|

市场调查报告书

商品编码

1644504

中国宅配、快捷邮件和小包裹(CEP) -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)China International Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

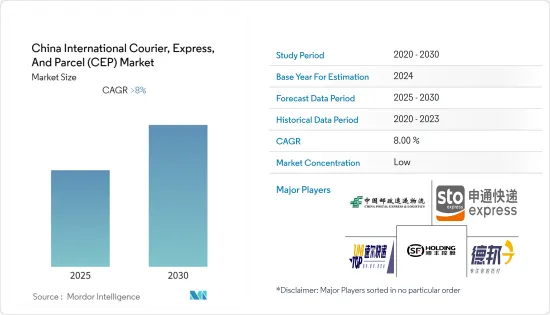

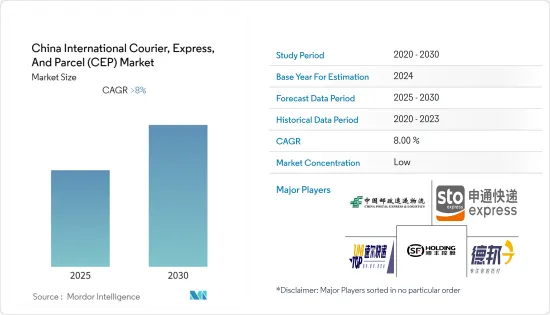

预计预测期内中国国际宅配、快捷邮件和小包裹市场复合年增长率将超过 8%

关键亮点

- 数位化正在对市场产生重大影响。随着电子商务的兴起,过去十年来中国宅配的小包裹数量增加了一倍以上。电子商务行业的蓬勃发展、跨境贸易的不断增长、技术进步以及众包交付模式正在推动中国国际 CEP 市场的成长。

- 随着电子商务的日益普及以及新数位工具推动的区域物流网路的不断扩张,中国的快捷邮件行业正在快速成长。由于对宅配服务的需求推动市场发展,该行业具有强劲的成长潜力。受益于中国强劲的经济表现和不断扩张的电子商务,宅配行业在过去五年中实现了快速增长。

中国国际宅配及快捷邮件(CEP )市场趋势

电子商务领域不断扩大,推动中国国际 CEP 市场发展

自2013年以来,中国零售电子商务市场已成为全球最大市场。 2022年,中国电商平台经历了显着的成长。此外,电商平台和宅配业者扩大货源和快递管道,为处于封锁状态的上海居民运送食品和其他必需品。为减轻疫情影响,上海市政府承诺保障2,500万市民的生活必需品供应,解决好上海市的配送问题。

根据京东统计,运往上海的生活必需品包括奶粉、纸尿裤等婴幼儿奶粉8万余包、药品及防疫用品近10万件、羊肉10吨。除京东外,全国还有近 4,000 家门市提供线上食品配送平台。这些线上平台正在推动国内宅配包裹市场的发展。

同时,2022年10月,中国电子商务带动快递物流年均成长超过4.9%。这一增长是由中国最大的网路购物节期间网上销售的增长所推动的。此外,2022年,根据国家统计局公布的数据,2021年双11购物节期间总出货量达6.96亿件,成长率为18%。营收成长也得益于中国航空货运量最快的復苏。 2022年第三季度,中国B2C电商平台呈现明显成长,其中天猫为领先平台之一,占B2C平台网路零售交易金额的63%以上,其次是京东、唯品会等。

中国也是世界上人口最多的国家,因此拥有最多的线上买家和卖家。其最大的电子商务平台阿里巴巴的奥宝在全国拥有450万活跃卖家。中国超过90%的电子商务销售是透过行动装置进行的。

三、层级层级城市正在推动中国电子商务的成长。随着难以接触实体店的新兴中等收入消费者转向电子商务,中国农村地区出现了强劲成长。新冠疫情危机导致整体消费支出下滑,但电子商务购买量却增加。

此外,社会消费品零售总额也受到电子商务的推动。 2021年,受实体商品在线上购买强劲成长的推动,电子商务在零售额中的份额将超过24.5%。

中国小包裹运输量增加

随着行动装置的使用和普及,透过智慧型手机和平板电脑购物已成为中国网路用户的新常态。除了技术升级之外,小城市和农村居民购买力的提升也显着改变了中国的网路零售格局。电子商务的兴起导致中国小包裹数量的增加。

根据国家邮政局统计,12月份,中国宅配业包裹寄送量突破1,000亿件。这项艰难成绩既体现了中国宅配行业的韧性,也体现了中国疫情防治和经济社会发展同步推进的成果。

12月前12天,全国共收寄小包裹超过43亿件,较去年同期成长5.6%。我国快递网路覆盖范围广泛,有41万个快递服务站,快递总里程达4,300万公里。我们每天为近7亿人提供服务。

今年以来,受新冠肺炎疫情影响,宅配业压力巨大。相关部门采取多项措施确保物流畅通,包括全面取消高速公路出入口临时检查、建立白名单机制、进行即时监控等。

此外,宅配产业的企业也积极采取措施,透过调整快递路线、建立紧急应变系统等,确保快捷邮件网路顺畅运作。

中国宅配小包裹( CEP)产业概况

市场较为分散,预计预测期内将会成长。市场竞争激烈,国际CEP市场的大部分份额被少数参与企业占据。中国在国际CEP市场上持续的价格竞争,一定程度上侵蚀了快捷邮件承运商的盈利。主要参与企业包括深圳顺丰泰森控股(集团)、速递易、中国邮政速递物流、德邦物流、申通快递等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场洞察

- 当前市场状况

- 技术趋势和自动化

- 政府监管

- 物流及仓储市场概况

- 中国跨境运输

- 货运市场概况

- 价值链/供应链分析

- CEP业务储存功能及附加价值服务详情

- 电子商务领域聚焦

- COVID-19 对 CEP 市场的影响(对市场和经济的短期和长期影响)

第五章 市场动态

- 市场驱动因素

- 电子商务崛起推动中国国际CEP市场发展

- 中国小包裹运输量增加

- 市场限制/挑战

- 基础设施薄弱,物流成本高

- 製造商对物流服务缺乏控制

- 市场机会

- 国际贸易和 B2C 货运量增加

- 快速都市化推动市场成长

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第六章 市场细分

- 按业务

- B2B(B2B)

- B2C(B2C)

- 客户对客户 (C2C)

- 按类型

- 电子商务

- 非电子商务

- 按最终用户

- 服务

- 批发和零售

- 医疗

- 製造业

- 其他的

第七章 竞争格局

- 公司简介

- China Postal Express & Logistics Co. Ltd

- STO Express Co. Ltd

- Shenzhen SF Taisen Holdings(Group)Co. Ltd

- Seino Super Express

- YTO Express Group Co. Ltd

- ZTO Express

- STO Express Co. Ltd

- Kerry EAS Logistics Ltd

- FedEx

- Guangzhou Shenzhen Yuanfeihang Logistics Co. Ltd*

第 8 章:市场的未来

第 9 章 附录

The China International Courier, Express, And Parcel Market is expected to register a CAGR of greater than 8% during the forecast period.

Key Highlights

- >

- Digitalization has had a significant impact on the market. With the rise of ecommerce, the number of delivered parcels in China more than doubled in the past 10 years. Growth in the e-commerce sector, rising cross-border trade, technological advancements, and crowdsourced delivery models are driving the growth of the Chinese international CEP market.

- China's express delivery industry is showing rapid growth due to the increasing popularity of e-commerce and the mushrooming local logistics networks, empowered by new digital tools. The sector has strong growth potential, as the demand for delivery services is boosting the market. The courier industry has recorded rapid growth over the past five years, benefiting from China's strong economic performance and growing e-commerce expansion.

China International Courier, Express, And Parcel (CEP) Market Trends

Rising E-commerce Sector to Boost the International CEP Market in China

China's retail e-commerce market has been the largest in the world since 2013. In 2022, e-commerce platforms witnessed significant growth in China. In addition, e-commerce platforms and couriers multiplied their supply and express channels to deliver food and other essentials to Shanghai residents during the lockdown. Shanghai authorities promised to ensure daily supplies for all 25 million residents and solve delivery problems in the city to mitigate the pandemic's impact.

As per JD.com, daily necessities transported to Shanghai included more than 80,000 packs of maternity and infant products such as infant formula powders and diapers, nearly 100,000 medicines and virus prevention supplies, 10 tons of mutton, etc. Along with JD.com, nearly 4,000 stores are providing online food delivery platforms in the country. These online platforms drive the courier express market in the country.

Meanwhile, in October 2022, China's e-commerce drove express logistics by more than 4.9% annually. This surge was due to increased online sales during China's biggest annual online shopping festival. In addition, in 2022, as per the State Bureau of China, total shipments during the 2021 Double 11 shopping festival reached 696 million at a growth rate of 18%. The fastest recovery of China's air freight also supported this sales growth. In Q3 2022, Chinese B2C e-commerce platforms witnessed significant growth, and Tmall is one of the major platforms that made more than 63% of online retail transactions on B2C platforms, followed by JD.com, Vipshop, etc.

In addition, China has the most online buyers and sellers, as it is the world's most populous nation. Its largest e-commerce platform, Alibaba's Taobao, has 4.5 million active sellers in the country. Over 90% of e-commerce sales in China are done through mobile devices.

E-commerce growth in China is driven by tier 3 and 4 cities. Rural China saw significant growth as emerging middle-income group consumers with limited access to physical retail outlets turned to e-commerce. Although the COVID-19 crisis has led to a slump in overall consumer spending, it has increased e-commerce purchases.

Moreover, total retail sales of consumer goods are driven by e-commerce. In 2021, the e-commerce share in retail sales accounted for more than 24.5%, driven by strong growth in online purchases of physical goods.

Increasing Volume of Parcel Shipments in China

Along with the ever-increasing use and distribution of mobile devices, shopping on smartphones or tablets has become a new norm for Chinese internet users. Apart from technology upgrades, the rise of small-town and rural residents' purchasing power has also reshuffled the online retail landscape in China. Due to the increase in e-commerce, there is an increase in the number of parcels in China.

According to State Post Bureau figures, China's courier industry delivered more than 100 billion items in December. This arduous accomplishment demonstrated both the tenacity of the Chinese courier sector and the results of China's synchronisation of COVID-19 policy with economic and social development.

Over 4.3 billion parcels were collected nationally in the first 12 days of December, increasing 5.6 per cent from the same period last year. China has a sizable express delivery network with 410,000 service stations and a total mileage of 43 million kilometres. It provides daily service to close to 700 million people.

Since this year, the courier sector has been under extreme pressure due to the COVID-19 pandemic. Relevant departments adopted a number of measures to ensure uninterrupted logistics, including the removal of all temporary checks at motorway entrances and exits, the establishment of a whitelist mechanism, and the start of real-time monitoring.

Additionally, businesses in the courier sector actively worked to guarantee the express delivery network operated without hiccups by rerouting delivery routes and setting up emergency response systems.

China International Courier, Express, And Parcel (CEP) Industry Overview

The market is fragmented and is expected to grow during the forecast period. The market is highly competitive, with a few players occupying the major share in the international CEP market. The continuous price war within China's international CEP market has harmed the profitability of express delivery firms to some extent. Some of the major players are Shenzhen SF Taisen Holdings (Group) Co. Ltd, Sure Express Co. Ltd, China Postal Express & Logistics Co. Ltd, Deppon Logistics Co. Ltd, and Sto Express Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends and Automation

- 4.3 Government Regulations

- 4.4 Overview of the Logistics and Warehousing Market

- 4.5 Spotlight on Cross-border Transportation in China

- 4.6 Brief on Freight Forwarding Market

- 4.7 Value Chain/Supply Chain Analysis

- 4.8 Elaboration on Storage Functions and Value-added Services in CEP Business

- 4.9 Spotlight on E-commerce Sector

- 4.10 Impact of COVID-19 on the CEP Market (Short-term and Long-term Impact on the Market and on the Economy)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising E-commerce Sector to Boost the International CEP Market in China

- 5.1.2 Increasing Volume of Parcel Shipments in China

- 5.2 Market Restraints/Challenges

- 5.2.1 Poor infrastructure and higher logistics costs

- 5.2.2 Lack of control of manufacturers on logistics services

- 5.3 Market Opportunities

- 5.3.1 Rise in International Trade and B2C shipments

- 5.3.2 Rapid Urbanization Boosting the growth of the Market

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Business

- 6.1.1 Business-to-Business (B2B)

- 6.1.2 Business-to-Consumer (B2C)

- 6.1.3 Customer-to-Customer (C2C)

- 6.2 By Type

- 6.2.1 E-commerce

- 6.2.2 Non-e-commerce

- 6.3 By End User

- 6.3.1 Services

- 6.3.2 Wholesale and Retail Trade

- 6.3.3 Healthcare

- 6.3.4 Industrial Manufacturing

- 6.3.5 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 China Postal Express & Logistics Co. Ltd

- 7.2.2 STO Express Co. Ltd

- 7.2.3 Shenzhen SF Taisen Holdings (Group) Co. Ltd

- 7.2.4 Seino Super Express

- 7.2.5 YTO Express Group Co. Ltd

- 7.2.6 ZTO Express

- 7.2.7 STO Express Co. Ltd

- 7.2.8 Kerry EAS Logistics Ltd

- 7.2.9 FedEx

- 7.2.10 Guangzhou Shenzhen Yuanfeihang Logistics Co. Ltd*