|

市场调查报告书

商品编码

1644828

伺服马达:全球市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Servo Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

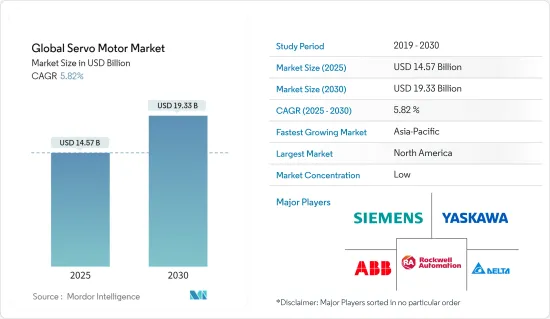

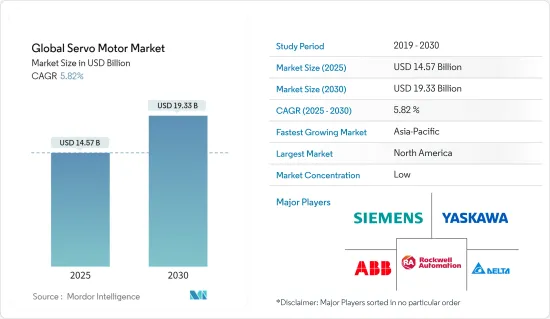

预计 2025 年全球伺服马达市场规模为 145.7 亿美元,到 2030 年将达到 193.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.82%。

最近的技术进步和政府政策(例如一些国家的最低能源性能标准 (MEPS))使得马达系统更加节能,从而扩大了伺服马达和驱动器的市场。

主要亮点

- 最先进的运动控制装置是伺服马达。它采用先进的设计技术、高磁性强度磁铁材料和精确的尺寸公差。虽然这些电动设备不是一种特定类型的马达,但它们是为需要高性能、快速反转和精确定位的运动控制应用而设计的。此外,它易于安装且无需维护,这在预测期内进一步推动了需求。

- 推动市场发展的主要因素是伺服马达在自动化领域的应用。伺服系统的技术进步正在激发最终用户的兴趣。这些电气设备用于各种行业,包括汽车製造、包装器材、食品加工、半导体和医疗保健。

- 截至 2021 年 2 月,Allied Motion Technologies 推出了 H 系列无刷伺服马达驱动器,其中包括 Hiperface DSL、多重回馈设备支援和安全扭力关闭 (STO) 安全选项。 H-Drive 是 Allied 新型 AMS伺服套件的一部分,旨在驱动 HeiMotion 无刷伺服马达和 Megaflux 系列无刷力矩马达。

- 此外,在 2022 年 Automate 展会上,科尔摩根首次推出了其新型 TMB2G 机器人无框伺服马达。在 2022 年 6 月的分组会议会上,科尔摩根也谈到了透过永磁马达的设计和选择来提高机器人效率。

- 影响市场成长的关键驱动因素包括自动化的快速成长和进步,以及越来越多地采用节能国际标准。严格的电力供应标准、不断上涨的电费以及用高效伺服马达替换旧的低效马达的需求预计将在预测期内推动对伺服马达的需求。

- 受新冠肺炎疫情影响,全球工业生产受到干扰。钢是伺服马达常见的原料。钢铁业出现了一些混乱,影响了伺服马达的生产。此外,中国也是主要的钢铁生产国。它每年生产世界上一半的钢铁。疫情期间,中国政府实施的工厂关闭和贸易限制阻碍了钢铁生产。

伺服马达市场趋势

提高自动化程度

- 製造过程中自动化、数位化和人工智慧的提高是推动汽车产业工业机器人需求的关键因素。

- 库卡集团 (KUKA AG) 等汽车製造商近年来一直在实现工厂自动化,以减少现场问题、提高效率并降低营运成本。许多公司也纷纷效仿,实现工厂自动化,以提高收益和效率,从而推动伺服马达和驱动器市场的发展。

- 例如,2022 年 6 月,Aerobotix 和 Automated Solutions Australia 正式建立国际机器人自动化伙伴关係,以开发、测试和生产高超音速飞弹。 Aerobotix 和 ASA 之间的合作将使澳洲国防部门和国防承包商能够更多地利用两家公司的自动化专业知识。

- 伺服马达用于机器人、数控机械和物料输送、包装、工厂自动化、工具机、组装和其他工业领域的自动化製造等要求严格的马达。因此,预计预测期内自动化和机器人技术的普及将推动汽车领域伺服马达市场的发展。

北美占很大份额

- 在北美,美国是工业机器人最大的用户,占该地区总安装量的79%。排名第二的是墨西哥,占 9%,排名第三的是加拿大,占 7%(资料来源:国际机器人联合会)。

- 例如,2021年12月,先进自动化协会报告称,北美工厂和工业相关人员在2021年前九个月订购了29,000台机器人,与前一年同期比较增长了37%。

- 在日本,多个製造过程都已自动化,伺服马达对精度和重复性有很高的要求。与液压泵和感应马达不同,伺服马达可以在运行过程中开启和关闭,从而减少高达 65% 的功耗。

- 伺服解决方案是基于最新的单一来源、系统为基础的设计思维。它利用了科尔摩根的AKD2G伺服驱动器和AKM2G伺服马达的性能。由于马达和驱动器在各个方面都精确匹配(驱动器开关频率、换向演算法、马达磁性等),工程师可以避免因选择不同製造商的组件而可能出现的微不相容性。

- Applied Motion Products 已扩大其 MDX 整合伺服马达的供应商接受度。此认证确保马达符合美国高品质电气安全标准。 Integrated 的马达已依照 ANSI/UL 标准 1004-1 旋转马达、1004-6 伺服和步进马达以及 61800-5-1 可调速驱动器进行测试。此认证的 UL 文件编号为 E472271。

伺服马达产业概况

由于市场参与企业热衷于克服处理器的缺点并越来越关注新产品的开发,因此预计预测期内伺服马达市场将面临激烈的竞争。公司也正在透过合作、併购来扩大其消费者范围。 ABB 有限公司、Allied Motion Technologies 有限公司、Ametek 有限公司、通用电气公司、日本电产株式会社、罗克韦尔自动化公司、施耐德电气、艾默生电气公司、西门子股份公司、WEG 工业公司、日立有限公司、东方马达、三菱电机和安川电机等公司是全球伺服马达製造业的主要企业。

- 2021 年 11 月-罗克韦尔自动化宣布扩展其 PowerFlex AC 变频驱动器产品组合,以支援更广泛的马达控制应用。借助 TotalFORCE 技术,客户可以受益于具有更高灵活性、效能和智慧化的下一代驱动器。

- 2021 年 4 月-透过增加新的伺服马达,西门子扩大了其 Sinamics S210 单电缆伺服驱动系统的应用范围。该公司正在推出 Simotics S-1FS2,这是一款带有不銹钢外壳的马达版本,适用于製药和食品行业,最高防护等级为 IP67/IP69,并配备高解析度 22 位元绝对式多圈编码器。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 越来越多采用国际能源效率标准

- 提高自动化程度

- 市场挑战

- 增加低成本替代品的可用性

第 6 章 分割

- 依马达类型

- 交流伺服马达

- 直流伺服马达

- 按最终用户产业

- 石油和天然气

- 化工和石化

- 发电

- 用水和污水

- 金属与矿业

- 饮食

- 离散製造业

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 智利

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东和非洲地区

- 北美洲

第 7 章 供应商市场占有率

第八章 竞争格局

- 公司简介

- Yaskawa Electric Corporation

- ABB Ltd.

- Siemens AG

- Rockwell Automation, Inc.

- Delta Electronics, Inc.

- Maxon Precision Motors, Inc.

- Mitsubishi Electric Corp.

- FANUC Corp.

- SANMOTION R.

- Schneider Electric

第九章投资分析

第十章:市场的未来

The Global Servo Motor Market size is estimated at USD 14.57 billion in 2025, and is expected to reach USD 19.33 billion by 2030, at a CAGR of 5.82% during the forecast period (2025-2030).

Recent technological advancements and government policies such as Minimum Energy Performance Standards (MEPS) in several countries have resulted in energy-efficient motor systems, which has increased the market for servo motors and drives.

Key Highlights

- The most advanced motion control devices are servo motors. It employs advanced design techniques, high-force magnet materials, and precise dimensional tolerance. Although not a specific type of motor, these electrical devices are designed and intended for motion control applications requiring high performance, quick reversing, and precise positioning. Furthermore, it is simple to install and requires no maintenance, further driving their demand over the forecast period.

- The primary factor driving the market is the use of servo motors for automation. Technological advancements in servo systems have increased end-user interest. These electrical devices are used in various industries, including automobile manufacturing, packaging machines, food processing, semiconductors, and healthcare.

- As of February 2021, Allied Motion Technologies introduced the H Series Brushless Servo Motor Drive, which includes Hiperface DSL, multi-feedback device support, and Safe Torque Off (STO) safety options. The H-Drive is part of Allied's new AMS servo packages and is designed to drive the HeiMotion brushless servo motors and Megaflux series of brushless torque motors.

- Further, at Automate 2022, Kollmorgen debuted the new TMB2G Robot-Ready Frameless Servo Motors. At the June 2022 breakout session, Kollmorgen also talked about improving Robot Efficiency Through Permanent Magnet Motor Design and Selection.

- Some significant drivers influencing the market growth are rapid growth and advancements in automation, and increasing adoption of international energy-efficient standards. Stringent electricity utilization standards, rising electricity prices, and the need to replace outdated low-efficiency electric motors with highly efficient servo motors are expected to drive demand for servo motors over the forecast period.

- Global industrial production was disrupted as a result of the COVID-19 pandemic. Steel is a common raw material used in servo motors. Several disruptions occurred in the steel industry and hampered servo motor production. Furthermore, China is a major steel producer. Every year, the country produces half of the world's steel. Steel production was hampered by factory closures and trade restrictions imposed by the Chinese government during the pandemic.

Servo Motor Market Trends

Increasing Automation Advancement

- The growing use of automation in manufacturing processes and the incorporation of digitization and AI are the primary factors driving demand for industrial robots in the automotive sector.

- Automakers, such as KUKA AG, have automated their plants in recent years to reduce the number of issues on the shop floor, improve efficiency, and lower operational costs. Many companies have followed suit, automating their plants to gain better returns and efficiency, thereby driving the servo motors and drives market.

- For instance, in June 2022, Aerobotix and Automated Solutions Australia officially announced an international robotic automation partnership for developing, testing, and manufacturing hypersonic missiles. The Aerobotix-ASA collaboration will make it easier for the Australian defense sector and defense contractors to access both companies' automation expertise.

- Servo motors are used in material handling, packaging, factory automation, machine tools, assembly lines, and other demanding applications such as robotics, CNC machinery, and automated manufacturing in the industrial sector. As a result, increased automation and robotics adoption is expected to drive the market for servo motors in the automotive sector over the forecast period.

North America to Hold Significant Share

- In North America, the United States is the largest industrial robot user in the Americas, accounting for 79% of total installations in the region. Mexico comes second with 9%, and Canada comes third with 7% (source: International Federation of Robotics).

- For Instance, in December 2021, According to the Association for Advancing Automation, factories and industrial concerns in North America ordered a record 29,000 robots in the first nine months of 2021, a 37 % increase over the previous year (A3).

- Servo motors demand accuracy and repeatability in a country where multiple manufacturing processes are becoming increasingly automated. Unlike hydraulic pumps or induction motors, Servo motors are switched on and off during operation to consume less power saving up to 65%.

- The servo solution is based on the most recent single-source, system-based design ideas. It uses Kollmorgen's AKD2G servo drive and AKM2G servo motor's performance capabilities. It avoids micro-incompatibilities when engineers select components from different manufacturers because the motor and drive are precisely matched in every element (e.g., drive switching frequency, commutation algorithms, and motor magnetics).

- Applied motion products increased MDX Integrated servo motor acceptance on the supplier front. The certification ensures that the motors meet high-quality electrical safety standards in the United States. The motors from Integrated were tested by the ANSI/UL standards 1004-1 Rotating Electrical Machines, 1004-6 Servo and Stepper Motors, and 61800-5-1 Adjustable Speed Drives. The certifications are listed as UL file number E472271.

Servo Motor Industry Overview

The market for servo motors is expected to be highly competitive over the forecast period, as market participants are increasingly focusing on new product development with a sharp focus on overcoming the processor's shortcomings. The players are also focusing on partnerships, mergers, and acquisitions to broaden their consumer base. Organizations such as ABB Ltd., Allied Motion Technologies, Inc., Ametek, Inc., General Electric Company, Nidec Corporation, Rockwell Automation Inc., Schneider Electric, Emerson Electric Company, Siemens AG, WEG Industries, Hitachi Ltd., Oriental Motor, Mitsubishi Electric Corp., Yaskawa Electric Corp. are the key performers in manufacturing servo motor globally.

- November 2021- Rockwell Automation, Inc. announced the expansion of its PowerFlex AC variable frequency drive portfolio to support a wider range of motor control applications. Customers will benefit from increased flexibility, performance, and intelligence in their next-generation drive thanks to TotalFORCE Technology.

- April 2021- By adding new servo motors, Siemens is expanding the range of applications for its Sinamics S210 single-cable servo drive system. The company is launching the Simotics S-1FS2, a motor version with a stainless-steel housing, the highest level of protection IP67/IP69, and high-resolution 22-bit absolute multiturn encoders for use in the pharmaceutical and food industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing the adoption of international energy-efficiency standards

- 5.1.2 Growing Automation Advancements

- 5.2 Market Challenges

- 5.2.1 Growing the availability of low-cost alternatives

6 SEGMENTATION

- 6.1 By Motor Type

- 6.1.1 AC Servo Motor

- 6.1.2 DC Servo Motor

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical & Petrochemical

- 6.2.3 Power Generation

- 6.2.4 Water & Wastewater

- 6.2.5 Metal & Mining

- 6.2.6 Food & Beverage

- 6.2.7 Discrete Industries

- 6.2.8 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 France

- 6.3.2.5 Russia

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia & New Zealand

- 6.3.3.6 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Chile

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle-East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Turkey

- 6.3.5.4 Rest of Middle-East and Africa

- 6.3.1 North America

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Yaskawa Electric Corporation

- 8.1.2 ABB Ltd.

- 8.1.3 Siemens AG

- 8.1.4 Rockwell Automation, Inc.

- 8.1.5 Delta Electronics, Inc.

- 8.1.6 Maxon Precision Motors, Inc.

- 8.1.7 Mitsubishi Electric Corp.

- 8.1.8 FANUC Corp.

- 8.1.9 SANMOTION R.

- 8.1.10 Schneider Electric