|

市场调查报告书

商品编码

1644554

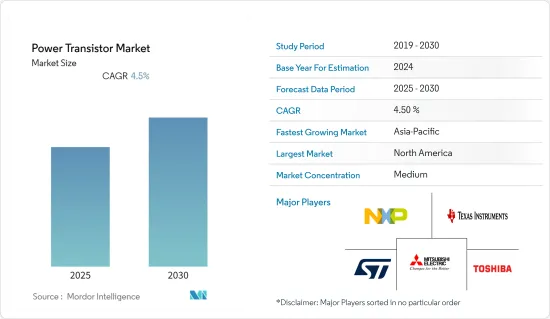

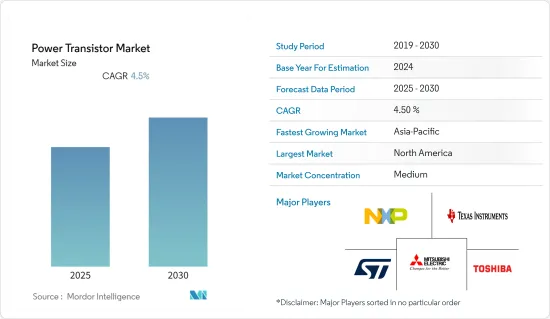

功率电晶体:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Power Transistor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计预测期内功率电晶体市场复合年增长率为 4.5%。

功率电晶体是家用电子电器中的关键元件,其应用包括透过提高家用电子电器效率来增强其性能和实用性,减小尺寸和系统成本,实现更小更时尚的设计,并提供专业音讯品质等新功能。

主要亮点

- 功率电晶体是一种广泛用于放大弱电讯号并进行相应调节的半导体装置。它们也可用作汽车、能源和电力产业等高功率应用中的开关。

- 通讯和连接电子设备对功率电晶体的需求不断增长以及该领域的投资增加将减少碳足迹并提高所用设备的生产率。

- 据KOSIS称,韩国二极体、电晶体和半导体元件製造业的整体销售额预计将在2021年达到59亿美元,到2024年终将达到62.6亿美元。亚太地区也出现了类似的趋势,预计预测期内这将推动市场成长。

- 功率电晶体散热迅速,防止过热并减少二氧化碳排放和电费。由于这些优点,功率电晶体已成为各种电子产品中不可或缺的元件。此外,人口的成长和石化燃料消费量的激增也推动了对节能电子设备的需求。

- 由于温度敏感性、15 kHz 以上开关频率下的有限操作以及反向阻断能力等限製而导致的操作限制可能会阻碍功率电晶体市场长期的成长。

- COVID-19 疫情严重影响了功率电晶体市场。由于全球经济放缓和劳动力短缺,半导体和电子产品生产设施停产。 COVID-19 造成製造业产运转率大幅下降、旅行禁令和製造工厂关闭,导致电力传输产业成长放缓。

功率晶体管市场趋势

消费性电子产业可望推动市场成长

- 消费性电子是功率电晶体的重要应用领域。耳机、笔记型电脑、智慧型手机、穿戴式装置和其他可携式设备等家用电子电器的快速普及正在推动该产业的发展。

- 5G 技术的出现正在增加支援各种代工节点的 5G 设备的采用。家用电子电器对更好、更有效率的半导体的需求不断增长,可能会推动对功率电晶体的需求。根据爱立信的行动报告,预计2021年第一季拥有5G设备的5G用户数将增加7,000万,到2021年终将达到5.8亿。

- 家用电子电器对高解析度音讯、更快充电和更节能设计的需求不断增长,将推动 GaN 技术的发展。 GaN电晶体技术为我们数位世界的持续改进提供了必要的适应性。

- 由于使用量的增加和资料处理所需资料的急剧增长,未来几年 5G 设备市场将会激增。 5G智慧型手机晶片製造商可能会面临5G晶片日益增长的需求,以支援对5G设备日益增长的需求。半导体晶片的增加促进了半导体的发展,最终支撑了功率电晶体的需求。

- 由于对功率电晶体的需求不断增长,已经出现半导体短缺的情况,预计未来需求将强劲。此外,美国参议院还提出了《FABS法案》,该法案将向半导体製造商提供税额扣抵,以扩大其半导体製造能力,并满足家用电子电器和汽车行业日益增长的需求。

亚太地区预计将出现最高成长

- 由于东芝公司和三菱电机等主要参与者的存在,亚太地区是全球功率电晶体市场成长最快的地区。中国、日本、台湾和韩国是占有较大市场占有率的主要国家。该地区还拥有巨大的智慧型手机和 5G 技术市场,并且对汽车(尤其是电动车)的投资正在增加。例如,氮化镓功率半导体製造商 GaN Systems 已与BMW签署了一份全面的产能协议,以生产其 GaN 功率电晶体,旨在提高关键电动车应用的效率和功率密度。

- 为了满足对电动车、家用电子电器以及能源和电力日益增长的需求,该全部区域电子製造业的蓬勃发展,预计将推动功率电晶体市场的成长。

- 中国是半导体市场的主要贡献者。电动车需求的激增将推动半导体在电动车中的使用。

- 随着各种电子产品不断转移到中国,日本、韩国和中国的半导体消费量与该地区其他国家相比成长更快。此外,全球五大家用电子电器产业都位于中国,这为预计期内该全部区域的半导体应用创造了巨大的机会。

功率晶体管产业概况

功率晶体管市场竞争激烈,因为主要参与者包括:仙童半导体国际公司、冠军微电子公司、瑞萨电子株式会社、英飞凌科技股份公司、德州仪器公司、恩智浦半导体公司、义法半导体公司、三菱电机公司、凌力尔特系统公司和东芝公司。

- 2022 年 4 月 - EPC 推出 EPC2050,这是一款 350V GaN 电晶体,最大 RDS(on) 为 80mΩ,脉衝输出电流为 26A。这种超小尺寸使电源解决方案占用的空间是同类硅解决方案的 10 倍。受益于EPC2050的快速开关速度和小尺寸的应用包括用于医疗电机的120V-150V电机控制、用于航太应用的120V-160V DC-DC转换、将400V输入转换为12V、20V或48V输出的DC-DC系统解决方案、DC-AC逆变器和图腾电柱。

- 2022 年 3 月 - Transphorm, Inc. 和 TDK 集团公司 TDK-Lambda 正在扩展其基于 AC-DC GaN 的 PFH500F 产品线。此产品系列包括TDK的500 W AC-DC电源PFH500F-12和PFH500F-48。此系列采用 Transphorm 的 72mΩ、8x8 PQFN GaN FET(TP65H070LDG)。此功率电晶体的高功率密度使TDK能够以薄底板冷却GaN电源。 TDK 生产了更纤薄的密封电源模组,能够支援在恶劣环境下运作的各种工业应用。应用包括客自订无风扇电源、雷射、5G通讯、讯号处理、商用现货 (COTS) 电源、数位电子看板/显示器等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 对连网型设备的需求不断增加

- 石化燃料使用量的快速成长增加了对节能电子产品的需求

- 市场挑战/阻碍因素

- 由于温度、频率和反向阻断能力等限製而导致的操作限制

第六章 市场细分

- 按产品

- 低压场效电晶体

- IGBT模组

- 射频和微波电晶体

- 高压场效电晶体

- IGBT电晶体

- 按类型

- 双极结型电晶体

- 场效电晶体

- 异质接面双极电晶体

- 其他(MOSFET、JFET、NPN电晶体、PNP电晶体、GaN电晶体)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Champion Microelectronics Corp

- Fairchild Semiconductor International Inc.

- Infineon Technologies AG

- Renesas Electronics Corporation

- NXP Semiconductors NV

- Texas Instruments Inc.

- STMicroelectronics NV

- Linear Integrated Systems Inc.

- Mitsubishi Electric Corporation

- Toshiba Corporation

第八章投资分析

第九章:市场的未来

The Power Transistor Market is expected to register a CAGR of 4.5% during the forecast period.

The power transistor is a crucial component used in consumer electronics; their application includes elevating the performance and utility of consumer electronics devices by increasing power efficiency, reducing size and system cost, enabling smaller, sleeker designs, and providing new features such as professional-level audio quality.

Key Highlights

- Power transistors are semiconductor devices widely used to amplify weak electrical signals and regulate them accordingly. They can also be employed as switches in several high-power applications such as automotive and energy & power industry.

- The rising demand for power transistors in the communication and connected electronic devices and increasing investment in the fields reduce carbon footprint and enhance the productivity of the devices in which it is used.

- According to KOSIS, the overall revenue from manufacturing diodes, transistors & semiconductor devices in South Korea was USD 5.9 billion in 2021 and is expected to reach USD 6.26 billion by the end of 2024. Similar trends are expected to be observed across the Asia Pacific region, propelling the market's growth in the forecast period.

- The power transistors aid in dissipating heat quickly, prevent overheating, and lower CO2 emissions and electricity costs. Due to these benefits, they are a crucial component in various electronic products. Furthermore, the growing population and surging fossil fuel consumption have propelled the demand for power-efficient electronic devices.

- The limitations in the operations due to the constraints such as temperature sensitivity, limitation of the operation above the switching frequency of 15 kHz, and reverse blocking capacity, among others, may hinder the market growth of the power transistors market in the long run.

- The COVID-19 pandemic severely impacted the Power transistors market. Semiconductors and Electronics production facilities halted due to the slowdown and non-availability of labor across the globe. COVID-19 caused a significant and prolonged drop in manufacturing utilization, and travel bans & manufacturing facility closures, which led to a decrease in the growth of the power transmission industry.

Power Transistor Market Trends

Consumer Electronics Sector is Expected to Boost Market Growth

- Consumer electronics is a significant application segment for power transistors. The surging adoption of consumer electronics such as earphones, laptops, smartphones, wearables, and other portable devices bolsters the segment's growth.

- The advent of 5G technology has increased the adoption of 5G enabled devices supporting the adoption of different foundry nodes. The rising demand for better and more efficient semiconductors in consumer electronics will propel the need for power transistors. According to Ericsson Mobility Report, 5G subscriptions with a 5G-capable device grew by 70 million during the first quarter of 2021 and are forecast to reach 580 million by the end of 2021.

- The rising demand for high-definition audio, fast charging, and more energy-efficient designs for consumer electronics will foster growth for GaN technology. The GaN transistors technology will provide the adaptation needed for the digital world to continue improving.

- The 5G enabled devices will witness a surge in the market in the coming years, owing to the increasing usage and surging data requirements of data processing. The chip manufacturers for 5G enabled smartphones will face demand growth for 5G chips to support the growing demand for 5G enabled devices. The increase in the semiconductor chips will contribute to the development of the semiconductor, eventually supporting the demand for power transistors.

- Since the demand for power transistors is growing, a shortage of semiconductors has been observed to create strong demand in the future. Additionally, the US Senate introduces FABS Act to give tax credits to semiconductor manufacturers to expand the semiconductor fabrication capacity in line with the demand growth in the consumer electronics and automotive industries.

Asia Pacific Expected to Witness the Highest Growth

- The Asia Pacific is the fastest-growing region in the power transistors markets globally, owing to the presence of major companies, such as Toshiba Corporation, and Mitsubishi Electric Corporation, among others. China, Japan, Taiwan, and South Korea are major countries with a significant market share. The region also contributes a substantial market for smartphones and 5G technology; it is also witnessing a rise in investments in automotive (especially EVs). For instance, GaN systems, a gallium nitride power semiconductor manufacturer, signed a comprehensive capacity agreement with BMW for the company's GaN power transistors, designed to increase the efficiency and power density of critical applications in EVs.

- The rise in electronic equipment manufacturing across the region to cater to the rising demand for electric vehicles, consumer electronics, and energy & power is expected to foster growth in the power transistor market.

- China contributes significantly to the semiconductor market. The surging demand for electric vehicles will propel the use of semiconductors in the Electric vehicle.

- The consumption of semiconductors is rapidly growing in Japan, South Korea, and China, compared to other countries in the region, due to the continuing transfer of diverse electronic equipment to China. In addition, the presence of the world's top five largest consumer electronics sectors is based in China, posing enormous opportunities for semiconductor adoption across the region in the estimated timeframe.

Power Transistor Industry Overview

The Power Transistor Market is a highly competitive market due to the presence of significant players such as Fairchild Semiconductor International Inc., Champion Microelectronics Corp, Renesas Electronics Corporation, Infineon Technologies AG, Texas Instruments Inc., NXP Semiconductors N.V., STMicroelectronics N.V., Mitsubishi Electric Corporation, Linear Integrated Systems Inc. and Toshiba Corporation.

- April 2022 - EPC announced the release of its product EPC2050, a 350 V GaN transistor with a maximum RDS(on) of 80 mΩ and a 26 A pulsed output current. This tiny size enables power solutions that occupy ten times less area than comparable silicon solutions. The application benefits from the fast-switching speed and small size of the EPC2050 include 120 V-150 V motor control for medical motors, DC-DC conversion from/to 120 V-160 V such as in aerospace applications, DC-DC solutions converting 400 V input to 12 V, 20 V or 48 V outputs and DC-AC inverters, multi-level converters such as Totem Pole PFC.

- March 2022 - Transphorm, Inc. and TDK-Lambda, a group company of TDK, are expanding their AC-DC GaN-based PFH500F product line. The product line includes PFH500F-12 and PFH500F-48 in TDK's 500-watt AC-DC power supplies. The series uses 72 mΩ, 8x8 PQFN GaN FETs (TP65H070LDG) from Transphorm. The power transistors high power density enabled TDK to cool the GaN power supplies via thin baseplates. Inline, TDK produced a slimmer, tightly contained power module capable of supporting a large variety of broad industrial applications operating in harsh environments. The applications include custom fanless power supplies, laser, 5G communication, signaling, commercial off-the-shelf (COTS) power supplies, digital signage/displays, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in demand for connected devices

- 5.1.2 Surging usage of fossil fuels has increasing demand for power-efficient electronic devices

- 5.2 Market Challenges / Restrain

- 5.2.1 Limitations in Operations due to constraints like temperature, frequency, reverse blocking capacity, etc

6 MARKET SEGMENTATION

- 6.1 Product

- 6.1.1 Low-Voltage FETs

- 6.1.2 IGBT Modules

- 6.1.3 RF and Microwave Transistors

- 6.1.4 High Voltage FETs

- 6.1.5 IGBT Transistors

- 6.2 Type

- 6.2.1 Bipolar Junction Transistor

- 6.2.2 Field Effect Transistor

- 6.2.3 Heterojunction Bipolar Transistor

- 6.2.4 Othersc(MOSFET, JFET, NPN Transistor, PNP Transistor, GaN transistor)

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Champion Microelectronics Corp

- 7.1.2 Fairchild Semiconductor International Inc.

- 7.1.3 Infineon Technologies AG

- 7.1.4 Renesas Electronics Corporation

- 7.1.5 NXP Semiconductors N.V.

- 7.1.6 Texas Instruments Inc.

- 7.1.7 STMicroelectronics N.V.

- 7.1.8 Linear Integrated Systems Inc.

- 7.1.9 Mitsubishi Electric Corporation

- 7.1.10 Toshiba Corporation