|

市场调查报告书

商品编码

1644772

欧洲智慧电錶 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Smart Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

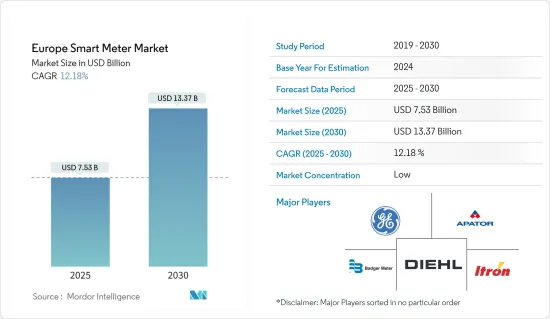

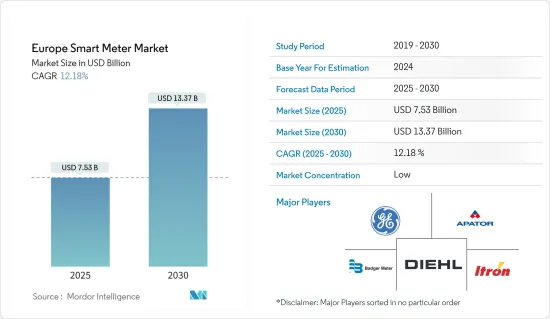

预计2025年欧洲智慧电錶市场规模为75.3亿美元,到2030年预计将达到133.7亿美元,预测期内(2025-2030年)的复合年增长率为12.18%。

预计,智慧电网计划认知度的提高、都市化进程的加速以及政府的支持性法规将继续成为推动欧洲调查市场成长的关键因素。

关键亮点

- 智慧电錶正在天然气、电力和水务领域广泛应用,因为它们可以实现消费者和供应商之间的双向通讯,即时追踪公用事业的使用情况,并方便供应商读取电錶并远端启动/停止供应。此外,智慧电錶的引入还可以引入家庭能源管理系统(HEMS)和建筑能源管理系统(BEMS),从而可以直观地了解每个家庭或整个建筑的用电情况。

- 近年来,智慧电錶在欧洲国家越来越受欢迎,取代了传统电錶,促进了电网的转型。此外,智慧电錶不仅可供供应商自动抄表,还可以让消费者了解自己的消费量。物联网通讯新无线技术的快速发展正在对欧洲智慧电錶市场产生重大影响。

- 根据英国政府统计,截至2022年9月底,英国家庭和小型企业中安装了约3,030万台智慧或先进电錶。此外,目前约有 54% 的电錶都是智慧电錶或先进电錶,其中 2,650 万台电錶以智慧模式运作。

- 此外,数位化也在使能源效率措施现代化和加速化。这就是智慧电网在欧洲蓬勃发展的原因。智慧电网有助于动态优化供应并从太阳能等再生能源来源中输送大量电力。

- 然而,安装智慧电錶的成本高、日益严重的安全问题以及基础设施安装的资本投入不足,阻碍了预测期内的市场成长。

欧洲智慧电錶市场趋势

智慧电网计划投资增加预计将推动市场成长

- 预计未来几十年欧洲的电力需求将大幅成长。例如,根据国际能源总署的预测,2019年至2025年间,欧洲的电力需求将成长40TWh。因此,预计电力基础设施现代化、扩建、数位化和分散化方面的弹性增强和计划投资将改变该地区的多种市场动态。

- 欧洲公共产业正在采用数位双胞胎和人工智慧等技术,同时政府的支持和倡议也不断增加,以吸引对智慧电网计划的投资。例如,在能源危机之后,德国能源部门推出了措施,鼓励采用联邦政府资助的节能倡议。根据新措施,供应商在提交资助申请后可直接开始实施计划。

- 智慧电錶的引入为智慧电网铺平了道路,它透过 GPRS 技术促进了配电公司和消费者之间的双向即时通讯,使其成为面向未来技术的合适指标。

- 欧洲国家越来越重视加强可再生能源发电能力,这也促进了该地区智慧电网基础设施的发展。 2023年,法国可再生能源发电量将超过70吉瓦。水力发电是所有可再生能源中最大的发电量,达到近26千兆瓦。约有 24 吉瓦的装置容量来自风能,其中大部分位于陆上发电厂。

英国占有较大市场占有率

- 以智慧电錶取代传统的电錶和燃气表是英国一项重要的国家基础设施升级,预计将使该地区的能源系统更便宜、更干净、更可靠。据英国政府称,截至2022年9月底,英国各地家庭和小型企业将安装约3,030万台智慧或先进电錶。

- 此外,截至 2022 年 9 月底,英国各大能源供应商总合在家庭物业中营运 2,380 万块燃气表和 2,880 万块电錶。此外,截至2022年9月底,主要能源供应商营运的43%的住宅燃气表和50%的住宅电錶已经智慧化。同样,全部区域的非住宅场所更有可能使用以智慧或先进模式运作的电錶,而不是燃气表(48% 对 37%)。

- 此外,能源价格的上涨使得该地区许多家庭希望即时监控他们的天然气和电力使用情况,重点的是了解他们为此支付了多少钱,这刺激了智慧电錶的采用。例如,根据英国国会的预测,家庭能源费用预计在2022年4月将上涨54%,2022年10月将上涨80%。

- 此外,为促进该地区智慧电錶应用而实施的各种法规也进一步促进了市场的成长。例如,自 2022 年 1 月起,该地区所有天然气和电力供应商都有约束力的年度安装目标,即在 2025年终前向其剩余的非智慧电錶客户推出智慧或先进电錶。

欧洲智慧电錶产业概况

欧洲智慧电錶市场竞争激烈,国内外参与企业均积极参与。由于市场预计将扩大并带来更多机会,预计更多参与企业将很快进入市场,从而在预测期内分散竞争格局。市场的主要企业包括 Elster Group GmbH、Diehl Stiftung &Co.KG。

2023 年 2 月,瑞典物联网营运商 Netmore 开始在法国部署 LoRaWAN 网络,瞄准智慧水錶和其他大型物联网和公共产业计划。 Netmore 表示,其 LoRaWAN 基础设施目前已在英国、瑞典、爱尔兰、荷兰、法国和西班牙推出。

2023年1月,德国政府宣布通过立法草案,重启能源转型数位化,并加速智慧电錶的推广。据政府称,该法律预计将于 2023 年春季生效,大规模智慧电錶推广将立即开始,并于 2025 年成为强制性规定。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 加大智慧电网计划投资

- 智慧城市部署的成长

- 政府监管趋严

- 市场挑战/限制

- 高成本和安全问题

- 与智慧电錶整合困难

第六章 市场细分

- 按计量表类型(销售量和出货量)

- 智慧燃气表

- 智慧水錶

- 智慧电錶

- 按最终用户

- 住宅

- 商业的

- 工业的

- ***依国家(销售及出货量)

- 英国

- 德国

- 法国

- 义大利

- 西班牙

第七章 竞争格局

- 公司简介

- General Electric Company

- Apator SA

- Badger Meter Inc.

- Diehl Stiftung & Co. KG

- Elster Group GmbH(Honeywell International Inc)

- AEM

- Itron Inc

- Kamstrup A/S

- Landis+GYR Group AG

- Arad Group

- Ningbo Sanxing Electric Co. Ltd.

- Sensus(Xylem Inc.)

- Zenner International GmbH & Co. KG

第八章投资分析

第九章:市场的未来

The Europe Smart Meter Market size is estimated at USD 7.53 billion in 2025, and is expected to reach USD 13.37 billion by 2030, at a CAGR of 12.18% during the forecast period (2025-2030).

The growing awareness for smart grid projects, increasing urbanization, and supportive government regulations are expected to remain among the major factors driving the studied market's growth in Europe.

Key Highlights

- Smart meters are being adopted in the region for different deployments, such as gas, electricity, and water, owing to their two-way communication feature, which facilitates real-time tracking of utility usage by both consumer and utility supplier and also facilitates reading/start/cutoff of supply remotely by the supplier. Additionally, the deployment of a smart meter also allows the implementation of a Home Energy Management System (HEMS) or Building Energy Management System (BEMS), allowing visualization of the electric power usage in every home or entire building.

- During the past few years, smart metering rollouts have taken place in various European countries, with smart meters replacing traditional regular meters, thus contributing to the grid transition. Moreover, smart meters are utilized not only for automatic readings by the provider but also for empowering the consumer to be aware of their consumption. The swift development of new wireless technologies for IoT communications has a significant impact on the smart metering market in Europe.

- As per the government of the UK, at the end of September 2022, there were about 30.3 million smart and advanced meters in homes and small businesses in Great Britain. Furthermore, about 54 percent of all meters are now smart or advanced meters, with 26.5 million operating in smart mode.

- Furthermore, digitization is also modernizing and accelerating energy efficiency measures, owing to which the deployment of smart grids is surging in the European region, as they are efficient in dynamically optimizing supply and fostering supply of significant amounts of electricity from renewable energy sources such as solar power.

- However, the high cost linked with installing smart meters, growing security concerns, and shortage of capital investment for infrastructure installations is hampering the market's growth over the forecast period.

Europe Smart Meter Market Trends

Increased investments in smart grid projects in expected to drive the market growth

- Electricity demand in the European region is anticipated to increase significantly in the next few decades. For instance, according to IEA, electricity demand in Europe is anticipated to increase by 40 TWh between 2019-2025. Modernization, expansion, digitization, and decentralization of the electricity infrastructure for improved resiliency and planned investment are, thus, expected to change several market dynamics in the region.

- Utilities in the European region are rising, adopting technologies like digital twinning and artificial intelligence and, coupled with surging government support and initiatives, further attracting investments in smart grid projects. For instance, amid the ongoing energy crisis, the German ministry concerning the energy sector has introduced measures to expedite the adoption of federally funded high-saving energy efficiency initiatives. Under the new measures, vendors can start implementing their projects directly after submitting their funding application, whereas previously, they needed to wait for approval.

- The adoption of smart meters, as they are a suitable measure of future-ready technologies, paves the way for the smart grid by facilitating two-way real-time communication between DISCOMs and consumers through GPRS technologies.

- The increasing focus of European countries towards enhancing renewable energy generation capacity is also contributing to the development of smart grid infrastructure in the region as renewable energy generation plants focus more on applying advanced technologies to enhance production and distribution efficiency. By 2023, France's renewable energy sources had a power capacity exceeding 70 gigawatts. Hydropower had the highest amount of energy installed among renewable sources, reaching nearly 26 gigawatts. Around 24 gigawatts of installed capacity is attributed to wind power, with most of it located in onshore power plants.

United Kingdom to Hold a Significant Market Share

- Replacing traditional electricity and gas meters with smart meters forms an important national infrastructure upgrade for the United Kingdom that is expected to help make the region's energy system cheaper, cleaner, and more reliable. According to the government of the United Kingdom, at the end of September 2022, there were around 30.3 million smart and advanced meters in homes and small businesses across Great Britain.

- Further, as of September 2022, a total of 23.8 million gas meters and 28.8 million electricity meters were operated by large energy suppliers in domestic properties across Great Britain. Also, at the end of September 2022, 43 percent of all domestic gas meters and 50 percent of all domestic electricity meters operated by large energy suppliers were smart. Similarly, in non-domestic sites across the region, more electricity meters operate in smart or advanced mode than gas meters (48 percent versus 37 percent).

- Moreover, with a spike in energy prices, many households in the region seek to monitor their gas and electricity usage in real-time and, crucially, how much it costs them, fueling the adoption of smart meters. For instance, per the UK Parliament, household energy bills increased by 54 percent in April 2022 and were expected to increase by 80 percent in October 2022.

- Further, the different regulations implemented to increase the deployment of smart meters in the region further contribute to the market growth. For instance, starting from January 2022, all gas and electricity suppliers in the region had a binding annual installation target to roll out smart and advanced meters to their remaining non-smart customers by the end of 2025.

Europe Smart Meter Industry Overview

The European smart meter market is competitive, with some local and international players active. With the market expected to broaden and yield more opportunities, more players will enter the market soon, fragmenting the competitive landscape during the forecast period. Key players in the market include Elster Group GmbH, Diehl Stiftung & Co. KG, etc.

In February 2023, Netmore, a Swedish IoT operator, started rolling out a LoRaWAN network in France, targeting smart water metering and other large-scale IoT and utility projects. The rollout forms the next step in expanding Netmore's LoRaWAN infrastructure, which, according to the company, is now available in the UK, Sweden, Ireland, the Netherlands, France, and Spain.

In January 2023, the German government announced the adoption of a draft law to restart the digitalization of the energy transition and accelerate the rollout of smart metering. According to the government, the law will likely enter into force in the Spring of 2023, enabling large-scale smart metering rollout to start immediately before becoming mandatory in 2025.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 On The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Investments in Smart Grid Projects

- 5.1.2 Growth in Smart City Deployment

- 5.1.3 Supportive Government Regulations

- 5.2 Market Challenges/Restraints

- 5.2.1 High Costs and Security Concerns

- 5.2.2 Integration Difficulties with Smart Meters

6 MARKET SEGMENTATION

- 6.1 By Type of Meter (Revenue and Unit Shipments)

- 6.1.1 Smart Gas Meter

- 6.1.2 Smart Water Meter

- 6.1.3 Smart Electricity Meter

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 ***By Country (Revenue and Unit Shipments)

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 General Electric Company

- 7.1.2 Apator SA

- 7.1.3 Badger Meter Inc.

- 7.1.4 Diehl Stiftung & Co. KG

- 7.1.5 Elster Group GmbH (Honeywell International Inc)

- 7.1.6 AEM

- 7.1.7 Itron Inc

- 7.1.8 Kamstrup A/S

- 7.1.9 Landis+ GYR Group AG

- 7.1.10 Arad Group

- 7.1.11 Ningbo Sanxing Electric Co. Ltd.

- 7.1.12 Sensus (Xylem Inc.)

- 7.1.13 Zenner International GmbH & Co. KG