|

市场调查报告书

商品编码

1644557

高功率雷射系统:全球市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global High Power Laser Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

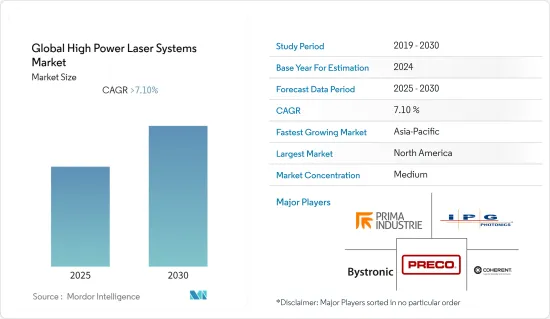

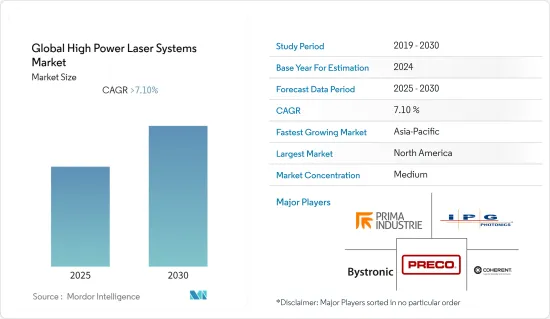

预计预测期内全球高功率雷射系统市场复合年增长率将超过 7.1%。

主要亮点

- 市场对配备先进雷射头感测器和人工智慧演算法的互联机器的需求强劲,以实现先进的製程监控和控制功能。这些机器可以与其他系统和管理软体集成,以最大限度地提高效率和生产力。

- 这使得高功率雷射机在每个阶段都由软体控制,包括导入用户系统中产生的生产订单、自动编程、生产计画、创建要加载到机器上的工作列表、收集有关生产的机器资料(生产的件数、使用的材料)和性能(机器状态、警报、加工时间)并提供生产管理系统所需的资料,同时完全符合工业 4.0 法规的要求。

- 汽车和一般製造业采用高功率雷射切割製程来缩短加工週期。工具成本的降低和材料灵活性的提高导致了雷射切割的使用量的快速增加。

- 此外,输出功率10千瓦及以上的高功率二极体雷射正在为雷射覆层开闢新的应用场景。例如,可以在汽车、机械製造和其他行业中生产和应用特别永续和资源高效的涂料。为了推进这一想法,2022 年 4 月,弗劳恩霍夫材料与光束技术研究所 IWS 与工业合作伙伴一起,在“HICLAD”标籤下为此类激光器开发了应用程序和特定工艺,从而能够使用高功率激光器进行弹性激光覆层,使其为工业化做好准备。

- 然而,采用雷射技术的成本高、政府法律规范和政策严格以及缺乏熟练的人力和专业知识限制了市场的发展并阻碍了其成长。雷射产业也受到了新冠肺炎疫情的严重影响。广泛应用高功率雷射的製造业和汽车业由于2020年生产限製而增长放缓,导致整体对雷射系统的需求减少。然而,随着生产活动的恢復,对雷射的需求预计将復苏并进一步增加。

高功率雷射系统市场趋势

焊接领域预计将占据主要市场占有率

- 焊接一直被认为是一项技术含量高且劳力密集的工艺。焊接品质不能只以外观来判断。焊接品质取决于熔化阶段材料与气体的相互作用以及冷却阶段材料之间的结合。

- 特殊合金(如硼钢、高强度镍合金、铬合金、钛合金等)的使用增加带来了新的挑战,因为这些材料的加工参数视窗变得越来越窄。利用高功率雷射系统可以严格控制焊接过程。

- 此外,由于焊接品质、可靠性和性能的提高,高功率光纤雷射焊接继续发展成为首选製程。一些光纤雷射焊接应用是自热焊,其中焊缝完全透过熔化一部分母材形成,并且不使用额外的填充丝或粉末。这些增强包括改善被焊接部件的接头配合公差(空气间隙、不匹配等)、消除焊接过程中的凝固裂纹以及修改焊缝金属的化学成分或微观结构以获得合适的机械性能。

- 此外,高功率雷射焊接在汽车行业越来越受欢迎。目前它已广泛应用于汽车的各个领域,包括车身框架(白色车身)、门框、后行李箱、车盖、底盘的大规模焊接、以及前背光源和电子外壳的雷射塑胶焊接。雷射焊接也广泛用于许多子部件的金属焊接,例如安全气囊启动器、电动马达中的线圈绕组、车辆电子设备中的电池接片和汇流排连接以及汽车製造中的电气互连,儘管这些马达有时会被遗忘,因为它们位于汽车内部并且体积很小。

- 随着全球汽车产业需求和产量的激增,所研究的市场预计将遇到有利可图的机会。例如,根据国际汽车製造商组织(OICA)的预测,2021年全球汽车产量将达到约8,000万辆。这一数字与前一年同期比较增长了约3%。到2020年,中国、日本和德国将成为最大的汽车和商用车生产国。

亚太地区市场预计将实现高成长

- 亚太地区雷射产业近年来由于国内经济状况的不断改善而获得了显着的成长。本区持续注重科学研究、技术提升、市场开拓及雷射工业建设,加强雷射产业发展力道。

- 例如,随着「中国製造2025」策略的推进,中国製造业正向高端化、智慧化转型。雷射技术以其效率高、耗材低、材料变形小、对工件适应性强等特点,已成为高端製造业不可或缺的工具。高端雷射加工设备越来越受到关注。在目前的雷射加工应用中,雷射切割是最普遍的,而光纤雷射是最受欢迎的光源系统。

- 2021年12月,由华南大学与锐利科雷射联合研发的我国首台100kW高功率雷射在湖南省衡阳市正式投入使用。与传统雷射相比,100kW高功率雷射结构更紧凑、电光转换效率更高、消费量更低、光束品质更好。

- 日本致力于开发先进的军事技术,例如高功率微波和雷射武器系统,以应对来自邻国日益增长的飞弹威胁。日本防卫省计画在2025年前研发出一种用于摧毁敌方无人机的高功率雷射器,并将与企业合作进行此计划。

- 近日,日本电气电子企业古河电工研发并发表了一款工业雷射。该公司目前正在进一步增强其光纤雷射技术,以用于能源、资讯、传热、连接和储存应用。

高功率雷射系统产业概况

全球高功率雷射系统市场较为分散,主要参与者包括 Prima Industrie SpA、IP Photonics Corporation 和 Coherent Inc.占据市场主导地位的大公司正致力于扩大多个地区的基本客群。这些公司正在利用战略合作计划来增加市场占有率和盈利。

- 2021 年 10 月-相干公司推出新型高功率紫外线雷射。相干公司的 AVIA LX 355-30 奈秒紫外线 (UV) 雷射具有无与伦比的高功率、可靠性和长寿命组合,可大幅提高生产率,尤其适用于微电子製造中的精密切割、钻孔和微结构操作。

- 2021 年 5 月 - Prima Industrie SpA 开发了一款在义大利设计和製造的新型 Laser Genius+ 2D 光纤雷射机。该机器速度快、生产效率高,轨道速度可达180公尺/分钟。 Laser Genius+ 机器有 1530、2060 和 2040 三种尺寸。光纤雷射的输出功率从2kW到15kW。这台机器旨在让您完全控制雷射加工,在所有可用功率下为您提供坚如盘石的可靠性和品质。新的雷射头还设计用于有效管理熔化板材所需的热量,同时保持冷却和清洁,并配有可即时主动控制切割过程的感测器、密封隔离的光学元件、简化的机械装置和高效的烟雾提取系统。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 系统中使用的雷射光源类型(光纤、圆盘、二极体、CO2)

第 5 章 Mahle 动力学

- 市场驱动因素

- 市场挑战

第六章 按应用分類的市场区隔

- 断开

- 焊接

- 其他(覆层、硬化、清洗、消融)

7. 按区域分類的市场

- 中国

- 日本

- 欧洲

- 北美洲

- 世界其他地区

第八章 竞争格局

- 公司简介

- Prima Industrie SpA

- Han's Laser Technology Industry Group

- IP Photonics Corporation

- Bystronic Laser AG

- El.En. SpA

- Coherent Inc

- TRUMPF SE+Co. KG

- Preco Inc

- HSG Laser

第九章投资分析

第十章 市场机会与未来趋势

简介目录

Product Code: 90663

The Global High Power Laser Systems Market is expected to register a CAGR of greater than 7.1% during the forecast period.

Key Highlights

- The market is witnessing robust demand for interconnected machines with advanced laser head sensors and artificial intelligence algorithms for advanced process monitoring and control features. These machines can be integrated with other systems and management software, thus maximizing efficiency and productivity.

- This enables the high-power laser machine to be managed by software for all phases, including importing production orders generated by the user's system, automatic programming, production planning and creation of worklists to be loaded onto the machine, collection of machine data on production (pieces produced, materials used) and performance (machine status, alarms, processing times), and offer the data necessary for production control management systems, all the while being fully compliant to Industry 4.0 law requirements.

- Automotive and general manufacturing operations use high-power laser cutting processes to shorten process cycle times. The combination of reduced tooling costs and flexibility in materials is leading to the rapidly increased use of laser cutting.

- Further, high-power diode lasers with outputs of ten or more kilowatts are opening new application scenarios for laser cladding. Particularly sustainable and resource-efficient coatings can be produced and applied, for instance, in automotive, machine construction, and other industries. To advance the idea, in April 2022, together with industrial partners, the Fraunhofer Institute for Material and Beam Technology IWS, developed applications and specific processes for this laser class to industry readiness under the label "HICLAD," which enables resilient laser cladding with a high-power laser.

- On the flip side, high costs associated with the deployment of laser technology, strict regulatory framework and policies imposed by the government, and a lack of skilled personnel and expertise restrict the market and hamper its growth. Also, the laser industry suffered significantly from the impacts of the covid-19 pandemic. Manufacturing and automotive industries, in which high-power lasers are widely used, witnessed a slowdown owing to production restrictions in 2020, resulting in a decline in the overall demand for laser systems. However, the resumption of production activities has revived the demand for lasers, which is expected to increase further.

High Power Laser Systems Market Trends

Welding Segment is Expected to Hold a Major Market Share

- Welding has always been considered a highly-skilled and labor-intensive activity, and in many respects, it is. One cannot assume the quality of a weld by appearance. The quality of the weld is demarcated by material and gas interactions during the molten phase and the bonding of the materials during the cooling phase.

- With the increasing use of specialty alloys (e.g., boron steel, high-strength nickel alloys, chromium alloys, and titanium alloys), new challenges arise because the processing parameter window for these materials may be narrow. The welding process can be tightly controlled with high-power laser systems.

- Further, High Power Fiber laser welding continues to evolve as a preferred process with enhancements in weld quality, reliability, and performance, as several fiber laser welding applications are autogenous, where the weld is formed entirely by melting parts of the base metal, and no additional filler wire or powder is used. The enhancements include better joint fit-up tolerance (air gaps, mismatch, etc.) of the parts to be welded, elimination of solidification cracking during the welding, and modifying the weld metal's chemical composition or microstructure to obtain suitable mechanical properties, etc.

- Also, high-power laser welding is gaining popularity in the automotive industry. It is now commonplace for many automotive applications, including large-scale welding of body frames (body-in-white), door frames, trunks, auto hoods, chassis, and laser plastic welding for front and backlights and electronic housings. Sometimes forgotten as the welds are internal to automobiles and sometimes very small in size, laser welding is also widely used for metal welding of many sub-components, including airbag initiators, motor coil windings, and battery tab-to-bus bar connections for vehicle electronics, and electrical interconnections within an automobile build.

- With the global upsurge in the demand and production in the automotive industry, the studied market is anticipated to encounter lucrative opportunities. For instance, according to the Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2021, approximately 80 million motor vehicles will be produced worldwide. This figure translates into an increase of around 3%, compared with the previous year. China, Japan, and Germany were the largest car and commercial vehicle producers in 2020.

The Asia Pacific Region is Expected to Witness a High Market Growth

- The Asia Pacific region's laser industry has seen significant growth in recent years, with the continuous improvement of domestic economic conditions. The region has consistently focused on scientific research, technology upgrades, market exploration, and the construction of laser industrial parks, which has intensified the development of the laser industry.

- For instance, with the advancement of the "Made in China 2025" strategy, the manufacturing industry in China is transforming into a high-end, intelligent type. Laser technology has become an indispensable tool in high-end manufacturing due to its high efficiency, low consumables, small material deformation, and strong adaptability to processing objects. High-end laser processing equipment is receiving more and more attention. In current laser processing applications, laser cutting is the most popular, and fiber laser is the most popular light source system.

- In December 2021, China's first 100 kW ultra-high-power laser, jointly developed by Nanhua University and Rayco Laser, was officially used in Hengyang City, Hunan Province. Compared with a traditional laser, the 100 kW ultra-high power laser has a more compact structure, higher electrical and optical conversion efficiency, lower energy consumption, and better beam quality.

- In Japan, the focus is on developing advanced military technologies such as high-power microwave- and laser-based weapon systems to help combat the growing missile threat posed by neighboring countries. Japan's Defense Ministry has planned to develop high-powered lasers to destroy enemy drones until 2025 and will engage with companies for the project.

- Recently, Japan's Furukawa Electric, an electric and electronics equipment company, developed and launched an industrial laser. The company is now further enhancing its fiber laser technology for energy, information, heat conduction, connection, and storage applications.

High Power Laser Systems Industry Overview

The Global High Power Laser Systems Market is moderately fragmented with significant players like Prima Industrie S.p.A, IP Photonics Corporation, Coherent Inc., etc. With a prominent share in the market, the major players are focusing on expanding their customer base across several regions. These companies leverage strategic collaborative initiatives to expand their market share and profitability.

- October 2021 - Coherent, Inc. launched its new high-power UV laser. The Coherent AVIA LX 355-30 nanosecond ultraviolet (UV) laser offers an unmatched combination of high output power, reliability, and long lifetime, providing a significant boost in productivity for high-precision cutting, drilling, and microstructuring tasks, particularly in microelectronics production.

- May 2021 - Prima Industrie S.p.A developed a new Laser Genius+ 2D fiber laser machine, wholly designed and built in Italy. The machine is fast and productive, with a trajectory speed of 180m/min. The Laser Genius+ machines comprise sizes 1530, 2060, and 2040. It can be equipped with numerous fiber laser powers, from 2 to 15 kW. The machine is built to have total control over the laser process and obtain robust reliability and quality with all available power. The new laser head has also been designed to efficiently manage the heat required to melt thick sheets while staying cold and clean, thanks to sensors that actively control the cutting process in real-time, hermetically isolated optics, simplified mechanics, and the high efficiency fumes extraction system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Consumers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Intensity Of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Type of Laser Sources Used on the Systems (Fiber, Disk, Diode, and CO2)

5 MARET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Challenged

6 MARKET SEGMENTATION - BY APPLICATION

- 6.1 Cutting

- 6.2 Welding

- 6.3 Others (Cladding, Hardening, Cleaning and Ablation)

7 MARKET SEGMENTATION - BY GEOGRAPHY

- 7.1 China

- 7.2 Japan

- 7.3 Europe

- 7.4 North America

- 7.5 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Prima Industrie S.p.A

- 8.1.2 Han's Laser Technology Industry Group

- 8.1.3 IP Photonics Corporation

- 8.1.4 Bystronic Laser AG

- 8.1.5 El.En. S.p.A

- 8.1.6 Coherent Inc

- 8.1.7 TRUMPF SE + Co. KG

- 8.1.8 Preco Inc

- 8.1.9 HSG Laser

9 INVESTMENT ANALYSIS

10 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219