|

市场调查报告书

商品编码

1644640

亚太仓库自动化-市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia Pacific Warehouse Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

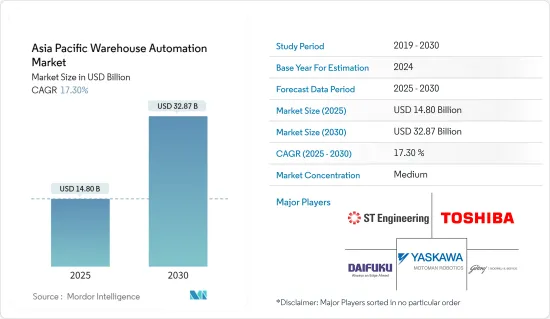

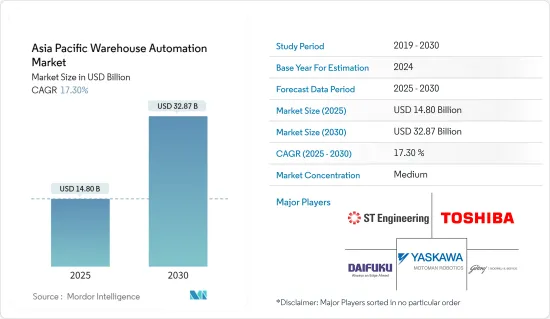

亚太地区仓库自动化市场规模预计在 2025 年为 148 亿美元,预计到 2030 年将达到 328.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 17.3%。

新冠疫情对中国、日本和印度等主要经济体造成了严重破坏,预计将影响未来几年的市场成长。在亚太地区,大量投资正在影响电子商务产业滚筒输送机的兴起以及越来越多的网路消费者的需求。

此外,随着对该行业的大量投资,製造业预计将占据相当大的市场占有率,并成为该国的主要贡献者之一。在短时间内交付各种产品的需求日益增长,这就要求有高效率的库存管理和逆向物流系统。

关键亮点

- 亚太地区仓库自动化市场的成长情况在印度、中国、澳洲、韩国、日本和亚洲其他地区均有考察。中国作为世界领先经济体之一,正在持续开发和部署仓库机器人。预计中国将占据主要市场份额。由于自动化程度高、知名供应商的存在以及仓库机器人的广泛使用,中国对仓库机器人的需求很高。

- 製造业、零售业和快速消费品产业的崛起继续推动亚太地区对工业自动化解决方案的需求。穿梭搜寻系统、自动化仓库和移动机器人平台的数量大幅增加。随着仓储和工业的组织参与,全部区域的工业和货运路线正在兴起。

- 此外,根据 Zebra Technologies 进行的 2022 年仓库愿景调查,该研究对澳洲、中国、印度、日本和新加坡的 1,500 多名仓库决策者和同事进行了调查。根据调查,包括亚太地区在内的全球27%的仓库业者已经采用了自主移动机器人(AMR)。预计未来五年,亚太地区将上升至 92%,国际上这一数字将上升至 90%。

- 虽然大多数仓库将采用 AMR 进行 P2G 拣选、物料转移和其他自动化库存移动,但更多的仓库也将投资软体来实现分析和决策的自动化。在亚太地区,95%的决策者打算投资此类软体,以提高劳动效率和效力,同时降低人事费用,略高于全球平均(94%)。

- 此外,在新冠疫情爆发后,该地区的公司正纷纷在全部区域采用仓库自动化。总部位于上海的移动工业机器人公司表示,其自主机器人可以在仓库和工厂内移动托盘和大件货物,在各行各业都很受欢迎。空中巴士、Flex、霍尼韦尔和 DHL 是需求成长的主要贡献者。

亚太仓库自动化市场趋势

自动导引运输车(AGV) 预计将大幅成长

- 移动机器人的主要应用是作为仓库和储存设施中的移动自动导引运输车(AGV) 在亚太地区运输货物。这些机器人按照预先设定的路线,每週 7 天、每天 24 小时移动物品进行运输或存放。 AGV 对于降低物流成本和简化供应链至关重要。

- 除补货和拣货外,AGV还用于入境和出站处理。例如,AGV 用于将库存从接收地点运送到储存地点或从长期储存地点运送到拣选地点以补充库存。将库存从长期仓库转移到拣选地点可确保拣选人员有足够的库存,从而实现更有效率的拣货流程。

- 亚太地区仓储业正在不断发展,不断提高自动化程度和优化手动任务,以降低成本并提高利润。仓库工人应该将他们的人类智慧应用于更高附加价值的活动中,而机器人则提高效率并减少浪费以实现顺畅的流程。

- 例如,2020 年 9 月,GreyOrange 宣布了一项技术专利,该技术对于帮助公司实现高产量比率的履约并透过多层次营运能力最大限度地提高设施空间利用率至关重要。专利包括「先填先得」技术、零售就绪履行技术和多层机器人移动技术。

- 机器人技术对于多个最终用户的盈利来说已经变得至关重要。 AMR 之所以处于领先地位,是因为它们对于快速、安全、无误交付、加快上市速度、降低成本和端到端可追溯性至关重要。自主移动机器人 (AMR) 与自主地面车辆 (AGV) 的差异在于自主程度。

- DHL 于 2021 年 10 月在新加坡开设了亚太研发中心,作为新展览的展示平台,展示尖端、自动化和完全整合的电子商务系统。 Geek+ 宣布与 DHL 合作,在其亚太研发中心展示该公司的一些最伟大的发明。 Geek+ 和 DHL 展示了仓库机器人自动化的未来。

印度可望见证亚太仓库自动化市场的强劲成长

- 印度的仓储产业正在经历重大变革时期,以跟上不断发展的製造业和庞大的物流业的步伐。预计仓储业将从商品及服务税的实施和房地产投资中受益匪浅。预计商品及服务税将确保印度首次出现拥有中央仓储园区的广大综合区域,而非目前分散的独立设施。

- 此外,随着印度电子商务的普及,仓储业业务呈指数级增长。这种快速扩张带来了许多新的障碍。运输延误、经验丰富的劳动力短缺以及其他因素促使相关人员不再局限于传统策略,而是转向机器人自动化系统。

- 例如,电子商务巨头亚马逊计划在印度投资 50 亿美元,专注于建造该国的自动化仓库。我们开设了多家新仓库以满足不同客户的需求。亚马逊是首批在仓库中尝试部署机器人的印度公司之一。

- 此外,印度的仓储格局正在发生变化,自动化程度更高,手动任务更优化,以降低成本并提高利润。仓库工人应该将他们的人类智慧用于更高附加价值的活动,而机器人则进行效率映射和减少浪费以实现顺畅的流程。机器人技术对于提高多个最终用户的盈利至关重要。

- 印度以仓库自动化闻名的公司 Atmos Systems 于 2021 年 12 月宣布推出 Atmos A42N,这是一款自主箱体处理机器人 (ACR) 系统,可大幅提高仓库出入库效率。该系统具有许多易于使用的功能,并允许仓库位置具有更大的灵活性。

亚太地区仓库自动化产业概况

亚太地区仓库自动化市场竞争适中且细分化,许多全球和地区参与企业占据了相当大的市场占有率。为了保持市场占有率,公司可能会不断创新并形成策略联盟。 ST Engineering、东芝全球、安川电机株式会社(Yaskawa Motoman)、大福、Grey Orange、Godrej Consoveyo Logistics Automation Ltd.(GCLA)等引领仓库自动化市场。 (GCLA)是该市场的重要参与企业。

- 2022 年 5 月-物流自动化公司 SYNUS Tech 和首个面向现代商业的 3D 机器人供应链系统供应商 Attabotics 今天建立了独家合作关係,为韩国市场提供综合物流系统仓库解决方案。在 Attabotics 等合作伙伴的帮助下,SYNUS Tech 在韩国率先开发智慧工业解决方案并将 AI 融入仓库。

- 2022 年 2 月—印度 Addverb Technologies 将以 1.32 亿美元收购其仓库机器人系列,并将其推向北美市场。 Addverb 凭藉自动化机器人、物料输送技术、系统整合服务和软体解决方案,协助仓库和工业业务提高效能和精度。

- 2020年8月-村田机械同意与Alpen合作打造日本首个3D机器人仓库系统「Alphabot」。 Alphabot 将安装在 Alpen 集团主要物流中心之一的 Alpen Komaki物流中心,以提高储存能力并减少约 60% 的挑选、分类和包装程序。该系统于2021年7月开始实施。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 仓库投资场景

- 宏观经济因素对仓库自动化市场的影响

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 电子商务行业的快速成长和客户期望

- 对更好的库存管理和控制的需求日益增加

- 市场问题

- 高资本投入

- 廉价劳动力和恶劣的工作条件

第六章 市场细分

- 成分

- 硬体

- 移动机器人(AGV、AMR)

- 自动储存和搜寻系统 (AS/RS)

- 自动输送机及分类系统

- 卸垛/码垛系统

- 自动识别和资料收集(AIDC)

- 拾料机器人

- 软体(仓库管理系统 (WMS)、仓库执行系统 (WES))

- 服务(附加价值服务、维护等)

- 硬体

- 最终用户

- 食品和饮料(包括製造设施和配送中心)

- 邮政和小包裹

- 食物

- 通用产品

- 服饰

- 製造业(耐久财和非耐久财)

- 其他的

- 国家

- 中国

- 印度

- 日本

- 其他亚太地区

第七章 竞争格局

- 公司简介

- ST Engineering

- ABB Limited

- Toshiba Global

- Yaskawa Electric Corporation(Yaskawa Motoman)

- Daifuku Co., Ltd.

- Grey Orange

- Godrej Consoveyo Logistics Automation Ltd.(GCLA)

- Bastian Solution Private Limited

- Murata Manufacturing Co., Ltd.

- Geek+Inc.

第八章投资分析

第九章 未来市场展望

The Asia Pacific Warehouse Automation Market size is estimated at USD 14.80 billion in 2025, and is expected to reach USD 32.87 billion by 2030, at a CAGR of 17.3% during the forecast period (2025-2030).

The COVID-19 pandemic, which wreaked havoc on major economies such as China, Japan, and India, is predicted to impact future market growth. Significant investments are influencing the rise of roller conveyors in the Asia-Pacific in the e-commerce industry and demand from ever-increasing internet-enabled consumers.

Furthermore, with large investments in the industry, the manufacturing sector is predicted to account for a significant market share and become one of the country's major contributors. The requirement to deliver varied products in short durations has grown, necessitating efficient inventory management and reverse logistics systems.

Key Highlights

- The expansion of the Asia-Pacific warehouse automation market is examined by looking at India, China, Australia, South Korea, Japan, and the rest of Asia. China, one of the world's major economies, is continually creating and deploying warehouse robots. China is expected to have a significant share in the market. As a result of the high automation rates, the presence of prominent vendors, and the widespread availability of warehouse robots, China's demand for warehouse robotics is significant.

- Due to the rise of the manufacturing, retail, and FMCG industries, there is an ever-increasing demand for industrial automation solutions across the APAC region. Shuttle retrieval systems, as well as automated storage and mobile robot platforms, are seeing a significant increase. Industrial and freight routes are sprouting up throughout the region, increasing the number of organized participants in the storage and industrial parks.

- Moreover, According to a 2022 study on warehouse vision conducted by Zebra Technologies, For the survey, more than 1,500 warehouse decision-makers and colleagues were polled from Australia, China, India, Japan, and Singapore. According to the survey, 27% of warehouse operators worldwide, including those in APAC, have already employed autonomous mobile robots (AMR). This ratio is expected to climb to 92% in APAC and 90% internationally in the next five years.

- While most warehouses will employ AMRs for P2G picking, material movements, and other automated inventory moves, more will invest in software that automates analytics and decision-making. In APAC, 95% of decision-makers expressed willingness to invest in such software to improve worker effectiveness and efficiency while lowering labor costs, slightly exceeding the global average (94%).

- Additionally, companies in the region are hurrying to adopt warehouse automation across the region in the wake of the COVID-19 outbreak. According to Mobile Industrial Robots in Shanghai, China, the company's autonomous robots that can transport pallets and large loads around warehouses and factories have seen growing demand across a wide range of industries. Airbus, Flex, Honeywell, and DHL are the major firms responsible for the rising demand.

APAC Warehouse Automation Market Trends

Automated Guided Vehicles (AGVs) is Expected to Have a Significant Growth

- The major application of mobile robots is in mobile automated guided vehicles (AGVs) that transfer items across APAC in warehouses and storage facilities. These robots follow pre-programmed paths, transporting things for transportation and storage 24 hours a day, seven days a week. AGVs are vital for lowering logistical costs and streamlining the supply chain.

- In addition to replenishing and picking, AGVs are used in inbound and outbound handling. AGVs, for instance, are used to move inventory from receipt to storage or from long-term storage to forward-picking locations to restock stock. Moving inventory from long-term storage to forward-picking locations guarantees enough inventory is available to selectors, resulting in a more effective order-picking process.

- The APAC warehouse landscape is evolving, with more automation and manual labor optimization used to cut costs and boost profits. Workers in a warehouse should spend their human intelligence on more value-adding activities while the robots step in and take care of efficiency mapping and waste reduction to produce a smooth flow.

- For instance, GreyOrange announced patents in September 2020 for technology critical for businesses to achieve high-yield omnichannel fulfillment and maximize facility space utilization through multilayer operation capabilities. First-to-Fill Technology, Retail-Ready Fulfilment, and Multilevel Robot Mobility are all covered by the patents.

- Robotics has become crucial to the profitability of several end users. The AMRs are leading the way since they are critical for quick, secure, and error-free delivery, a quick time to market, lower costs, and end-to-end trackability. The degree of autonomy distinguishes autonomous mobile robots (AMRs) from autonomous ground vehicles (AGVs).

- DHL established the Asia Pacific Innovation Center in Singapore in October 2021 as a showcase for new displays showcasing a cutting-edge, automated, and fully integrated e-commerce system. Geek+ announced a relationship with DHL to exhibit some of the company's greatest inventions at the Asia Pacific Innovation Center. Geek+ and DHL will demonstrate the future of warehouse robot automation.

India is Expected To Witness High Growth In The Asia-Pacific Warehouse Automation Market

- The warehousing industry in India is undergoing a considerable transformation to keep pace with the country's growing manufacturing sector and massive logistics industry. The warehouse industry is expected to benefit significantly from adopting the goods and services tax and real estate investments. Instead of the current scattered and standalone facilities, GST would ensure that India sees a vast, consolidated area with central warehousing parks for the first time.

- Furthermore, India's adoption of e-commerce has resulted in a tremendous increase in business for the warehousing industry. This rapid expansion has brought with it a slew of new obstacles. Transportation delays, a shortage of experienced labor, and other factors prompted stakeholders to look beyond traditional tactics in favor of robotics-enabled automation systems.

- For instance, e-commerce giant Amazon, which plans to invest USD 5.0 billion in India, is focusing on automated warehouses around the country. It opened several new warehouses to serve a variety of customers. Amazon was one of the first few Indian corporations to experiment with and implement robotics in its warehouses.

- Also, India's warehouse landscape is evolving, with more automation and manual labor optimization used to save costs and boost profits. Workers in a warehouse should spend their human intelligence on more value-adding activities while the robots step in and take care of efficiency mapping and waste reduction to produce a smooth flow. Robotics has become crucial to multiple end users' profitability.

- Atmos Systems, India, a prominent name in warehouse automation, announced the Atmos A42N, an autonomous case handling robotic (ACR) system that can greatly improve a warehouse's inbound and outgoing efficiency in December 2021. The system is packed with user-friendly features, allowing greater warehouse location flexibility.

APAC Warehouse Automation Industry Overview

The APAC warehouse automation market is moderately competitive and fragmented, with many global and regional players holding significant market shares. To maintain their market share, corporations will continue to innovate and form strategic collaborations. ST Engineering, Toshiba Global, Yaskawa Electric Corporation (Yaskawa Motoman), Daifuku Co., Ltd., Grey Orange, Godrej Consoveyo Logistics Automation Ltd. (GCLA), and others are some of the prominent players in this market.

- May 2022 - SYNUS Tech, a logistics automation firm, and Attabotics, the first 3D robotics supply chain system for modern commerce, established an exclusive cooperation today to provide integrated logistics system warehousing solutions to the South Korean markets. SYNUS Tech is developing smart industrial solutions and integrating AI into warehouses for the first time in Korea, thanks to partners like Attabotics.

- February 2022 - Addverb Technologies, India is pushing its warehouse robotics product suite to the North American market after acquiring USD 132.0 million. With its fleet of automated robots, material handling technology, system integration services, and software solutions, Addverb will help improve the performance and precision of warehouse and industrial operations.

- August 2020 - Murata Machinery has agreed to build Japan's first 3D robot warehousing system, "ALPHABOT," in collaboration with Alpen Co. Ltd. ALPHABOT will be installed at the Alpen Komaki Distribution Center, one of Alpen Group's key distribution centers, to increase storage capacity and cut picking, sorting, and packaging procedures by about 60%. The system was started in July 2021.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study assumptions and market definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness -Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Warehouse Investment Scenario

- 4.6 Impact of Macro-economic Factors on the Warehouse Automation Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Exponential Growth of the E-commerce Industry and Customer Expectation

- 5.1.2 Increasing Need for Better Inventory Management and Control

- 5.2 Market Challenges

- 5.2.1 High Capital Investments

- 5.2.2 Availability of Cheap Labor and Harsh Operating Conditions

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Hardware

- 6.1.1.1 Mobile Robots (AGV, AMR)

- 6.1.1.2 Automated Storage and Retrieval Systems (AS/RS)

- 6.1.1.3 Automated Conveyor & Sorting Systems

- 6.1.1.4 De-palletizing/Palletizing Systems

- 6.1.1.5 Automatic Identification and Data Collection (AIDC)

- 6.1.1.6 Piece Picking Robots

- 6.1.2 Software (Warehouse Management Systems(WMS), Warehouse Execution Systems (WES))

- 6.1.3 Services (Value Added Services, Maintenance, etc.)

- 6.1.1 Hardware

- 6.2 End-User

- 6.2.1 Food and Beverage (Including Manufacturing Facilities and Distribution Centers)

- 6.2.2 Post and Parcel

- 6.2.3 Groceries

- 6.2.4 General Merchandise

- 6.2.5 Apparel

- 6.2.6 Manufacturing (Durable and Non-Durable)

- 6.2.7 Other End-user Industries

- 6.3 Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 Rest Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ST Engineering

- 7.1.2 ABB Limited

- 7.1.3 Toshiba Global

- 7.1.4 Yaskawa Electric Corporation (Yaskawa Motoman)

- 7.1.5 Daifuku Co., Ltd.

- 7.1.6 Grey Orange

- 7.1.7 Godrej Consoveyo Logistics Automation Ltd. (GCLA)

- 7.1.8 Bastian Solution Private Limited

- 7.1.9 Murata Manufacturing Co., Ltd.

- 7.1.10 Geek+ Inc.