|

市场调查报告书

商品编码

1644604

北美半导体蚀刻设备:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Semiconductor Etch Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

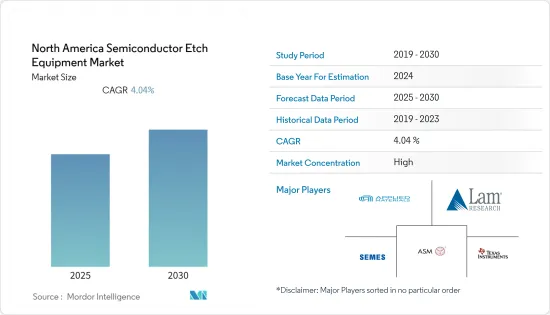

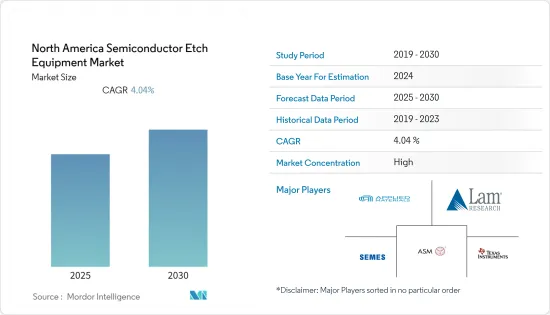

预测期内,北美半导体蚀刻设备市场预计复合年增长率为 4.04%

关键亮点

- 北美半导体蚀刻设备市场的成长依赖于半导体晶圆沉积和晶圆加工产业的扩张。由于晶片设计成本上升、新材料、晶片线宽缩小以及製造製程整合的需要,记忆体製造商和代工厂正在加大对更新、更具创新性的设备的投资。例如,2022年2月,德州仪器透露,计画在2030年在美国半导体晶片生产上投资数十亿美元。德州仪器宣布,计画到 2025 年每年向美国半导体晶片製造业投资 35 亿美元。

- 2021 年 3 月,英特尔宣布将在亚利桑那州再建两座製造工厂(晶圆厂)。在这一消息传出的背景下,人们担心全球晶片短缺正在困扰从汽车到电子等各个行业,并且美国在半导体製造业方面落后。该代工厂准备生产一系列采用 ARM 技术的晶片,该技术用于行动设备,历史上曾与英特尔青睐的 x86 技术竞争。

- 感测器在工业自动化和汽车领域的使用增加了半导体的应用,从而增加了几乎每个工业领域的需求。这间接提振了半导体蚀刻设备市场。例如,北爱荷华大学(UNI)、扬斯敦州立大学(YSU)和国家国防製造与製造中心(NCDMM)已建立新的合作关係,旨在筹集 1000 万美元的第一年融资。预计每年有数百家公司将从伙伴关係中受益,透过消除采用积层製造、人工智慧(AI)和机器人等工业 4.0 技术的障碍,在扩大和加强供应链的同时增加高品质零件的产量。

- 随着智慧型手机应用和其他消费品的日益普及,半导体蚀刻设备市场产业正在不断成长。为了获得竞争优势,公司正在加大对製程设备的投资。例如,英特尔将在俄亥俄州投资超过200亿美元建造两家新的晶片工厂。这项投资将大幅提升美国半导体的生产能力,而半导体是电脑、智慧型手机、汽车和其他电子设备的关键零件。随着半导体市场的扩大,半导体蚀刻设备市场也随之扩大。

- 半导体蚀刻设备产业需要大量的资金,政府的支持在该产业的发展中发挥了至关重要的作用。虽然基于市场的政府支持可以促进创新和技术传播,但不透明和歧视性的补贴可能会抑制竞争并造成市场扭曲。由于担心政府针对半导体蚀刻设备製造商的计画有偏见,製造商不愿投资开发优质产品,这限制了市场的发展。

- COVID-19 正在扰乱半导体产业的供应链和生产,从而对市场产生负面影响。由于劳动力短缺,半导体蚀刻设备製造商受到的影响更加严重。疫情期间,全球半导体供应链中的多家公司被迫限製或停止营运。该行业一直在努力应对高亏损和不断增长的需求,导致供应链出现严重缺口。

北美半导体蚀刻设备市场趋势

北美市场正受到美国为避免与中国的贸易摩擦而生产半导体及其相关产品的策略的推动。

- 国内半导体製造对美国政府的运作至关重要。预计新政府将解决日益严重的晶片短缺问题,并消除立法者对外包晶片製造使美国更容易受到供应链中断影响的担忧。拜登启动了为期100天的审查,新措施和政府支持可能会为美国晶片公司带来重大提振。因此,北美半导体蚀刻设备市场持续成长。

- 美国晶片需求主要来自大型个人电脑、资讯和通讯基础设施(包括资料中心和网路设备)、应用市场、智慧型手机和工业设备。苹果等美国智慧型手机製造商是台积电的主要客户。美国政府正在寻求500亿美元资金支持国内晶片製造。台积电正考虑美国亚利桑那州晶片工厂投入比之前披露金额多数百亿美元的资金。此外,台积电预计将与英特尔和三星电子竞争美国政府的建厂补贴。所有这些都为该地区半导体蚀刻设备市场的成长创造了有利的环境。

- 新的美国贸易协定是另一个明显有利于北美半导体企业的措施。美国的国家技术和工业基础可以扩大到包括参与企业。此外,美国与欧盟之间的贸易协定,例如《全面与进步协定》(原为TPP)和《跨大西洋贸易和投资伙伴关係》,将降低外国对美国半导体和高科技设备的壁垒,同时增加美国获得进口半导体相关商品和服务的机会。因此,该地区的半导体蚀刻设备市场预计将扩大。

- 透过美国投资局,美国政府正在与国会两院合作,提供 520 亿美元来刺激私人对半导体市场的投资,并美国美国领先地位。例如SK集团在美国投资新的研发中心、美光公司在美国扩大生产等。预计这将导致该地区半导体蚀刻设备市场的成长。

先进半导体晶片在5G和工业4.0的应用将推动市场成长

- 北美的公司正专注于在工业自动化领域应用5G技术。例如,芝加哥数位製造研究所和国家製造业网路安全中心安装了私人 5G 网路来连接感测器,以实现工厂设备的自动化、监控和预测性维护。

- 加拿大作为一个商业开放的国家在国际上享有盛誉。加拿大准备采取重要措施,成为未来半导体代工领域的突出地区。此外,该国市场伙伴关係活动也十分活跃。例如,加拿大政府已启动一项耗资 1.5 亿加元的半导体挑战赛,并向加拿大国家研究委员会投入 9,000 万加元,用于建立用于通讯网路的光电製造中心。

- 半导体在通讯网路基础设施中有着应用。为了鼓励国内生产半导体和半导体蚀刻设备,加拿大政府正在限制外国通讯网路基础设施供应商在该国的运作。例如,政府已禁止华为和中兴的产品和服务在加拿大通讯系统中使用。

- 三星电子计划在德克萨斯州泰勒市建立一座价值 170 亿美元的晶片製造厂。新工厂将生产用于移动、5G、高效能运算和人工智慧的先进製程技术的产品,推动该地区半导体蚀刻设备市场的发展。

- Lam Research Corporation是一家美国晶圆製造设备供应商,致力于开发结合5G和Wi-Fi 6/6E的无线连接。如果这两种技术处于相同或相近的频段,那么建立平行网路将变得极为困难。该公司目前正在提高其氮化铝薄膜中的钪掺杂水平(通常在 20% 以上),以提高装置性能。这显示该地区半导体蚀刻设备市场技术发展迅速。

北美半导体蚀刻设备产业概况

北美半导体蚀刻设备市场竞争激烈,少数几家主要企业控制相当一部分市场占有率。由于所需资本庞大,新进入者很难进入该市场,主要参与者正在透过併购来扩大其市场主导地位。

- 2021 年 9 月,应用材料公司宣布了一项新解决方案,帮助全球领先的碳化硅 (SiC) 晶片製造商从 150 毫米晶圆生产转向 200 毫米晶圆生产,使每个晶圆的晶粒产量几乎翻了一番。

- 2022 年 2 月,泛林集团宣布推出全新选择性蚀刻产品系列,该产品系列采用突破性的晶圆製造技术和新化学工艺,支援晶片製造商开发环栅 (GAA) 晶体管结构。 Argos(R)、Prevos(TM) 和 Selis(R) 蚀刻产品组合中的三种产品在先进逻辑和记忆体半导体解决方案的设计和製造方面具有显着的优势。

- 2022年2月,松下公司采用独特的捲对捲加工方式,将全球首款兼具低电阻与高透过率的双面全布线透明导电膜商业化。采用Panasonic独特的捲对卷工艺,可以实现传统蚀刻方法无法实现的2m布线宽度。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 美国为避免与中国的贸易紧张而采取的国内生产半导体及相关产品的策略

- 先进半导体晶片在5G和工业4.0的应用

- 市场限制

- 缺乏透明度,可能出现歧视性政府补贴

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对市场的影响

第五章 市场区隔

- 依产品类型

- 高密度蚀刻设备

- 低密度蚀刻设备

- 依蚀刻类型

- 导体蚀刻

- 介电蚀刻

- 多晶硅蚀刻

- 按应用

- 逻辑和记忆

- 功率元件

- MEMS

- 其他的

- 按国家

- 美国

- 加拿大

第六章 竞争格局

- 公司简介

- Applied Materials, Inc

- Hitachi High Technologies America, Inc

- Lam Research Corporation

- SEMES

- Axcelis Technologies, Inc.

- ASM America

- Lattice Semiconductor Corporation

- Texas Instruments

- Panasonic Corporation

第七章投资分析

第 8 章:市场的未来

简介目录

Product Code: 90874

The North America Semiconductor Etch Equipment Market is expected to register a CAGR of 4.04% during the forecast period.

Key Highlights

- The growth of the semiconductor Etch Equipment market in North America is dependent on the expansion of the semiconductor wafer deposition and wafer processing sectors. Memory makers and foundries are increasingly focusing on investing in newer and creative equipment due to rising chip design costs, new materials, smaller linewidths on a chip, and the necessity for integrated manufacturing processes. For instance, in February 2022, Texas Instruments detailed its plan to invest billions in U.S. semiconductor chip production through 2030. Texas Instruments revealed plans to invest USD 3.5 billion annually in its U.S. semiconductor chip manufacturing through 2025 as manufacturers face a global shortage of the tech necessary for an increasing number of goods.

- In March 2021, Intel committed to two more new fabrication plants, or fabs, in Arizona. The news comes during a global chip shortage that is snarling industries from automobiles to electronics and worries the United States is falling behind in semiconductor manufacturing. The foundry is poised to manufacture a range of chips based on ARM technology used in mobile devices and has historically competed with Intel's favored x86 technology.

- Industrial automation and the usage of sensors in automotive are increasing the applications of semiconductors and their demand in almost all the industry verticals. Because of this, the Semiconductor Etch Equipment market is rising indirectly. For instance, The University of Northern Iowa (UNI), Youngstown State University (YSU), and the National Center for Defense Manufacturing and Machining (NCDMM) have formed new cooperation that aims to leverage $10 million in first-year financing. Hundreds of businesses are expected to benefit from the partnership each year by removing barriers to adopting Industry 4.0 technologies, such as additive manufacturing, artificial intelligence (AI), and robotics, to increase the output of high-quality parts while expanding and strengthening the supply chain.

- The semiconductor Etch Equipment market industry is growing as smartphone applications and other consumer items become more popular. To achieve a competitive advantage, firms increase their investment in process equipment. For example, Intel will invest more than USD 20 billion in two new chip plants in Ohio. This investment will significantly increase semiconductor manufacturing capabilities in the United States, a critical component of computers, smartphones, automobiles, and other electronic devices. With the increase of the semiconductor market, the semiconductor Etch Equipment market will also increase.

- The semiconductor Etch Equipment industry requires a large amount of cash, and government support has played an essential role in its development. While market-based government support may promote innovation and technological diffusion, non-transparent and discriminatory subsidies can stifle competition and generate market distortions. Fears about skewed government schemes for semiconductor etch equipment makers are constraining market expansion since manufacturers are unwilling to invest in developing high-quality products.

- COVID-19 has negatively impacted the market by disrupting the semiconductor industry's supply chain and production. Due to workforce shortages, the impact on semiconductor etches equipment makers were more severe. Several players in the semiconductor supply chain worldwide had to limit or even cease their operations during the pandemic. The sector was plagued by a high deficit and rising demand, resulting in a considerable supply chain gap.

North America Semiconductor Etch Equipment Market Trends

The United States' strategies for manufacturing semiconductors and peripheral products to avoid trade tensions with China are driving the market in North America.

- Domestic semiconductor manufacturing is essential for the administration of the U.S. government. The new administration is expected to fix the rising chip shortages and address lawmakers' concerns that outsourcing chipmaking had made the United States more vulnerable to supply chain disruptions. In an executive action, Biden started a 100-day review that could significantly boost American chip companies with additional new policies and government support. This is increasing the North American semiconductor Etch Equipment market to grow.

- Most demand for chips in the United States includes large P.C.s and information and communications infrastructure (including data centers and network equipment), application markets, smartphones, and industrial equipment. Smartphone manufacturers based out of the United States, such as Apple, are prominent customers of TSMC. The United States government has called for USD 50 billion in funding to support domestic chip manufacturing. TSMC is weighing plans to pump tens of billions of dollars more into the chip factories in the U.S. state of Arizona than it had previously disclosed. In addition, TSMC is expected to compete against Intel Corp and Samsung Electronics Co Ltd for subsidies from the U.S. government in building the plants. These all create a conducive environment for the growth of the semiconductor Etch Equipment market in the region.

- New U.S. trade agreements are another clear step that would benefit the semiconductor business in North America. The United States National Technology and Industrial Base might be expanded to include allies such as Japan, South Korea, Germany, and the Netherlands, dominant players in the semiconductor supply chain. In addition, trade agreements between the United States and the European Union, such as the Comprehensive and Progressive Trans Partnership (formerly the TPP) and the Transatlantic Trade and Investment Partnership, would increase access to imported semiconductor-related goods and services while lowering foreign barriers to U.S. semiconductors and high-tech devices. Because of this, the semiconductor Etch Equipment market in the region will increase.

- The U.S. Innovation and Competition Act (USICA) and the Administration are working with the House and Senate to provide $52 billion to catalyze more private-sector investments in the semiconductor market and continued American technological leadership. For example, S.K. Group investments in a new R&D center in USA and Micron to expand U.S. production. Due to this, the semiconductor Etch Equipment market in the region will increase.

The application of advanced semiconductor chips in 5G and Industry 4.0 is fostering the market growth

- Companies in the North American region are focusing on implementing 5G technology in Industrial Automations. For example, The Digital Manufacturing Institute and the National Center for Cybersecurity in Manufacturing in Chicago have installed a private 5G network with connections to sensors to automate, monitor, and provide predictive maintenance for factory equipment, which will serve as a real-world model for companies investigating the potential benefits of Industry 4.0 technologies and applications.

- Canada has a significant reputation internationally as a country open for business. It is poised to take essential steps to emerge as a prominent region in the future semiconductor foundry landscape. In addition, the country is witnessing significant partnership activities in the market. For instance, the Canadian government has launched a Canadian Dollar 150 million semiconductor challenge and a Canadian Dollar 90 million to the national research council of Canada for photonics fabrication centers used in the telecommunication network.

- There are applications of semiconductors in communication network infrastructure. To encourage the in-house manufacturing of semiconductors and Semiconductor Etch Equipment, the Canadian government has restricted foreign telecommunication network infra providers from operating in the country. For example, the government prohibits Huawei and ZTE goods and services from being used in Canada's telecommunications systems.

- Samsung Electronics plans to set up a USD 17 billion chip fabrication plant in Taylor, Texas. This new facility will produce goods based on sophisticated process technologies for use in mobile, 5G, high-performance computing, and artificial intelligence, which will drive the Semiconductor Etch Equipment market in the region.

- Lam Research Corporation is an American supplier of wafer fabrication equipment and is working on developing wireless connectivity by combining 5G and Wi-Fi 6/6E. These two technologies in the same or nearby frequency bands will make parallel network setup extremely difficult. Higher scandium doping levels (usually >20 percent) in aluminum nitride films are currently being used by the company to improve device performance. This shows the rampant technological development of the region's semiconductor Etch equipment market.

North America Semiconductor Etch Equipment Industry Overview

The North America Semiconductor Etch Equipment Market is competitive, and few key players contribute to the significant market share. For new entrants, it is difficult to enter this market due to the significant capital required, and significant businesses are pursuing mergers and acquisitions to expand their market dominance.

- In September 2021, Applied Materials, Inc. announced new solutions to help the world's leading silicon carbide (Sic) chipmakers shift from 150mm to 200mm wafer production, which nearly doubles die output per wafer, to help meet the world's growing demand for premium electric vehicle powertrains.

- In Feb 2022, Lam Research Corp announced a new suite of selective etch products that apply breakthrough wafer fabrication techniques and novel chemistries to support chipmakers in developing gate-all-around (GAA) transistor structures. The company's three products, such as Argos(R), Prevos(TM), and Selis(R) etch portfolio, provide a powerful advantage in designing and manufacturing advanced logic and memory semiconductor solutions.

- In Feb 2022, Panasonic Corporation commercialized a double-sided full wiring transparent conductive film combining low resistance and high transmissivity, using its unique roll-to-roll construction method for the first time. Panasonic's original roll-to-roll fabrication approach allowed for a wiring width of 2 m, which was impossible to achieve with traditional etching procedures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 The United States' strategies for the manufacturing in-house semiconductors and peripheral products to avoid trade tensions with China

- 4.2.2 The application of advanced semiconductor chips in 5G and Industry 4.0

- 4.3 Market Restraints

- 4.3.1 Non-transparent and chance of Government discriminatory subsidies

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 High-density Etch Equipment

- 5.1.2 Low-density Etch Equipment

- 5.2 By Etching Type

- 5.2.1 Conductor Etching

- 5.2.2 Dielectric Etching

- 5.2.3 Polysilicon Etching

- 5.3 By Application

- 5.3.1 Logic and Memory

- 5.3.2 Power Devices

- 5.3.3 MEMS

- 5.3.4 Others

- 5.4 Country

- 5.4.1 United States

- 5.4.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Applied Materials, Inc

- 6.1.2 Hitachi High Technologies America, Inc

- 6.1.3 Lam Research Corporation

- 6.1.4 SEMES

- 6.1.5 Axcelis Technologies, Inc.

- 6.1.6 ASM America

- 6.1.7 Lattice Semiconductor Corporation

- 6.1.8 Texas Instruments

- 6.1.9 Panasonic Corporation

7 Investment Analysis

8 Future of the Market

02-2729-4219

+886-2-2729-4219