|

市场调查报告书

商品编码

1644524

美国水力发电:市场占有率分析、行业趋势和成长预测(2025-2030 年)United States Hydropower - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

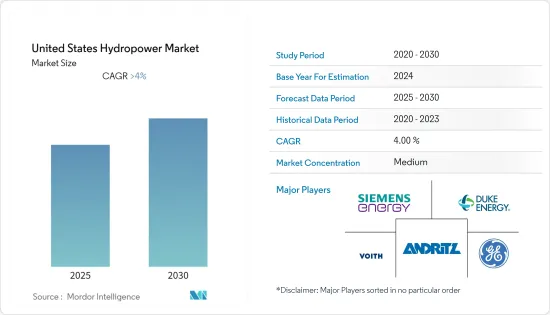

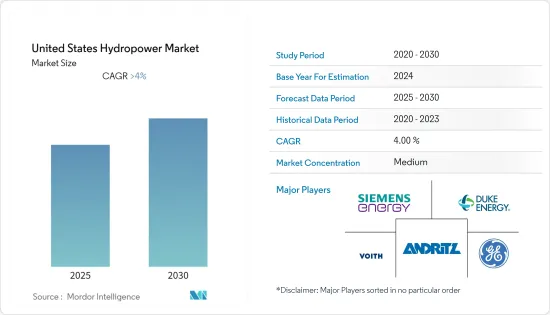

预计预测期内美国水电市场复合年增长率将超过 4%

关键亮点

- 预计预测期内大型水力发电量将大幅成长。

- 美国的目标是到2030年,33%-50%的电力生产来自再生能源。这个目标,加上丰富的水资源,可能会为新进入市场的参与企业创造机会。

- 太阳能和风力发电等替代可再生能源可能会成为市场限制因素,因为它们成本极低且易于安装和操作。

美国水力发电市场趋势

大型水力发电成为主流

- 大型水力发电是一种利用流动的水来发电的可再生能源发电,用于驱动大型水轮机。为城市生产大量水力发电需要湖泊、水库和水坝来储存和调节水,以便日后用于发电、灌溉、家庭或工业用途。由于大型水力发电设施可以轻鬆开启和关闭,因此水力发电比大多数其他能源来源更可靠,能够满足全天的尖峰时段电力需求。

- 传统型的水力发电大坝有抽水蓄能和径流式,世界各地有许多不同类型的大型水力发电厂。

- 2020 年 1 月,美国颁发了三个 2 吉瓦新发电工程许可证,并获得了另外 22 吉瓦的预许可。抽水蓄能发电的需求正在增长,但进一步部署抽水蓄能发电的一个主要障碍是获得长期融资以支付高昂的初始资本成本。能源部水电技术办公室继续为水力发电研究和开发提供创纪录的资金,其中包括 7,000 万美元用于海洋能,3,500 万美元用于常规水力发电。

- 此外,正在建设中的 400 兆瓦戈登布特抽水蓄能水力发电厂预计将进一步推动市场发展,该电站计划于 2023 年开始商业运作。

- 因此,由于上述因素,大型水力发电在预测期内可能会显着增长。

替代可再生能源计划阻碍了市场发展

- 太阳能在美国正变得越来越便宜和受欢迎。这是因为近年来太阳能发电面板的平均成本下降了近 80%。在大多数州,太阳能已经具备与传统能源来源相媲美的经济竞争力,因此太阳能领域在美国各地迅速成熟。

- 根据美国太阳能产业工业统计,2021年美国太阳能发电装置容量达9,618千万瓦,与前一年同期比较增加约26%。公共产业太阳能领域有超过 11.2 吉瓦的计划正在建设中,市场正按每年新增 17.5 吉瓦的容量速度发展。住宅太阳能安装量在业界历史上首次在单季内超过 1GW,达到 13 万个系统。

- 2021年3月,美国能源局(DOE)宣布了一项雄心勃勃的目标,即未来十年将太阳能发电成本降低60%。此外,美国能源部还提供了约 1.28 亿美元的资金,用于降低成本、提高效能并加速到 2030 年太阳能技术的部署。

- 此外,自美国能源资讯署开始收集资料以来,风力发电已成为 2022 年 4 月第二大发电来源。此外,风电产业也透过旨在提高国内能源产量的「美国优先」计画获得了政府的大力支持。

- 2022 年 4 月,维斯塔斯宣布已收到美国一个未具名计划的 33 台 V162-6.2 MW 涡轮机和 1 台 V136-3.45 MW 涡轮机的订单。

- 因此,鑑于上述情况,预测期内替代可再生能源可能会抑制美国水力发电市场。

美国水力发电产业概况

美国水力发电市场适度整合。市场的主要企业包括通用电气再生能源、西门子能源股份公司、安德里茨股份公司、福伊特股份公司和杜克能源公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2028年水力发电装置容量及预测(单位:GW)

- 水力发电容量占比(2022年)

- 水力发电量(TWh)(至 2028 年)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- PESTLE分析

第五章 市场规模细分

- 大型水力发电(100MW以上)

- 小型水力(10MW以下)

- 其他规模(10-100MW)

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- GE Renewable Energy

- Siemens Energy AG

- Andritz AG

- Voith Gmb & Co. KGaA

- Duke Energy Corporation

- Georgia Power Company

第七章 市场机会与未来趋势

简介目录

Product Code: 90575

The United States Hydropower Market is expected to register a CAGR of greater than 4% during the forecast period.

Key Highlights

- Large Hydropower is likely to witness significant growth during the forecast period.

- The United States aims to achieve 33-50 % of electricity production through renewables by 2030. This target coupled with the presence of significant water resources is likely to present opportunities to players involved in the market in the future.

- Alternative renewable energy sources such as solar energy, and wind energy due to their significantly less cost and less difficulty of installation and operation are likely to restrain the market.

US Hydropower Market Trends

Large Scale Hydropower to Dominate

- Large-scale hydropower is a form of renewable energy generation derived from flowing water, which is used to drive large water turbines. To generate large amounts of hydroelectricity for cities, lakes, reservoirs, and dams are needed to store and regulate water for later release for power generation, irrigation, and domestic or industrial use. Since large-scale hydropower facilities can easily be turned on and off, hydropower has become more reliable than most other energy sources for meeting peak electricity demands throughout the day.

- Conventional hydroelectric dams pumped storage, and run-of-the-river are the different types of large-scale hydropower plants across the world.

- In January 2020, the United States issued three licenses for 2 GW of new pumped storage projects, and another 22 GW had received preliminary permits. Although demand for storage is increasing, the primary obstacle to the deployment of additional pumped storage hydropower is obtaining long-term financing to cover high up-front capital costs. The Department of Energy Water Power Technologies Office continues to see record funding levels for hydropower research and development, including USD 70 million for marine energy and USD 35 million for conventional hydropower

- Furthermore, the under-construction 400 MW Gordon Butte Pumped Storage Hydro Power plant is expected to go into commercial operations in 2023 which will further drive the market.

- Thus, due to the above-mentioned factors, large-scale hydropower is likely to witness significant growth during the forecast period.

Alternative Renewable Energy Projects to Restrain the Market

- Solar energy is more affordable, accessible, and prevalent in the United States than ever before. This is due to the declining average cost of solar PV panels by nearly 80% in recent years. The solar energy segment is maturing rapidly around the country since solar electricity is now economically competitive with conventional energy sources in most states.

- In 2021, according to the Solar Energy Industries Association of the United States, solar PV installed capacity in the United States reached 96.18 GW 2020, representing an increase of about 26% compared to the previous year's value. The utility solar PV sector has more than 11.2 GW of under-construction projects, putting the market on pace to hit 17.5 GW of annual capacity additions. The residential solar installations exceeded 1 GW and more than 130,000 systems in a single quarter for the first time in the industry's history.

- In March 2021, the United States Department of Energy (DOE) announced ambitious targets to reduce the cost of solar energy by 60% in the next ten years. Additionally, DOE has funded around USD 128 million to lower costs, improve performance, and speed the deployment of solar energy technologies by 2030.

- Furthermore, Wind Energy became the second-largest source of electricity generation in April 2022 since Energy Information Authority began collecting data. Moreover, the Wind Power sector is receiving immense support from the government, due to the America First Policy, which aims to boost domestic energy production.

- In April 2022, Vestas announced that it received an order to supply 33 V162-6.2 MW turbines and 1 V136-3.45 MW turbines to an unnamed project in the United States which will be commissioned in the last quarter of 2023.

- Thus due to the above-mentioned points, alternative renewable energy sources are likely to restrain the hydropower market in the United States during the forecast period.

US Hydropower Industry Overview

The United States Hydropower Market is moderately consolidated. Some of the major players operating in the market are GE Renewable Energy, Siemens Energy AG, Andritz AG, Voith Gmb & Co. KGaA, Duke Energy Corporation, and many more.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in GW, till 2028

- 4.3 Hydropower Installed Capacity Share, 2022

- 4.4 Hydroelectric Generation in TWh, till 2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION-BY SIZE

- 5.1 Large Hydropower (Greater than 100 MW)

- 5.2 Small Hydropower (Smaller than 10 MW)

- 5.3 Other Sizes (10-100 MW)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 GE Renewable Energy

- 6.3.2 Siemens Energy AG

- 6.3.3 Andritz AG

- 6.3.4 Voith Gmb & Co. KGaA

- 6.3.5 Duke Energy Corporation

- 6.3.6 Georgia Power Company

7 MARKET OPPORUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219