to India after retirement. Moreover, southern cities account for a major share of the senior living market in the country, followed by the west and north regions. Meanwhile, Bengaluru, Chennai, Puducherry, and Hyderabad are the most preferred southern cities for post-retirement settlement, followed by Delhi-NCR, Chandigarh, and Dehradun, which emerged as popular areas to settle in north India. Mumbai, Pune, Ahmedabad, Panaji, and Surat are some of the most opted retirement destinations in west India.

- Even though India is a welfare state and has several senior citizen-focused laws, it is still lagging behind developed nations in providing for its aged people. The Ministry of Statistics and Programme Implementation reported that there will be close to 139.4 million senior persons living in India in the current year. In addition, 5.6% of Indians were 60 years of age or older in 1961. This proportion rose to 10.1% in 2021 and is expected to reach 13.1% in eight years, according to official figures.

- It is anticipated that demand for senior living projects in non-metro cities will more than triple over the next four to five years. There are several reasons for this. These cities have become more appealing as a result of attractive financing options, the availability of land, and plenty of space to build sprawling complexes. And seniors appreciate the open spaces. Although growth rates vary by region, a growing trend indicates that the majority of seniors prefer to live in cities with low population densities. This growth is also being aided by the trend of seniors moving to cities with low population densities. It provides opportunities for developers to create new projects in less competitive markets. Predictions for the medium to long term market indicate that, when compared to metros, many more senior living communities would come up in these markets.

India Senior Living Market Trends

Increasing Investments in the Senior Living Sector

The COVID-19 pandemic made Indians realize the need for assisted-care homes, which increased the demand in the country's senior living market. In addition, many elders who stayed in joint families are now opting to live in senior living homes. Both these factors resulted in the demand for residential complexes for senior citizens.

To meet the increasing demand for senior living in the country, the Government of India announced a scheme called Atal Vayo Abhyuday Yojana (AVYAY) for 2021-2022. Under this scheme, the government offers a society where senior citizens live a healthy, happy, empowered, dignified, and self-reliant life, along with strong social and inter-generational bonding.

Under the AVYAY scheme, the government is investing more than INR 530 crore (USD 642.87 million) in the welfare of senior citizens. From this budget, more than INR 300 core (USD 363.89 million) are invested in seniors living under the Shelter and Health for Senior Citizens scheme, which includes the Integrated Programme for Senior Citizens (IPSrC) and State Action Plan for Senior Citizens (SAPSrC) programs.

In addition, the projects under IPSrC include Senior Citizen Homes 25, Senior Citizen Homes 50, Continuous Care Homes and Homes for senior citizens with Alzheimer's disease/ Dementia, and Regional Resource and Training Centers. More than 180 projects were initiated under this scheme, and 1,75,800 senior citizens benefit from these programs and projects.

The Southern Part of the Country is Expected to Witness Growth

Southern cities in India, such as Bengaluru, Chennai, Kochi, and Coimbatore, are emerging as hubs for senior living communities, followed by the western and northern regions. This growth is driven by pleasant climatic conditions, improved connectivity, and the presence of prominent healthcare providers. In addition, southern cities contribute to more than 70% of senior living projects in the country, which include communities such as independent living, assisted living, skilled or nursing care, and continuing care retirement communities.

Furthermore, in 2021, the developers of senior housing communities operated their businesses through outright purchases or sales, leases or rentals, and the hybrid model (includes both sales and leases). For instance, Bengaluru is one of the prominent cities in India that use the outright purchase model. In contrast, other cities such as Coimbatore and Chennai have a combination of outright purchases and leases to meet customer demand.

Most of the sales in the southern part are observed from medium-end projects, with prices ranging from INR 40 lakh (USD 48,518) to INR 50 lakh (USD 60,648). Meanwhile, high-end projects also contributed to the sales growth in the senior living sector by offering large apartments or villas with particular attention to healthcare, hospitality, and design elements for older adults looking to live in a comfortable and lavish lifestyle post-retirement.

India Senior Living Industry Overview

The Indian senior living market is fragmented, with many local players. There exists high competition among fragmented players. In addition, players expand their businesses using mergers, acquisitions, strategic partnerships, and new project launches to meet customer needs. Some of the major players in the market include AntaraSeniorCare, Columbia Pacific Communities, Ashiana Housing Ltd, Paranjape Schemes (Construction) Ltd, and Covai Property Centre (I) Pvt. Ltd. A senior housing project's potential success would mostly depend on the caliber of its amenities and facilities. The government will need to make specific policy announcements to ensure this asset class is successful for all parties.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Increasing Investments in the Senior Living Sector

- 4.2.1.2 The Southern Part of the Country is Expected to Witness Growth

- 4.2.2 Market Restraints

- 4.2.2.1 Lack of financial resources available to seniors

- 4.2.2.2 Lack of awareness and acceptance of ageing related issues

- 4.2.3 Market Opportunities

- 4.2.3.1 Increasing demand for healthcare services and products

- 4.2.3.2 Increasing adoption of technology contributing to the growth of the market

- 4.2.1 Market Drivers

- 4.3 Insights into Technological Innovation in the Senior Living Sector

- 4.4 Government Regulations and Initiatives

- 4.5 Supply Chain/Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Property Type

- 5.1.1 Assisted Living

- 5.1.2 Independent Living

- 5.1.3 Memory Care

- 5.1.4 Nursing Care

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 AntaraSeniorCare

- 6.2.2 Columbia Pacific Communities

- 6.2.3 Ashiana Housing Ltd

- 6.2.4 Paranjape Schemes (Construction) Ltd

- 6.2.5 Covai Property Centre (I) Pvt. Ltd

- 6.2.6 Oasis Senior Living

- 6.2.7 Primus Lifespaces Pvt. Ltd

- 6.2.8 The Golden Estate

- 6.2.9 Vedaanta Retirement Communities

- 6.2.10 Bahri Realty Management Services Pvt.Ltd

- 6.2.11 Ananya's NanaNaniHomes

- 6.2.12 Athashri*