|

市场调查报告书

商品编码

1644836

亚太地区智慧电錶:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia Pacific Smart Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

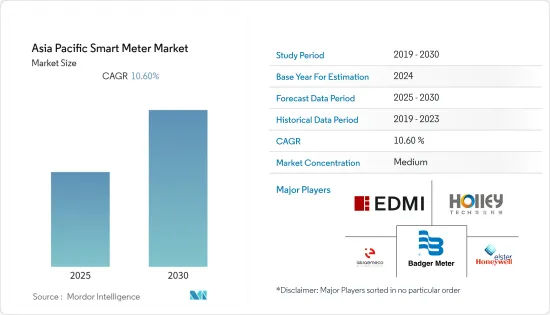

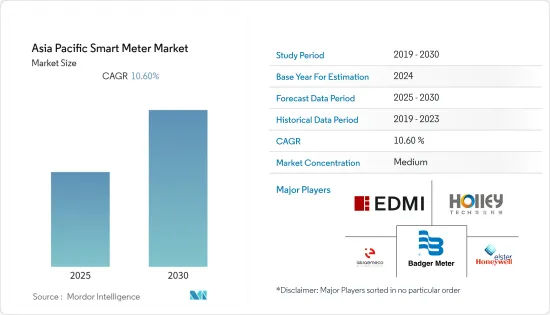

预计预测期内亚太智慧电錶市场复合年增长率将达到 10.6%。

主要亮点

- 亚太地区智慧电錶市场对分析和云端运算等智慧技术的采用正在显着成长。该地区的多个政府已经启动了智慧城市计划,为这些企业创造了巨大的成长机会。此外,对电网远端监控和控制的需求不断增长,正在推动该技术在亚太地区的传播。

- 此外,中国、日本、印度和澳洲的智慧城市发展预计将推动该地区对智慧水錶、智慧气表的需求,符合联合国2030年永续议程。此外,泰国和马来西亚正在进行试点项目,并计划在印尼和菲律宾进一步开展试点。事实证明,由于识字率低,印度对电力公司来说是一个难以实施智慧电錶的市场。

- 在印度和日本,电力窃盗现象高于正常水平,透过使用智慧电錶可以减少这一现象。在许多欠发达经济体中,人均电价较低,导致大规模安装成本过高。预计智慧电网将在未来几年推动智慧电錶市场的成长。除此之外,本地和国际智慧电錶供应商正在进入市场。在亚太地区,随着各国政府寻求解决能源需求成长和提高电力品质等能源产业问题,中国、日本、澳洲和印度的智慧电錶采用率预计将增加。

- 例如,能源效率服务有限公司的智慧电錶国家计画 (SMNP)提案到 2022 年用智慧电錶取代所有传统电錶,正如联邦财政部长在 2020 年预算 (EESL) 中所建议的那样。法国公用事业公司 EDF 和能源效率服务有限公司将在 2020 年前在印度安装约 1,000 个智慧电錶。

- 中国和韩国是特别孤立的市场,有相当数量的本地供应商为各自的国家公用事业提供服务。同样,在智慧电錶通讯领域,每个国家都遵循了很大程度上独立的技术轨迹:RF网格、国家PLC技术、蜂巢等。预计通讯将成为印度大规模采用计画和澳洲市场主导采用的首选方案。

- 由于几乎每个主要国家都实施了封锁并关闭了非必要的业务, COVID-19 疫情减缓了智慧电錶的推广。缺乏对发展终端用户产业关注对智慧电錶产生了负面影响。製造和供应链中的其他延迟也阻碍了智慧电錶的发展。人员流动的限制也阻碍了安装电錶所需的初始位置和人力。

亚太地区智慧电錶市场趋势

智慧电錶市场可望快速成长

- 智慧电錶在工业、住宅、製造和商业领域非常重要,因为它们可以测量客户消耗的能源量。透过将电力基础设施升级为智慧电錶,电力产业继续向清洁能源转型。电力公司可以透过提高系统运作的可视性来提高电网弹性和运作能力,并避免中断。

- 此外,政府在影响亚太地区智慧电錶市场成长方面发挥的作用是由其在终端用户领域安装智慧电錶的授权和政策所驱动。当疫情袭击马来西亚时,政府监管机构推迟了智慧电錶的安装。儘管如此,国家能源公司 (TNB) 表示,随着智慧电錶安装恢復,到 2021年终,智慧电錶客户数量将增加到 180 万以上。新加坡的140万台模拟电錶将在2024年达到使用寿命,并将逐步被智慧电錶取代。

- 市场领先供应商与通讯技术供应商建立策略联盟以增强其产品和地位,这也可能推动亚太市场采用智慧电錶。不断上涨的能源价格以及对发电和配电环境问题的担忧促使世界各地的行业寻求创新、省时且经济高效的方式来管理发电和配电。

- 例如,印度政府于2021年推出了电力分配部门现代化计画(RDSS),要求到2025年3月部署25兆台智慧预付费电錶。此外,根据印度政府的国家智慧电錶计划,印度国营能源效率服务有限公司(EESL)已在全国完成约 1,000 万台智慧电錶的安装。未来几年,EESL 计划部署 2,500 万台智慧电錶。

- 日本也投入巨资安装智慧电錶,以降低能源支出。此外,我们也致力于改善能源供应安全的脆弱性,2011年福岛第一核核电事故造成的环境破坏和大规模停电暴露了这个问题。

中国有望成为智慧电錶最有利可图的市场

- 中国正在对智慧电网(包括计量)进行大量投资。未来几年,智慧电錶产业预计将受益于中国都市化进程加速和电动车需求成长。中国正持续努力改善电錶、输电、配电网和发电能力,这有助于该国智慧电錶市场的成长。

- 此外,据外交关係委员会称,中国是世界上最大的温室气体排放,早期采用智慧电錶是安全的。这有助于优化中国的能源配置。因此,许多中国智慧电錶製造商正在与外国公司合作,以采用他们的技术并开发中国的智慧电錶分销市场。

- 因此,五年来,中国智慧电网公司带动电力工业(包括能源装备製造)转型升级,减少新建燃煤发电厂,确保电力稳定供应,维护了国家电力安全。这些倡议正在推动智慧电錶资料管理产业向前发展。

- 此外,根据中国资讯通讯研究院(CAICT)的数据,2020年中国智慧电网市场价值近800亿元人民币,预计2021年终将扩大到约855亿元人民币。建设智慧电网是中国打造低碳智慧城市的重要措施之一。

- 此外,不断增加的基础设施投资正在推动该地区智慧电錶产业的成长。据法国机动车特别集团称,中国正在大力投资基础设施,建设 4 万公里的新天然气管道,连接 4.7 亿人。产业参与者正在利用增加的支出和基础设施开发来推进他们的智慧电錶专案。

亚太地区智慧电錶产业概况

亚太地区智慧电錶市场竞争激烈,主要参与者包括: EDMI Limited、Holley Metering Limited、Iskraemeco India Private Limited、Badger Meter, Inc. 和 Honeywell (Elster Group)。

- 2022 年 5 月 - 领先的先进计量和智慧电网技术供应商 Trilliant 宣布与 SAMART 建立新的合作伙伴关係,为泰国省电力局提供先进计量基础设施 (AMI) (PEA)。此次部署体现了 Trilliant 致力于为亚太地区的电力公司提供市场领先性能水准的持续承诺。在印度和马来西亚,Trilliant 目前已拥有超过三百万个连网智慧电錶。

- 2021 年 8 月-Tancy 被选中为印度电力公司 Indraprastha Gas Limited (IGL) 的电网升级计划提供智慧燃气表。五年内,Tansy 将向 IGL 供应约 2,000 台旋转燃气表、电子容积补偿器、Enesis 平台和资料託管服务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 增加智慧电网计划投资

- 通讯网路基础建设

- 政府倡议

- 市场挑战

- 与智慧电錶整合困难

- 基础建设实施的资本支出高,缺乏投资报酬率

第六章 市场细分

- 智慧电錶类型(出货量)

- 智慧电錶

- 智慧燃气表

- 智慧水錶

- 按最终用户

- 住宅

- 商业

- 产业

- 按国家(出货量)

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

第七章 竞争格局

- 公司简介

- EDMI Limited

- Holley Metering Limited

- Iskraemeco India Private Limited

- Badger Meter, Inc.

- Honeywell(Elster Group)

- Itron Inc.

- Secure Meter Limited

- Suntront Tech Co., Ltd

- Aichi Tokei Denki Co., Ltd

- Diehl Stiftung & Co., KG

- Xylem Inc.(Sensus)

第八章投资分析

第九章 未来市场展望

The Asia Pacific Smart Meter Market is expected to register a CAGR of 10.6% during the forecast period.

Key Highlights

- The implementation of smart technologies such as analytics and cloud computing has increased significantly in the Asia-Pacific smart electric meter market. Several governments in the region have initiated smart city programs, which provide these businesses with a considerable growth opportunity. Furthermore, rising demand for remote monitoring and control of power grids would boost technological penetration in Asia-Pacific.

- Moreover, with smart city developments in China, Japan, India, and Australia, the need for smart water and smart gas meters in the region is predicted to rise in line with the UN's 2030 Agenda for Sustainable Development. In addition, pilot programs have been developed in Thailand and Malaysia, with more initiatives in Indonesia and the Philippines in the works. India has proven to be a difficult market for utility companies to convert to smart meters due to the country's low literacy rate.

- Electricity theft is higher than usual in India and Japan, although this can be reduced by using smart meters. In many underdeveloped economies, large-scale installations are prohibitively expensive due to low per capita electricity rates. Smart grid will boost smart meter market growth in the next years. Aside from that, both domestic and international smart metering providers are entering the market. As governments aim to solve energy sector concerns such as increases in energy demand and improve power quality, deployments of smart meters in China, Japan, Australia, and India are projected to increase in the Asia Pacific region.

- For Instance, Energy Efficiency Services Ltd's Smart Meter National Programme (SMNP) proposes that all conventional meters be replaced with smart meters by 2022, as recommended by Union Finance Minister in the 2020 budget (EESL). EDF, a French power company, and Energy Efficiency Services Ltd. installed roughly 1 lakh smart electric meters in India by 2020.

- China and South Korea are two especially isolated marketplaces with a significant number of local vendors serving their respective national utilities. Similarly, in the smart meter communications space, the countries have seen largely independent technology trajectories, with RF mesh, domestic PLC technologies, and cellular. In India's planned mass deployments, as well as in Australia's market-driven installations, cellular communications is projected to be a preferred alternative.

- Due to the implementation of lockdown in practically all major countries and the halting of non-essential operations, the COVID-19 pandemic has slowed the proliferation of smart meters. Due to a lack of focus on the development of the end user's industry, this had a negative impact on smart meters. Aside from that, manufacturing and supply chain delays have been seen, posing a barrier to smart meters. As people's movement was restricted, the manpower required for the initial arrangement of meters and installations was also hampered.

APAC Smart Meter Market Trends

Smart Electricity Meters Market is Anticipated to Grow at the Robust Pace

- The smart electric meter is important in the industrial, residential, manufacturing, and commercial sectors since it measures the amount of energy consumed by customers. By upgrading electricity infrastructure to smart meters, the electric power industry continues to move toward cleaner energy. It will allow electric firms to improve the resilience and operations of the electricity grid, as well as obtain more visibility into system operations and thereby avoid disruptions.

- Furthermore, the government's role in influencing the growth of the smart meter market in the Asia Pacific is influenced by the mandate and policy of installing smart meters throughout end-user sectors. During the pandemic in Malaysia, government regulatory bodies delayed the installation of smart meters. Nonetheless, with metering operations resumed, according to Tenaga Nasional Berhad (TNB), the number of smart meter customers will rise to more than 1.8 million by the end of 2021. When the 1.4 million analog meters in Singapore expire in 2024, they will be gradually replaced with smart meters.

- The creation of a strategic alliance by leading market vendors with communication technology providers to boost their offering and position is also likely to promote the smart electric meter in the Asia-Pacific market. With rising energy prices and environmental concerns about power generation and distribution, industries all over the world are looking for innovative, time-and cost-effective ways to manage power generation and distribution.

- For instance, the Indian government launched the Revamped Distribution Sector Scheme (RDSS) in 2021, which calls for the deployment of 25 crore smart prepayment meters by March 2025. Also, under the government of India's Smart Meter National Programme, India's state-owned Energy Efficiency Services Limited (EESL) completed the installation of about 10 lakh smart meters across the country. Over the next few years, EESL plans to deploy 25 million smart meters.

- In addition, Japan is heavily investing in the deployment of smart electric meters in order to keep energy expenditure low. Furthermore, it is concentrating on improving energy supply safety vulnerabilities that were exposed by the Fukushima Daiichi disaster's environmental catastrophe and huge outages in 2011.

China is Expected to become as the Most Lucrative Market for Smart Meters

- China is investing extensively in smart grids that include metering. In the next few years, the smart meter industry will benefit from rising urbanization and increased demand for electric vehicles in the country. The ongoing actions in China to improve meters, transmission systems, distribution networks, and generating capabilities are assisting the country's smart meter market growth.

- Furthermore, according to the Council on Foreign Relations, China is the world's largest emitter of greenhouse gases and has been on the safe side due to the early implementation of smart meters. This has aided China's energy deployment optimization. As a result, a number of Chinese smart meter manufacturers are partnering with foreign firms to adapt their technology and develop their smart meter distribution market in China.

- As a result, the Smart Grid Corporation of China (SGCC) has been updating the power industry (including energy-equipment manufacture), minimizing the deployment of new coal-fired power plants, assuring a dependable power supply, and maintaining national power security over the last five years. These measures are propelling the smart meter data management industry forward.

- Also, According to China Academy of Information and Communications Technology (CAICT), China's smart grid market was worth almost 80 billion yuan in 2020, and it was projected to increase to about 85.5 billion yuan by the end of 2021. One of the most crucial phases in China's aim to establish low-carbon smart cities was the creation of the smart grid.

- Additionally, Increased infrastructure investments are driving the growth of the smart meter industry in the region. According to the Groupe Speciale Mobile Association, China is investing heavily in infrastructure to build a new 40,000-kilometer gas pipeline that will connect 470 million people. Such increased expenditures and infrastructural improvements are being used by industry participants to move the smart meter business forward.

APAC Smart Meter Industry Overview

The Asia Pacific Smart Meter Market is highly competitive and consists of several major players such as EDMI Limited, Holley Metering Limited, Iskraemeco India Private Limited, Badger Meter, Inc., and Honeywell (Elster Group). Due to the presence of large as well as Medium-sized enterprises, the given market is quite fragmented. The leading players in this market are concentrating their efforts on increasing their consumer base and expanding into other countries. These businesses are boosting their market share and profits by implementing strategic innovations and collaborative activities.

- May 2022 - Trilliant, a leading provider of advanced metering and smart grid technology, has announced a new partnership with SAMART to provide Thailand's Provincial Electricity Authority with Advanced Metering Infrastructure (AMI) (PEA). This deployment demonstrates Trilliant's ongoing commitment to utilities in the Asia-Pacific region at market-leading performance levels. In India and Malaysia, Trilliant has now connected over 3 million smart meters for clients.

- August 2021 - Tancy has been chosen by Indian utility Indraprastha Gas Limited (IGL) to supply smart gas meters for its grid upgrade program. Tancy will supply approximately 2000 rotary displacement gas meters, an electronic volume corrector, the Enesys Platform, and data hosting services to IGL over a five-year period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Investments in Smart Grid Projects

- 5.1.2 Development of Communication Network Infrastructure

- 5.1.3 Government Initiatives

- 5.2 Market Challenges

- 5.2.1 Integration Difficulties with Smart Meters

- 5.2.2 High Capital Investment for Infrastructure Installation and Lack of ROI

6 MARKET SEGMENTATION

- 6.1 Smart Meter Type (Unit Shipments)

- 6.1.1 Smart Electricity Meter

- 6.1.2 Smart Gas Meter

- 6.1.3 Smart Water Meter

- 6.2 End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 Country (Unit Shipments)

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 South Korea

- 6.3.5 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 EDMI Limited

- 7.1.2 Holley Metering Limited

- 7.1.3 Iskraemeco India Private Limited

- 7.1.4 Badger Meter, Inc.

- 7.1.5 Honeywell (Elster Group)

- 7.1.6 Itron Inc.

- 7.1.7 Secure Meter Limited

- 7.1.8 Suntront Tech Co., Ltd

- 7.1.9 Aichi Tokei Denki Co., Ltd

- 7.1.10 Diehl Stiftung & Co., KG

- 7.1.11 Xylem Inc. (Sensus)