|

市场调查报告书

商品编码

1644788

欧洲即时付款:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Real Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

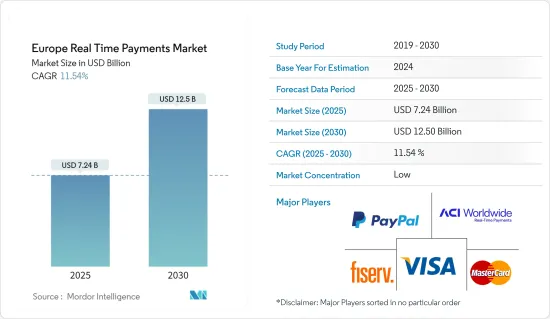

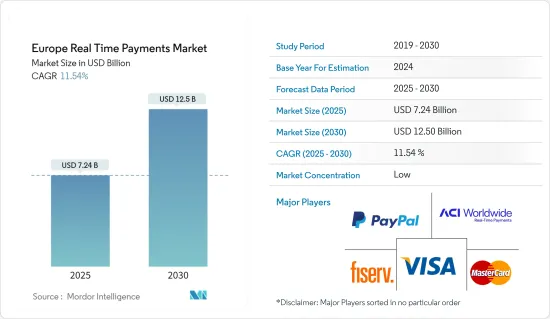

预计 2025 年欧洲即时付款市场规模为 72.4 亿美元,到 2030 年将达到 125 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.54%。

智慧型手机的快速普及、消费者对快速付款的需求以及欧洲地区政府的倡议是推动市场成长的一些关键因素。

主要亮点

- 随着欧洲即时付款的采用率不断提高以及基础设施的不断发展和演变,预计未来几年该地区的即时付款将出现强劲增长。包括英国和荷兰在内的大多数欧洲市场,即时资金转帐的数量和金额都呈现强劲成长。 P27 在北欧地区的推出预计将推动即时付款市场的成长。

- 欧洲付款理事会(EPC)设计了泛欧即时付款系统,以加速欧洲即时付款的发展。 SEPA 即时信用转帐 (SCT Inst) 流程是基于 EPC 的目前 SEPA 信用转帐 (SCT) 方案。

- 此外,此付款系统将实现欧元信用转账,资金可在几秒钟内随时转入该地区的帐户,并将逐步扩展到36个欧洲国家。几家地区性银行正在使用 SEPA 即时信用转帐 (SCT inst.)。例如,花旗银行刚在欧洲推出了单一欧元付款区 (SEPA)即时付款。

- 此外,欧洲还有几项基于ISO20022的即时付款计画。英国有新支付架构(NPA),北欧有P27,德国有SCT Inst.,欧盟有欧洲支付倡议(EPI)。这些即时付款系统将透过提供更简单的存取度来增加参与度,促进持续的稳定性和弹性,并透过增加即时付款市场的竞争来刺激创新。

- 此外,ISO 20022的使用有望改善跨境区域连结性,并增加可用于建立新服务的资料框架。此外,瑞典、西班牙、丹麦和波兰等许多欧盟国家的行动和网路普及率很高,为该地区的即时付款成长提供了坚实的基础。

- 然而,授权推送付款等即时付款中诈欺活动的增多可能会阻碍该地区即时付款市场的成长。支援 PSD2 的 3D Secure 2.2通讯协定和其他 SCA 技术减少了该地区的信用卡诈欺,但该地区的授权推送支付诈欺有所增加。

- COVID-19 疫情对我们地区人们的购物和支付方式产生了巨大影响。付款支付和数位付款等新兴支付方式为顾客提供了更多便利,并且在未来几年可能会进一步成长。

欧洲即时付款市场趋势

智慧型手机的普及预计将推动市场成长

- 许多欧洲国家的智慧型手机普及率正在提高,扩大了该地区的即时付款市场。根据GSMA Intelligence报告的资料,2023年初芬兰的智慧型手机普及率为总人口的169.5%。同样,在奥地利、德国、西班牙和英国等其他欧洲国家,这一数字分别占总人口的138.8%、141%、119%和105%。

- 此外,行动商务的兴起进一步促进了该地区的即时付款,因为许多电子商务平台为该地区的电子商务用户提供即时信用和后付款服务。

- 消费者更喜欢行动 BNPL 服务,因为它们价格实惠且方便。 BNPL、消费者信用或 Afterpay 让消费者只用钱来支付。提供 BNPL 服务的主要企业包括 Klarna、PayPal Credit 和 Split。

- 此外,全部区域智慧型手机的高普及率也支援了智慧型手机越来越多地用于即时个人对个人 (P2P) 和个人对企业 (P2B) 的资金转帐。预计这些因素将在预测期内进一步扩大欧洲即时付款市场。

预计英国将占最大份额

- 在英国,自 2008 年 Pay.the UK 营运的即时付款系统「快速支付系统」(FPS)推出以来,即时付款已经成为可能。此外,快速支付系统还支援该国的行动付款服务 Paym,该服务允许用户使用行动电话号码向家人、朋友和小型企业付款。

- 此外,该国大多数金融机构都参与了FPS,使数百万人都可以使用它。此外,该地区的许多银行都已采用FPS。例如,2022 年 5 月,一家主要企业伦敦银行宣布已成为英国快速支付系统 (FPS) 的直接连接付款参与者,快速支付系统是 24/7 即时付款基础设施。

- 儘管消费者可以轻鬆且廉价地进行即时付款,但英国的付款基础设施仍然与传统工具(尤其是卡片)紧密相关。此外,英国的即时付款主要着重于小额、高价值的转账,而非日常消费。然而,这种情况正在不断变化,随着该地区的即时付款采用不断增加,预计在预测期内将进一步扩大。

- 英国也支持英国即时付款系统的发展。例如,即时付款供应商Pay.UK正在对其快速支付服务进行现代化改造,这是其新支付架构(NPA)计划的一部分,该计划包括采购符合ISO 20022标准的新中央基础设施。新支付架构(NPA)将提供一个有弹性、扩充性的平台,以加速英国即时付款的成长。

- 预计所有上述因素都将在整个预测期内推动英国即时付款产业的需求。

欧洲即时付款产业概况

欧洲即时付款市场竞争激烈,参与者众多,市场显得较分散。这些市场参与者正在采取包括併购在内的各种策略,以提供创新的付款解决方案并获得竞争优势。欧洲即时付款市场的主要企业包括 ACI Worldwide Inc.、Fiserv Inc.、Mastercard Inc.、Visa Inc. 等。

- 2023 年 6 月 - 全球支付科技公司 ACI Worldwide 向欧洲和英国的商家推出了其实时付款解决方案 ACI Instant Pay。 Instant Pay 让商家能够透过与 ACI 支付编配平台的单一 API 整合来接受线上、行动和店内即时付款。

- 2023 年 4 月-PayPal 的线上付款解决方案允许小型企业接受 PayPal付款、信用卡、签帐金融卡、数位钱包等。它还将提供有助于中小企业经营业务的功能,例如按交换加 (IC++) 定价的全额付款。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 欧洲付款格局的演变

- 与欧洲无现金交易扩张相关的主要市场趋势

- COVID-19 对欧洲付款市场的影响

第五章 市场动态

- 市场驱动因素

- 智慧型手机普及率不断提高

- 减少对传统银行业务的依赖

- 即时便捷的即时付款

- 市场挑战

- 付款诈骗,包括授权推送支付诈骗

- 德国等主要国家现金依赖现状

- 市场机会

- 政府鼓励数位付款成长的政策预计将推动消费者即时付款的成长。

- 数位付款产业的关键法规和标准

- 全球监管状况

- 可能成为监管障碍的经营模式

- 随着商业环境的变化而有发展空间

- 关键用案例和使用案例分析

- 实际支付交易占全部交易比重及主要国家交易量、金额区域分析

- 非现金交易中实际支付交易占比及主要国家分地区交易量分析

第六章 市场细分

- 依付款类型

- P2P

- P2B

- 按国家

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- ACI Worldwide Inc.

- Fiserv Inc.

- Paypal Holdings Inc.

- Mastercard Inc.

- VISA Inc.

- FIS Global

- Apple Inc.

- Finastra

- Volante Technologies Inc

- Nets(Nexi Group)

第八章投资分析

第九章:未来市场展望

The Europe Real Time Payments Market size is estimated at USD 7.24 billion in 2025, and is expected to reach USD 12.50 billion by 2030, at a CAGR of 11.54% during the forecast period (2025-2030).

The rapid proliferation of smartphones, consumers' need for quicker settlements, and government initiatives in the European region, among others, are the key reasons driving the market's growth.

Key Highlights

- Increasing real-time payment adoption rates and continuous development and evolution of infrastructure across Europe indicate strong growth of real-time payments in the region in the coming years. Most European markets, including the UK and the Netherlands, experienced significant growth in volumes and values of real-time fund transfers; with the introduction of the P27 in the Nordic region, the real-time payment market is anticipated to grow.

- The European Payments Council (EPC) designed a pan-European instant payment system to accelerate the development of real-time payments in Europe. The SEPA Instant Credit Transfer (SCT Inst) process is based on the EPC's current SEPA credit transfer (SCT) scheme.

- Furthermore, this payment system enables euro credit transfers, with funds becoming available on the account in seconds at any time and in a region that will progressively expand to encompass 36 European countries. Several regional banking institutions are using SEPA Instant Credit Transfer (SCT inst.). Citi, for example, just implemented Single Euro Payments Area (SEPA) Instant Payments throughout Europe.

- Moreover, several initiatives based on ISO 20022 for real-time payments exist in Europe. In the United Kingdom, there is the New Payments Architecture (NPA), P27 in the Nordic region countries, SCT Inst. in Germany, and the EU is pushing on with the European Payments Initiative (EPI). These real-time payment systems will provide simpler access for increased participation, boost ongoing stability and resilience, and increase innovation through greater competition in the real-time payments market.

- Furthermore, the use of ISO 20022 is anticipated to improve cross-border and regional connectivity and enable additional data frames that can use to build new services. Furthermore, strong mobile and internet penetration in many countries of the EU, such as Sweden, Spain, Denmark, Poland, etc., is providing a strong platform for the growth of real-time payments in the region.

- However, growing payment frauds in real-time payments, such as Authorized Push payments, can hamper the growth of the real-time payments market in the region. With the 3D Secure 2.2 protocol and other SCA technologies to accommodate PSD2, card fraud in the region declined, but Authorized Push Payments frauds increased in the region.

- The COVID-19 pandemic enormously impacted how people shop and pay in the region. The new practices, including real-time and digital payments, are more convenient for customers and are likely to grow in the coming years.

Europe Real Time Payments Market Trends

Rising Penetration of Smartphone is Expected to Foster the Market Growth

- The increasing penetration of smartphones across many European countries is increasing the real-time payment market in the region. As per data reported by GSMA Intelligence, the smartphone penetration in Finland at the start of 2023 was 169.5% of the total population. Similarly, in other European countries such as Austria, Germany, Spain, and the United Kingdom was 138.8%, 141%, 119%, and 105% of the total population, respectively.

- Furthermore, the rise of mobile commerce is further proliferating real-time payments in the region as many e-commerce platforms offer real-time credit or buy now pay later services to the e-commerce users in the region.

- Consumers prefer mobile BNPL services due to their affordability and convenience. BNPL, consumer credit, or after-pay enables consumers to pay money only. Some key European players offering BNPL service include Klarna, PayPal Credit, and Splitit.

- Furthermore, the increasing adoption of smartphone usage for real-time fund transfer from Person to Person (P2P) and Person to business (P2B) is further supported by the strong smartphone penetration across the region. These factors are further expected to augment the real-time payments market in Europe over the forecast period.

United Kingdom is Anticipated to Hold the Largest Share

- Real-time payments have been available in the United Kingdom since 2008 with the launch of the U.K.'s real-time payments system called the Faster Payments System (FPS), operated by Pay. the U.K. in the country. Furthermore, the Faster Payment System also powers Paym, the country's mobile payments service, making it possible to pay family, friends, and small businesses using mobile numbers.

- Furthermore, most financial institutions in the country are participants of the FPS, making it reach millions of people. Moreover, many banking institutions in the region are adopting FPS. For instance, in May 2022, The Bank of London, one of the leading-edge technology companies, announced that it had become a Directly Connected Settling Participant of the Faster Payment System (FPS), the United Kingdom's 24*7 real-time payments infrastructure.

- Payment infrastructure in the United Kingdom is still very much tied to traditional tools, especially cards, despite being easy and cheap for consumers to access real-time payments. Further, real-time payments in the U.K. are still focused on low-volume, high-value transfers, not everyday expenditures. However, the scenario is continuously changing, and the adoption of real-time payments is increasing in the region and is further expected to grow over the forecast period.

- The U.K. further supports the growth of the United Kingdom's real-time payments system. For instance, real-time payments operator Pay. U.K. is modernizing the Faster Payments Service as part of its New Payments Architecture (NPA) program, which also involves procuring a new ISO 20022-ready central infrastructure. The New Payments Architecture (NPA) will be a resilient, scalable platform that will expand the growth of real-time payments in the United Kingdom.

- All the abovementioned factors are expected to boost demand for the UK real-time payments industry throughout the forecast period.

Europe Real Time Payments Industry Overview

The competition in the Europe real-time payments market is intensifying, and the market appears to be fragmented due to the presence of numerous players. These market players offer innovative payment solutions and are involved in various strategies, such as mergers and acquisitions, to gain a competitive advantage. Major players in the Europe real-time payments market include ACI Worldwide Inc., Fiserv Inc., Mastercard Inc., and Visa Inc., among others.

- June 2023 - Global paytech firm ACI Worldwide has launched ACI Instant Pay, a real-time payment solution for European and UK merchants. Merchants using Instant Pay can accept instant online, mobile, and in-store payments through a single API integration with the ACI payments orchestration platform.

- April 2023 - PayPal's online payment solution enables SMBs to accept PayPal payments, credit and debit cards, digital wallets, and more. Beginning, SMBs will also be able to accept payments with Apple Pay, allow their customers to save payment methods with the PayPal vault and keep their cards up to date with real-time account updater, as well as get access to features to help them run their business including interchange plus (IC++) pricing with gross settlement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in Europe

- 4.4 Key market trends pertaining to the growth of cashless transaction in Europe

- 4.5 Impact of COVID-19 on the payments market in Europe

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Smartphone Penetration

- 5.1.2 Falling Reliance on Traditional Banking

- 5.1.3 Immediacy and Ease of Convenience of the Real Time Payments

- 5.2 Market Challenges

- 5.2.1 Payment Fraud such as Authorized Push Payment Scams

- 5.2.2 Existing Dependence on Cash in Major Countries such as Germany

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Paymentis expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across the World

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

- 5.6 Analysis of Real Payments Transactions as a share of all Transactions with a regional breakdown of key countries by volume and transacted value

- 5.7 Analysis of Real Payments Transactions as a share of Non-Cash Transactions with a regional breakdown of key countries by volumes

6 Market Segmentation

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

- 6.2 By Country

- 6.2.1 United Kingdom

- 6.2.2 Germany

- 6.2.3 France

- 6.2.4 Italy

- 6.2.5 Rest of Europe

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 ACI Worldwide Inc.

- 7.1.2 Fiserv Inc.

- 7.1.3 Paypal Holdings Inc.

- 7.1.4 Mastercard Inc.

- 7.1.5 VISA Inc.

- 7.1.6 FIS Global

- 7.1.7 Apple Inc.

- 7.1.8 Finastra

- 7.1.9 Volante Technologies Inc

- 7.1.10 Nets (Nexi Group)