|

市场调查报告书

商品编码

1644800

开放原始码ERP -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Open Source ERP - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

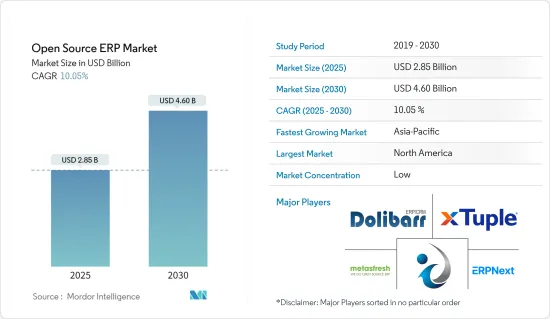

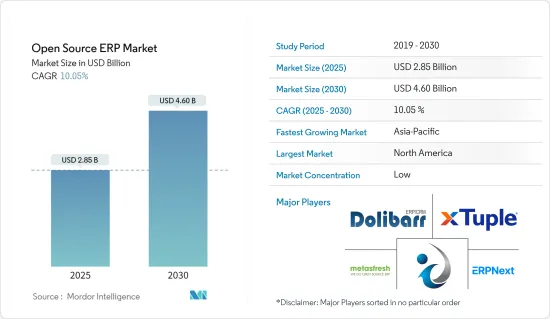

开放原始码ERP 市场规模在 2025 年估计为 28.5 亿美元,预计到 2030 年将达到 46 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.05%。

推动开放原始码ERP 软体市场发展的关键因素是业务计划对功能熟练度和简单性的需求、云端和可携式应用程式选项的普及、以及资讯便利化动态的日益普及。

关键亮点

- 此外,COVID-19 疫情期间云端基础的ERP 的普及预计将影响 ERP 市场的发展。

- 开放原始码ERP 对于想要升级或自订其 ERP 系统而又不必支付高额许可和支援费用的中小型企业 (SME) 非常有利。大多数开放原始码ERP 软体系统都提供免许可选项,可与开放原始码资料库和作业系统一起使用。使用开放原始码ERP 的另一个原因是它是完整的来源内容,并且在实施软体时不存在供应商锁定或依赖。

- 传统的ERP技术已经存在了很长时间,然而,物联网、人工智慧、综合资讯研究等尖端技术创新的重新利用已经扩大并推动了业务发展。将 ERP 与基于物联网的设备结合,协会可以识别和处理不必要的资源等问题。同样,透过物联网创新实现週期机械化,工厂活动将按计画进行,无需人工干预。

- 在 COVID-19 疫情期间,云端基础的ERP 程式设计激增,以支援组织应对中断。此外,ERP 程式解决方案透过各种亮点(包括远端存取、电脑化资讯交易、机器人化改进和持续职场控制)使整个业务流程有效地运作。

- 疫情也限制了世界各地的组织将实体职场迁移到遥远的职场。这一因素导致 ERP 编程需求大量涌现,而 ERP 市场的开放也满足了这一需求。

开放原始码ERP 市场趋势

了解哪些市场的云端部署成长最快

- 云端基础的开放原始码ERP 解决方案相对便宜,对小型和大型企业组织都有益处。云端基础的ERP 软体安装在供应商的远端伺服器上,而不是您自己的硬体上。一些解决方案是基于服务提供的,因此也被称为 SaaS ERP 解决方案。

- SaaS ERP 采用多租户软体架构,让多个客户使用供应商所託管的相同软体平台。其优点包括:部署速度更快、软体实施的前期成本更低、单一租户 SaaS 应用程式自订更轻鬆、配置和维护流程更简单、资料自动备份和灾害復原更轻鬆,以及整合和迁移更轻鬆。

- 此外,随着数位转型的推进,包括教育公司、广告媒体平台、IT服务、製造业、医疗保健业、零售业、运输和物流、批发商等在内的各种终端用户都开始采用开放原始码云端 ERP。

- 此外,各行业和各地区的客户都迫切需要自动化、标准化、简化和创新,这推动了市场研究。因此,供应商也正在投入大量研发资金,为其现有的开放原始码云端 ERP 产品推出新的升级。

预计北美将占据最大份额

- 开放原始码软体已成为该地区商业业务的支柱,而开放原始码ERP 解决方案是这一演变的自然的下一步。开放原始码ERP 和 CRM 解决方案可供企业购买和使用。

- 该地区向云端运算的快速转变正在推动开放原始码ERP 市场的成长。根据 Epicor Software 的 2021 年度洞察报告,94% 的美国中型关键任务企业已在 2021 年实施了 ERP,而 2020 年将云端运算作为策略重点的企业比例仅为 25%。

- 此外,94% 的人相信云端运算将为他们的业务提供未来保障。开放原始码云端 ERP 是该地区营运的製造商的核心投资策略之一。特别是,采用开放原始码ERP 仓库管理系统 (WMS) 与云端运算的采用是一致的。

- 为客户提供相关和个人化体验的需求推动了开放原始码ERP 系统的采用,该系统可以透过高度可自订的仪表板等功能来满足这一需求。根据 Movable Ink 的《2021 年单一受众报告》研究,61% 的消费者表示,如果公司透过品牌内容提供个人化体验,他们更有可能购买产品或服务。 (n=1,000 名美国消费者)

开放原始码ERP 产业概况

开放原始码ERP 市场高度细分,有许多竞争对手,包括 ERPNext、Dolibarr、Metasfresh 和 Odoo。新兴市场参与企业正在采取伙伴关係、产品开发、併购和收购等策略活动来获取市场占有率。市场的主要发展如下:

- 2021 年 9 月 - Deltek Inc. 宣布为美国企业推出一项新产品“Deltek Payments”,帮助 ERP 客户实现其付款流程的数位转型和现代化。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 对无缝客户体验的需求不断增加

- 人工智慧、物联网和分析等尖端技术的集成

- 市场限制

- 从手动到软体测试流程的转变增加了复杂性

- 监管状态

- 关键使用案例

第六章 市场细分

- 依实施类型

- 云

- 本地

- 按组织规模

- 中小型企业

- 大型企业

- 按最终用户产业

- 资讯科技

- BFSI

- 通讯

- 医疗

- 零售

- 教育

- 其他行业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- iDempiere

- xTuple

- Dolibarr

- Metasfresh

- ERPNext

- Compiere

- ERP5

- Bitrix24

- OpenPro

- Openbravo

- MixERP

- TRYTON

第八章投资分析

第九章:市场的未来

The Open Source ERP Market size is estimated at USD 2.85 billion in 2025, and is expected to reach USD 4.60 billion by 2030, at a CAGR of 10.05% during the forecast period (2025-2030).

The key drivers of the development of the open-source ERP software market are the proficiency and simplicity of features in business initiatives, the proliferation of cloud and portable application choices, and the need for a popular expansion in information-driven dynamics.

Key Highlights

- In addition, the popularity of cloud-based ERP floods during the COVID-19 pandemic is expected to impact the development of the ERP market.

- Open source ERP is beneficial for small and medium-sized enterprises (SMEs) who want to upgrade or customize their ERP system without paying a large license or support fee. Most open-source ERP software systems can be used as open-source databases and operating systems that offer license-free options. Another reason open source ERP is used is that it is complete source content, and there are no vendor lock-ins or dependencies to implement the software.

- Traditional ERP technology has been around for a very long time, but nevertheless, the diversion of cutting-edge innovations such as IoT, AI, and comprehensive information research has expanded and driven business development. By combining ERP and IoT-based gadgets, associations can distinguish and handle issues such as unwanted resources. Similarly, the mechanization of cycles through IoT innovation keeps plant activities on schedule without human intervention.

- During the COVID-19 pandemic, cloud-based ERP programming called for a surge to support organizations to support interruptions. In addition, ERP programming arrangements effectively function business-wide measures through a variety of highlights, including remote access, computerized information transactions, robotized refinement, and ongoing workplace control.

- Pandemics also constrain organizations worldwide from moving their real workplaces to distant workplaces. This factor caused the flood required for ERP programming and subsequently met the development of the ERP market.

Open Source ERP Market Trends

Cloud Deployments to Witness Highest Market Growth

- Cloud-based open source ERP solutions are comparatively cheaper that benefit both SMEs and large enterprise organizations. The cloud-based ERP software is installed in the vendor's remote serves instead of the company's hardware. Some of the solutions are provided based on services, and therefore they are also called SaaS ERP solutions.

- The SaaS ERPs incorporate multi-tenant software architecture that allows multiple customers to use the same software platform hosted by the vendor. Some of the advantages include faster deployment, lower upfront costs for software implementation, easy customization of single-tenant SaaS applications, easy configuration, and maintenance process, automatic data back and disaster recovery, and lastly, easy integration and migration.

- Further, with growing digital transformation, various end-users like education firms, advertising and media platforms, IT services, manufacturing department, healthcare sectors, retail, transportation and logistics, and wholesale distributors, among others, have started incorporating open-source cloud ERPs.

- Further, the need for automation, standardization, simplification, and innovation is imperative for the customers across industries and geographies, driving the market study. Therefore, vendors are also investing in significant research and development to introduce a new upgrade to the existing open-source cloud ERPS.

North America is Expected to Hold the Largest Share

- Open-source software has gained an essential foothold in business work in the region, and, naturally, open-source ERP solutions are the next step in the evolution of the process. The open-source ERP and CRM solutions can be purchased by a company and used as-is.

- The rapid shift to the cloud in the region is driving the growth of the market for open source ERPs. According to Epicor Software's 2021 Annual Insights Report, 94% of mid-sized essential businesses in the United States are adopting ERPs in 2021, up from 25% that declared cloud a strategic priority in 2020.

- In addition, 94% believed the cloud would help future-proof their businesses. Open source cloud ERP is one of the central investment strategies for the manufacturers operating in the region. The adoption of an open-source ERP warehouse management system (WMS), among others, is in line with cloud adoption.

- The need to deliver personalized and relevant experiences to the customers leads to open source ERP systems that can accommodate those needs with features like highly customizable dashboards. According to a survey by Movable Ink's Audience of One Report 2021, 61% of consumers suggested that they were likely to buy goods or services when a company created a personalized experience in their branded content. (n=1,000 US consumers).

Open Source ERP Industry Overview

The open-source ERP market is highly fragmented, with a large number of competitors like ERPNext, Dolibarr, Metasfresh, Odoo, etc. Players in the market adopt strategic activities such as partnerships, product development, mergers, and acquisitions to capture the market share. Some of the key developments in the market are:

- September 2021 - Deltek Inc announced a new offering for US-based businesses, Deltek Payments, a new offering to help ERP customers digitally transform and modernize their payment processes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Seamless Customer Experience

- 5.1.2 Integration of Advanced Technologies such as AI, IoT, and Analytics

- 5.2 Market Restraints

- 5.2.1 Rising Complexities to Implement Transition from Manual to Software Testing Process

- 5.3 Regulatory Landscape

- 5.4 Key Use Cases

6 MARKET SEGMENTATION

- 6.1 By Deployment Mode

- 6.1.1 Cloud

- 6.1.2 On-premises

- 6.2 By Organization Size

- 6.2.1 Small and Medium Sized Companies

- 6.2.2 Large Companies

- 6.3 By End-user Verticals

- 6.3.1 Information Technology

- 6.3.2 BFSI

- 6.3.3 Telecommunication

- 6.3.4 Healthcare

- 6.3.5 Retail

- 6.3.6 Education

- 6.3.7 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 iDempiere

- 7.1.2 xTuple

- 7.1.3 Dolibarr

- 7.1.4 Metasfresh

- 7.1.5 ERPNext

- 7.1.6 Compiere

- 7.1.7 ERP5

- 7.1.8 Bitrix24

- 7.1.9 OpenPro

- 7.1.10 Openbravo

- 7.1.11 MixERP

- 7.1.12 TRYTON