|

市场调查报告书

商品编码

1644849

美国汽车物流:市场占有率分析、产业趋势与成长预测(2025-2030 年)United States Automotive Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

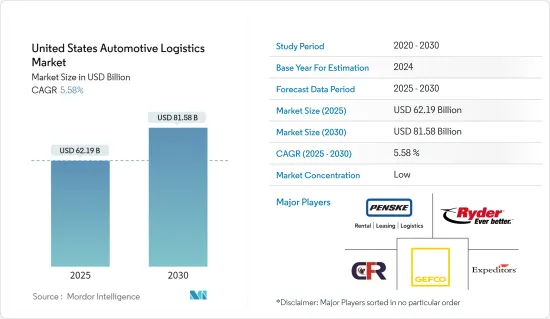

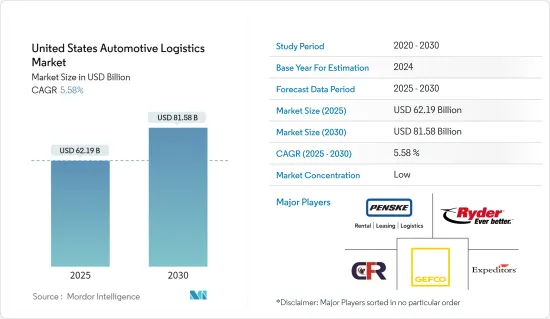

2025年美国汽车物流市场规模预估为621.9亿美元,预计2030年将达815.8亿美元,预测期间(2025-2030年)的复合年增长率为5.58%。

美国汽车市场受到电动车产业的推动,轻型汽车占据美国市场主导地位。

去年3月新冠疫情爆发后,美国汽车产业需求急遽下降。这对整个汽车供应链物流行业产生了影响。美国汽车销量与前一年同期比较下降了38%。

在解除封锁限制、开放市场后,轻型车产业反弹,本财年的销售量达到约 1,384 万辆。光是轻型车就占了美国汽车销量的约 97%。随着市场在疫情后復苏,美国汽车物流行业的进出口预计将大幅成长。

美国是世界第二大汽车市场和产业,中国紧随其后,位居第一。该部分在美国进出口中发挥重要作用。美国是世界第二大汽车生产国,生产汽车超过150万辆,商用车超过760万辆。美国是该地区最有前景、成长最快的汽车市场之一。美国汽车产业受到多种因素的支撑,包括研发力度、劳动力可用性、政府支持和地理优势。

美国汽车物流市场趋势

美国电动车产业蓬勃发展

该产业组织表示,到 2022 年,美国汽车销量中将有约 5.7% 是纯电动车,高于 2021 年的 3.2%。该地区的纯电动车销量占全球插电式电动车总销量的 8% 多一点。特斯拉继续主导美国电动车市场,美国电动车销量预计为 302,000 辆。但竞争开始愈演愈烈,通用汽车等製造商不断在其汽车产品中增加新的电动车车型。雪佛兰 Bolt 已跻身最畅销电动车榜。当年的销量略低于该车型上市时的销量,则位居第二。通用汽车计划在 2035 年只销售零排放汽车,并且已经在全球插电式电动车市场中处于领先地位。

特斯拉在该地区插电式电动车市场占据主导地位,大众集团紧随其后。整体而言,製造商都希望增加研发支出,其中电动车领域是投资的重中之重。部分原因是美国政府承诺在 2030 年实现一半汽车销售实现零排放。

轻型汽车占据美国市场主导地位

2022年,美国汽车业销售了约1,384万辆轻型汽车。这一数字包括约 290 万辆汽车零售和近 1,090 万辆轻型卡车零售额。小型车占据美国市场的主导地位,因为它们实用且省油,很受欢迎,是消费者的经济选择。由于对轻型商用车的需求不断增长,墨西哥和美国之间的短途海运量增加,而《美国-墨西哥-加拿大协议》(USMCA)的签署预计将促进汽车物流行业的发展。该行业组织表示,当被问及对微型车的满意度时,美国消费者对本田、Lexus和宝马的车型最为满意。根据每 100 辆车报告的问题数量,Lexus是最值得信赖的品牌之一。

美国汽车物流产业概况

美国汽车物流市场高度分散且竞争激烈,拥有大量国内外参与者。华盛顿国际参与企业(Expeditors International of Washington Inc.)、DHL、GEFCO 和日本通运 (Nippon Express) 等国际公司与 CFR Rinkens、Ryder System Inc. 和 Penske Logistics 等国内巨头展开竞争。由于国内外对电动车的需求不断增加、对轻型车辆的需求不断增长以及其他影响市场的因素,预计市场将会成长。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况

- 市场动态

- 驱动程式

- 电子商务和网上销售的成长

- 轻型汽车生产的需求

- 限制因素

- 燃油价格波动

- 技术纯熟劳工短缺

- 机会

- 增材製造

- 对联网汽车和自动驾驶汽车的需求不断增加

- 驱动程式

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 政府法规和倡议

- COVID-19 市场影响

第五章 市场区隔

- 按类型

- 整车

- 汽车零件

- 其他的

- 按服务

- 运输

- 仓储业

- 经销和库存管理

- 其他的

第六章 竞争格局

- 公司简介

- Expeditors International of Washington Inc.

- CFR Rinkens

- Ryder System Inc.

- GEFCO

- Penske Logistics

- US Auto Logistics

- DHL

- Nippon Express

- JB Hunt Transport Services Inc.

- CH Robinson Worldwide*

第七章:市场的未来

第 8 章 附录

- 宏观经济指标(按活动分類的 GDP 分布、运输和仓储业对经济的贡献等)

- 贸易统计 出口与进口统计

- 汽车业相关外贸统计数据

The United States Automotive Logistics Market size is estimated at USD 62.19 billion in 2025, and is expected to reach USD 81.58 billion by 2030, at a CAGR of 5.58% during the forecast period (2025-2030).

The US automotive market is driven by the electric vehicle sector, and light vehicles dominate the US market.

The automotive industry in the United States experienced a sharp decline in demand because of the COVID-19 outbreak last year in March 2020. This impacted the entire automotive supply chain logistics industry. The US vehicle sales were down by 38% year-on-year.

After the lockdown restrictions were lifted and the market was opened, the light vehicle segment sector bounced back to reach some 13.84 million units of sales in the current year. Light vehicles alone accounted for about 97% of the motor vehicles that were sold in the United States. Post-pandemic and with the market bouncing back, the United States automotive logistics industry is anticipated to see huge growth in both imports and exports.

The United States is the world's second-biggest auto market and automotive industry, the first being China. This sector plays an important role in US imports and exports. The country is the second-largest automaker in the world, manufacturing more than 1.5 million cars and 7.6 million commercial vehicles. The United States is one of the most promising and fastest-growing automobile markets in the region. The United States automobile industry is supported by multiple factors such as R&D efforts, labor availability, government support, and geographic advantages.

U.S. Automotive Logistics Market Trends

Electric Vehicle Sector growing in the United States

According to an industry association, approximately 5.7% of US car sales were fully electric in 2022, up from 3.2% in 2021. The battery electric vehicle sales in the region made up just over eight percent of the total plug-in electric vehicle sales worldwide. Tesla continues to dominate the US EV market, with an estimated 302,000 electric vehicles sold in the United States. However, competition is beginning to gain momentum, and manufacturers such as General Motors are continuing to add new EV models into their range of vehicles offered. Chevrolet's Bolt made it into the list of best-selling electric vehicle models. The model recorded its second-largest sales volume that year, just under its sales-the year the model launched. General Motors intends to sell only zero-emission vehicles by 2035 and was already one of the global plug-in EV market leaders.

While Tesla dominated the plug-in electric vehicle market in the region, it was also followed closely by the Volkswagen Group, whose worldwide electric vehicle sales soared that same year. Overall, manufacturers were looking to increase their research and development expenditure, with electric mobility at the forefront of their investments. This was in part motivated by the US Government's commitment to zero-emission for half of all vehicle sales by 2030.

Light Vehicles dominating the US Market

In 2022, the auto industry in the United States sold approximately 13.84 million light vehicle units. This figure includes retail sales of about 2.9 million autos and just under 10.9 million light truck units. Light-duty vehicles dominate the US market because they are popular for their utility and better fuel economy, which makes them an economical choice for consumers. With the increase in demand for light commercial vehicles, growth in short-sea volumes between Mexico and the US is being observed, which is forecasted to grow the automotive logistics sector with the signing of the US-Mexico-Canada Agreement (USMCA). According to an industry association, when asked about light vehicle satisfaction, consumers in the United States were most satisfied with Honda, Lexus, and BMW models. Lexus was among the most dependable brands based on the number of problems reported per 100 vehicles.

U.S. Automotive Logistics Industry Overview

The US automotive logistics market is highly fragmented and competitive, with the presence of big international and domestic firms in the country. International players like Expeditors International of Washington Inc., DHL, GEFCO, and Nippon Express compete with local giants like CFR Rinkens, Ryder System Inc., and Penske Logistics. The market is expected to grow because of the growing demand for electric vehicles at the domestic and international levels, an increase in the demand for lightweight vehicles, and other factors influencing the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Growth of E-commerce and Online Sales

- 4.2.1.2 Demand from Light Vehicle Production

- 4.2.2 Restraints

- 4.2.2.1 Fluctuating fuel prices

- 4.2.2.2 Shortage of skilled workforce

- 4.2.3 Opportunities

- 4.2.3.1 Additive Manufacturing

- 4.2.3.2 Rising demand for Connected and Autonomous vehicles

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Government Regulations and Initiatives

- 4.5 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Finished Vehicle

- 5.1.2 Auto Component

- 5.1.3 Other Types

- 5.2 By Service

- 5.2.1 Transportation

- 5.2.2 Warehousing

- 5.2.3 Distribution and Inventory Management

- 5.2.4 Other Services

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration Analysis and Major Player)

- 6.2 Company Profiles

- 6.2.1 Expeditors International of Washington Inc.

- 6.2.2 CFR Rinkens

- 6.2.3 Ryder System Inc.

- 6.2.4 GEFCO

- 6.2.5 Penske Logistics

- 6.2.6 US Auto Logistics

- 6.2.7 DHL

- 6.2.8 Nippon Express

- 6.2.9 J.B. Hunt Transport Services Inc.

- 6.2.10 C.H Robinson Worldwide*

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution by Activity, Transport and Storage Sector-contribution to Economy, etc.)

- 8.2 Trade Statistics: Imports and Exports

- 8.3 External Trade Statistics related to the Automotive Sector