|

市场调查报告书

商品编码

1644659

记忆体 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

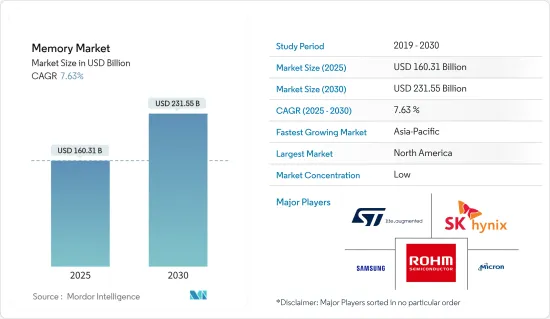

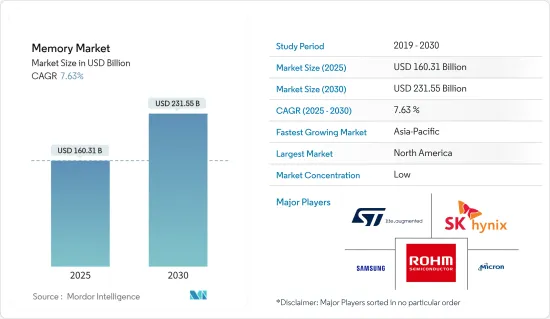

预计 2025 年记忆体市场规模为 1,603.1 亿美元,到 2030 年将达到 2,315.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.63%。

2020 年初,全球新冠疫情严重扰乱了市场研究的供应链和生产。对于製造设备而言,影响更加严重。由于人手不足,亚太地区许多包装、组装和检测工厂已经缩减甚至暂停营运。这给依赖半导体的终端用户公司带来了瓶颈。最近,中国因新冠疫情而实施的封锁再次扰乱了全球记忆体市场的供应链。 2021 年 12 月,全球两大记忆体晶片製造商三星电子和美光科技警告称,中国西安市实施的严格 COVID-19 限制和封锁可能会扰乱他们在该地区的晶片製造地。美光科技表示,封锁可能会导致资料中心广泛使用的 DRAM 记忆体晶片供应延迟。

记忆体市场正在经历快速成长,半导体已成为大多数现代技术的基本组成部分。该市场的技术创新和进步最终将对所有下游技术产生直接影响。

美国有线电视和通讯协会预测,到 2020 年连网型设备数量将达到约 501 亿台。每个 IoT 或 IIoT 设备都包含先进的半导体记忆体晶片,可让设备远端连接。此外,物联网预计将大幅成长,这也将影响记忆体市场的成长。

到 2025 年,市场将从汽车产业、连接性、通讯和资料中心的持续发展和创新中受益匪浅。汽车安全、资讯娱乐和导航中使用的电子元件的消费量增加将进一步促进市场成长。

半导体记忆体产品广泛应用于智慧型手机、平面显示器、LED 电视以及商用航太和军事系统等电子设备。内存产业也可能受益于生物识别功能的进步。此外,对智慧型手机和穿戴式装置等技术先进产品的需求不断增长也推动了该市场的成长。

此外,多家供应商正在投资这项技术以获得优势。例如,2022 年 4 月,提供先进设计和检验解决方案的领先技术公司 Keysight Technologies, Inc. 宣布,SK Hynix 采用了 Keysight 的 PCIe(集成外围组件互连快速规范)5.0 测试平台,以加速用于设计可管理海量资料和支援高速资料的先进产品的记忆体半导体的开发。

记忆体市场趋势

消费品预计将占据主要市场占有率

新的储存技术正在扩大储存的潜力,使其能够以比数位相机、行动电话和笔记型电脑等常见家用电子电器中使用的昂贵硅晶片更低的成本储存更多的资料。

全球半导体代工厂台湾联华电子股份有限公司 (UMC) 正在提供采用 28nm CMOS 製造工艺的嵌入式非挥发性 STT-MRAM 区块,使客户能够将低延迟、超高性能、低功耗的嵌入式MRAM 记忆体区块整合到用于物联网、可穿戴设备和家用电子电器领域的 MCU 和 SoC 中。

该领域的技术进步正在推动所研究市场的需求。 Nanteroh 等开发人员开发出了一种名为 NRAM 的高密度非挥发性记忆体。这种记忆体速度极快,可在小空间内提供大量储存空间,且功耗极低。 Nantero 的 NRAM 使家用电子电器产品供应商能够开发未来的新型消费性设备。预计这些发展将推动非挥发性记忆体的普及。

预测期内,该领域的新兴记忆体技术预计将以更快的速度成长,主要由穿戴式装置和连网型设备的推动。根据思科系统公司预测,到2022年全球连网穿戴装置数量将达到11.05亿。

由于数位相机、智慧型手机和游戏设备等其他家用电子电器也需要高效内存,因此对这些内存技术的需求预计会进一步增长。爱立信预测,2022年智慧型手机出货量将达到15.744亿支。

美洲占最大市场占有率

快速变化的技术以及跨行业的大量资料生成使得国家对更有效率的处理系统的需求日益增加。行动和低功耗设备、高阶资料中心和大型片上快取的出现,产生了另一个高需求优先权:非挥发性、高密度、低耗能记忆体。

在记忆体半导体製造技术方面,美国近年来在DRAM和3D-NAND方面重新夺回竞争优势,美国企业已全面采用EUV(极紫外线)技术。

根据美国能源局统计,美国约有 300 万个资料中心。资料中心已经成为新的计算单位。 DPU(资料处理单元)是安全、现代加速资料中心的重要组成部分,其中 GPU、CPU 和 DPU 可以组合成一个完全可程式设计的运算单元。 Nvidia 估计资料管理消耗了资料中心高达 30% 的中央处理核心。资料中心需求的不断增长也推动了对记忆体组件的需求。目前,北美正在进行大规模资料中心计划,对DRAM等记忆体的需求增加。

此外,5G有望实现短时间内传输通讯资料,这将要求设备储存更多的数据。预计这将增加NAND快闪记忆体的采用。

美国是工厂自动化和工业控制的主要市场。 FRAM 具有快速随机存取、高读取/写入耐久性和低功耗的特性。在工厂自动化中,业界标准架构、介面、功能和封装可实现简单的嵌入式解决方案,无需昂贵的系统重新设计。

记忆体产业概况

记忆体市场竞争激烈,有多家供应商向国内和国际市场供应记忆体。市场呈现中度细分化,主要供应商采用併购、策略联盟等策略来扩大市场渗透率并维持市场竞争力。市场的主要企业包括三星电子、美光科技公司、SK海力士公司和罗姆。市场最近的一些趋势包括:

2021 年 10 月-美国记忆体製造商美光科技将在未来十年内在全球投资超过 1,500 亿美元用于先进记忆体的製造、研发,包括可能扩建其在美国的工厂。

2021 年 12 月-美光科技宣布扩大与联华电子股份有限公司的合作关係,并表示未来有机会确保为移动、汽车和关键客户提供供应。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 5G 和物联网设备日益普及

- 资料中心的记忆体需求不断增加

- 消费性电子和汽车产业的需求增加

- 市场问题

- 疫情和美国贸易战为供应链带来短期挑战

第六章 市场细分

- 按类型

- DRAM

- SRAM

- NOR快闪记忆体

- NAND快闪记忆体

- ROM & EPROM

- 其他的

- 按应用

- 消费性产品

- 个人电脑/笔记型电脑

- 智慧型手机/平板电脑

- 资料中心

- 车

- 其他的

- 按地区

- 美洲

- 欧洲

- 中国

- 日本

- 亚太地区

第七章 竞争格局

- 公司简介

- Samsung Electronics Co. Ltd

- Micron Technology Inc.

- SK Hynix Inc.

- ROHM Co. Ltd.

- STMicroelectronics NV

- Maxim Integrated Products Inc.

- IBM Corporation

- Cypress Semiconductor Corporation

- Intel Corporation

- Nvidia Corporation

- Kioxia Corporation

- Vendor Ranking

第八章投资分析

第九章:市场的未来

The Memory Market size is estimated at USD 160.31 billion in 2025, and is expected to reach USD 231.55 billion by 2030, at a CAGR of 7.63% during the forecast period (2025-2030).

The COVID-19 pandemic across the globe significantly disrupted the supply chain and production of the market studies in the initial phase of 2020. For fabrication units, this impact was more severe. Owing to the labor shortages, many of the package, assembly, and testing plants in the Asia Pacific region reduced and even suspended operations. This created a bottleneck for end-user companies that depend on semiconductors. More recently, COVID-19-related lockdowns in China again disrupted the Global Memory Market supply chain. In December 2021, Samsung Electronics and Micron Technology, two of the world's largest memory chip producers, warned that strict COVID-19 curbs and lockdowns in the Chinese city of Xian might disrupt their chip manufacturing bases in the area. According to Micron Technology, the lockdowns could cause delays in the supply of DRAM memory chips, widely used in data centers.

The memory market is witnessing rapid growth, with semiconductors emerging as the basic building blocks of most modern technologies. The innovations and advancements in this market are resulting in a direct impact on all downstream technologies.

The National Cable and Telecommunications Association projected that the number of connected devices in 2020 will be around 50.1 billion. Every IoT or IIoTdevice contains sophisticated semiconductor memory chips that permit devices to achieve remote connectivity. Moreover, as the IoT is poised to grow significantly, it is expected to impact the growth of the memory market as well.

By 2025, the market is set to experience significant benefits from the ongoing development and innovation in the automotive industry, connectivity, communications, and data centers. The rise in the consumption of electronic components used in the navigation of safety, infotainment, and automobiles further contributes to the market's growth.

Semiconductor memory products are used extensively across electronic devices, such as smartphones, flat-screen monitors, LED TVs, and civil aerospace and military systems. The memory industry is also likely to benefit from progress in biometrics capabilities. The growing demand for smartphones and technologically advanced products, such as wearable gadgets, etc., is also accelerating the growth of the market studied.

Further, several vendors are investing in this technology to gain an advantage. For instance, in April 2022, Keysight Technologies, Inc., a leading technology company that provides advanced design and validation solutions, announced that SK Hynix selected Keysight's integrated peripheral component to interconnect express (PCIe) 5.0 test platforms for speeding up the development of memory semiconductors used for designing advanced products capable of managing huge data and supporting high data speeds and.

Memory Market Trends

Consumer Products is Expected to Hold Significant Market Share

The emerging memory technologies have enhanced the potential of memory by allowing the storage of more data at a lesser cost than the expensive-to-build silicon chips used by popular consumer electronic gadgets, including digital cameras, cell phones, notebooks, etc.

Taiwan's United Microelectronics Corporation (UMC), a global semiconductor foundry, is providing embedded non-volatile STT-MRAM blocks based on a 28nm CMOS manufacturing process, which will enable customers to integrate low latency, very high performance, and low power embedded MRAM memory blocks into MCUs and SoCs, targeting the Internet of Things, wearable, and the consumer electronics sector.

The technological advancements in the field are driving the demand for the market studied. Companies like Nanterohave developed high-density non-volatile memory called NRAM, which is incredibly fast, offer huge amounts of storage in a small space, and consumes very little power. With Nantero'sNRAM, consumer electronics vendors can develop new consumer devices that are considered to be futuristic. With such developments, the adoption of non-volatile memory is expected to grow.

The emerging memory technologies in the sector are mainly driven by wearable and connected devices that are expected to grow at a faster pace during the forecast period. Cisco Systems estimates that the number of connected wearable devices worldwide could reach 1,105 million units by 2022.

The demand for these memory technologies is further expected to rise owing to the effective memory requirement for other consumer electronics devices such as digital cameras, smartphones, gaming devices, etc. Ericsson estimates that the shipment of smartphone units could reach 1574.4 million by 2022.

The Americas Account for the Largest Market Share

Rapidly changing technologies and high data generation across industries are creating a need for more efficient processing systems in the country. With the advent of mobile and low-power devices, as well as high-end data centers and large on-chip caches, another high-priority demand has emerged: non-volatile, dense, and low-energy-consuming memories.

In memory semiconductor manufacturing technology, the United States has regained its competitiveness in DRAM and 3D-NAND in the last few years, and US companies are fully embracing EUV (Extreme Ultraviolet).

According to the US Department of Energy, there are about 3 million data centers in the United States. The data center has become the new unit of computing. DPUs (Data Processing Units) are the essential elements of secure and modern accelerated data centers in which GPUs, CPUs, and DPUs are able to combine into a single computing unit that is fully programmable. Nvidia estimates that data management drains up to 30% of the central processing cores in data centers. The increasing demand for data centers is also boosting the demand for memory components. Currently, large data center projects in North America have contributed to the strong demand for memory, such as DRAM.

Furthermore, It is expected that 5G will enable the transmission of a huge amount of telecommunications data in a short time, which also means devices would need more storage. This would increase the adoption of NAND flash.

The US is a major market for factory automation and industrial control. FRAM offers fast random access, high read and write endurance, and low power consumption. In factory automation, the industry-standard architecture, interface, features, and packages can enable a simple drop-in solution that can eliminate the costly re-designs of the system.

Memory Industry Overview

The Memory Market is highly competitive owing to multiple vendors providing memory to the domestic and international markets. The market appears to be moderately fragmented, with the significant vendors adopting strategies for mergers and acquisitions and strategic partnerships, among others, to expand their reach and stay competitive in the market. Some major players in the market are Samsung Electronics Co. Ltd, Micron Technology Inc., SK Hynix Inc., and ROHM Co. Ltd., among others. Some of the recent developments in the market are:

October 2021 - Micron Technology, a US-based memory manufacturer, will invest more than USD 150 billion worldwide over the next decade in advanced memory manufacturing, research, and development, including potential United States-based fab expansion.

December 2021 - Micron Technology announced an expansion of its business relationship with United Microelectronics Corporation, providing Micron the opportunities to secure supply for mobile, automotive, and critical customers into the future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Penetration of 5G and IoT Devices

- 5.1.2 Growing Memory Requirement in Data Centers

- 5.1.3 Rising Demand from Consumer Electronics and Automotive Sectors

- 5.2 Market Challenges

- 5.2.1 Short term supply chain challenges due to the pandemic scenario and the US-China Trade war scenario

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 DRAM

- 6.1.2 SRAM

- 6.1.3 NOR Flash

- 6.1.4 NAND Flash

- 6.1.5 ROM & EPROM

- 6.1.6 Others

- 6.2 By Application

- 6.2.1 Consumer Products

- 6.2.2 PC/Laptop

- 6.2.3 Smartphone/Tablet

- 6.2.4 Data Center

- 6.2.5 Automotive

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Europe

- 6.3.3 China

- 6.3.4 Japan

- 6.3.5 Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 Micron Technology Inc.

- 7.1.3 SK Hynix Inc.

- 7.1.4 ROHM Co. Ltd.

- 7.1.5 STMicroelectronics NV

- 7.1.6 Maxim Integrated Products Inc.

- 7.1.7 IBM Corporation

- 7.1.8 Cypress Semiconductor Corporation

- 7.1.9 Intel Corporation

- 7.1.10 Nvidia Corporation

- 7.1.11 Kioxia Corporation

- 7.2 Vendor Ranking