|

市场调查报告书

商品编码

1644794

全球消费者识别及存取管理市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global Consumer Identity and Access Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

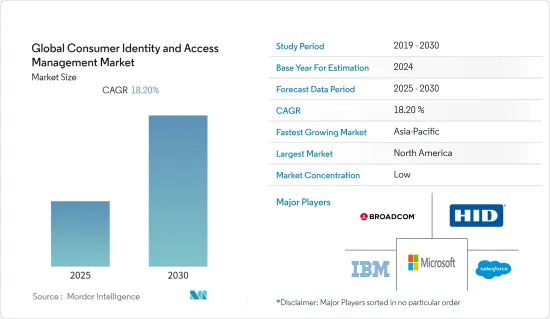

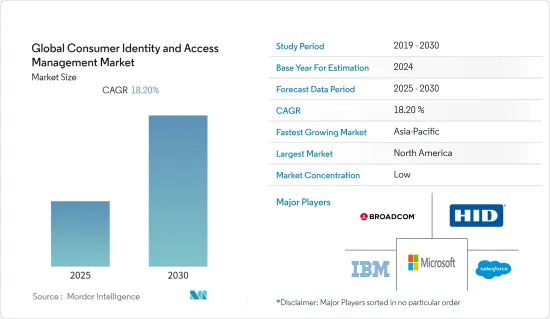

预测期内全球消费者识别及存取管理市场预计复合年增长率为 18.2%

关键亮点

- 由于合规性要求、管理本地访客等替代用户群体的愿望日益强烈以及对及时和安全访问的关注,消费者识别及存取管理的需求正在迅速增加。您还可以管理员工、承包商、供应商等的身份验证生命週期。

- 当今世界日益数位化,几乎所有商业交易都是以数位化方式进行的。这对于骇客来说有很大的吸引力。此外,资料外洩不仅是由骇客造成的,而且常常是由组织内有权存取网路或设备敏感部分的个人造成的。由于许多企业计划增加资料安全预算,各个终端使用者群体对消费者识别及存取管理的需求正在增长

- 此外,引入消费者识别及存取管理也是必要的,以保护系统免受诈欺的使用者等外部威胁。各种终端用户产业,例如 BFSI、IT、电讯等,都具有拥有大量关键且高价值资讯和资产的特性。因此,这些最终用户部门必须儘早意识到潜在威胁。

- 此外,与消费者识别及存取管理相关的许多好处都围绕着资料保护和网路安全。当组织部署消费者识别及存取管理系统时,会实施凭证管理的最佳实践,透过要求员工频繁更改密码来消除这些问题和相关问题。

- 然而,行动技术和云端基础服务的日益普及使得组织的业务流程变得更加灵活和更快回应。然而存取管理变得越来越复杂。此外,如果没有适当采用创新的行动技术,企业客户可能会面临储存在第三方和云端服务中的资料安全方面的挑战。这可能会阻碍市场成长。

- 在新冠肺炎疫情期间,由于采取封锁和严格措施来遏制病毒传播,对线上业务的依赖显着增加。各种终端用户产业,如 BFSI、医疗保健、IT、电信等,都依赖网路生态系统提供消费者所需的服务。此外,在疫情期间,企业对消费者身分和存取管理系统的需求增加。

消费者识别及存取管理市场的趋势

BFSI 部门预计将大幅成长

- 银行和其他金融机构 (BFSI) 受到越来越严格的审查,以确保它们采取了足够的安全措施,尤其是在过去几年发生多起备受瞩目的资料外洩事件之后。此外,金融机构储存了非常有价值的资料,其数位转型努力增加了网路攻击者存取这些资料的机会。

- 例如,2022 年 2 月,房屋抵押贷款机构 Radius Financial Group 遭遇资料洩露,其伺服器遭到未授权存取,16,000 名客户的个人资料被盗。此外,2022 年 4 月,T.A Square(现为 Block)遭遇资料洩露,影响了 820 万名现任和前任员工。金融领域的这些资料外洩正在推动对消费者身分和存取管理解决方案的需求。

- 此外,主要国家银行诈骗的不断增加推动了对更好的基础设施和安全解决方案的需求,从而增加了 BFSI 领域对消费者识别及存取管理系统的需求。例如,印度储备银行发布的资料显示,印度的银行诈骗案件数量从2017财年的5,076起增加到2021财年的7,400起。

- 许多银行和金融机构都认识到保护客户委託给他们的宝贵而敏感的金融资产的重要性。因此,大多数组织都投资了先进的技术,以防止可能对收益、业务成本和声誉产生负面影响的安全漏洞。消费者识别及存取管理解决方案可以为银行和其他金融机构带来意想不到的投资回报,并有助于保护收益。

预计北美将占据最大市场占有率

- 预计北美将在全球消费者识别及存取管理市场中占据最大的市场份额,这得益于各个终端用户领域对消费者身份和识别及存取管理解决方案的采用日益广泛,以及微软公司、Salesforce Inc.和Broadcom Inc.等几家主要参与者在该地区提供安全和消费者识别及存取管理市场占有率。

- 此外,美国各终端产业的资料外洩事件不断增加,进一步增加了该地区对消费者识别及存取管理解决方案的需求。此外,网路犯罪分子一直在寻找利用威胁的新方法,该地区各个终端用户部门发生的一系列重大资料外洩事件再次证明了安全系统往往出奇地脆弱。

- 例如,根据身分盗窃资源中心(ITRC)发布的报告,美国在2021年经历了创纪录的1,862起资料外洩事件。 2021 年资料外洩事件数量打破了 2017 年记录的 1,506 起的纪录,与 2020 年的 1,108 起相比增加了 68%。银行、金融服务和保险业、医疗保健、商业和零售业等行业最容易受到攻击,每年影响数百万美国。

- 此外,《格雷姆-里奇-比利雷法案》(GLB)等严格的政府法规在美国采用消费者识别及存取管理解决方案方面发挥关键作用。该法案要求证券公司和金融机构实施严格的法规,透过建立评估资料风险和防范威胁的计画来保护消费者资料的隐私。

- 该地区对消费者识别及存取管理解决方案的需求日益增长,主要参与者都在努力抢占更多的市场占有率。例如,2021年11月,网路安全巨头GBG宣布收购其前竞争对手Acuant。此次合併将使两家产业巨头合併为一个组织。收购 Acuant 将使 GBG 进一步扩展到美国全球最大且具有战略意义最重要的位置、身分和诈骗服务市场。

消费者识别及存取管理行业概览

全球消费者识别及存取管理市场似乎被分割开来,有许多参与企业。此外,顶级公司在研发方面的投资和资金筹措迅速增加,以推出消费者身分和存取管理市场产品的有效解决方案,从而加剧了全球市场的竞争。消费者识别及存取管理领域的全球领先公司包括微软公司、博通公司、Salesforce 公司和 IBM 公司。

- 2022 年 6 月-Verisk 企业与消费者身分管理专家 Infutor 今天宣布推出 Infutor Identity Resolution。该内建应用程式原生丰富并启动来自 Snowflake 资料云的第一方资料。 Infutor Identity Resolution 应用程式使用 Snowflake 的原生应用程式框架构建,目前处于私人预览阶段。这使得开发人员能够使用 Snowflake 核心功能建立应用程序,在 Snowflake 市场中在全球范围内分发它们,并将它们部署在客户的 Snowflake 帐户中。

- 2022 年 4 月 - Zoho Alumni Securden 从 Tiger Global、Accel 和 Together Fund 筹集了 1050 万美元的 A 轮融资,以扩展其统一平台的存取和身分管理方法。 Securden 正在寻求与存取安全和管治领域的大型公司竞争,包括 CyberArk、BeyondTrust、Delinea 和 Microsoft。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 严格遵守安全规定和政府法规

- 现场访客和承包商管理

- 市场限制

- 储存在第三方(云端)的资料的安全性

第六章 市场细分

- 按组件

- 解决方案

- 按服务

- 按部署

- 云端基础

- 本地

- 按最终用户产业

- BFSI

- 医疗

- 资讯科技/通讯

- 政府

- 能源公共产业

- 其他终端用户产业(运输、航太和国防、教育)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Microsoft Corporation

- Salesforce Inc.

- IBM Corporation

- HID Global(Assa Abloy AB)

- Broadcom Inc.

- AlertEnterprise Inc.

- Micro Focus International PLC

- Access Security Corporation

- WIPRO Ltd

- SAASPASS Inc.

- IDCUBE Identification Systems(P)Ltd

- Amazon Web Services Inc.

- Convergint Technologies LLC

第八章投资分析

第九章:未来市场展望

The Global Consumer Identity and Access Management Market is expected to register a CAGR of 18.2% during the forecast period.

Key Highlights

- The demand for consumer identity and access management is rapidly increasing due to compliance mandates, a growing desire to manage alternative user populations, like on-premises visitors, and an emphasis on timely and secure access. It also allows organizations to manage the lifecycle of identities, such as employees, contractors, and vendors.

- Nowadays, with growing digitization across the world, nearly every business transaction is now processed digitally. This is a big attraction for hackers. Moreover, data breaches are not only committed by hackers, but individuals also commit many within an organization who have access to sensitive parts of networks or facilities. Many companies are planning to increase their data security budget, which will drive the need for consumer identity and access management across various end-user segments.

- Moreover, consumer identity and access management deployments are needed to safeguard the system from outside threats, such as unauthorized users. Various end-user industries, such as BFSI, IT, Telecom, etc., are characterized by many critical and highly valuable information and assets; any breach or lapse in security can be disastrous and costly, with revenue loss. As a result, it is becoming essential for these end-user sectors to be able to recognize potential threats as soon as possible.

- Moreover, The many benefits associated with consumer identity and access management revolve around data protection and cyber security. When an organization implements a consumer identity and access management system, best practices for credential management are put into place to eliminate these and related issues by requiring employees to frequently change their passwords, which mitigates the possibility of a password being stolen when better authentication methods are not available.

- However, the growing adoption of mobile technologies and cloud-based services enables organizations to be more agile and quick in their business processes. Still, it makes managing access even more complex. And without proper adoption of innovative mobile technologies, enterprise customers may face the security of data stored in third-party or cloud services. This may hamper the growth of the market.

- During the COVID-19 pandemic, when lockdowns and strict measures were adopted to stop the spreading of the virus, the dependency on online businesses increased significantly. Various end-user industries such as BFSI, healthcare, IT and telecom, etc., relied on the internet ecosystem to provide necessary services to consumers. Further, during the outbreak, businesses have experienced an increased demand for a consumer identity and access management system.

Consumer Identity & Access Management Market Trends

BFSI Segment is Expected to Gain Significant Traction

- Banks and other financial institutes (BFSI )are under increasing scrutiny to ensure they have the appropriate security measures in place, especially in the wake of the numerous high-profile data breaches that have taken place over the last few years. In addition, financial institutions store highly valuable data, and their digital transformation efforts create greater opportunities for cyber attackers to access that data.

- For instance, in February 2022, Mortgage lender, Radius Financial Group, fell victim to a data breach when an unauthorized party accessed its server and stole private data pertaining to 16,000 customers. Additionally, in April 2022, a data breach occurred at A Square (now known as Block), impacting 8.2 million current and former employees. These data breaches in the finance sector are growing the demand for consumer identity and access management solutions.

- Furthermore, a growing number of banking frauds in major countries is increasing the need for better infrastructure and security solutions, thus increasing the demand for consumer identity and access management systems in the BFSI sector. For instance, as per data published by the Reserve bank of India, the number of bank fraud cases in India increased from 5,076 in FY 2017 to 7,400 in FY 2021.

- Many banks and financial institutions have recognized the critical need to secure the valuable and sensitive financial assets their customers trust to keep them safe. Hence, most of these organizations have invested in advanced technologies to prevent lapses in security, which may negatively impact their revenues, operating costs, reputation, and much more. Consumer identity and access management solutions may provide unexpected ROI to banks and other financial institutions that help protect their bottom line.

North America is Anticipated to Hold the Largest Market Share

- North America is anticipated to account for the largest market share in the global consumer identity and access management market owing to the growing adoption of consumer identity and access management solutions across various end-user sectors and the presence of several major players such as Microsoft Corporation, Salesforce Inc., Broadcom Inc., etc. that provide security and consumer identity and access management solutions in the region.

- Furthermore, the growing number of data breaches across various end sectors in the United States is further driving the need for consumer identity and access management solutions in the region. Moreover, cybercriminals are constantly exploring new methods, and a series of major data breaches across the various end-user sectors in the region have again demonstrated that supposedly secure systems are often surprisingly vulnerable.

- For instance, according to a report published by the Identity Theft Resource Center (ITRC), a record number of 1862 data breaches occurred in 2021 in the United States. The number of data breaches in 2021 broke the previous 1506 set in 2017 and represented a 68% increase compared to the 1108 breaches in 2020. Sectors like BFSI, healthcare, business, and retail are the most commonly attacked, impacting millions of Americans annually.

- Additionally, stringent government regulations, such as the Gramm-Leach-Bliley (GLB) Act, play a crucial role in adopting consumer identity and access management solutions in the United States. The act requires securities firms and financial institutions to implement strict regulations for protecting consumer data privacy by establishing a program that assesses risks to the data and protects against threats.

- With the growing need for consumer identity and access management solutions in the region, major companies are making efforts to acquire more market share. For instance, in November 2021, the massive cybersecurity company GBG announced to acquire the Acuant, its erstwhile competitor. The merger brings two industry giants together within a single organization. The acquisition of Acuant enables GBG to expand further into the United States, the world's largest and most strategically important market for location, identity, and fraud services.

Consumer Identity & Access Management Industry Overview

The global consumer identity and access management market appears to be fragmented due to the presence of many players. Furthermore, the swift rise in investment and funding of top players in research and development for launching efficient solutions in consumer identity and access management market products is driving the competition in the global market. Major global consumer identity and access management companies include Microsoft Corporation, Broadcom Inc., Salesforce Inc., and IBM Corporation, among others.

- June 2022 - Infutor, a Verisk business and consumer identity management expert, today announced that it is launching Infutor Identity Resolution. This embedded application will natively enrich and activate first-party data in the Snowflake Data Cloud. The Infutor Identity Resolution application is built using Snowflake's Native Application Framework, which is currently in private preview. It enables developers to build applications using Snowflake core functionalities, globally distribute them on Snowflake Marketplace and deploy them within a customer's Snowflake account.

- April 2022 - Zoho Alumni's Securden Raised Series A funding of USD 10.5 million from Tiger Global, Accel, and the Together Fund to expand its unified platform approach to access and identity management. Securden is looking to take on the likes of CyberArk, BeyondTrust, Delinea, Microsoft, and other giants in the access security and governance space.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Security Compliances and Government Regulations

- 5.1.2 Management of On-site Visitors and Contractors

- 5.2 Market Restraints

- 5.2.1 Security of Data Stored with Third Party (Cloud)

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 Cloud Based

- 6.2.2 On-Premise

- 6.3 By End-user Industries

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 IT and Telecom

- 6.3.4 Government

- 6.3.5 Energy and Utilities

- 6.3.6 Other End-user Industries (Transporation, Aerospace and Defense, and Education)

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Salesforce Inc.

- 7.1.3 IBM Corporation

- 7.1.4 HID Global (Assa Abloy AB)

- 7.1.5 Broadcom Inc.

- 7.1.6 AlertEnterprise Inc.

- 7.1.7 Micro Focus International PLC

- 7.1.8 Access Security Corporation

- 7.1.9 WIPRO Ltd

- 7.1.10 SAASPASS Inc.

- 7.1.11 IDCUBE Identification Systems (P) Ltd

- 7.1.12 Amazon Web Services Inc.

- 7.1.13 Convergint Technologies LLC