|

市场调查报告书

商品编码

1644638

欧洲仓库自动化 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Warehouse Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

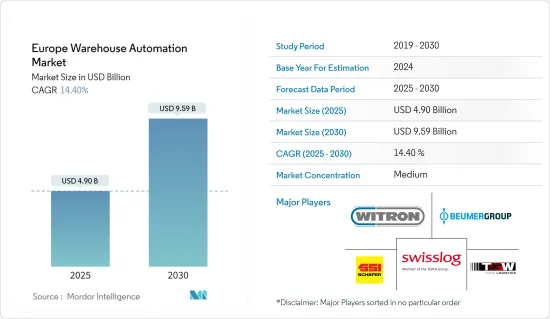

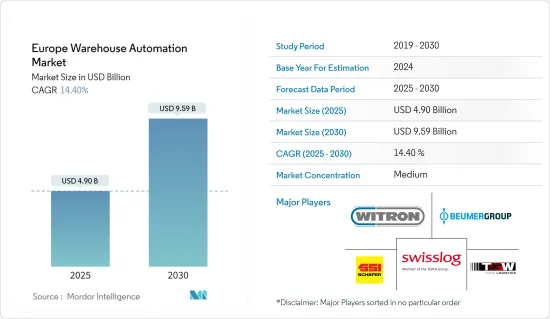

预计 2025 年欧洲仓库自动化市场规模为 49 亿美元,到 2030 年将达到 95.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 14.4%。

此外,儘管迄今为止仓库机器人的部署速度非常快,但 COVID-19 可能会显着加快其部署速度。 COVID-19 疫情的爆发促使仓库所有者希望加快自动化和机器人部署的时间表。成功采用自动化的公司也展示瞭如何透过限制工人互动来创造更安全的职场,同时提高生产力以满足日益增长的电子商务需求。近年来电子商务的兴起已导致数千家实体店关闭。

关键亮点

- 在欧洲,自疫情爆发以来,仓库自动化成长有所回升。这是由于两个相互关联的趋势造成的:电子商务似乎不可阻挡的崛起以及持续的人事费用。欧洲仓库机器人市场受到仓库数量的增加、仓库自动化支出的增加、人事费用的上升以及可扩展技术解决方案的可用性的推动。

- 从需求量以及OEM和系统整合商数量来看,德国是仓库自动化领域中领先的国家之一。许多OEM都位于欧洲,包括德国、义大利、法国、荷兰和西班牙。中欧和东欧是欧洲发展最快的地区之一,波兰和捷克共和国已成为具有良好经济潜力的物流中心。然而,包括俄罗斯-乌克兰衝突在内的当前地缘政治局势已使扩张和投资计画被搁置。

- 物联网正在推动库存和仓库自动化的发展。物联网正在帮助将仓库转变为互联的协作系统。 2021 年以后,更低的成本和更完善的物联网感测器预计将推动物联网在仓库中的应用。例如,2020 年 5 月,德国物流公司 DHL 宣布已与美国科技公司思科合作,在欧洲三个大型仓库业务中部署物联网。

- 然而,自动化仓库管理对于降低整体业务费用和消除产品交付故障非常有益。儘管具有这些优势,但据着名的 3PL 运营商和仓库自动化技术的主要终端用户 DHL 称,80% 的仓库仍然在没有自动化辅助的情况下手动操作。此外,基于输送机、分类机和拾放式仓库占所有仓库的 15%。相比之下,只有 5% 的仓库实现了自动化。

欧洲仓库自动化市场趋势

自主移动机器人 (AMR) 在欧洲越来越受欢迎

- 欧洲仓库自动化领域的两大发展包括使用能够在满载货架间导航的自主机器人以及升级堆高机以实现繁忙时段的自动化。输送机、手动堆高机、手推车、牵引装置等可用于转移和接管传统上由移动机器人处理的任务。其他应用包括包装、运输和分类。

- 自主移动机器人 (AMR) 正在取代欧洲各地物流应用中的自动导引车 (AGV)。与 AGV 不同,AMR 拥有更先进的车载计算机,可连接到惯性测量单元 (IMU)、雷射扫描测距仪、2D 和 3D 彩色摄影机以及马达控制器。 AMR 也为库存管理开闢了新的可能性。当与带有 RFID 标籤的产品和设备结合时,这些设备可以在仓库中按照设定的时间表自主执行库存清扫。

- 例如,总部位于英国的 Iconsys 透过推出 Iconsys 自主移动机器人 (iAM-R) 扩展到自主移动解决方案领域。这是为了向公司的客户提供自主机器人解决方案。

- 2022 年 5 月,IFOY 提名者、履约仓库自主移动机器人 (AMR) 领域的领导者 Locus Robotics 宣布扩大其仓库 AMR 产品线。这些新外形与 Locus Origin 机器人一起,形成了全面的 AMR 系列,可满足当今履约和配送设施中的所有产品移动需求,从电子商务、箱体拣选和托盘拣选到需要更大、更重有效载荷的场景。

- 2022 年 6 月在斯图加特举办的 LogiMAT 展会上,生产和仓库物流用高科技自动导引运输车(AGV) 的领先製造商和集成商 ek robotics 宣布与全球领先的灵活智能自主移动机器人 (AMR) 公司 OTTO Motors 建立全球技术合作伙伴关係。两家公司提供的AGV硬体与AMR软体的组合将使全球製造业和仓储业客户受益。

汽车产业自动储存和搜寻系统 (AS/RS) 的采用率很高

- 许多着名汽车品牌都在欧洲设有基地,包括宾士、沃尔沃、阿斯顿马丁、宾利、保时捷、兰博基尼和法拉利。德国、法国和英国的许多汽车生产厂都严重依赖 AS/RS 系统来保持竞争力。总部位于英国的 Exmac Automation 为阿斯顿马丁、宾利、捷豹和 IBC 汽车提供储存解决方案。

- 例如,英国领先的 AS/RS 解决方案供应商 Industore 提供适用于各种规模的仓库和储存设施的各种产品。另一家主要企业ExMac Automation 为全国各行业提供自动化储存和搜寻起重机系统 - 从大容量小型负载起重机和货架到高架仓库起重机。

- 欧盟委员会支持全球技术协调,并提供研发资金,以帮助汽车产业保持竞争力和技术领先地位。此外,根据欧洲汽车製造商协会(ACEA)的调查,欧盟每1000人拥有持有569辆。卢森堡是欧盟中汽车密度最高的国家(每千人拥有 694 辆汽车),拉脱维亚最低。根据OICA预测,2020年欧洲乘用车总销量将达1,416万辆。

- 英国汽车供应链是需求主导的(包括车辆客製化程度的提升),迫使OEM供应商选择更灵活的仓库自动化。汽车製造过程中 AS/RS 系统和自动化的日益普及、数位化和人工智慧的出现是推动荷兰汽车产业数位化需求的一些关键因素。

- 此外,德国是世界上最大的自动化物料输送系统使用者之一。根据国际机器人联合会(IFR)的数据,德国是继韩国和日本之后机器人密度最高的国家,每10,000名工人拥有294台机器人。这些因素可能会推动整个欧洲对仓库自动化的需求。

欧洲仓库自动化产业概况

根据竞争格局,欧洲仓库自动化市场呈现分散状态。 Dematic Group、Swisslog Holding AG、Swisslog Holding AG (KUKA AG) WITRON、Logistik+Informatik GmbH SSI Schaefer AG BEUMER Group GmbH &Co.KG、TGW Logistics Group GmbH 和 Jungheinrich AG 是该地区的一些重要竞争对手。

这些占据了很大市场份额的主要竞争对手正专注于在新的国家扩大消费群。此外,仓库自动化领域的市场参与企业正在采用产品发布、收购和合作等关键策略。以下是一些最新趋势。

- 2022 年 2 月-DHL 供应链在德国布伦瑞克的全通路竞标网站 1-2-3.tv 部署了首个配备机器人拣选功能的全自动汽车商店物流系统。 AutoStore 系统由物流技术公司 Element Logic 建立,使用机器人拣选和软体解决方案来加快每个订单的履行速度,提高业务效率并最大限度地提高地点的储存容量。

- 2021 年 11 月 - Honeywell Intelligrated 仓库自动化宣布计画建立一个新的先进研发 (R&D) 测试中心,以满足对更快、更准确的供应链技术日益增长的需求。该中心将使霍尼韦尔的硬体和软体工程师能够创建、製作原型并测试供物流公司使用的新型仓库自动化系统。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 仓库投资场景

- 宏观经济因素对仓库自动化市场的影响

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 电子商务行业的快速成长和客户期望

- 製造复杂性和技术可用性不断提高

- 工业 4.0 投资推动自动化和物料输送需求

- 市场问题

- 高资本投入

- 严格的监管要求

第六章 市场细分

- 成分

- 硬体

- 移动机器人(AGV、AMR)

- 自动储存和搜寻系统 (AS/RS)

- 自动输送机及分类系统

- 卸垛/码垛系统

- 自动识别和资料收集(AIDC)

- 拾料机器人

- 软体(仓库管理系统 (WMS)、仓库执行系统 (WES))

- 服务(附加价值服务、维护等)

- 硬体

- 最终用户

- 食品和饮料(包括製造设施和配送中心)

- 邮政和小包裹

- 食物

- 通用产品

- 服饰

- 製造业(耐久财和非耐久财)

- 其他的

- 国家

- 英国

- 德国

- 法国

- 欧洲其他地区

第七章 竞争格局

- 公司简介

- Swisslog Holding AG(KUKA AG)

- WITRON Logistik+Informatik GmbH

- SSI Schaefer AG

- BEUMER Group GmbH & Co. KG

- TGW Logistics Group GmbH

- Kion Group AG(Dematic Group)

- Knapp AG

- Jungheinrich AG

- Vanderlande Industries BV

- Mecalux SA

第八章投资分析

第九章 未来市场展望

The Europe Warehouse Automation Market size is estimated at USD 4.90 billion in 2025, and is expected to reach USD 9.59 billion by 2030, at a CAGR of 14.4% during the forecast period (2025-2030).

Furthermore, whereas warehouse robots have had enormous deployments, COVID-19 is likely to significantly increase deployment speed. The COVID-19 outbreak has prompted warehouse owners to explore expediting their automation and robotics implementation timelines. Those who have successfully adopted automation have also demonstrated the establishment of safer workplaces by limiting worker interactions while raising productivity to meet rising e-commerce needs. Thousands of brick-and-mortar stores have closed their doors due to the recent increase in e-commerce.

Key Highlights

- In Europe, the warehouse automation growth increased post-pandemic. This results from two interconnected trends: a seemingly unstoppable rise in e-commerce and a persistent labor shortage resulting in rising labor prices. The market for warehouse robots in Europe has been driven by the growing number of warehouses and increased expenditures on warehouse automation, rising labor costs, and the availability of scalable technical solutions.

- Regarding demand and the presence of OEMs and System Integrators, Germany is one of the leading countries in warehouse automation. OEMs are well-represented in Europe, with strongholds in Germany, Italy, France, the Netherlands, and Spain. Central and Eastern Europe is a rapidly growing region within Europe, with Poland and the Czech Republic emerging as logistical hubs with promising economic potential. However, expansion and investment plans have been put on hold due to the present geopolitical circumstances, including the Russia-Ukraine conflict.

- The Internet of Things is driving inventory and warehouse automation developments. It's contributing to the transformation of the warehouse into a connected and coordinated system. In 2021 and beyond, lower costs and enhanced IoT sensors are expected to boost the use of IoT in warehouses. For Instance, In May 2020, DHL, a German logistics company, said that it had partnered with Cisco, a US technology company, to introduce IoT to three large warehouse operations across Europe.

- However, warehousing automation is extremely beneficial when it comes to lowering overall business expenditures and eliminating product delivery faults. Despite the benefits, 80 percent of warehouses are "still manually operated with no supporting automation," according to DHL, a notable 3PL business and a major end-user of warehouse automation technologies. Furthermore, conveyor-based, sorter-based, and pick-and-place warehouses account for 15% of all warehouses. In comparison, only 5% of today's warehouses are automated.

Europe Warehouse Automation Market Trends

Autonomous Mobile Robots (AMRs) are Gaining Popularity Throughout Europe

- Two European warehouse automation developments include using autonomous robots capable of transferring filled shelves and updating forklifts to help automation during busy periods. To transfer and take over activities traditionally handled by mobile robots, conveyors, manual forklifts, carts, and towing devices can all be used. Other applications include packing, transportation, and sorting.

- Autonomous mobile robots (AMRs) in logistical applications across Europe are displacing automatic guided vehicles (AGVs). AMRs, unlike AGVs, have more advanced onboard computers linked to inertial measuring units (IMU), laser scanning range finders, 2D and 3D color cameras, and motor controllers. AMR also opens up new possibilities for inventory management. These devices may now execute inventory sweeps autonomously at warehouse-determined schedules when paired with RFID-tagged products and equipment.

- For instance, the United Kingdom-based Iconsys expanded into autonomous mobile solutions with the launch of its iAM-R (Iconsys Autonomous Mobile Robot). It is designed to provide autonomous robotic solutions to the company's customers.

- In May 2022, Locus Robotics, a 2022 IFOY nominee and leader in autonomous mobile robots (AMRs) for fulfillment warehouses, announced the expansion of its warehouse AMR line. These new form factors join the Locus Origin robot to form a comprehensive family of AMRs that handle the full range of product movement needs in today's fulfillment and distribution facilities, from e-commerce, case-picking, and pallet-picking to scenarios needing larger, heavier payloads.

- In June 2022, At LogiMAT in Stuttgart, ek robotics, the leading manufacturer and integrator of high-tech automated guided vehicles (AGVs) for production and warehouse logistics, announced a global technology partnership with OTTO Motors, the world's leading developer of flexible and intelligent autonomous mobile robots (AMR). Customers in the manufacturing and warehousing industries worldwide will benefit from the combination of AGV hardware and AMR software offered by the two firms.

High Adoption of Automated Storage and Retrieval Systems (AS/RS) in Automotive Sector

- Many well-known vehicle brands are based in Europe, including Mercedes-Benz, Volvo, Aston Martin, Bentley, Porsche, Lamborghini, Ferrari, and others. Numerous vehicle production facilities in Germany, France, and the United Kingdom rely heavily on AS/RS systems to stay competitive. Exmac Automation, situated in the United Kingdom, provides storage solutions for Aston Martin, Bentley, Jaguar, and IBC vehicles.

- For instance, Industore, a major AS/RS solution provider in the UK, has a wide range of products utilized in warehouses and small and large storage units. ExMac Automation, another key player in AS/RS, provides automated storage and retrieval crane systems (ranging from high-capacity mini-load cranes and racking to high-bay warehouse cranes) to various industries across the country.

- The European Commission supports worldwide technical harmonization and offers to fund R&D to help the automotive industry maintain its competitiveness and technological leadership. Furthermore, according to ACEA research, 569 automobiles per 1,000 people in the European Union. Luxembourg has the highest car density in the EU (694 cars per 1,000 people), while Latvia has the lowest. According to the OICA, total European passenger car sales reached 14.16 million in 2020.

- The demand-driven nature of the UK automotive supply chain (including increasing levels of customization within a car) is compelling OEM suppliers to choose warehouse automation with greater flexibility. The increasing adoption of AS/RS systems and automation in the automotive manufacturing process and the advent of digitization and AI are some of the primary factors driving the demand for digitalization in the automotive sector of the Netherlands.

- Moreover, Germany is one of the world's largest users of automated material handling systems. According to the International Federation of Robotics (IFR), Germany has the highest robot density (294 units per 10,000 workers), behind South Korea and Japan. These factors will increase the demand for warehouse automation throughout Europe.

Europe Warehouse Automation Industry Overview

The European warehouse automation market is fragmented by its competitive landscape. Dematic Group, Swisslog Holding AG, and Swisslog Holding AG (KUKA AG) WITRON, Logistik + Informatik GmbH SSI Schaefer AG BEUMER Group GmbH & Co. KG TGW Logistics Group GmbH, and Jungheinrich AG are some of the regional significant competitors in this sector.

These major competitors, which hold a considerable share of the market, are concentrating on growing their consumer base in new countries. Furthermore, market participants in the warehouse automation sector use major strategies, including product launches, acquisitions, and collaborations. The following are some of the most recent developments:

- February 2022 -DHL Supply Chain has deployed the first fully automated auto store logistics system with robot picking for the omnichannel auction site 1-2-3.tv in Braunschweig, Germany. The Autostore system was created by Element Logic, a logistics technology company, and it uses robot picking and a software solution to increase the processing speed of each order, improve operational efficiency, and maximize the location's storage capacity.

- November 2021 - Honeywell Intelligrated warehouse automation announced plans to create a new advanced research and development (R&D) testing center to fulfill the growing demand for technologies that enable speedier, more accurate supply chains. Honeywell hardware and software engineers will be able to create, prototype, and test novel warehouse automation systems utilized by logistics companies at the site.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study assumptions and market definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness -Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Warehouse Investment Scenario

- 4.6 Impact of Macro-economic Factors on the Warehouse Automation Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Exponential Growth of the E-commerce Industry and Customer Expectation

- 5.1.2 Increasing Manufacturing Complexity and Technology Availability

- 5.1.3 Industry 4.0 Investments Driving The Demand For Automation & Material Handling

- 5.2 Market Challenges

- 5.2.1 High Capital Investment

- 5.2.2 Stringent Regulatory Requirements

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Hardware

- 6.1.1.1 Mobile Robots (AGV, AMR)

- 6.1.1.2 Automated Storage and Retrieval Systems (AS/RS)

- 6.1.1.3 Automated Conveyor & Sorting Systems

- 6.1.1.4 De-palletizing/Palletizing Systems

- 6.1.1.5 Automatic Identification and Data Collection (AIDC)

- 6.1.1.6 Piece Picking Robots

- 6.1.2 Software (Warehouse Management Systems(WMS), Warehouse Execution Systems (WES))

- 6.1.3 Services (Value Added Services, Maintenance, etc.)

- 6.1.1 Hardware

- 6.2 End-User

- 6.2.1 Food and Beverage (Including Manufacturing Facilities and Distribution Centers)

- 6.2.2 Post and Parcel

- 6.2.3 Groceries

- 6.2.4 General Merchandise

- 6.2.5 Apparel

- 6.2.6 Manufacturing (Durable and Non-Durable)

- 6.2.7 Other End-user Industries

- 6.3 Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Swisslog Holding AG (KUKA AG)

- 7.1.2 WITRON Logistik + Informatik GmbH

- 7.1.3 SSI Schaefer AG

- 7.1.4 BEUMER Group GmbH & Co. KG

- 7.1.5 TGW Logistics Group GmbH

- 7.1.6 Kion Group AG (Dematic Group)

- 7.1.7 Knapp AG

- 7.1.8 Jungheinrich AG

- 7.1.9 Vanderlande Industries BV

- 7.1.10 Mecalux SA