|

市场调查报告书

商品编码

1644547

积体电路:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Integrated Circuits - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

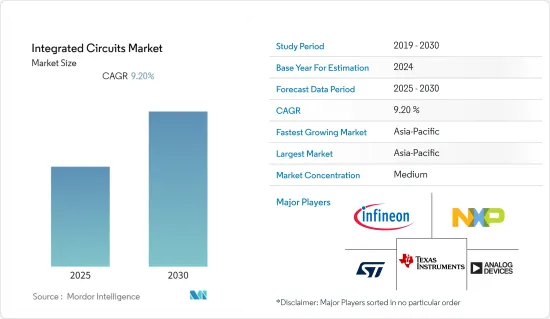

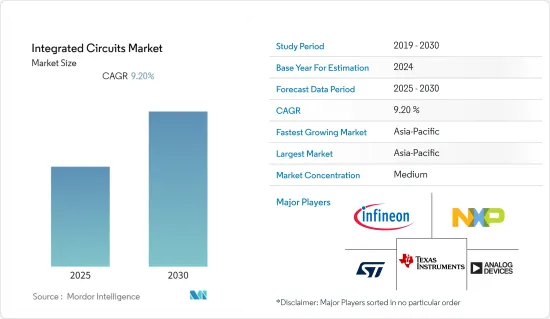

预计预测期内积体电路市场复合年增长率为 9.2%。

积体电路市场是资讯科技产业的核心,是支撑经济社会发展的基础性、策略性、主导产业。在市场需求拉动下,积体电路产业近年来快速成长,综合能力不断提升。积体电路设计与製造业与全球发展同步。

主要亮点

- 全球积体电路产业正处于转型调整的关键期。全球市场秩序正进入加速调整期,投资体量大幅增加,市场占有率向主要企业集中。

- 物联网(IoT)、云端运算和巨量资料等新兴趋势正在迅速发展,预计将推动积体电路技术向新的方向发展。

- 地方政府正在加强支持力度,发展自己的积体电路产业生态系统。例如,中国正在积极建立新的製造产能,并推出了中国积体电路投资基金。根据国际半导体产业协会(SEMI China)的数据,这些投资正在获得回报,中国晶圆厂产能市场占有率将从 2010 年的 9% 飙升至 2020 年的 17%。

- 在家工作、上门送货和电子商务的转变推动了科技产品需求的激增。积体电路市场参与者尚未预料到近年来会出现如此巨大的需求。兴建这些新工厂将耗资数十亿美元,并需要数年时间才能运作。由于製造能力有限,意外的激增导致全球积体电路短缺。预计2023年市场将恢復正常。

- 新冠疫情已影响到积体电路产业的多个领域。由于航运暂停、边境关闭和整体的不确定性,全球供应链中断,导致积体电路生产面临挑战。新冠肺炎疫情暴露了供应链中的许多脆弱性。

积体电路市场趋势

增加晶圆厂产能以满足不断增长的需求

- 根据产业组织SEMI在2021年5月发布的晶圆厂调查显示,预计2024年全球晶片製造商每月晶圆产量将达到创纪录的660万片。该预测反映了对 200 毫米晶圆厂设备的大量投资,预计到 2021 年该投资将接近 40 亿美元,较 2012 年至 2019 年的 20 多亿美元几乎增长一倍。

- 例如,2021年8月,晶圆代工厂芯恩(青岛)积体电路有限公司在青岛开始生产8吋硅片,并测试新的12吋生产线。此外,2021年9月,中芯国际宣布将投资88.7亿美元在上海兴建晶片製造厂。该公司的发展规划主要集中在28奈米及以上製程节点的积体电路代工和技术服务。

- 同样,英特尔也制定了雄心勃勃的资本支出计画。 2021年3月,英特尔宣布计画投资200亿美元在美国亚利桑那州兴建两座新工厂。

- 各类新参与企业也正致力于提升其製造能力。例如,2021年10月,Pragmatic Semiconductor获得了8,000万美元的C轮投资。该资金筹措将用于支持在英格兰东北部建造第二个 FlexLogIC 工厂,以满足对超低成本柔性积体电路 (FlexIC) 日益增长的需求。

预计亚太地区将以最高复合年增长率成长

- 亚太地区积体电路市场的成长与全部区域的终端用户成长相关,亚太地区是智慧型手机的主要市场之一,在可再生能源、汽车(尤其是电动车)和其他各个领域的投资不断增加。

- 随着各种电子设备不断向中国转移,中国、韩国和日本的半导体元件消费成长速度快于其他国家。此外,作为中国积体电路产业最大的产业,积体电路设计已从专注于低利润的消费应用发展到涵盖汽车、物联网(IoT)、加密挖掘和人工智慧(AI)等不断增长的市场的先进运算和通讯半导体。

- 受惠于中国经济的稳健成长,以及云端运算、5G、物联网、人工智慧、智慧汽车、联网汽车等新应用,中国积体电路市场的需求预计将持续增加。

- 中国工业与资讯化部电子资讯司司长乔岳山介绍,「十三五」期间,中国积体电路产业成长速度是世界的4倍。

- 此外,印度等该地区的其他国家也采取重大倡议吸引投资,并愿意提供奖励在印度建立晶圆厂以吸引投资。该国政府已发布了在该国建立/扩建现有半导体晶圆/设备製造设施的意向书(EoI)。

积体电路产业概况

积体电路市场竞争激烈,参与者众多。市场参与者正在采取产品创新、併购等各种策略。此外,随着积体电路製造流程的进步增强了应用功能,新的市场参与者正在增加其在市场上的份额并扩大企业发展。

- 2022 年 3 月 - Micross Components, Inc. 是一家为航太、国防、医疗和工业应用提供关键任务微电子元件和服务的全球供应商,该公司宣布与防辐射设计半导体供应商 Apogee Semiconductor 合作。 Micros 和 Apogee Semiconductor 目前提供多种外形尺寸的产品,包括介面、逻辑和转换 IC。

- 2021 年 8 月—ADI 公司 (ADI) 今天宣布已完成先前宣布的对 Maxim 整合式, Inc. 的收购。此次合併可望进一步巩固 ADI 作为高性能模拟半导体公司的地位。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 对市场的影响

第五章 市场动态

- 市场驱动因素

- 智慧型手机、平板电脑和家用电器日益普及

- 工厂增加资本投资以提高生产能力

- 市场限制

- 晶片尺寸缩小导致製造製程复杂

第六章 市场细分

- 按类型

- 数位IC

- 类比IC

- 混合讯号 IC

- 依产品类型

- 通用 IC

- 专用积体电路

- 按最终用户产业

- 消费性电子产品

- 车

- 资讯科技/通讯

- 製造与自动化

- 其他终端用户产业(医疗保健、航太和国防等)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Intel Corporation

- Texas Instruments Inc

- Analog Devices Inc

- Infineon Technologies AG

- STMicroelectronics NV

- NXP Semiconductors NV

- On Semiconductor Corporation

- Microchip Technology Inc

- Renesas Electronics Corporation

- MediaTek Inc.

第八章投资分析

第九章:市场的未来

The Integrated Circuits Market is expected to register a CAGR of 9.2% during the forecast period.

The Integrated Circuits Market is the core of the Information Technology (IT) industry; it is a basic, strategic, and leading industry supporting economic and social development. With market demand, the integrated circuit industry has been experiencing rapid growth and improved general competency in recent years. The integrated circuit design and manufacturing industry have been keeping pace with global development.

Key Highlights

- The Global Integrated Circuits industry is undergoing an important phase of transformation and adjustment. The global market order has been going through an accelerated adjustment period, investment volumes are substantially increasing, and market share is becoming concentrated among dominant companies.

- New trends such as the Internet of Things (IoT), cloud computing, and big data are progressing rapidly, which is expected to lead integrated circuit technology in new directions.

- Regional governments are extending their support to develop their national IC industry ecosystem. For instance, China has been aggressively building new fab capacities, accelerated by the introduction of the China Integrated Circuit Investment Fund. According to SEMI China, these investments are paying off, as China's wafer fab capacity market share surged from 9% in 2010 to 17% in 2020.

- The surge in demand for high-tech products was further accelerated by working from home, lockdown, and a shift to e-commerce. IC market players didn't expect this tremendous demand in the last few years. Building new fabs cost billions of dollars and took years to operational; the unexpected surge caused a global shortage of ICs due to limited manufacturing capacity. The market is expected to normalize not until 2023.

- The COVID-19 pandemic has impacted multiple sectors of the Integrated Circuits industry. The global supply chain was disrupted owing to transport stoppages, border closures, and general uncertainty leading to challenges in IC production. COVID-19 exposed many vulnerabilities in the supply chain.

Integrated Circuits Market Trends

Increasing Fab Capacities to meet Surging Demands

- According to a fab survey released in May 2021 by the industry group SEMI, Global chip manufacturers are forecasted to produce a record 6.6 million wafers every month by 2024. That forecast reflected substantial investments in 200-mm fab equipment, which is expected to approach USD 4 billion in 2021, nearly doubling since hovering above USD 2 billion between 2012 and 2019.

- For instance, in August 2021, SiEn (Qingdao) Integrated Circuits Co, a foundry, started production of 8-inch silicon wafers in Qingdao and tested a new 12-inch production line. Moreover, in September 2021, Semiconductor Manufacturing International Corp (SMIC) announced an investment of USD 8.87 billion in building a chip manufacturing plant in Shanghai. The company's plan has been focused on integrated circuit foundry and technology services on process nodes for 28 nanometers and above.

- Similarly, Intel also laid out ambitious CapEx plans. In March 2021, Intel announced plans to invest USD 20 billion in two new fabs in Arizona, United States.

- Various new market players are also focussing on adding manufacturing capacities. For instance, in October 2021, PragmatIC Semiconductor secured USD 80 million of Series C investment. This funding was aimed to build a second FlexLogIC fab in the North East of England, which intends to meet the growing demand for ultra-low-cost flexible integrated circuits (FlexICs).

Asia Pacific is Expected to Grow with the Highest CAGR

- The growth of the Integrated Circuits Market in the Asia Pacific correlates with the end-user growth across the region, being one of the main markets for smartphones, and is witnessing rising investments in renewable, automotive (particularly EVs), among various others.

- The consumption of semiconductor components is rapidly increasing in China, South Korea, and Japan as compared with other countries due to the continuing transfer of diverse electronic equipment to China. Moreover, IC design, the largest sector of China's Integrated Circuits industry, has progressed from low-margin consumer applications focus to encompass advanced computing and communication semiconductors across growth markets in automotive, the Internet of Things (IoT), and crypto mining, and artificial intelligence (AI).

- The demand for China's integrated circuit market is anticipated to continue increasing with the steady growth of China's economy and driven by new applications such as cloud computing, 5G, Internet of Things, artificial intelligence (AI), and intelligent and connected vehicles.

- According to Qiao Yueshan, head of the electronic information department at China's Ministry of Industry and Information Technology, China's Integrated Circuit Industry growth rate was four times the global growth rate during the country's 13th Five-Year Plan period.

- Also, other countries such as India in the region are taking significant steps to attract investments in the country and intend to incentivize and attract investments for setting up fabs in India; the government has issued an Expression of Interest (EoI) for setting up/expansion of existing semiconductor wafer/ device fabrication facilities in the country.

Integrated Circuits Industry Overview

The integrated Circuits Market is highly competitive and consists of several players. The market players adopt various strategies such as product innovation, mergers, and acquisitions, among others. In addition, with the advancement in the IC manufacturing process, which provides enhanced applications, new market players are increasing their market presence and expanding their business footprint across the emerging economies.

- March 2022 - Micross Components, Inc., a global provider of mission-critical microelectronic components and services for aerospace, defense, medical, and industrial applications, announced its partnership with Apogee Semiconductor, a company providing Radiation-Hardened-by-Design semiconductors. Together, Micross and Apogee Semiconductor now offer products that include interface, logic, and translation ICs, in various form factors.

- August 2021 - Analog Devices, Inc. (ADI) announced the completion of its previously announced acquisition of Maxim Integrated Products, Inc. The combination is expected to strengthen other ADI's position as a high-performance analog semiconductor company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Penetration of Smartphones, Tablets and Consumer Electronics

- 5.1.2 Rising Capital Spending by Fabs to Increase Production Capacities

- 5.2 Market Restraints

- 5.2.1 Complex Fabrication Process owing to the Decreasing Chip Size

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Digital IC

- 6.1.2 Analog IC

- 6.1.3 Mixed-Signal IC

- 6.2 By Product Type

- 6.2.1 General-Purpose IC

- 6.2.2 Application-Specific IC

- 6.3 By End-User Industry

- 6.3.1 Consumer Electronics

- 6.3.2 Automotive

- 6.3.3 IT & Telecommunications

- 6.3.4 Manufacturing and Automation

- 6.3.5 Other End-user Industries (Healthcare, Aerospace & Defense, etc.)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Texas Instruments Inc

- 7.1.3 Analog Devices Inc

- 7.1.4 Infineon Technologies AG

- 7.1.5 STMicroelectronics N.V.

- 7.1.6 NXP Semiconductors N.V.

- 7.1.7 On Semiconductor Corporation

- 7.1.8 Microchip Technology Inc

- 7.1.9 Renesas Electronics Corporation

- 7.1.10 MediaTek Inc.