|

市场调查报告书

商品编码

1644767

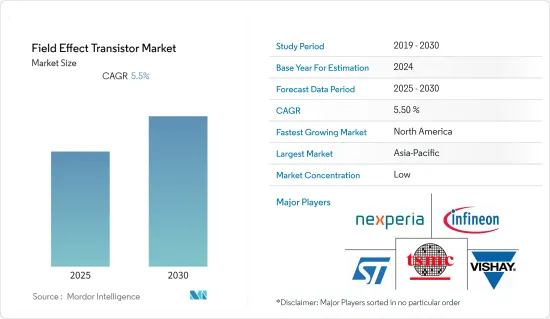

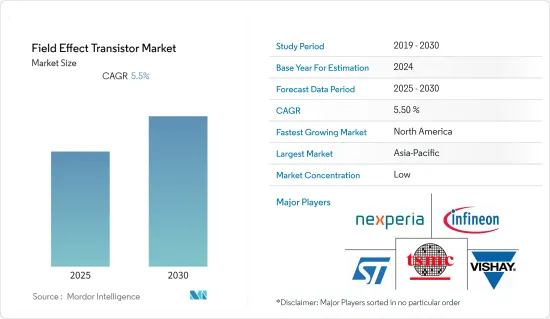

场效电晶体:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Field Effect Transistor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计场场效电晶体市场在预测期间的复合年增长率为 5.5%。

此外,汽车零件的安全性、资讯娱乐、导航和燃油效率等功能以及工业零件的安全、自动化、固态照明、运输和能源管理等功能有望推动市场研究。电晶体可用作放大器来调节马达(例如交流鼓风机马达)的速度,或用作固态开关来控制致动器(例如燃油喷射器)。

根据国际能源总署预测,2021年全球电动车销量将达660万辆。电动车占全球汽车销量的9%。

控制电路功率和小型化的需求不断增长,推动了场效电晶体市场的发展。例如,恩智浦半导体在保持相同功率性能的同时,将电晶体封装尺寸缩小了55%。 Diodes Incorporated 也宣布推出采用 DFN2020 封装的 DMTH4008LFDFWQ 和 DMTH6016LFDFWQ 汽车级 MOSFET。

搅拌机电路中的场效电晶体(FET)控制低调变失真。 FET 用于低频放大器,因为它们需要较短的耦合电容器。作为一种电压调节器设备,它用作运算放大器中的电压可变电阻。静电会损坏场效电晶体。

COVID-19 也影响了主要电子品牌的全球供应链。中国是各种电子输入电源的最大生产国和出口国之一,包括场效电晶体、电容器、二极体、整流器和放大器。中国持续的停产,迫使美国和欧洲多家电子製造商停止生产电视、智慧型手机和行动电话适配器等成品电子设备,导致电子产品出现供需缺口。

场效电晶体市场趋势

汽车产业可望推动市场成长

场效电晶体市场受到汽车产业技术改进的影响。使用传统内燃机的汽车只需要很少的电气元件。

随着电动和混合动力汽车的日益普及,汽车成为场效电晶体产业的成长领域之一。预计它将占据很大的份额。自动驾驶技术、再生煞车、各种感测器整合等创新正在推动场效电晶体的需求。此外,政府强制推行的 ADAS(高级驾驶辅助系统)法规也支持了该领域的成长。汽车领域的电子元件对安全至关重要,并且暴露在高电压和恶劣条件下。製造商正透过开发新型汽车场效电晶体来应对这一问题。

2021 年 12 月,义法半导体推出 STPOWER 碳化硅 (SiC) MOSFET,以改善电动车 (EV)动力传动系统和其他应用的电力电子设备,在这些应用中,功率密度、能源效率和可靠性对于满足目标标准至关重要。

电动车市场竞争激烈,新的製造商不断突破技术创新的界限。例如,保时捷 Taycan 采用 800V 系统,但许多现代电动车使用 400V 电池。因此,现有的汽车零件製造商针对汽车市场开发了场效电晶体。

2021 年 3 月,功率半导体、电源 IC 和数位电源解决方案的设计商、先驱和全球供应商 Alpha Omega Semiconductor Limited 宣布推出经 AEC-Q101核准、采用优化的 TO-247-4L 封装的 1200V SiC MOSFET。该产品专为需要高效率和高可靠性的电动车(EV)车载充电器、马达驱动逆变器和非车载充电站而设计。在符合汽车标准的 TO-247-4L 中,典型闸极驱动电压为 15V,1200V SiC MOSFET 可实现低导通电阻。

2022 年 5 月,宝马计划在其墨西哥产品线中增加一款电动车。 BMW将在墨西哥投资 10 亿美元,该组装厂可能成为宝马下一个专门的电动车製造工厂。电动车製造业的成长将推动场效电晶体市场的发展。

北美可望实现强劲成长

北美是场效电晶体最重要的市场之一,因为其汽车和其他产业蓬勃发展。位于该地区的公司包括安森美半导体 (ON Semiconductor Corporation)、Diode Incorporated 和 D3 Semiconductor LLC。

半导体产业和场效电晶体製造严重依赖美国的生产、设计和研究。该地区的重要性源于电子产品出口需求的不断增长,以及大量使用场效电晶体的终端用户领域(如家用电器和汽车)。

半导体业务(包括分立元件)是美国最重要的出口产业之一。根据国际贸易协会(ITA)统计,绝大多数半导体(超过82%)直接从美国出口,并由美国在其他国家的子公司销售。其中包括在美国进行的研究和开发、智慧财产权开发、设计和其他高附加价值活动。根据世界半导体贸易统计(WSTS)组织的数据,该地区约占半导体产业的22%。

目前,新冠肺炎疫情已导致工厂关闭。这两家工厂的关闭是由于最近爆发的新冠肺炎疫情。中国约占全球半导体产量的40-50%,用于国内製造和出口。因此,美国半导体公司的收益很大程度上依赖中国。

此外,工厂关闭和生产设施利用不足可能导致订单减少,从而导致收入减少或延迟。与苹果、高通和博通公司有较大销售关係的半导体公司可能会在短期内受到影响。总体而言,德克萨斯等强大的电子和半导体公司推动了该地区的场效电晶体产业的发展,其终端用户遍及家用电器和汽车零件等众多领域。需求是由全部区域的消费者需求所推动的。

场效电晶体产业概况

全球场效电晶体市场高度分散,有许多场效电晶体製造商提供产品。公司不断投资于产品和技术,以促进永续的环境成长并防止环境灾难。这些公司还收购了专门生产这些产品的其他公司,以增加其市场占有率。

- 2022 年 6 月-东京大学工业技术研究所的科学家製造了一种3D垂直形成的场效电晶体,该电晶体具有铁电极绝缘体和原子层沉积氧化物半导体通道,用于生产高密度资料储存设备。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 汽车和电子领域对高节能设备的需求不断增加

- 绿色能源发电需求推动市场

- 市场限制

- 静电对场效电晶体的损坏

第六章 市场细分

- 按类型

- JFET-结型场效电晶体

- P型

- N型

- MOSFET-金属氧化物场效电晶体

- P型

- N型

- JFET-结型场效电晶体

- 按应用

- 类比开关

- 扩大机

- 相移振盪器

- 电流限制器

- 数位电路

- 其他的

- 按最终用户

- 车

- 家电

- 资讯科技/电信

- 发电业

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Nexperia

- Infineon Technologies AG

- Vishay Intertechnology, Inc.

- Taiwan Semiconductor Manufacturing Company Ltd

- STMicroelectronics

- Semiconductor Components Industries, LLC

- Sensitron Semiconducto

- Shindengen America Inc

- NATIONAL INSTRUMENTS CORP. ALL

- Texas Instruments

- Solitron Devices, Inc.

- NTE Electronics, Inc.

- Alpha and Omega Semiconductor Limited

- Broadcom.

- MACOM

- Toshiba Corporation

- NXP Semiconductors.

- Mitsubishi Electric Corporation

第八章投资分析

第 9 章:未来趋势

The Field Effect Transistor Market is expected to register a CAGR of 5.5% during the forecast period.

In addition, features such as safety, infotainment, navigation, and fuel efficiency in automotive components and security, automation, solid-state lighting, transportation, and energy management in industrial parts are likely to drive the market studied. A transistor can be used as an amplifier to regulate the speed of electric motors like AC blower motors or as a solid-state switch to control actuators like fuel injectors.

According to the IEA, worldwide sales of electric automobiles had reached 6.6 million in 2021. Electric vehicles accounted for 9% of all vehicle sales worldwide.

The growing requirement to control power across circuits and miniaturization drives the Field Effect Transistor market. NXP semiconductors, for instance, reduced the packing size of their transistors by 55% while maintaining the same power performance. Diodes Incorporated also introduced DMTH4008LFDFWQ and DMTH6016LFDFWQ automotive-compliant MOSFETs packed in DFN2020.

Field effects transistors (FETs) in mixer circuits regulate low intermodulation distortions. Because of their short coupling capacitors, FETs are employed in low-frequency amplifiers. Because it is a voltage-controlled device, it is used as a voltage variable resistor in operational amplifiers. Due to the Static Electricity, Field Effect Transistors can be damaged.

COVID-19 has also impacted the global supply chain of major electronic brands. China is one of the largest producers and exporters of various electronics input supplies such as field effect transistors, capacitors, diodes, rectifiers, amplifiers etc. Due to the continuous production standstill in China, several electronic manufacturers in the United States and Europe have been compelled to halt production manufacturing of finished electronic items like TVs, Smart Phones, and mobile phone adaptors resulting in a demand-supply gap in electronic products.

Field Effect Transistor Market Trends

The Automotive Segment is Expected to Drive the Market Growth

The Field Effect Transistor market is being influenced by the automobile industry's rising technical improvements. Cars using traditional IC engines only require a few electrical components.

With the increased adoption of Electric vehicles and Hybrid vehicles, automotive is one of the rising segments of the Field Effect Transistor industry. It is expected to have a significant share. Innovations like autonomous car technology, regenerative braking, and the integration of various sensors have raised the demand for Field-Effect Transistors. Additionally, government rules requiring advanced driver assistance systems (ADAS) have supported the segment's growth. Electronic components in the automobile sector are vital for safety and are exposed to high voltages and extreme Conditions. Manufacturers have responded by creating a new range of Field Effect Transistors for automotive applications.

In December 2021, STPOWER silicon-carbide (SiC) MOSFETs were launched by STMicroelectronics, improving the power electronic devices for electric-vehicle (EV) powertrains and other applications where power density, energy efficiency, and reliability are critical to meeting goal criteria.

The electric vehicle market is very competitive, and new manufacturers are constantly pushing the boundaries of innovation. Porsche, for instance, built its Taycan with an 800 V system, although many modern electric vehicles use 400 V batteries. As a result, established automotive component makers developed Field Effect Transistor offerings for the automobile market.

In March 2021, Alpha & Omega Semiconductor Limited, a designer, pioneer, and global supplier of power semiconductors, power ICs, and digital power solutions, introduced AEC-Q101 approved 1200V SiC MOSFETs in an optimized TO-247-4L package. It's designed for electric vehicle (EV) onboard chargers, motor drive inverters, and off-board charging stations that demand excellent efficiency and dependability. For an automotive-qualified TO-247-4L with a typical gate drive of 15V, the 1200V SiC MOSFETs provide low on-resistance.

In May 2022, in Mexico, BMW planned to add electric vehicles. BMW is investing one billion USD in Mexico, and the assembly factory could become the automaker's next exclusive electric car manufacturing facility. An increase in the manufacturing of electric cars boosts the Field Effect Transistor Market.

North America is Expected to Register the Major Growth

North America is one of the most important markets for Field-Effect Transistors because of the region's automotive solid and other sectors. On Semiconductor Corporation, Diodes Incorporated, and D3 Semiconductor LLC are among the firms based in the area.

The semiconductor industry and Field Effect Transistor manufacturing rely heavily on the United States for production, design, and research. The region's significance fuels demand for electronic equipment exports and increasing end-user sectors that utilize large amounts of Field Effect Transistors, such as consumer electronics and automobiles.

The semiconductor business (including discrete) is one of the most significant exporting sectors in the United States. According to the International Trade Association (ITA), most semiconductors (more than 82%) come from direct US exports and sales by US-owned subsidiaries in other countries. They include US-based R&D, IP development, design, and other high-value-added activities. According to the World Semiconductor Trade Statistics (WSTS) organization, the area shares roughly 22% of the semiconductor industry.

The current COVID-19 pandemic has resulted in factory closures. For both factories, closures have resulted from the recent outbreak of COVID-19. China utilizes around 40-50% of worldwide semiconductor output for domestic and export manufacturing. As a result, semiconductor companies in the United States have significant revenue exposure to China.

Furthermore, plant closures or underutilization of production facilities may result in order reductions and, as a result, fewer or delayed sales. Semiconductor companies with significant sales exposure to Apple, Qualcomm Inc., and Broadcom Inc. might be impacted in the short run. Overall, powerful electronics and semiconductor firms like Texas Instruments drive the Field Effect Transistor industry in the area, with end-consumers from numerous sectors such as consumer electronics and automotive parts. Demand is fueled by consumer demand throughout the region.

Field Effect Transistor Industry Overview

The Global Field Effect Transistor market is highly fragmented, with numerous Field Effect Transistor manufacturers providing the product. The companies are continuously investing in the product and technology to promote sustainable environmental growth and prevent environmental hazards. The companies are also acquiring other companies that specifically deal with these products to boost the market's share.

- June 2022 - Scientists from the Institute of Industrial Science at The University of Tokyo fabricated three-dimensional vertically formed field-effect transistors to produce high-density data storage devices by ferroelectric gate insulator and atomic-layer-deposited oxide semiconductor channel.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics

- 5.1.2 Demand for Green Energy Power Generation Drives the Market

- 5.2 Market Restraints

- 5.2.1 Due to the Static Electricity Field Effect Transistors can be Damaged

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 JFET - Junction Field Effect Transistors

- 6.1.1.1 P - Type

- 6.1.1.2 N - Type

- 6.1.2 MOSFET - Metal-Oxide-Semiconductor Field Effect Transistor

- 6.1.2.1 P - Type

- 6.1.2.2 N - Type

- 6.1.1 JFET - Junction Field Effect Transistors

- 6.2 By Application

- 6.2.1 Analog Switches

- 6.2.2 Amplifiers

- 6.2.3 Phase Shift Oscillator

- 6.2.4 Current Limiter

- 6.2.5 Digital Circuits

- 6.2.6 Others

- 6.3 By End-User

- 6.3.1 Automotive

- 6.3.2 Consumer electronics

- 6.3.3 IT/Telecom

- 6.3.4 Power Generating Industries

- 6.3.5 Other End Users

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nexperia

- 7.1.2 Infineon Technologies AG

- 7.1.3 Vishay Intertechnology, Inc.

- 7.1.4 Taiwan Semiconductor Manufacturing Company Ltd

- 7.1.5 STMicroelectronics

- 7.1.6 Semiconductor Components Industries, LLC

- 7.1.7 Sensitron Semiconducto

- 7.1.8 Shindengen America Inc

- 7.1.9 NATIONAL INSTRUMENTS CORP. ALL

- 7.1.10 Texas Instruments

- 7.1.11 Solitron Devices, Inc.

- 7.1.12 NTE Electronics, Inc.

- 7.1.13 Alpha and Omega Semiconductor Limited

- 7.1.14 Broadcom.

- 7.1.15 MACOM

- 7.1.16 Toshiba Corporation

- 7.1.17 NXP Semiconductors.

- 7.1.18 Mitsubishi Electric Corporation